Health Insurance

62% of Americans Feel Stress at Least Weekly, and It’s Severely Disrupting Sleep

Costs are stressful, and stress is costly.

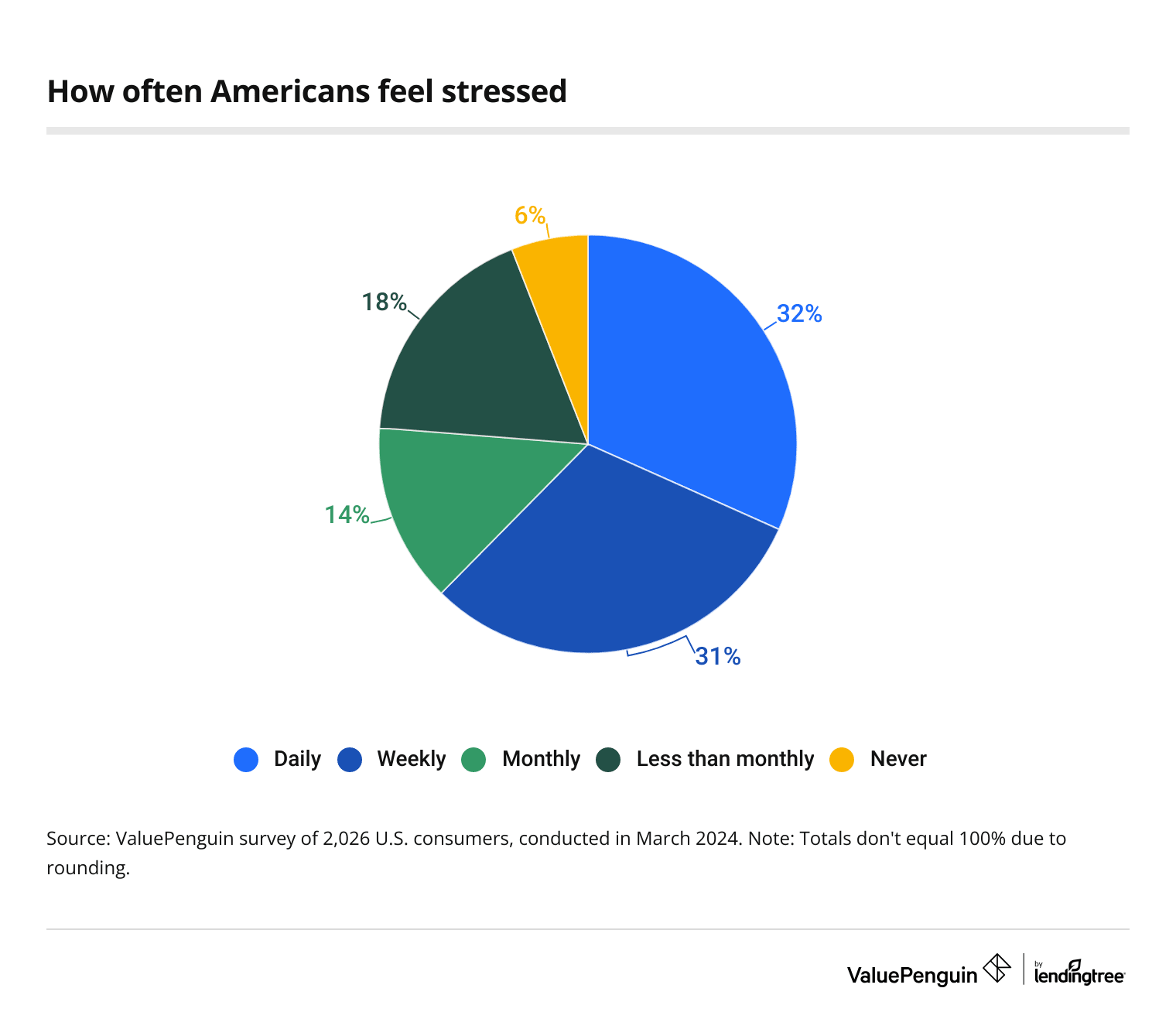

According to the latest ValuePenguin survey of over 2,000 U.S. consumers, more than 3 in 5 (62%) Americans are stressed at least weekly — and money is the top factor.

Here’s a look at stressors, how they affect Americans and what they’re doing to combat them. In addition to reviewing our findings, learn how health insurance can affect stress management.

On this page

Key findings

- Most Americans experience frequent stress, and finances are the primary factor. 62% of Americans say they grapple with stress at least weekly, with money the No. 1 pressure. 67% of those stressed about money cite inflation and cost of living, 51% cite monthly bills and 44% cite credit card debt.

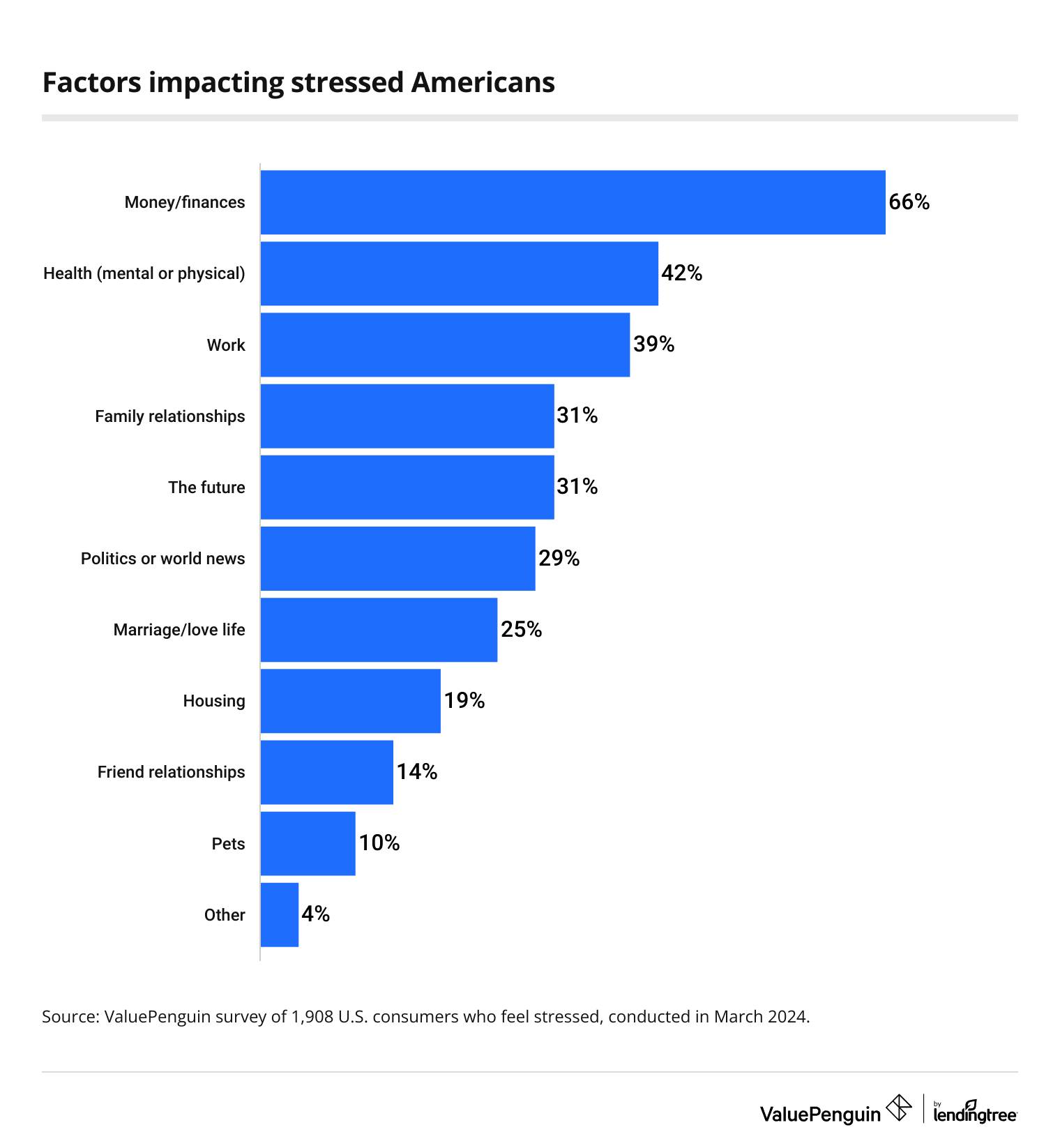

- Money isn’t the only thing stressing out people. Those who experience stress also cite their health (42%), work (39%), family (31%) and future (31%) as top contributing factors. Stress has far-reaching effects, as 54% say they experience sleeping difficulties, 38% struggle with physical symptoms and 36% cite mental health concerns.

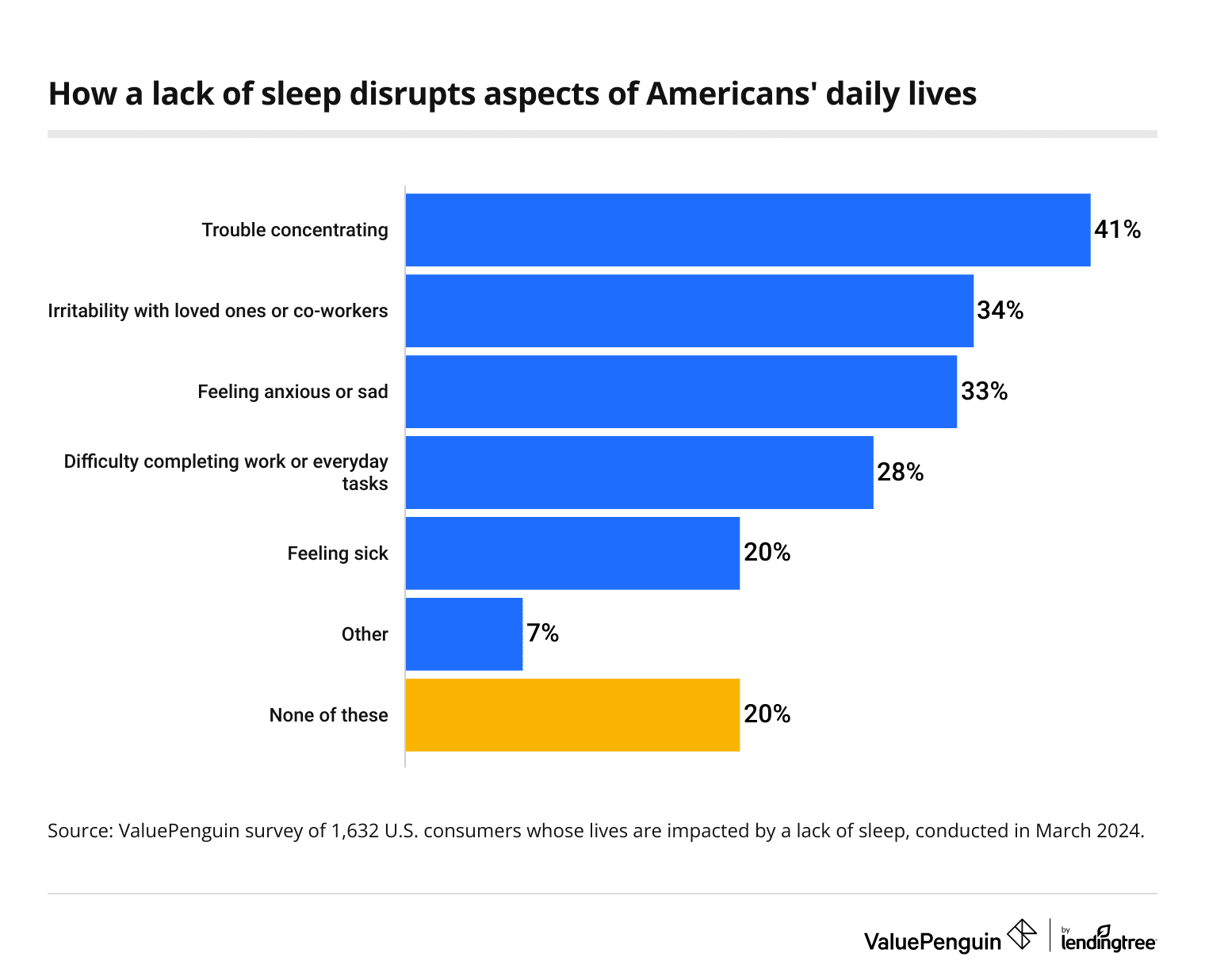

- Many Americans’ daily lives are also disrupted by sleep deprivation. Over half (53%) of Americans report getting an average of six or fewer hours of sleep a night, with 26% saying they sleep for five hours or less. Additionally, 80% of those experiencing sleep deprivation say it disrupts their life, leading to trouble concentrating (41%), irritability (34%) and feelings of anxiety or sadness (33%). Meanwhile, 45% of Americans regularly use substances or medications to sleep.

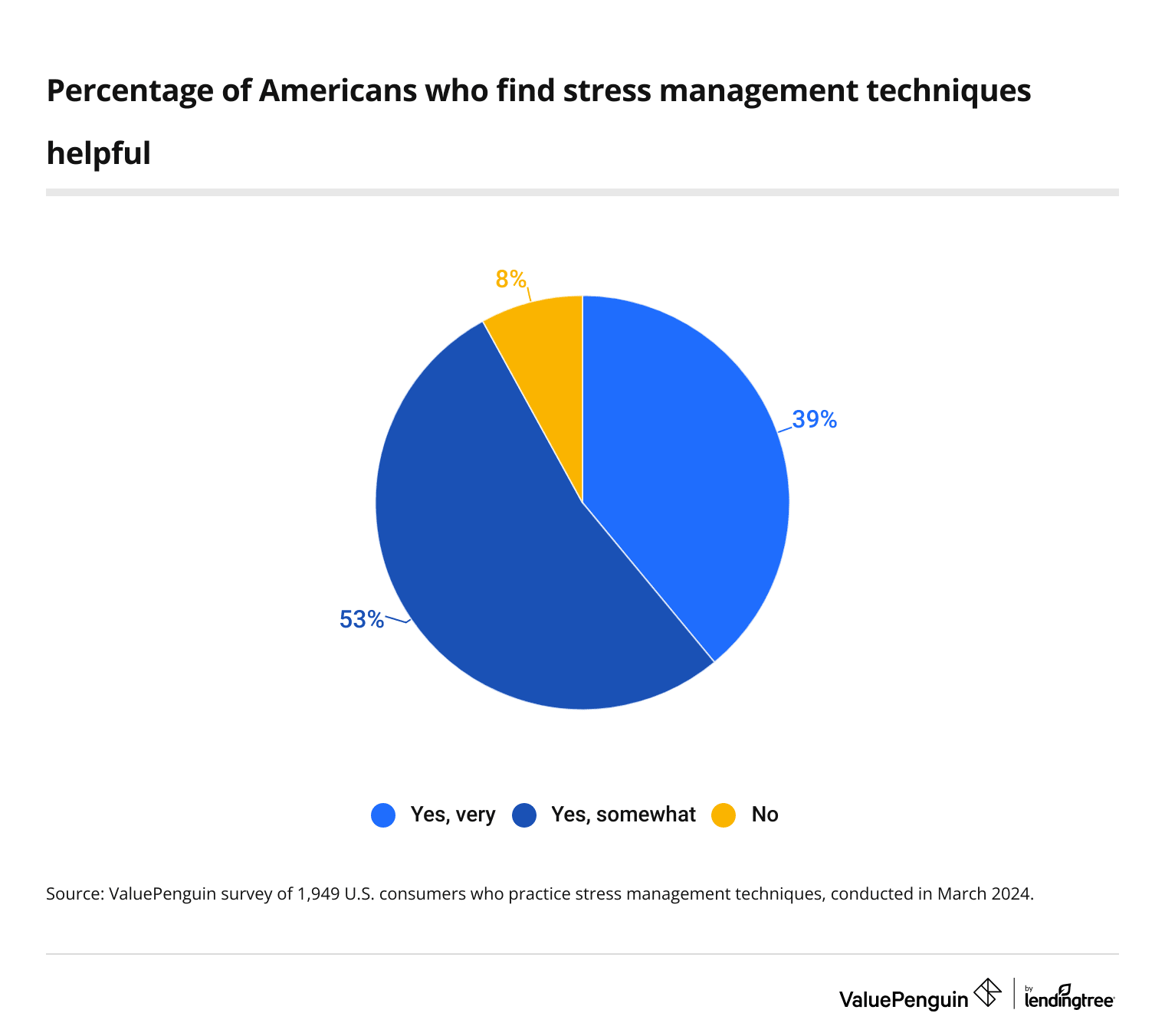

- Fortunately, many Americans practice stress management techniques. Most Americans utilize at least one method, and an overwhelming majority (92%) find their stress management practices helpful. Additionally, 35% of Americans have sought therapy for stress or sleep troubles. Of those who have, 66% found it helpful.

More money, more problems: Finances are top stressor

Most Americans experience stress frequently. In fact, 62% say they grapple with it at least weekly, with 32% feeling stressed daily. Younger Americans, in particular, are very stressed, with Gen Zers ages 18 to 27 (74%) the most likely to feel stress at least weekly. That compares with:

- 70% of millennials ages 28 to 43

- 67% of Gen Xers ages 44 to 59

- 41% of baby boomers ages 60 to 78

That means Gen Zers are 80% more likely to report feeling stress at least weekly than their baby boomer counterparts.

Women (66%) are more likely to report feeling stressed daily or weekly than men (58%). Meanwhile, those with children younger than 18 (69%) and those without children (67%) are significantly more likely to feel stress at least weekly than those with kids 18 or older (50%).

As for what’s causing stress, money ranks first at 66%. Among those who’ve felt stressed about money, the top money-related stressors are:

- Inflation and cost of living (67%)

- Monthly bills (51%)

- Credit card debt (44%)

- Lack of savings (39%)

- Insufficient income (33%)

- Mortgage (18%)

- Retirement planning (17%)

- Insurance payments (16%)

- Student loans (16%)

- Auto loans (15%)

- Other loans (9%)

According to ValuePenguin health insurance expert Divya Sangameshwar, financial stress has a terrible impact on mental health. "Many Americans feel shame and guilt over their mismanagement of money and keep their problems to themselves, feeling like they’re alone in fighting their money battles," she says. "This unfortunately leads to a significant decline in their mental health, which will make it harder to manage their money woes like mounting debt — contributing to more financial stress."

By age group, millennials (70%) are the most likely generation to cite money and finances as their primary source of stress, citing inflation and cost of living (63%), their monthly bills (54%) and credit card debt (45%) as their biggest financial stressors.

While baby boomers experience the least stress compared to their younger counterparts, they also cite money and finances (57%) as their biggest stressor. This group also cites inflation and the rising cost of living (71%), monthly bills (49%) and credit card debt (43%) as the main sources of money stress.

Health, work are also main stressors

It’s not just money causing stress. Health (42%), work (39%), family (31%) and the future (31%) are additional factors among those who feel stress. In a presidential election year, it’s worth noting that nearly 3 in 10 (29%) are also stressing over politics or world news, with 42% of baby boomers reporting this.

While 16% of Americans with money stress worry about student loans, that figure rises to 28% among Gen Zers. Among stressed Americans, over half of millennials (54%) and Gen Zers (51%) report feeling stressed by work — nearly five times more than their baby boomer counterparts (11%).

By gender, men (46%) are more likely to report stress over their work, while women are more likely to feel stressed about their health (46%).

Stress has physical and mental consequences. Of those experiencing stress, 54% say they have difficulty sleeping, 38% struggle with physical symptoms (like pain, headaches or digestive issues) and 36% cite mental health concerns. Following that, stressed Americans also report:

- Overeating or under-eating (27%)

- Difficulty controlling emotions (27%)

- Less enjoyment of hobbies (25%)

- Strained relationships with partners or family (22%)

- Decreased libido (13%)

- Poorer workplace performance (12%)

According to Sangameshwar, these effects mean Americans should be proactive in treating their stress. "While our bodies are equipped to handle small doses of stress, long-term or chronic stress can harm almost every part of your body," she says. "Stress can lead to long-term chronic and potentially fatal diseases like heart attacks, strokes and Type 2 diabetes, and it can also exacerbate conditions like asthma."

Each generation feels the impact of stress differently. For example, Gen Xers are more likely to say they have difficulty sleeping (58%) or struggle with physical symptoms (43%). Meanwhile, Gen Zers are the most likely to report mental health concerns (49%) and millennials are the most likely to say they have strained relationships with their partners or family (27%).

By gender, women are more likely to report difficulty sleeping (57%) and physical symptoms (43%), while men are more likely to report less enjoyment of hobbies (27%) and poorer workplace performance (17%).

53% of Americans get 6 or fewer hours of sleep a night

Like stress, sleep deprivation is prevalent across Americans. In fact, 53% report they get an average of six or fewer hours of sleep a night, with just over a quarter (26%) getting five or fewer hours of sleep.

By age group, Gen Xers struggle with sleep the most, with 58% of this group saying they get a maximum of six hours of sleep a night. Meanwhile, baby boomers get the best sleep. Of this group, 56% say they sleep at least seven hours each night.

Understandably, those with children younger than 18 (59%) are the most likely to get six or fewer hours of sleep a night. That compares with 51% of those with children 18 or older and 50% of those without kids.

There are physical and mental consequences to sleep deprivation. Of those who struggle to sleep enough each night, 80% say it disrupts their daily life. Trouble concentrating (41%), irritability (34%) and feelings of anxiety or sadness (33%) are the top disruptions.

Sleep aids may help — and many are willing to try them. Across all Americans, 45% regularly use substances or medications to sleep. Over-the-counter remedies (18%), CBD or marijuana (14%) and prescription sleeping medication (11%) are the top aids. More worryingly, 9% use alcohol as a sleep aid.

"As a rule of thumb, talk to your primary care physician about your difficulties with sleep before taking any medications or supplements," Sangameshwar says. "While the occasional sleepless night or bout with insomnia can be treated with a melatonin gummy or an over-the-counter sleep aid, relying on medication to sleep for the long term can worsen the quality of your sleep."

Because of this, Sangameshwar says insurers take a cautious approach to covering sleeping medication — especially prescription sleeping aids that can lead to long-term dependence. Many insurers have limits on the types of sleeping pills covered, and they may also require you to try other approaches, including therapy, to manage your insomnia before turning to pills.

Stress management techniques help most Americans

With such a high percentage of Americans feeling stress or losing sleep, it may not be surprising that 96% practice at least one stress management technique. Physical exercise (50%) is the top stress management technique, followed closely by staying hydrated (49%), listening to music (49%) and watching TV or movies (49%). Other top stress management techniques include:

- Eating healthy (37%)

- Taking supplements and vitamins (33%)

- Engaging in hobbies like reading and knitting (22%)

- Taking medication (19%)

- Meditating (15%)

- Getting adequate sleep (12%)

- Practicing religion (10%)

- Wearing devices like smartwatches and fitness trackers that track health indicators (6%)

- Using mental health and stress management applications like Calm and Talkspace (5%)

Almost all (92%) Americans who practice stress management find these practices helpful.

Of course, affordability may prevent many Americans from practicing alternative stress management techniques. To help offset costs, Sangameshwar says it’s worth calling your insurer and asking about coverage — though she notes that alternative medicine coverage isn’t mandated. If your insurer doesn’t cover alternative therapies, you can probably use the funds in your health savings account (HSA) or flexible spending account (FSA).

Also worth noting, 35% of Americans have sought therapy for stress or sleep troubles, with 66% of this group finding it helpful. Notably, 52% of Gen Zers have sought the help of a therapist to manage their stress or trouble sleeping — nearly four times more than baby boomers (14%).

Meanwhile, 65% of those who sought therapy have told their family and friends about it. However, 75% of Americans believe there’s still a stigma around therapy and mental health, despite 46% saying it’s gotten better over the years.

Utilizing health insurance resources for stress: Top expert tips

Your insurance can be a powerful tool to help you combat stress or insomnia and take care of your mental health. To help utilize it, Sangameshwar offers the following advice:

- Know that most private and employer health insurance plans offer coverage for mental health services, including therapy. "If you have it, your health insurance provider will be able to share their network of therapists and mental health care facilities," she says. "In-network telehealth therapy sessions can be great to save on therapy, as their copays tend to be lower than in-person sessions. App-based therapy, often the cheapest option, may come with its own risks. It’s important to talk to your health care provider about its effectiveness for your mental health and to your health insurer about whether the cost of app-based care is covered."

- If you’re on Medicare or Medicaid, therapy should be covered. You can look up how much it’ll cost you on your summary of benefits and coverage document. "If you can’t find this information here, locate the customer service phone number on the back of your Medicaid card," Sangameshwar says. "The representatives on the hotline will be able to look up your health insurance plan and share with you information about your mental health benefits, as well as the therapists in-network."

- If you’re uninsured, you’ll need to pay for therapy out of pocket. "However, you can ask your therapist about sliding-scale payment options, which peg the cost of therapy to your income," she says. "You can also contact your state’s department of public health and ask about local community-based clinics near you that offer free or low-cost mental health services. Nonprofits like the National Alliance on Mental Illness (NAMI) and Mental Health America can also connect you with low-cost or free mental health facilities."

Methodology

ValuePenguin commissioned QuestionPro to conduct an online survey of 2,026 U.S. consumers ages 18 to 78 from March 1 to 5, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78