Homeowners Insurance

41% of People in At-Risk Areas Had Hurricane-Related Debt

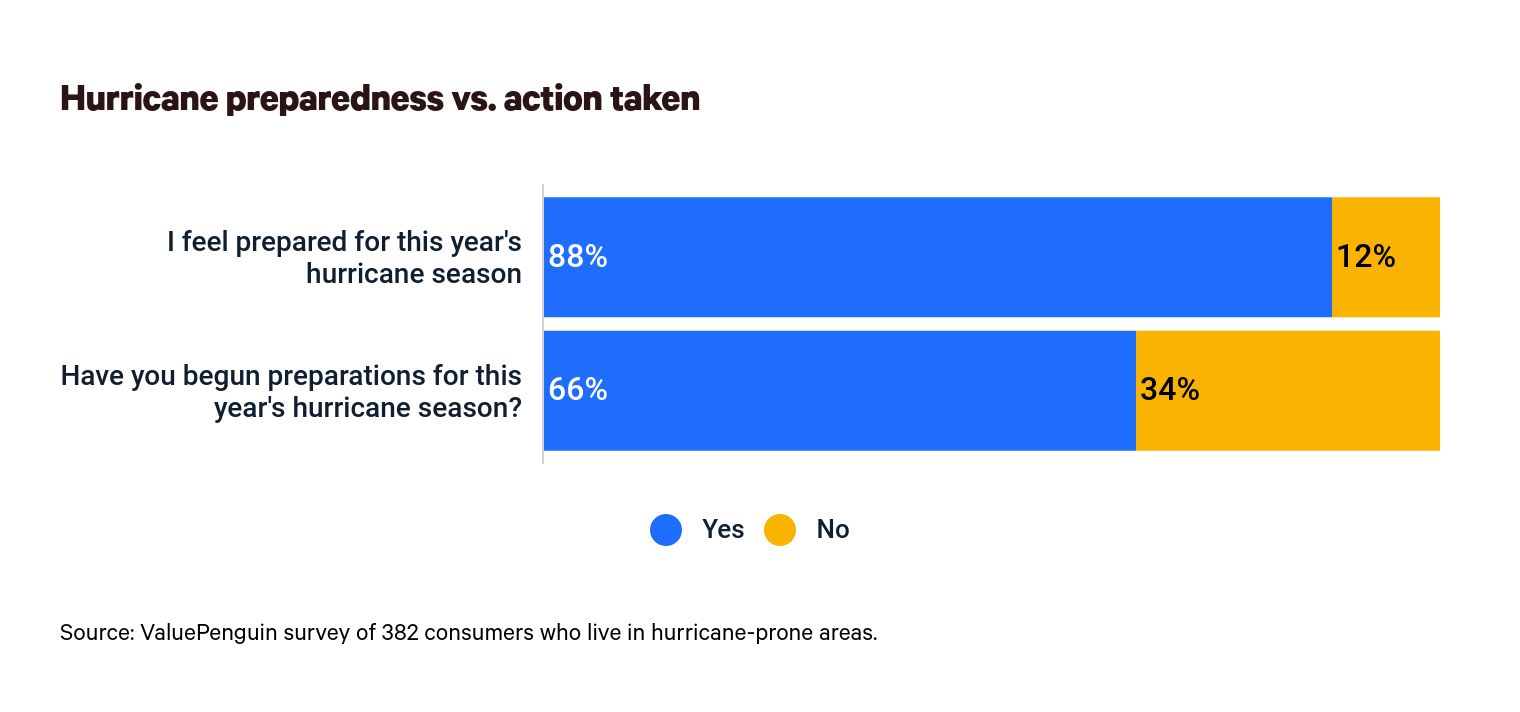

ValuePenguin's latest survey finds that consumers living in hurricane-prone areas may be less prepared for this year's season than they claim. Eighty-eight percent of respondents judge themselves to be prepared for hurricane season, but 34% haven't started prepping yet.

Additionally, 31% admit they aren't financially prepared to purchase supplies, evacuate or repair damage should the need arise. Consumers may also lack knowledge about how insurance coverage can help them recover after a storm and their coverage limits. Forty-five percent of residents in these hurricane-prone areas mistakenly believe a regular home insurance policy would cover flood damage. These knowledge gaps can be costly, especially as 41% of consumers have gone into debt before because of hurricanes.

Key findings

- 41% of those living in an area with a history of hurricanes have gone into debt as a result of a hurricane. Of those who went into debt, 65% racked up $1,000 or more.

- Nearly a third (31%) of those living in hurricane-prone areas aren't financially ready for hurricane season. For renters, that jumps to 42% (versus 25% of homeowners).

- Residents used to hurricanes may have a false sense of preparedness. Though 88% feel prepared for this year’s hurricane season, 34% haven’t done anything to get ready.

- Nearly 1 in 4 (24%) consumers in hurricane-prone areas don’t spend any money preparing their home for potential hurricane damage. As far as spending on stockpiling supplies, homeowners spend more than renters — 33% of homeowners spend at least $150 a year, compared with 17% of renters.

- Almost half (47%) of residents in hurricane-prone areas don’t know how much hurricane-related insurance coverage they need to be fully protected — and some falsely believe damage will be covered without a flood insurance policy. 45% believe flood damage is covered under a basic homeowners or renters insurance policy when — in reality — it must be purchased separately.

Hurricane-related debt has affected 41% of those living in storm-prone areas, but nearly a third of consumers say they aren't financially prepared for this year’s storm season

In the past, homeowners have been more likely than renters to go into debt because of a storm. Hurricanes have caused 48% of property owners to fall behind financially, while 29% of renters have gone into debt due to a storm. And hurricane-related debt is often sizable.

Among consumers whom hurricanes have caused to go into debt, 65% have fallen behind by $1,000 or more. Homeowners are more likely than renters to carry larger debt, as the debt for 69% of property owners totaled at least $1,000, while 49% of renters had this much debt. This year, researchers found that the percentage of people who could face debt because of the 2021 storm season is potentially significant.

Thirty-one percent of residents living in hurricane-prone areas, including 42% of renters and 25% of homeowners, can’t prepare for and respond financially to the impacts of a hurricane. These consumers lack the resources to purchase supplies, evacuate and repair damage to their homes.

Amount of debt | Percentage |

|---|---|

| Less than $500 | 10% |

| $500 to $999 | 25% |

| $1,000 to $1,499 | 33% |

| $2,000 to $2,499 | 15% |

| $2,500 or more | 17% |

There continues to be a disconnect between consumers' attitudes about preparedness and their reality — and it's gotten slightly worse in the past year

The finances for those living in the potential path of hurricanes could be made even worse by a lack of emergency preparation. Although 88% of people living in hurricane-prone areas claim they’re prepared for this year's storms, just 66% have begun preparing for storm season, meaning more than one-third haven't.

The percentage of people who claim to be prepared for hurricane season without having prepared grew in the last year.

ValuePenguin has conducted similar surveys since 2019, each time comparing consumers' sentiments about their preparation with their actions. In 2019, 77% of consumers felt prepared, but only 48% took appropriate measures. This gap narrowed in the survey conducted in 2020, when 86% judged themselves prepared, while 68% took action. This year, the gap widened by four percentage points.

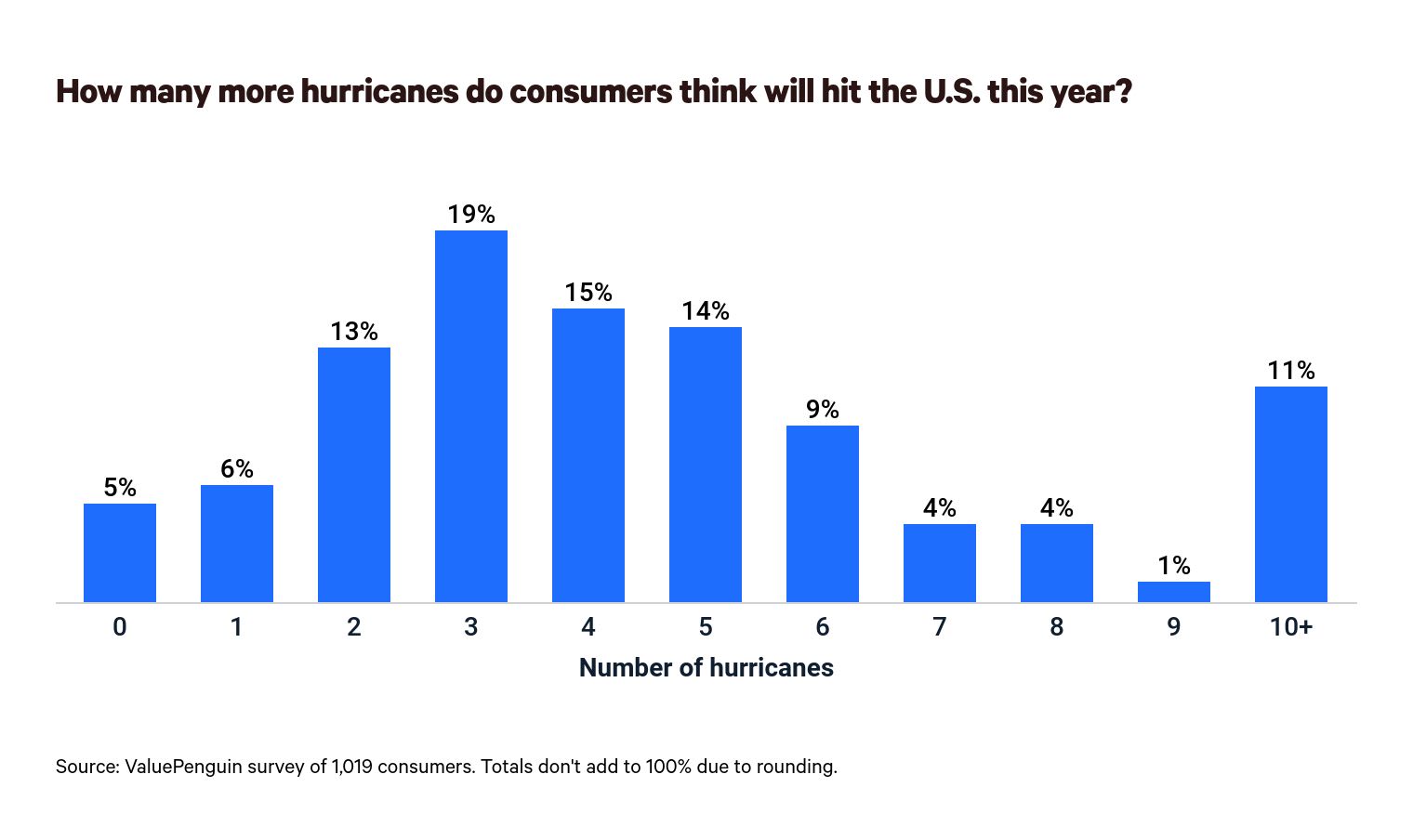

This negative movement is particularly surprising given residents' predictions for hurricane season. Half of people in areas impacted by hurricanes believe they’ll be hit by one this year. At the same time, 45% of people living in potentially affected areas believe this year's hurricane season will be worse than the year before, while 29% think that this year's storms will be about the same as last year's — when there were a record number of named hurricanes.

Despite a record number of named hurricanes in 2020, 16% of respondents don't believe that climate change contributes to the strength and number of hurricanes.

Part of the problem may be that consumers are unable to prepare adequately. Those who feel prepared but who haven't begun preparations for storms may be part of the 31% who aren't financially able to make preparations. Others may be habitually underprepared. In fact, 24% of people living in hurricane-prone areas never spend any money getting their homes ready for storms, while 53% spend less than $100 stockpiling food and supplies.

Money spent stockpiling supplies | Percentage | Money spent preparing home for damage | Percentage |

|---|---|---|---|

| $0 | 11% | $0 | 24% |

| $1 to $49 | 12% | $1 to $49 | 14% |

| $50 to $74 | 16% | $50 to $74 | 12% |

| $75 to $99 | 14% | $75 to $99 | 13% |

| $100 to $149 | 21% | $100 to $149 | 15% |

| $150 to $199 | 12% | $150 to $199 | 9% |

| $200 or more | 15% | $200 or more | 13% |

Almost half of residents in hurricane-prone areas are mistaken about how insurers treat hurricane damage, potentially leaving themselves vulnerable to high out-of-pocket costs

A regular home insurance policy offers partial coverage against damage from hurricanes. Standard policies reimburse homeowners or renters for damage caused by wind, collapse, falling objects and rain. However, if someone's home is inundated with water and flooded, that homeowner would need a separate flood insurance policy to avoid paying for repairs on their own.

Despite these restrictions, 47% of residents in areas prone to hurricanes don't know how much insurance they need to be fully covered from a storm. This includes 61% of renters and 38% of homeowners. Residents also aren't sure about how insurers treat damage from a flood differently than the effects of wind and rain that come with hurricanes. Just 30% of people know that flood damage is covered by flood insurance and that, if their homes were damaged, their home insurance policy wouldn't offer coverage.

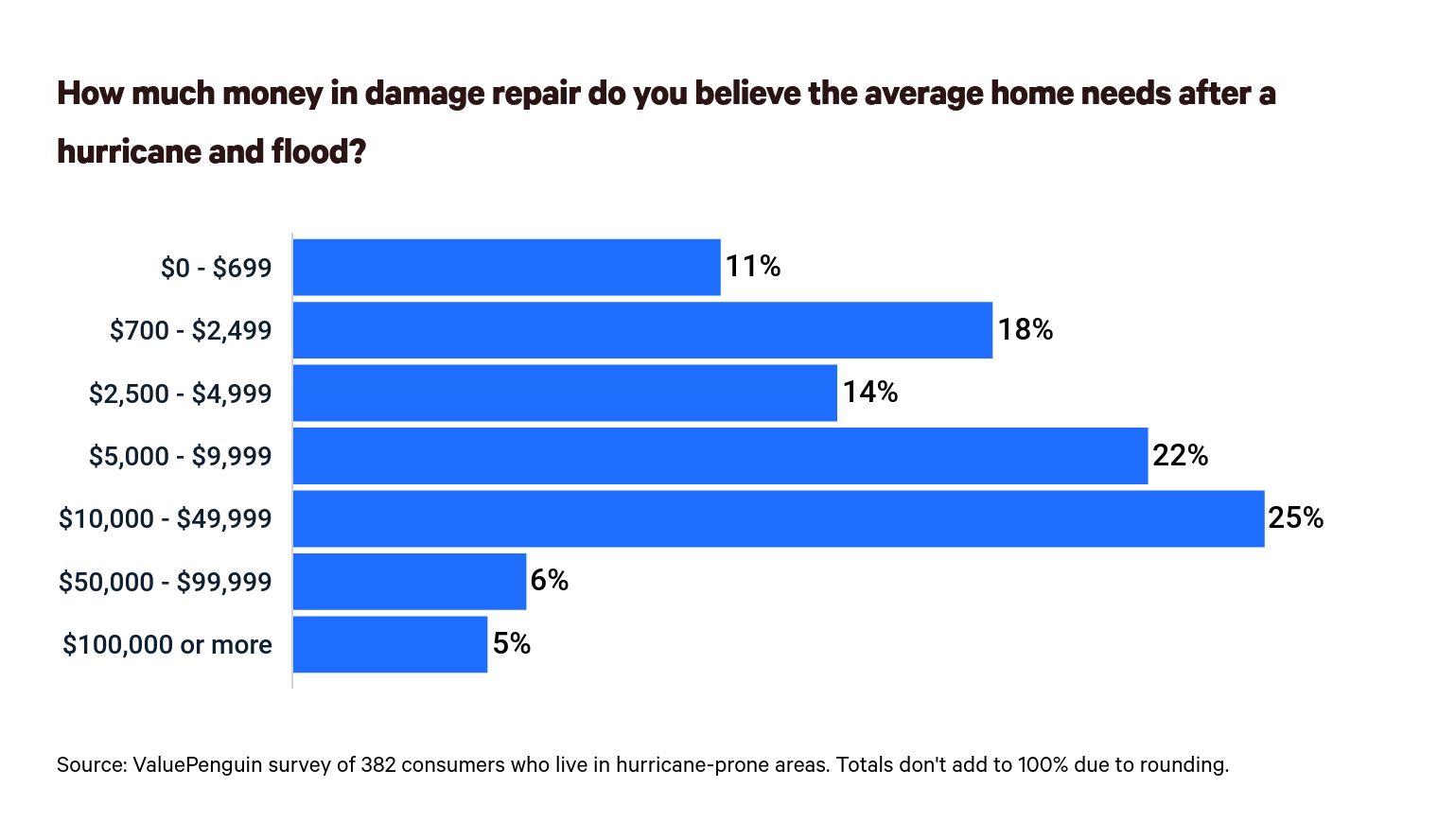

Many residents living in high-risk areas may also be underestimating the destructive power of hurricanes. The average flood claim, according to the Federal Emergency Management Agency (FEMA), was $52,000 in 2019. But 89% of consumers living in hurricane-prone areas estimated that the typical home needs less than $50,000 of repairs after a storm. Without flood insurance, homeowners could be left paying a lot of money out of their pockets.

Methodology

ValuePenguin commissioned Qualtrics to field an online survey of 1,019 Americans who live in hurricane-prone areas, conducted July 9-15, 2021. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.