Primerica Term Life Insurance: Reviewed by Experts

Standard term life insurance policies with a wide variety of riders.

Find Cheap Life Insurance Quotes in Your Area

Primerica Financial Services, also called Prime America, offers fairly standard term life insurance at higher-than-average rates. If you're looking for whole life insurance, you'll need to go elsewhere. While reviewers tend to criticize the company's sales tactics, Primerica has a great Financial Strength Rating and pays claims quickly.

Pros and cons

Pros

Guaranteed issue options

No medical exam for less than $300K coverage

Large network of local agents

Cons

Average premiums

No permanent insurance options

Pushy sales tactics

Primerica: Specialized in term life insurance

Primerica offers term life insurance products. Its TermNow policy comes with a $300,000 maximum death benefit and usually doesn't require a medical exam. Primerica's Custom Advantage policy costs a little less.

Primerica's term lengths and coverage details

Primerica offers term life insurance policies in increments of 10, 15, 20, 25, 30 and 35 years, but your options depend on your age. Some of Primerica's longer term policies (such as the 30-year and 35-year options) only guarantee level premiums for the first 20 years. Your premiums can potentially increase after that period, and you might lose coverage if you can't afford the extra cost.

Term length | Guaranteed level premium | Availability by age |

|---|---|---|

| 10 years | 10 years | 18–70 years old |

| 15 years | 15 years | 18–65 years old |

| 20 years | 20 years | 12–60 years old |

| 25 years | 20 years | 18–55 years old |

| 30 years | 20 years | 18–50 years old |

| 35 years | 20 years | 18–45 years old |

All of Primerica's policies offer a "guaranteed insurability" option, which means you can renew your policy without a new health exam or application until age 95. The premium may increase, but it would only be due to age. Guaranteed insurability can be an incredibly valuable feature. If you had a normal policy and got cancer during the original term, for example, you might not qualify for a new policy. And if you do qualify, the cost would be incredibly high.

Primerica also offers several riders that allow you to customize a term policy to your financial situation. Each rider will typically increase your premiums by a small amount.

With its "increasing benefit rider," you can increase the death benefit of your policy by up to 10% per year for 10 years. This rare add-on is available until the policyholder is 55. Most insurers only offer "decreasing" benefits because financial obligations tend to drop with age.

For example, say you purchased enough life insurance to cover your mortgage. With every mortgage payment you make, your financial obligation decreases and your life insurance benefit needs to cover less.

Comparing Primerica Custom Advantage vs. TermNow

Unless you need coverage immediately, we recommend Primerica's Custom Advantage policy over TermNow. That's because:

- Custom Advantage is significantly cheaper than TermNow

- TermNow policies are limited to $300,000 or less in benefits

TermNow is an option if your life insurance policy has a death benefit between $15,000 and $300,000. Since the payout is limited, Primerica allows you to go through a simplified underwriting process with no medical exam. Instead, you allow the company to run background checks through the Medical Information Bureau and DMV. If there are no issues, Primerica issues coverage within a few minutes. The key downside? TermNow premiums are significantly higher. That's true for most life insurance products that simplify the underwriting process.

The underwriting process on a Custom Advantage policy can take between one and six weeks. But you can choose the face value, with death benefits over $1 million, and you pay less for comparable coverage. And while it may sound like a hassle, the medical exam typically takes less than an hour and can be scheduled at your home or work.

How much does Primerica's life insurance cost?

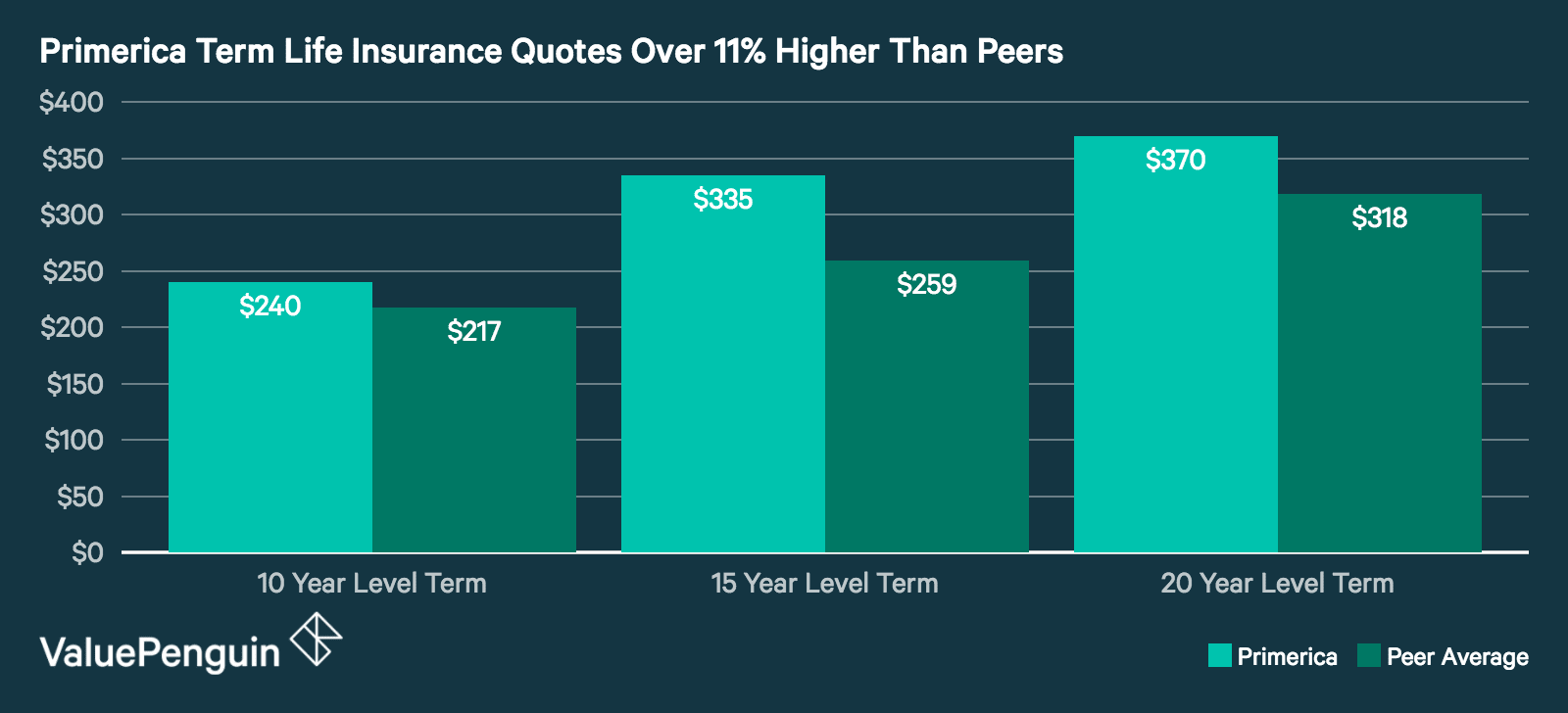

ValuePenguin compared sample quotes for Primerica and 50 other insurers. Primerica's policies are typically 11% to 29% more expensive for the same coverage.

Sample quotes were for a 35-year-old nonsmoking man in great health. All policies are for $500,000 in coverage.

Find Cheap Life Insurance Quotes in Your Area

Primerica consumer reviews and complaints

Credit rating agency A.M. Best gives Primerica an A+ (Superior), which means the company can meet its financial obligations. Primerica pays 94% of claims within 14 days on average. Positive consumer reviews mention the company's wide range of financial products, such as mutual funds and investment accounts, and knowledgeable agents.

Complaints primarily focus on Primerica's sales tactics and sales process, which can best be described as a multilevel marketing operation. Primerica's agents are "captive," which means they're not allowed to represent other insurers. To compare Primerica's rates with other companies, you'll need to do the work yourself.

Primerica's agents are encouraged to sell policies to their friends and family and recruit them as new agents. Then, the recruiting agent receives a portion of the commission from each sale one of the recruits makes. Many agents receive poor ratings because they lack experience with life insurance.

Frequently Asked Questions

Is Primerica a legitimate life insurance company?

Based on Primerica's ability to maintain an A+ rating from A.M. Best, the company's life insurance policies clearly provide real coverage. However, Primerica's sales and recruitment practices leave something to be desired.

How do I cancel a Primerica life insurance policy?

Canceling life insurance from Primerica works the same as with any other provider. Contact the company by calling (800) 257-4725 or emailing [email protected]. Keep in mind that generally, term life insurance policies don't offer refunds on premiums you've already paid. Also be sure to cancel any direct deposits after you cancel.

Is Primerica life insurance expensive?

Primerica's term life insurance costs roughly 11% to 29% more than equivalent policies from a group of 50 major competing companies. Our findings were based on quotes for a 35-year-old nonsmoking man seeking $500,000 in coverage.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.