Mutual of Enumclaw Insurance Review

Families and rural homeowners in the Pacific Northwest will find great coverage, service and prices at this Washington-based insurer, but people looking for a basic or online option should look elsewhere.

Find Cheap Auto Insurance Quotes in Your Area

Mutual of Enumclaw is a standout auto and home insurance company in the Pacific Northwest. Its "Members Best" insurance offers great rates and an impressive selection of coverage options for both auto and home, as well as highly rated customer service. It particularly specializes in coverage that will appeal to residents of rural areas, including wildfire protection — at no extra cost.

The only way to buy Mutual of Enumclaw insurance is through an independent agent. The insurer does have a smartphone app that allows you to save your insurance card and begin the claim process right from your phone, but in general, Mutual of Enumclaw is a better option for people who want to have a close relationship with an agent who knows them and their needs.

Pros and cons

Pros

Good rural homes and farms

Lots of coverage add-ons

Great for bundling homeowners and auto insurance

Cons

Not the cheapest option

Can't buy a policy online

Only available in 6 states

Mutual of Enumclaw car insurance quotes

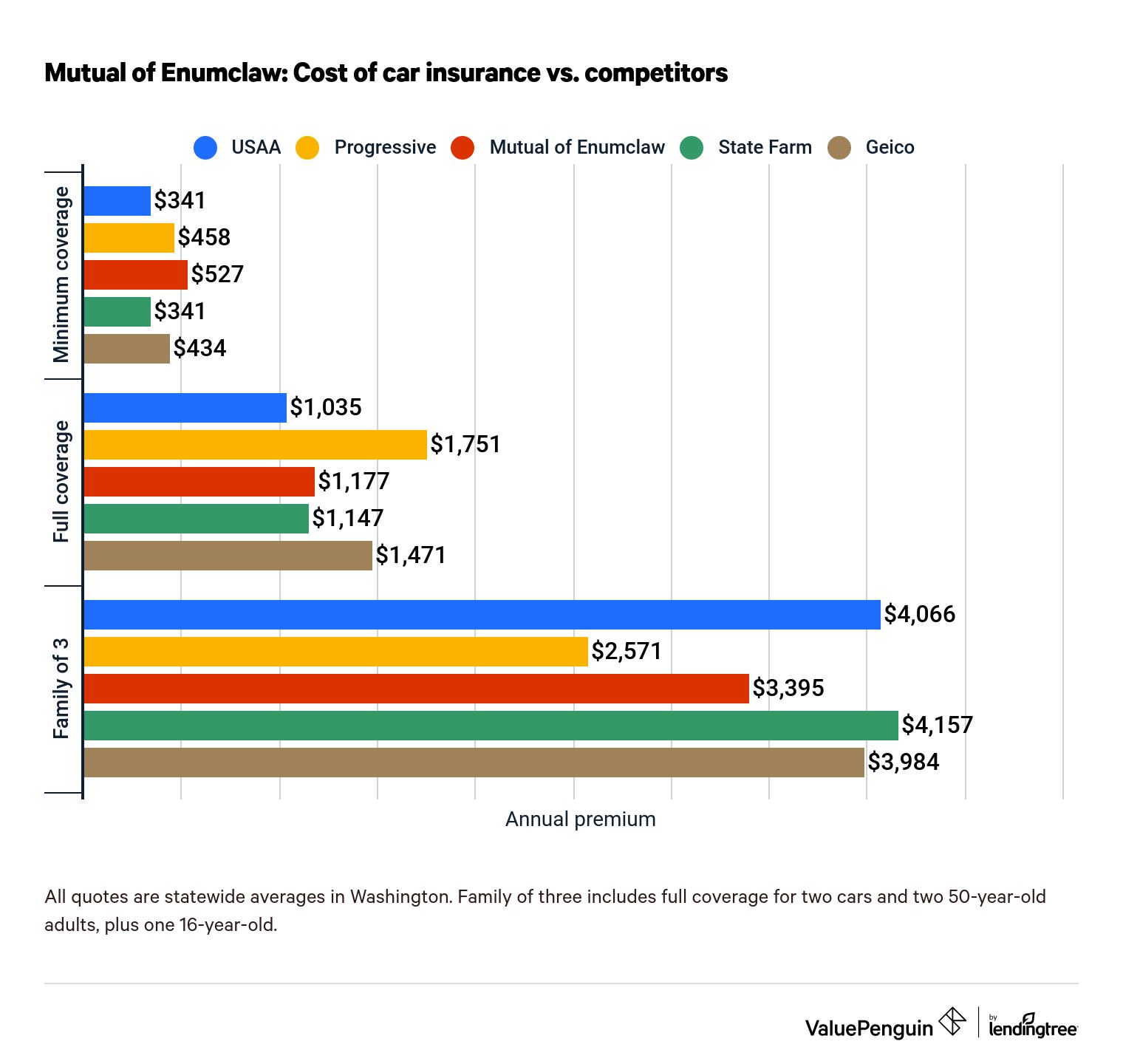

The cost of car insurance at Enumclaw was better than average among companies we looked at, though it was not the absolute cheapest option.

For a 30-year-old driver, we found an annual rate of $1,177 for a full coverage policy in Washington. That's cheaper than the rates we found at Geico and Allstate but not as cheap as the rates at Progressive and USAA.

A minimum coverage policy was comparatively expensive. With an average price of $527 per year, Enumclaw was more expensive than every other insurer except Allstate. Drivers looking for a minimum coverage policy at bargain rates should look elsewhere, such as at USAA or State Farm.

A family of three with two parents and a teen driver can find relatively competitive rates at Mutual of Enumclaw. Our sample drivers got a quote for $3,395, which is the second-cheapest price we found behind Progressive.

Find Cheap Auto Insurance Quotes in Your Area

Mutual of Enumclaw car insurance rates vs. competitors

Minimum coverage | Full coverage | Family of three | |

|---|---|---|---|

| USAA | $341 | $1,035 | $4,066 |

| Progressive | $458 | $1,751 | $2,571 |

| Mutual of Enumclaw | $527 | $1,177 | $3,395 |

| State Farm | $341 | $1,147 | $4,157 |

| Geico | $434 | $1,471 | $3,984 |

| Allstate | $865 | $2,547 | $8,274 |

| Average | $494 | $1,521 | $4,408 |

All quotes are statewide averages in Washington. Family of three includes full coverage for two cars and two 50-year-old adults, plus one 16-year-old.

Mutual of Enumclaw car insurance coverage and discounts

Mutual of Enumclaw has a solid selection of car insurance coverage options for a smaller insurer. In addition to the basic coverage options like liability, comprehensive and collision, we liked that Enumclaw offers less-common coverage options including new car replacement, child seat replacement and emergency travel expense coverage.

- Towing and roadside services

- Emergency travel expenses

- Deductible waiver

- Child safety seat replacement

- Liability protection

- Personal injury protection

- Collision and comprehensive

- Uninsured and underinsured motorist

- Increased coverage limit (optional)

- New car replacement (optional)

- Gap coverage (optional)

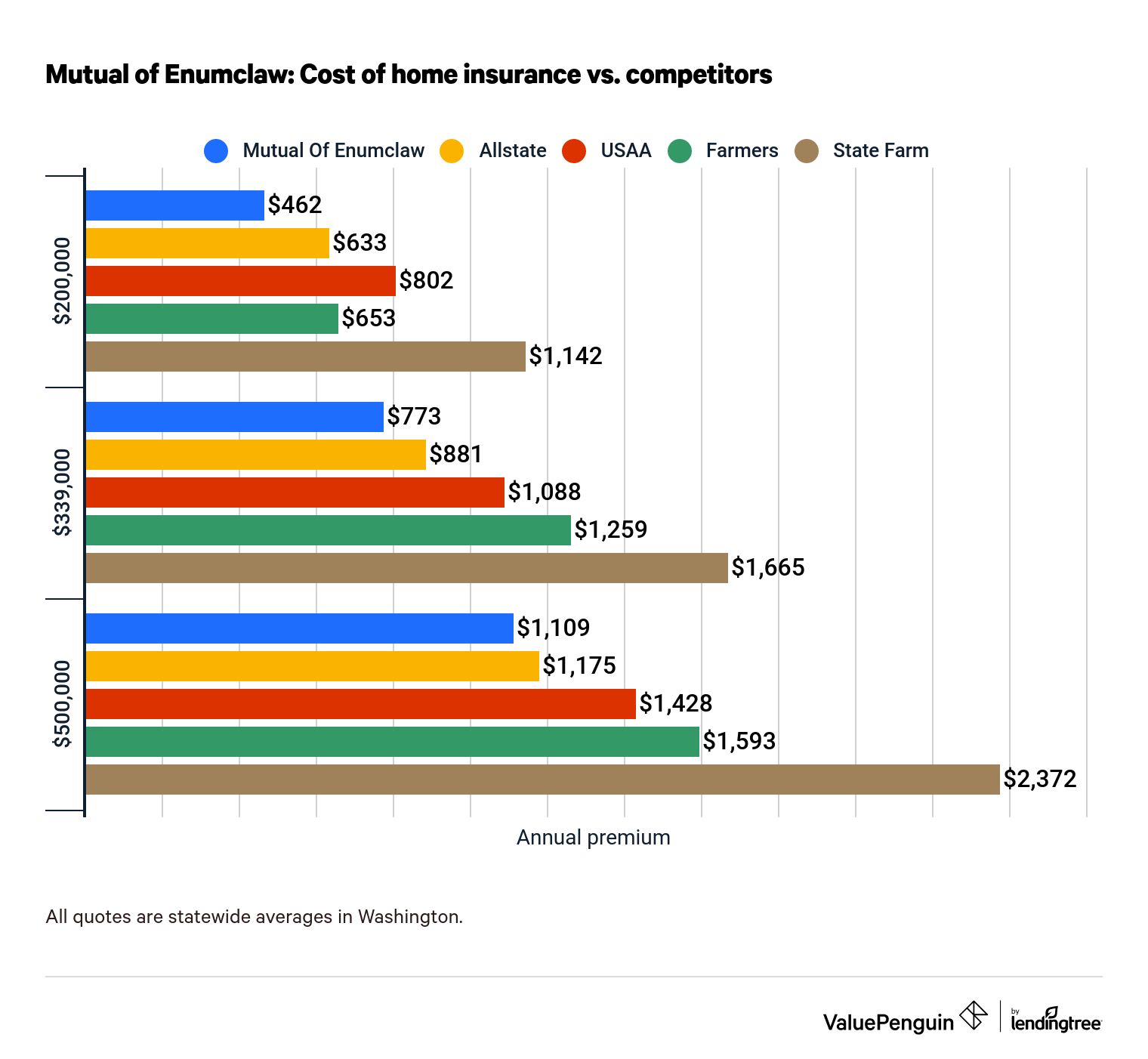

Mutual of Enumclaw home insurance quotes

Mutual of Enumclaw's homeowners insurance prices are very competitive for homeowners in Washington and the surrounding states. It was consistently the most affordable insurer among its competitors, offering the lowest price for each of the coverage levels we evaluated. Enumclaw offered an average annual price of $773 for $339,000 of dwelling coverage; that's 31% lower than the average rate we found among top insurers.

Graph footnote: Rates are for statewide averages in Washington with 50% personal property coverage and 10% other structures coverage with a $1,000 deductible, plus $100,000 in liability coverage. The median home cost in Washington is $339,000.

Find Cheap Homeowners Insurance Quotes in Your Area

Mutual of Enumclaw home insurance rates vs. competitors

$200,000 | $339,000 | $500,000 | |

|---|---|---|---|

| Mutual of Enumclaw | $462 | $773 | $1,109 |

| Allstate | $633 | $881 | $1,175 |

| USAA | $802 | $1,088 | $1,428 |

| Farmers | $653 | $1,259 | $1,593 |

| State Farm | $1,142 | $1,665 | $2,372 |

Mutual of Enumclaw home insurance coverage review

We were very impressed by the breadth of homeowners coverage options from Mutual of Enumclaw.

The most notable offering for Enumclaw customers is wildfire protection.

If you have a homeowners policy and your home is threatened by wildfires, Mutual of Enumclaw will dispatch its own private team of firefighters to keep your home safe — at no additional cost beyond your home insurance policy. It works with Wildfire Defense Systems Inc. to guard the homes of its customers in case of fires.

Even if you don't live in a fire-prone area, there are plenty of useful coverage options, especially if you live in a rural area. For example, Enumclaw's service line coverage will cover damage to your sewer, natural gas or electrical lines, which are longer and therefore more prone to damage in rural areas.

Other notable options include lock and key coverage, extended replacement cost, emergency living expenses and pet injury coverage.

Home coverages from Mutual of Enumclaw

- Liability protection

- Physical structure

- Emergency living expenses

- Personal property

- Key and lock

- Pet injury

- Identity fraud

- Wildfire protection and monitoring

- Extended replacement cost (optional)

Other types of insurance

Mutual of Enumclaw sells a range of other insurance products besides auto and homeowners. These include:

- Service line coverage: Covers repairs of sewer, electrical or gas lines to your home.

- Personal excess liability/umbrella insurance: Extends your home and/or auto liability coverage to much higher limits.

- Renters insurance

- Boat insurance

- Equipment breakdown: Pays to repair or replace mechanical items that break down through the course of normal use.

- Cyber protection: Pays for costs incurred relating to digital fraud, extortion and data breach, among others.

Mutual of Enumclaw customer service reviews and ratings

Mutual of Enumclaw has positive customer service reviews overall. It has an overall complaint index of 0.60 from the National Association of Insurance Commissioners (NAIC), meaning it's received only 60% as many complaints as a typical insurer of its size — suggesting customers tend to be satisfied with the service they receive. Even more impressive is that its complaint index for auto insurance is 0.00, meaning it didn't receive any complaints about car insurance service at all.

Mutual of Enumclaw also has strong financial stability. It has an A- financial strength rating from AM Best. This means it has an "excellent" ability to pay out claims, even in a negative economic climate or during times of high claim demand, such as after a disaster.

Agency | Rating |

|---|---|

| NAIC complaint index (overall) | 0.60 |

| AM Best | A- |

Where is Mutual of Enumclaw available?

Mutual of Enumclaw sells insurance in six states in the Western United States:

- Arizona

- Idaho

- Montana

- Oregon

- Utah

- Washington

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.