Homeowners Insurance

As Winter Sets in, 62% of Homeowners with Damage from Last Season Are Still Dealing With the Consequences

A nationwide survey commissioned by ValuePenguin found that 62% of homeowners who had experienced property damage from last winter's snow and ice were still coping with the fallout. While most of these homeowners had managed to get repairs done, they were still trying to pay off the cost of the work. Meanwhile, a significant minority reported that they hadn't started repairs at all.

Preparing for winter hazards is an important aspect of owning a home — even if you live in a warmer part of the country. Our survey responses also suggested that homeowners in the West and South may not be winterizing their properties as thoroughly as they should.

Key findings:

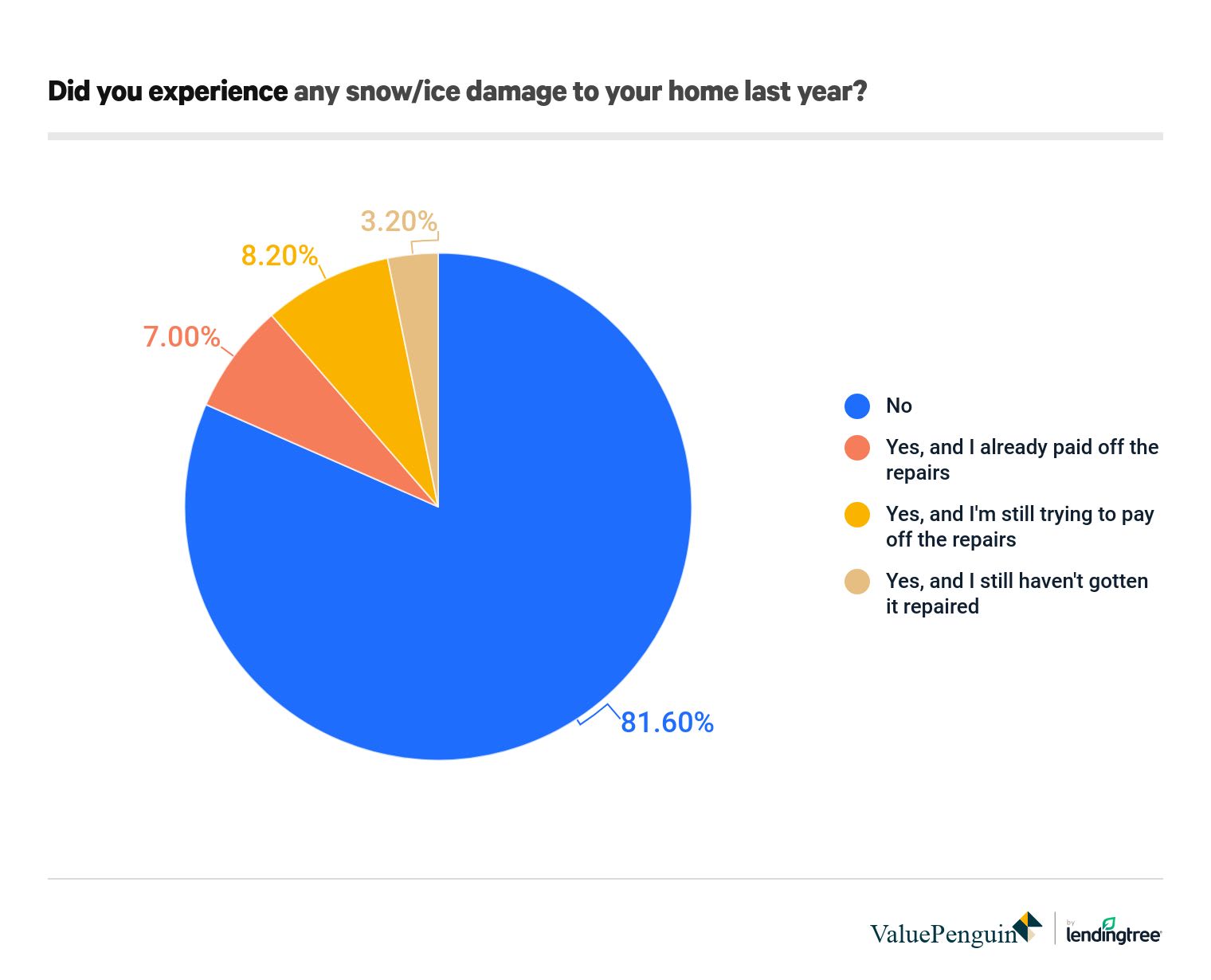

- Winter weather poses a significant risk to homeowners. Just over 18% of all homeowners said that they experienced snow and ice damage to their homes last winter.

- In that group, only 38% said that they had already repaired the damage and paid the full cost of the work. Almost 45% said they were still trying to pay off their repairs, while 17% hadn't started repairs at all.

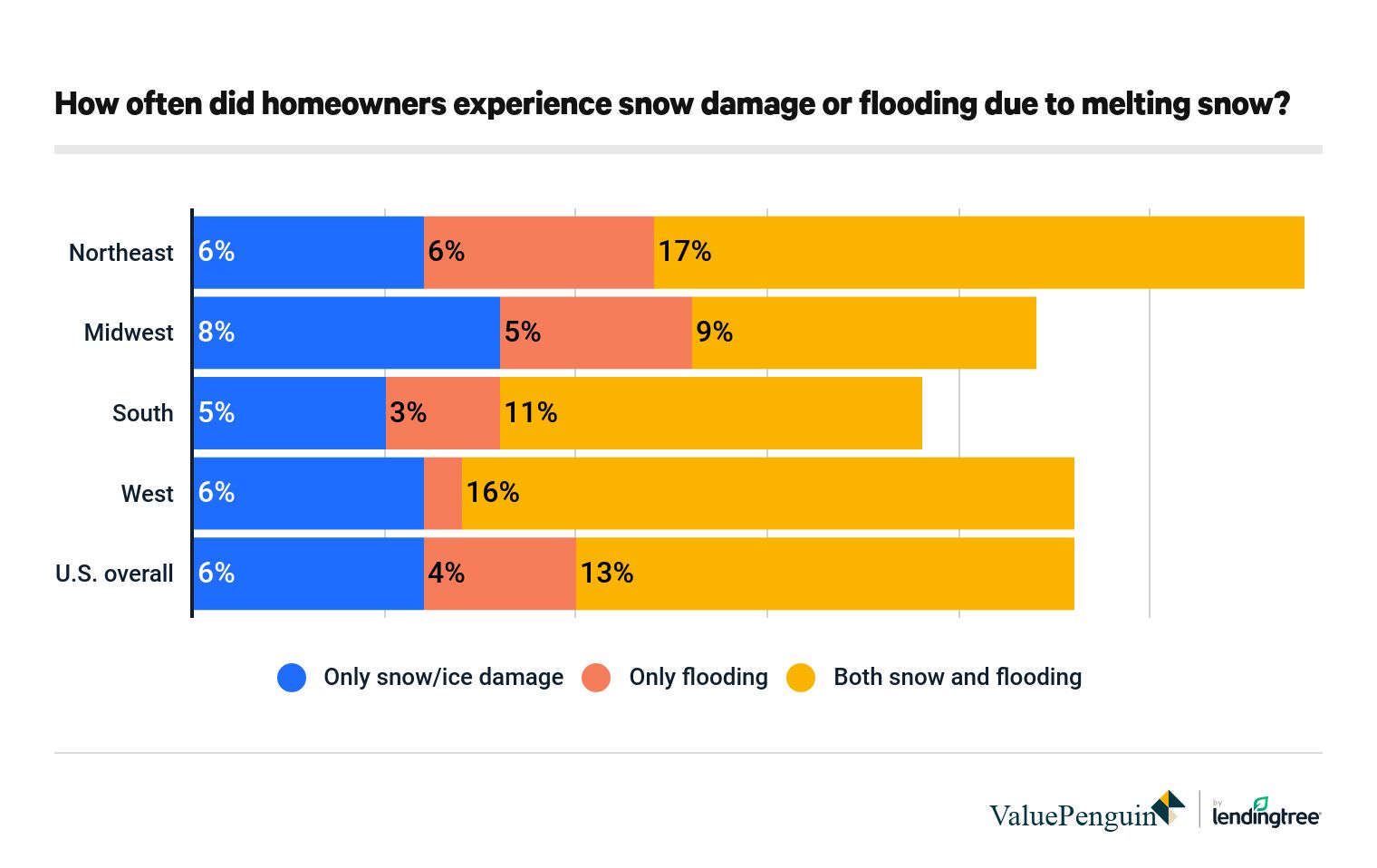

- The dangers of snow can continue even as winter ends. Over 16% of homeowners surveyed experienced flood damage from melting snow in early spring.

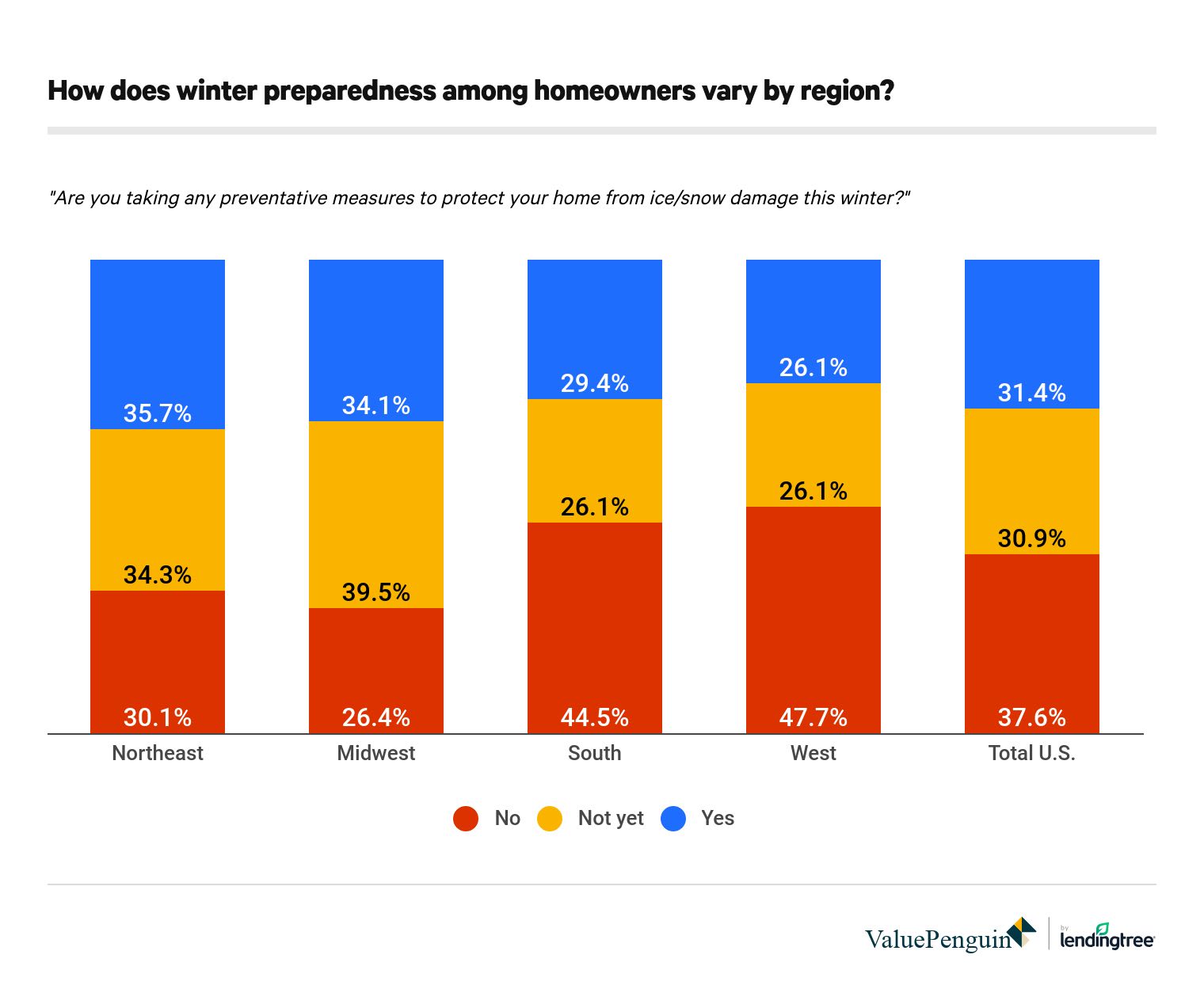

- Like the weather, preparedness varies by region. Midwestern and Northeastern homeowners were more likely to take preventive measures before winter, while nearly half of respondents in the West and South said they wouldn't be doing anything.

- However, those in Western states were actually more likely to report weather damage than those in Midwestern states.

Winter weather affected almost 1 in 5 homeowners last year, many of whom are still struggling with the consequences

When asked whether their homes had been damaged by snow or ice during the previous winter, 18% of homeowners in the survey said yes. Within the group of those affected by such damage, only 38% indicated that they had already completed and paid for appropriate repair work.

The remainder of homeowners who experienced winter damage — just over 11% of the total population — said that they either hadn't started repairs at all or were still trying to pay off the cost of those repairs. This means that among the homeowners who had snow or ice damage last year, 62% were still feeling either the financial or physical consequences of that damage.

While our survey didn't ask what specific types of damage homeowners encountered, it's likely that repairs which haven't been done were either too trivial or too expensive for homeowners to address immediately. In either case, inaction is usually not a good idea. When it comes to home maintenance, persistent problems often intensify or lead to bigger issues over time.

Home insurance is another reason for you to invest in maintaining your property before things break. Insurers will often deny a claim if their adjusters can prove that the damage was primarily due to a lack of proper maintenance. With the cost of homeowners insurance coverage rising each year, prevention is the best medicine.

Homeowners in warmer regions make fewer winter preparations, but still have significant exposure

When we conducted our survey in early November, we found that attitudes towards winter preparedness varied significantly in different parts of the U.S. As expected, respondents living in colder areas tended to be more prepared than those in warmer states.

In the West and South, 44% to 47% of homeowners said they wouldn't be taking any steps to prevent winter damage, compared to just 26% of Midwesterners and 30% of Northeastern residents.

However, the responses about actual winter damage suggested that the more relaxed attitude of Westerners and Southerners wasn't necessarily justified. When asked, homeowners in the West actually reported experiencing snow-related home damage at a higher rate (22%) than those in the Midwest (17%). Southerners weren't far behind (16%).

The risk of spring flooding also seemed fairly similar across regions. When asked about flood damage caused by melting snow in the spring months, 17% of homeowners in Western states reported damage, compared to just 14% of Midwesterners.

Unlike the types of damage often caused by winter ice and snow, flood damage is almost never covered by a standard HO-3 homeowners insurance policy. This makes it important to consider whether your local elevation poses enough of a flood risk to justify the purchase of a separate flood insurance policy.

Homeowners who prepare for winter do so in different ways

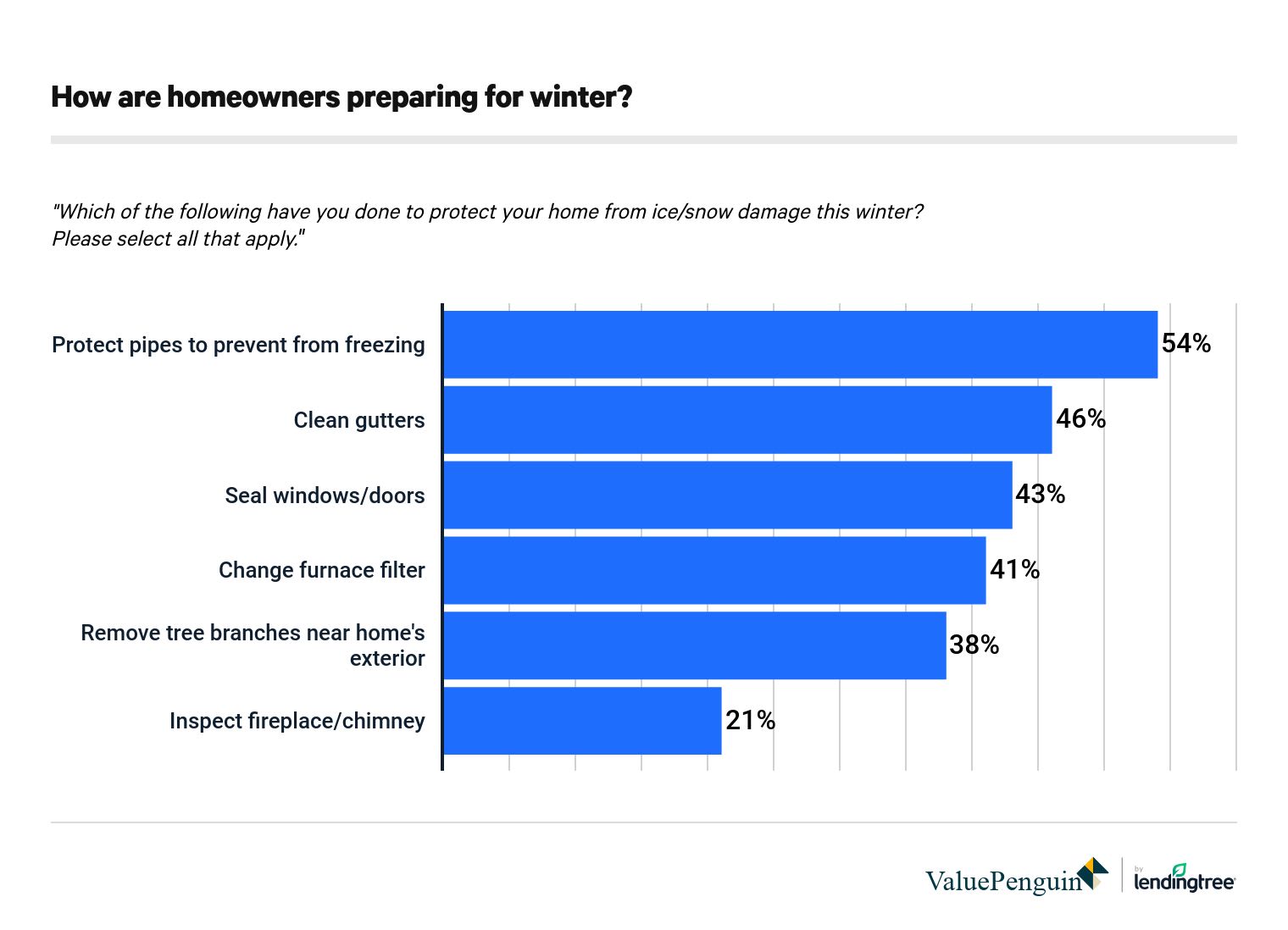

The actual steps that homeowners decided to take in preparation for winter were far from unanimous. The most popular measure — protecting pipes against freezing — was on the list for only 54% of the people who said that they were taking preventive measures.

No other method of preparation attracted more than half of the homeowners who said they had done something to prepare for winter. The most popular action after pipe protection was to clean gutters of debris, seal windows and doors against heat loss, and change furnace filters. While the necessary amount of winterization varies depending on where you live, each of the above practices can be useful in most cases.

Preparation becomes all the more important when you consider the fact that homeowners insurance policies have quite a few exceptions in their coverage of common winter perils. Insurers may reject claims if they involve damage that can be blamed on a lack of proper maintenance by the homeowner. And even when home insurance claims are paid out, they often lead to higher premiums in the future.

Here's a quick list of some common winter risks and whether or not a standard insurance policy would cover the cost of damages in each case.

Damage | Typical insurance coverage |

|---|---|

| Water pipes freeze or burst | Not covered unless you already took steps such as maintaining indoor heat, shutting off your water supply and draining your pipes |

| Roof collapsed by snow or by a tree felled by snow | Covered as long as tree fell due to wind, hail or weight of snow/ice |

| Clogged gutters cause roof leaks or mold | Not covered. Insurers consider proper maintenance the homeowner's responsibility |

| Home floods due to melting snow in spring | Not covered. Flood coverage is excluded from standard policies |

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,029 Americans, with the sample base proportioned to represent the overall population. The survey was fielded Nov. 1-4, 2019.