Auto Insurance

Despite Blind Spots About Insurance Fraud, Nearly 1 in 3 People Believe They’ve Been a Victim

ValuePenguin asked consumers about their familiarity with various types of auto insurance fraud, from faulty parts replacements to staged accidents to price gouging. While consumers have some understanding, an average of 68% of consumers aren’t familiar with the seven types of fraud detailed in the survey.

Still, despite many not knowing the specifics, 32% of consumers say they’ve been victims of fraudsters. While reports of insurance fraud have grown exponentially over the past decade, ValuePenguin found that affected consumers are underreporting instances of fraud.

Additionally, researchers discovered that some consumers may be committing fraud themselves. More than 1 in 5 admit to lying to their auto insurer to receive lower premiums or more compensation.

Key findings

- Nearly 1 in 3 consumers suspect they’ve been a victim of auto insurance fraud. Residents in the South and Northeast have higher rates of fraud suspicion than residents in the Midwest and West (35% and 34%, respectively, versus 28% and 27%).

- Auto insurance fraud is underreported, as 29% of those who say they were victims never reported their suspicions. Women are less likely to report suspected fraud than men (35% versus 24%).

- 72% of alleged fraud victims say their auto insurance premiums increased as a result. Premium increases are most likely to affect millennials, 78% of whom saw higher costs after being victims of fraud.

- Consumers need more education about the various types of auto insurance fraud to protect themselves and their wallets. For example, 78% haven’t heard about faulty windshield replacement scams, 77% haven’t heard about bandit tow trucks and 77% aren’t aware of faulty air bag replacement scams.

- More than one-fifth of drivers lied to their insurer. 22% admit to lying to their auto insurer, most commonly by claiming damage to their vehicle but then pocketing the money intended for repairs, or by lying about their address or number of drivers to get a cheaper premium.

Despite underreporting insurance fraud, 32% of consumers suspect they've been targeted by fraudsters

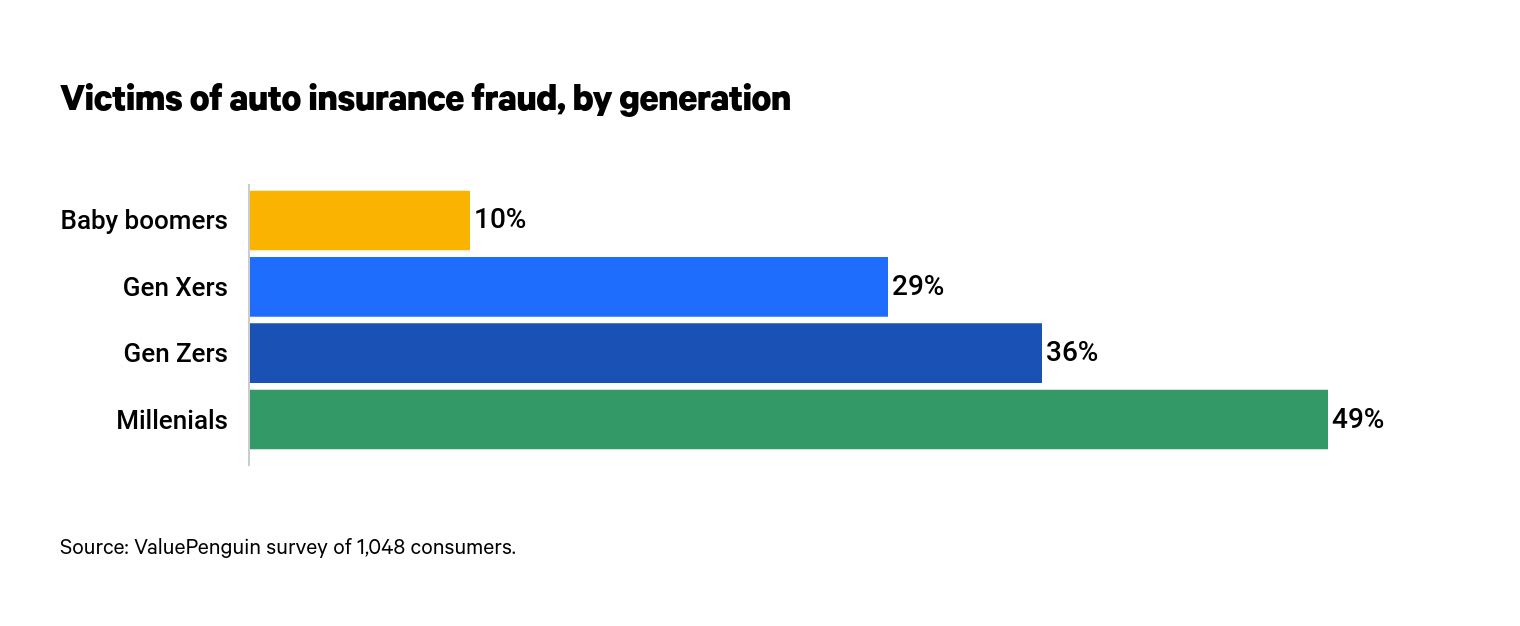

Younger consumers report higher rates as victims of auto insurance fraud. Nearly half — 49% — of millennials (ages 25 to 40) think they’ve been affected by fraud. Up next is 36% of Gen Zers (ages 18 to 24).

Just 10% of baby boomers (ages 56 to 75) think they’ve been a target of auto insurance fraudsters — the lowest of any generation.

Auto insurance fraud is less common in the West and Midwest, according to its residents. The West (27%) and Midwest (28%) have the lowest percentage of residents who think they’ve experienced fraud, versus 34% in the Northeast and 35% in the South.

Consumers claim fraud is most likely to take the form of mechanics inflating repair costs for damaged vehicles (39%). Next, 26% of fraud victims claim mechanics billed their insurance companies for new air bags after installing faulty or used models. Finally, 25% of consumers were victims of towing scams, where unrequested tow trucks take away vehicles for an inflated price after an accident.

Fraud | Percentage affected |

|---|---|

| Exaggerated repair costs | 39% |

| Faulty air bag replacement | 26% |

| Towing scam | 25% |

| Staged car accident | 24% |

| Fake or multiple injury claims after an accident | 23% |

| Faulty windshield replacement | 23% |

| False at-fault damage claims by another driver | 14% |

| Other | 3% |

Source: ValuePenguin survey of 1,048 consumers.

While many Americans believe they were victims of fraud, a significant share — 29% — didn’t report their suspicions. Women are less likely to report run-ins with auto insurance fraud than men — 35% versus 24%.

Only 1 in 5 consumers are completely unfamiliar with types of auto insurance fraud, but few know the forms it could take

Despite nearly one-third of consumers believing they’ve been victims of auto insurance fraud, 29% failed to report their encounters with fraud. After quizzing consumers on types of fraudulent behaviors related to car insurance, ValuePenguin found that respondents' levels of familiarity suggest that auto insurance fraud may be even more underreported.

Researchers asked consumers if they were familiar with seven types of fraud:

- Mechanics charging insurers for exaggerated costs of repairs

- Salespeople or mechanics repairing or replacing a windshield when there's no visible damage

- Mechanics charging insurers for the cost of new air bags despite installing cheaper, used models

- Unrequested tow trucks inflating the cost to get back a vehicle

- Staging car accidents

- Fake or exaggerated injury claims after an accident

- Lying about old damage to a car to get a bigger payout

More than 1 in 5 people (22%) aren’t familiar with any of these types of auto insurance fraud. Millennials are the most likely to know about at least one form of fraud, as just 17% are unfamiliar with each type of auto insurance-related fraud in the survey.

Fraud | Percentage familiar |

|---|---|

| Exaggerating the costs of repairs | 53% |

| Faking injury claims after an accident | 36% |

| Staging car accidents | 33% |

| Lying about previous damage | 32% |

| Faulty air bag replacement | 23% |

| Bandit tow trucks | 23% |

| Faulty windshield replacement | 22% |

| Never heard of any of these types of fraud | 22% |

Consumers could select more than one answer.

An average of 32% of people are familiar with each type of insurance fraud, meaning 68% aren’t. The form most consumers had heard about or experienced before was overcharging by mechanics (53%) — the only form that at least half of people had heard about before.

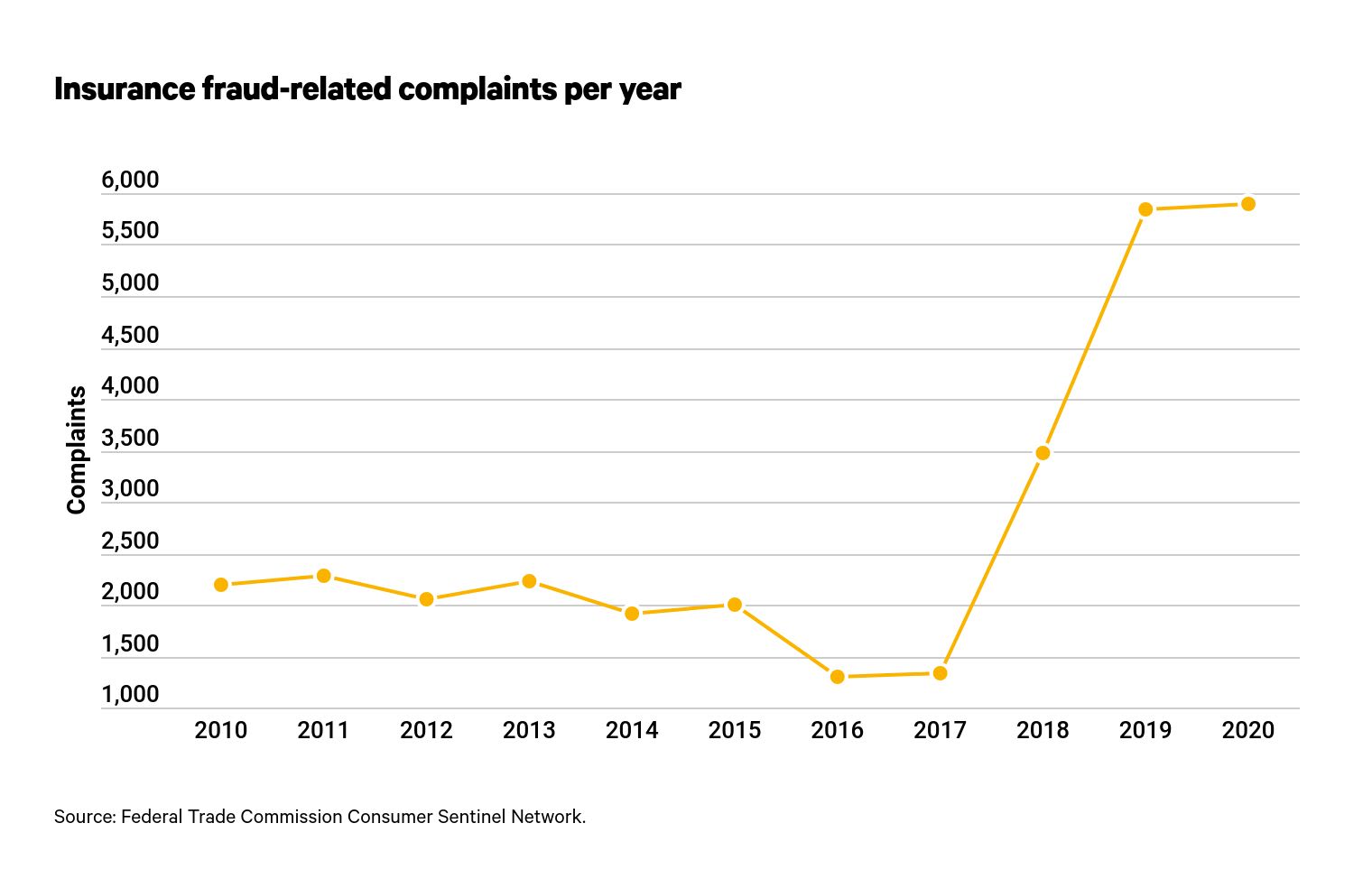

Even while consumers have gaps in their knowledge of the forms of auto insurance fraud and are prone to underreport their encounters with fraudsters, Federal Trade Commission (FTC) records show all fraud-related complaints — not only related to automobiles — have increased exponentially since 2010.

From 2017 to 2018, the number of insurance fraud-related complaints increased by 161% — the largest year-over-year jump in the period examined. From 2010 to 2020, the number of complaints rose by 168%, from 2,196 to 5,893. There were drops in three years, with the steepest in 2016, when complaints dropped by 35% compared to the year before.

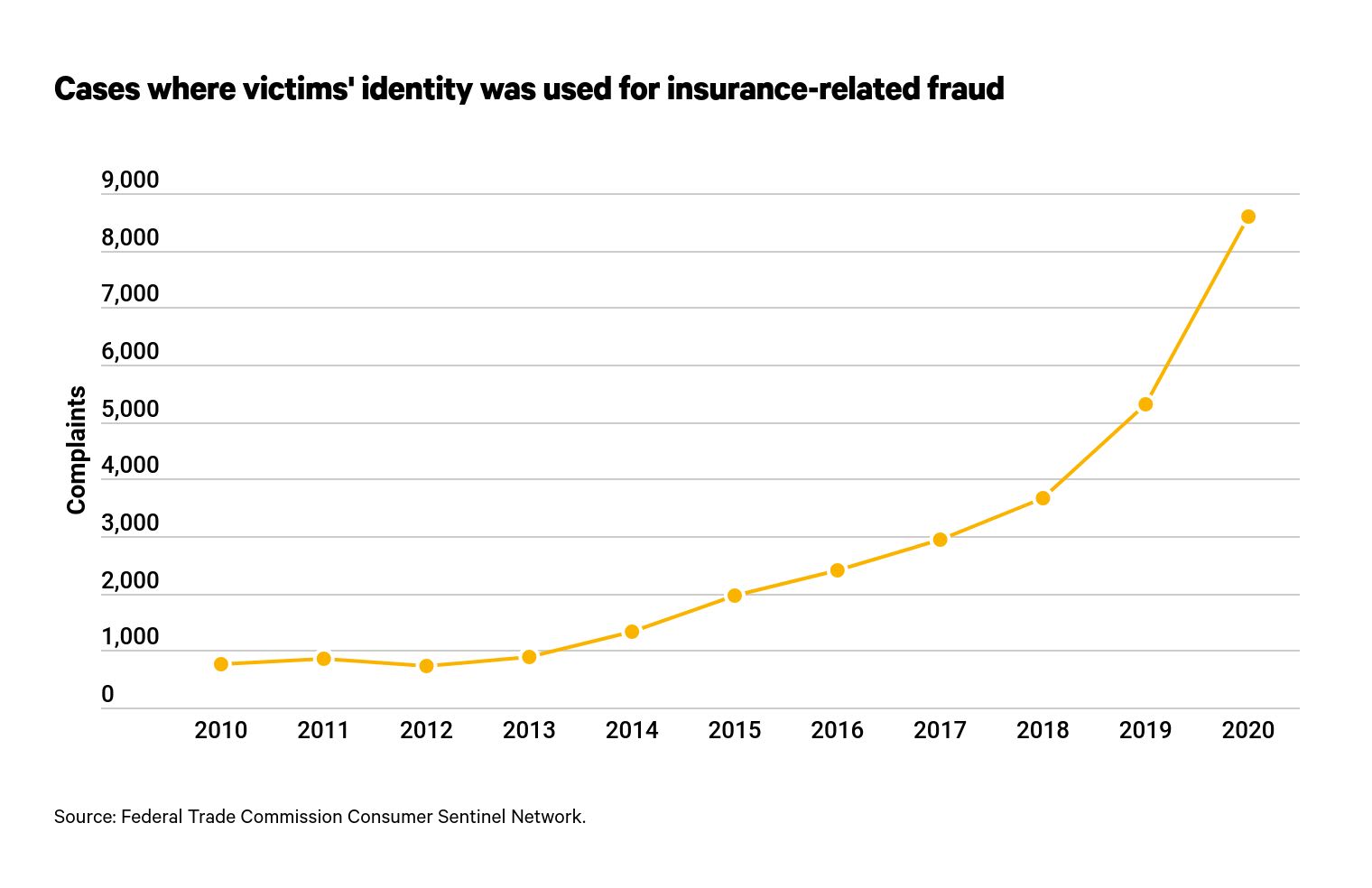

During the same 10-year period, the FTC reports that cases where a victim of identity theft's information was used to execute an insurance-related scam grew significantly, too. These types of fraud were fairly uncommon at the start of the decade, as just 753 cases were reported in 2010. Complaints rose to 8,600 by 2020 — an increase of 1,042% over 10 years.

Despite these drastic increases in the number of insurance fraud cases, consumers' tendencies to underreport their own experiences with fraud — and their incomplete understanding of the forms fraud takes — could mean that real cases are much higher than even the FTC's records show.

When it comes to auto insurance, more than 20% of consumers have lied to their insurance providers — though they haven’t necessarily committed fraud

Seventy-eight percent of consumers maintain they have never lied to their insurance provider. But, when given anonymity, 22% admit to lying at least once — and sometimes more than once — to their insurer.

Response | Percentage |

|---|---|

| No, I’ve never lied to my auto insurer | 78% |

| Yes, I made a claim about damage to my vehicle but instead pocketed the money and didn’t get the car repaired | 9% |

| Yes, I haven't informed my insurer about all the drivers in my household to get a cheaper premium | 8% |

| Yes, I've lied about my address to get a cheaper premium | 8% |

| Yes, my car was stolen and I overinflated the value of the items inside | 4% |

| Yes, I have lied about something else | 2% |

Policies explicitly require customers to tell the truth after a claim. Misrepresenting losses or the events that lead to a loss is fraudulent. While they could lead to an insurance provider refusing to reimburse a policyholder for a loss, they could also constitute a crime. But not every lie consumers admit to telling is necessarily fraud.

Nine percent of those who admit to lying to their insurer made claims for damages and then pocketed it after receiving a claims check for damages. This isn't fraud. Policyholders can keep the money intended for repairs as long as their policy doesn't prohibit it and they own the car outright. It would be fraud, however, if a policyholder claimed the same damage after a future accident to get reimbursed twice.

Twenty percent of those who admit to lying to their insurance provider in other ways have been committing versions of insurance fraud. Eight percent of consumers have lied about the number of drivers in their household and their address to get cheaper car insurance. Four percent have overinflated the value of their items after their car was stolen. Both of these are versions of "soft fraud" rather than "hard fraud" — the latter of which involves staging accidents or making false claims.

Soft insurance fraud is still a form of illegal behavior, although it's more difficult for insurers to uncover and far more common than its more serious counterpart. Policyholders caught committing soft auto fraud can face their car insurance coverage being voided, probation, fines or jail time — depending on the circumstances.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,048 U.S. consumers from June 18 to 22, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2021:

- Generation Z: 18 to 24

- Millennial: 25 to 40

- Generation X: 41 to 55

- Baby boomer: 56 to 75

While the survey also included consumers from the silent generation (those age 76 and older), the sample size was too small to include findings related to that group in the generational breakdowns.

Researchers also analyzed Federal Trade Commission (FTC) Consumer Sentinel Network fraud data from 2010 to 2020 focused on changes to cases of fraud related to insurance (other than medical) and identity theft where stolen personal information was used for insurance-related fraud.