Kin Home Insurance Review: Great Rates & Coverage

Many insurers force you to choose between affordable home insurance rates or great service; however, that isn't the case with Kin Insurance.

Find Cheap Homeowners Insurance Quotes in Your Area

Kin Insurance offers affordable, convenient insurance for homeowners. Besides providing standard home coverage, Kin specializes in areas that are often harder to insure, such as mobile homes and flood insurance.

While Kin's lack of auto insurance options will disappoint shoppers looking to save by bundling, it's still a great choice if you prefer to avoid the long hold times and exhaustive questioning that many other insurers put you through. But you'll only be able to get Kin Insurance in Alabama, Arizona, California, Florida, Georgia, Louisiana, Mississippi, South Carolina, Texas and Virginia.

Pros and cons

Pros

Quick online homeowners insurance quotes

Affordable basic homeowners insurance coverage

Cons

Can't bundle multiple insurance policies

No in person agents

Only available in Florida and Louisiana

Our Thoughts

Kin's number one value proposition for homeowners is a high level of convenience. All that's required to get a quote from Kin is your physical address, minimal personal information and the answers to a handful of questions. Other insurance companies often require you to answer dozens of additional questions before delivering a quote.

And Kin Insurance provides easy-to-understand explanations for each coverage option, saving you the hassle of going back and forth with an agent for questions you may have.

If you do need personalized assistance from an agent, Kin Insurance offers that by phone or with the chat function on its website. While many insurance customers experience long wait times on the phone with traditional insurers, Kin's use of the chat platform makes the process faster and less painful.

Where can I get Kin home insurance?

- Alabama

- Arizona

- California

- Florida

- Georgia

- Louisiana

- Mississippi

- South Carolina

- Texas

- Virginia

The main drawbacks with Kin are its limited availability and its lack of insurance products other than homeowners coverage. The company only offers homeowners insurance in a few states. And it's not possible to bundle your home and car insurance with Kin, which usually lowers your rate for both policies.

Kin Insurance rates

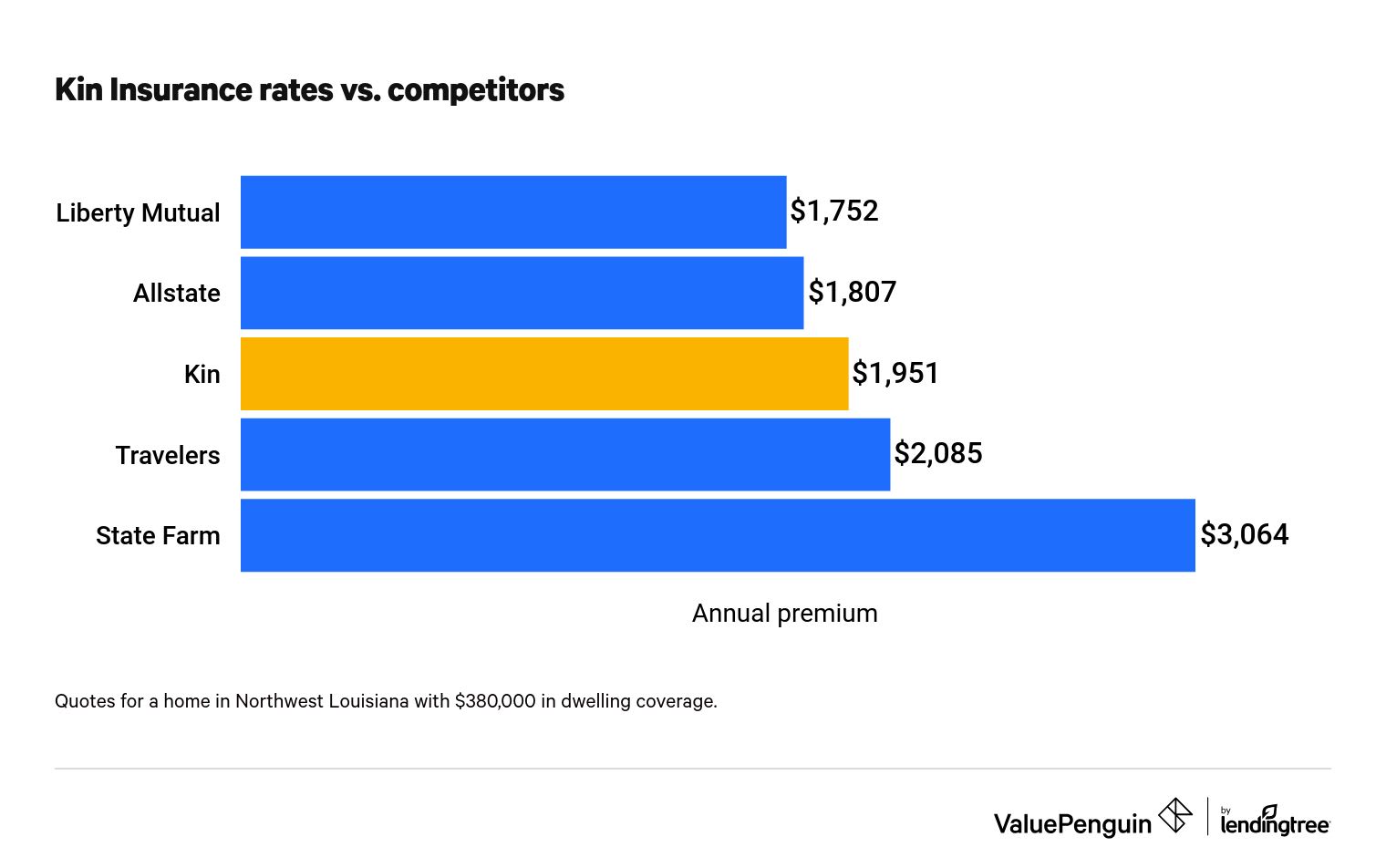

Kin Insurance offers average home insurance rates that are cheaper than larger companies such as State Farm and Travelers. Kin's rate of $1,951 per year was $134 less than Travelers and $1,114 less than State Farm.

Find Cheap Homeowners Insurance Quotes in Your Area

Kin yearly home insurance rates vs. competitors

Company | Annual Premium |

|---|---|

| Liberty Mutual | $1,752 |

| Allstate | $1,807 |

| Kin | $1,951 |

| Travelers | $2,085 |

| State Farm | $3,064 |

Kin home insurance discounts

When you sign up for a Kin Insurance policy online, the website will automatically apply discounts you qualify for, such as having a fire alarm or wind mitigation, which includes having a hip-shaped roof.

- Fire and security alarm discount: Applied when a home has a monitored fire or burglar alarm

- Community-based discount: Applied if your home is in a gated community

- Electronic policy discount: Applied when a customer uses paperless billing

- Mature homeowner discount: Applied when the applicant is 55 or older

- Water leak detection and mitigation device discount: Applied if the home has a remote water detection device installed

- Responsible repair discount: Customers can get 5% off if they agree to not sign over claims benefits to a contractor.

Kin home insurance coverage

While Kin Insurance is a relatively new home insurance company, it offers all of the standard coverage options for dwelling, personal property and personal liability. It will insure homes with older roofs at lower premiums, but the payout will be for the actual cash value of an older roof instead of the price of replacing it.

Another thing that sets Kin apart is its willingness to provide types of home insurance that traditional companies often won't. Kin operates mostly in high-risk hurricane states on or near the Gulf Coast, and it offers policies for mobile homes and flood insurance, which can be harder to find policies for.

Kin Insurance doesn't have the longest list of endorsements or add-ons for policyholders to choose from, but it isn't missing anything critical. If you're looking for a highly specific coverage, then consider a Progressive home insurance policy.

Identity fraud expense: Consider adding this optional coverage if you're concerned about becoming a victim of identity theft. The endorsement covers expenses associated with your identity being compromised, such as attorney expenses, credit report costs and notary fees. Identity fraud expense coverage also connects you to an identity fraud specialist who will work with you to restore your identity.

Special personal property: While a standard homeowners insurance policy typically provides coverage for your property, the coverage only applies in certain situations. This endorsement expands the types of claims under which your property might be covered.

Personal injury: This provides coverage in situations such as libel and slander, both written and electronic, as well as privacy violations.

Animal liability: Kin's main personal liability policies do not include coverage for damages an animal might cause, but that coverage is added with this endorsement. There are two coverage limits, one that covers liability claims and another that covers medical payments for others.

Screened closure coverage from hurricane damage: This will cover damage to screen enclosures, including porches, patios and over pools. Screens are not covered by standard hurricane coverage.

Non-catastrophic limited sinkhole coverage: Sinkhole coverage will protect your home from even more minor damage that results from a nearby sinkhole. Shifts in earth can damage foundations, displace parts of floors and lead to walls buckling. This coverage goes beyond what's called catastrophic ground cover collapse insurance, which requires a high standard of damage to receive a payout.

Standard coverage options available through Kin Insurance

What's covered by a Kin Insurance policy? | Details |

|---|---|

| Your home | This portion of your Kin Insurance policy would pay for repairing or rebuilding your home's physical structure should it suffer damage from a covered peril |

| Other structures | Your home insurance policy also covers detached structures, such as a garage or your fence |

| Your personal items | Damage, destruction or the theft of your personal possessions would also be covered under your home insurance policy |

| Loss of use | Reimburses you for the increased expenses associated with living away from home after a covered loss |

| Personal liability | Protects you from claims made against you for things such as property damage |

| Medical payments | Covers medical bills if someone suffers an injury on your property |

Kin Home Insurance reviews and customer support

Kin Home Insurance reviews are overwhelmingly positive. Reviews consistently speak highly about Kin Insurance's excellent rates and its personable agents, which can be reached by email, online chat or phone.

The company did not receive a single complaint last year through the National Association of Insurance Commissioners, a national organization that regulates the insurance industry. It also has an A+ rating from the Better Business Bureau, which means the company quickly replies to complaints, and has minimal complaints overall.

Some homeowners might have second thoughts about insuring their homes with a startup due to limited insight into the company's financial standing and its ability to pay customer claims. The company does not have a rating from A.M. Best but has an A rating from Demotech, which means it has "excellent" financial stability.

Methodology

Quotes were for a four-bedroom home in Louisiana built in 1955. Policies included $380,000 in dwelling coverage, $285,000 in personal property coverage and $100,000 in personal liability coverage.

The quotes were collected directly from insurers. If an exact coverage limit was not made available, the closest available option was selected.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.