Homeowners Insurance

With Extreme Weather on the Rise, Mother Nature Is a Homeowner’s Worst Enemy: 70% of Insurance Claim Filers Say It Was for Weather-Related Damages

Severe weather is on the rise, and it’s affecting U.S. homeowners. While the majority of homeowners haven’t had to file a home insurance claim, 70% of those who have said it was for weather-related damages.

The newest ValuePenguin survey asks more than 1,000 U.S. homeowners about all things homeowners insurance. Here’s what else we found.

On this page

- Key findings

- 55% of homeowners have never filed a home insurance claim

- Homeowners most likely to file claims for weather-related damages

- 37% of homeowners haven’t updated their home insurance policy since purchasing their home

- Insurance companies keep homeowners on their toes

- What homeowners need to know about their insurance policies

- Methodology

Key findings

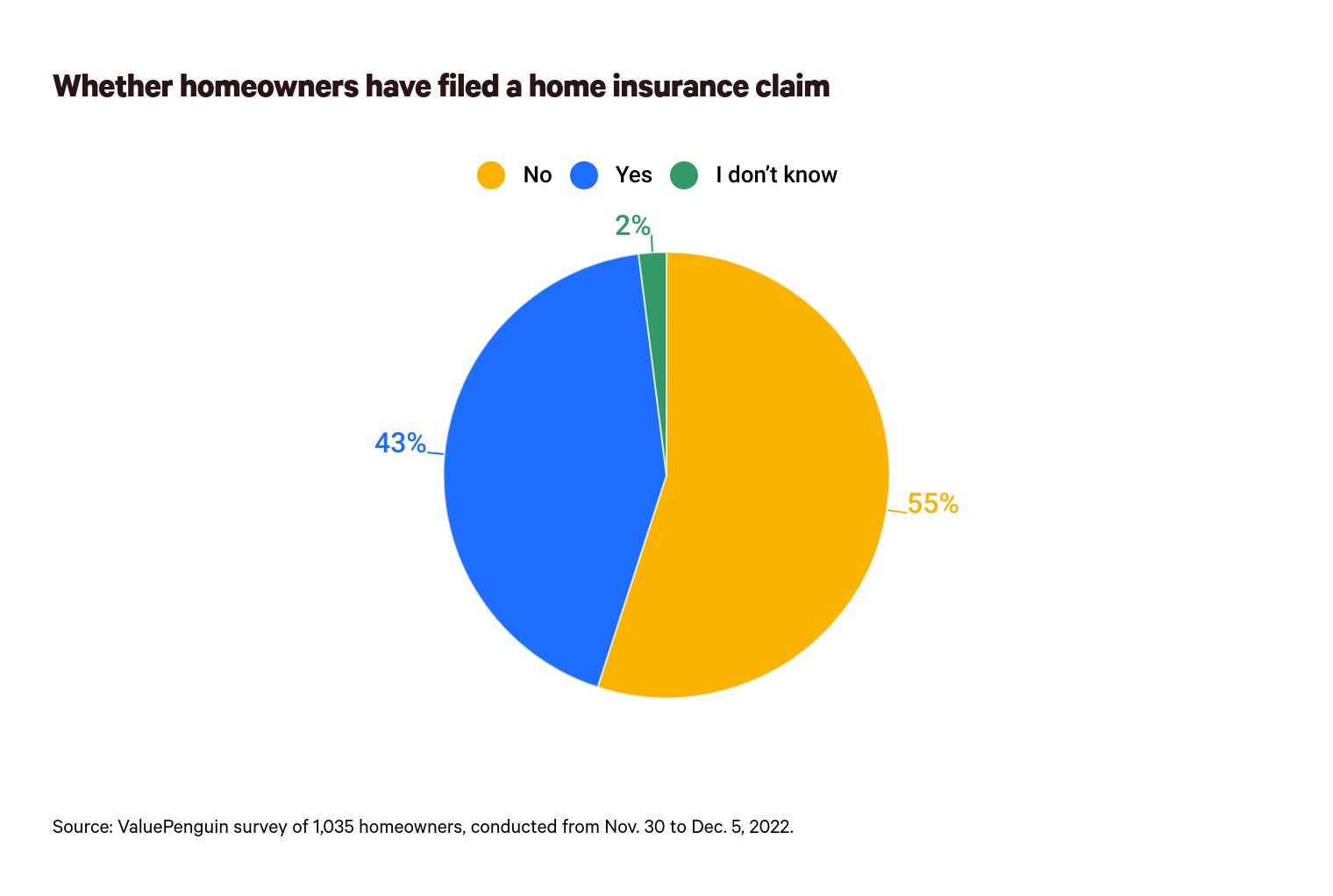

- Luck is on homeowners’ side. 55% of homeowners say they’ve never filed a home insurance claim. Gen Xers are the luckiest age group, with 59% reporting they’ve never filed a claim. Meanwhile, first-time homeowners are more likely to say they haven’t filed a claim (59%) than those who previously owned another home (53%).

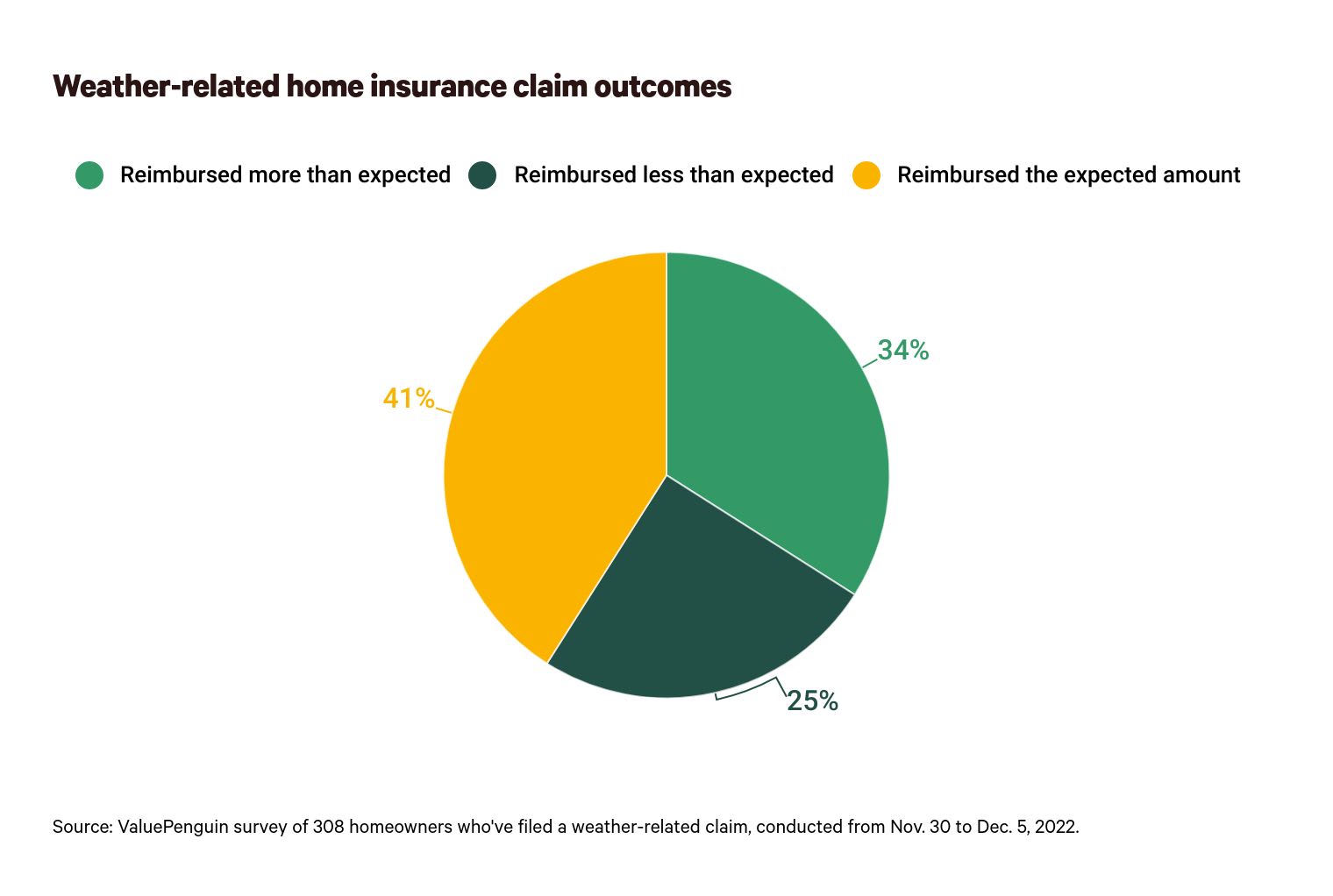

- Mother Nature is a homeowner's worst enemy. 70% of homeowners who’ve filed an insurance claim say it was for weather-related damages. Among those who’ve made weather-related insurance claims, 34% were reimbursed for more than expected, 25% received less than expected and 41% received about what they expected.

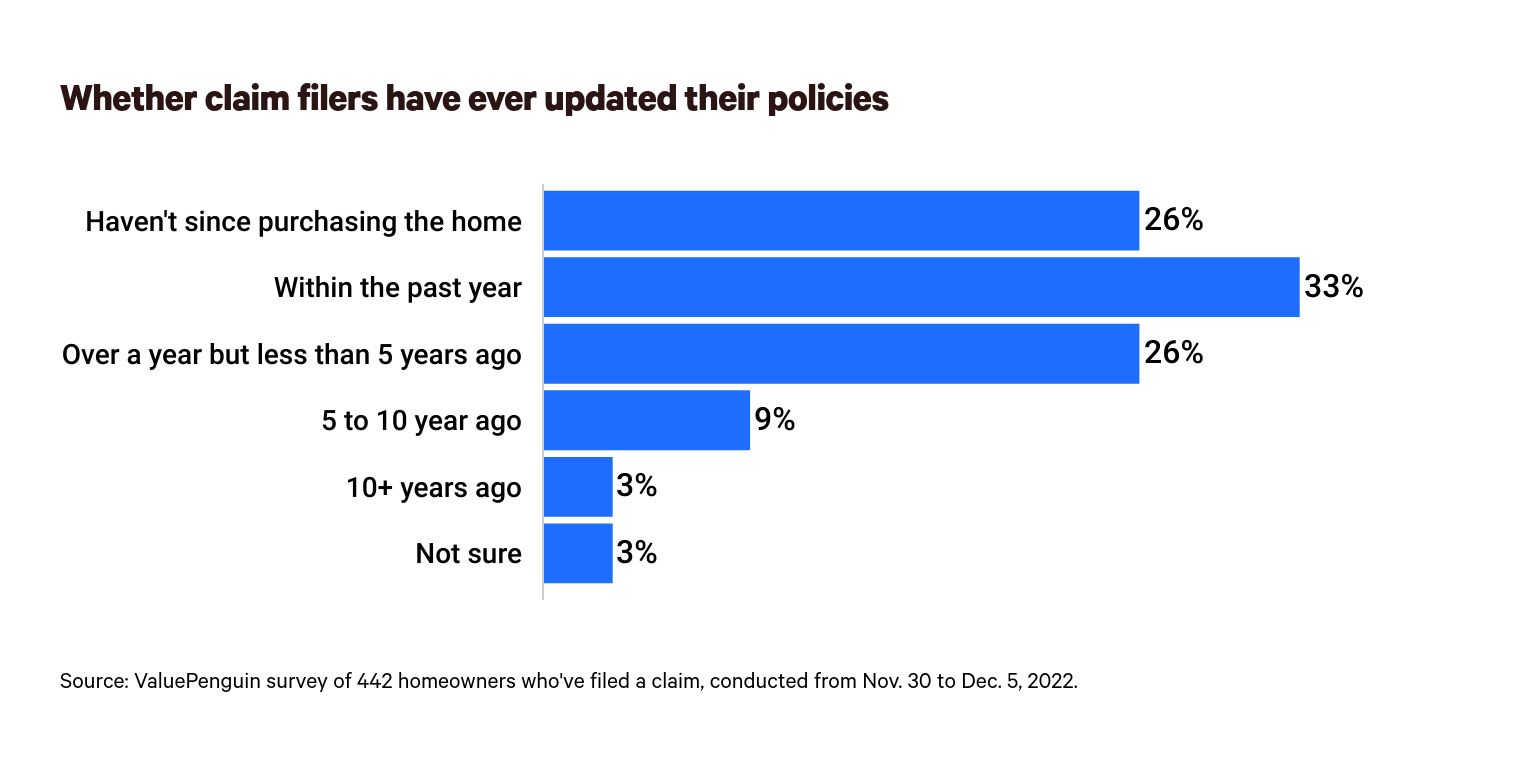

- Out of sight, out of mind. 37% of homeowners haven’t updated their home insurance policy since they purchased their homes. In comparison, 71% of those who’ve filed a claim have made at least one update since purchasing. New buyers in the past year and those who make less than $35,000 a year (both 48%) are the most likely not to have touched their policies since their home purchase.

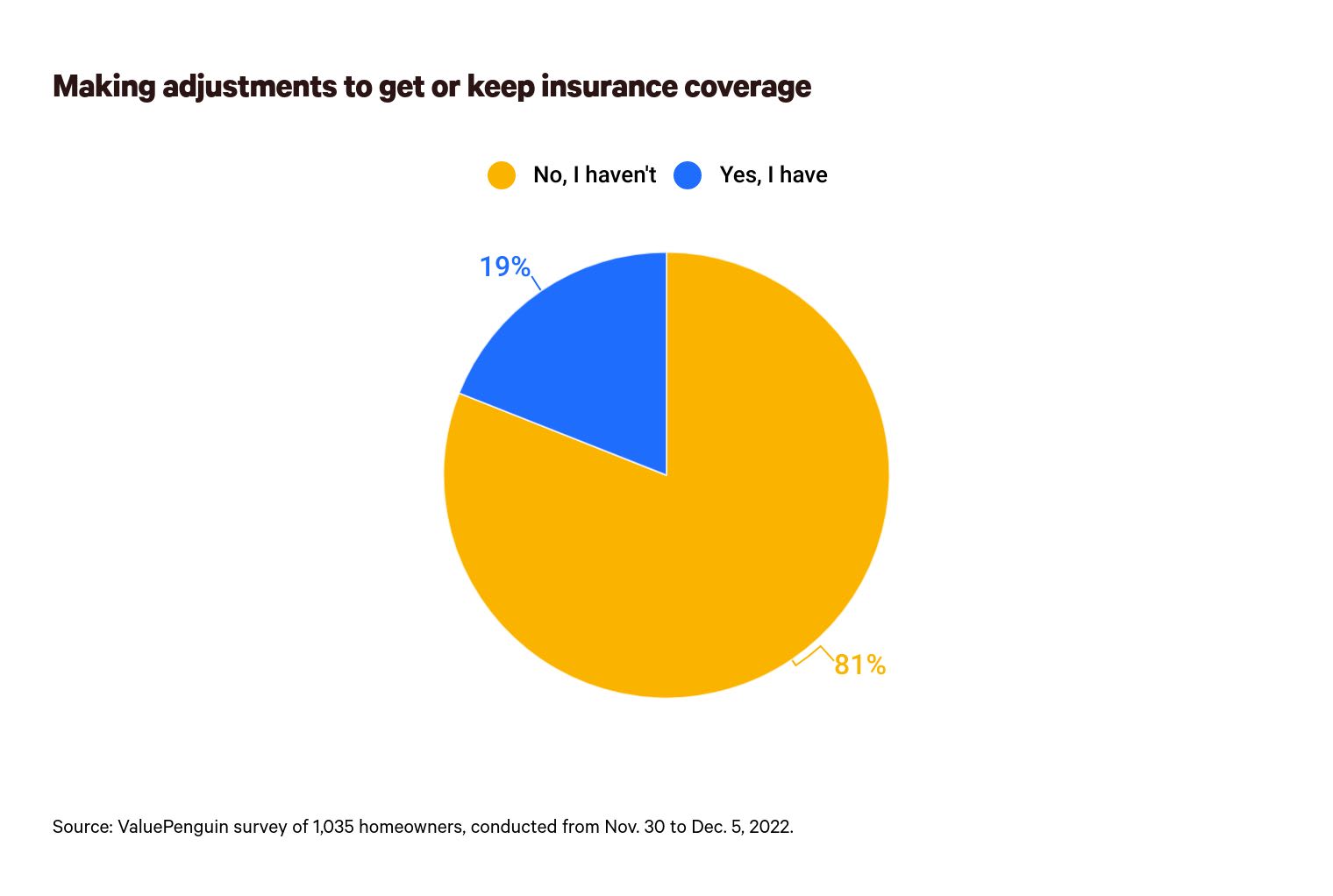

- Insurance companies are keeping homeowners on their toes. 19% of homeowners say they’ve had to adjust something about their home or make repairs to get or keep insurance coverage. That rises to 30% for homeowners who’ve previously filed a claim, which could suggest doing so invites more scrutiny from insurance companies. The changes aren’t exactly cheap either, as 73% cost homeowners more than $1,000.

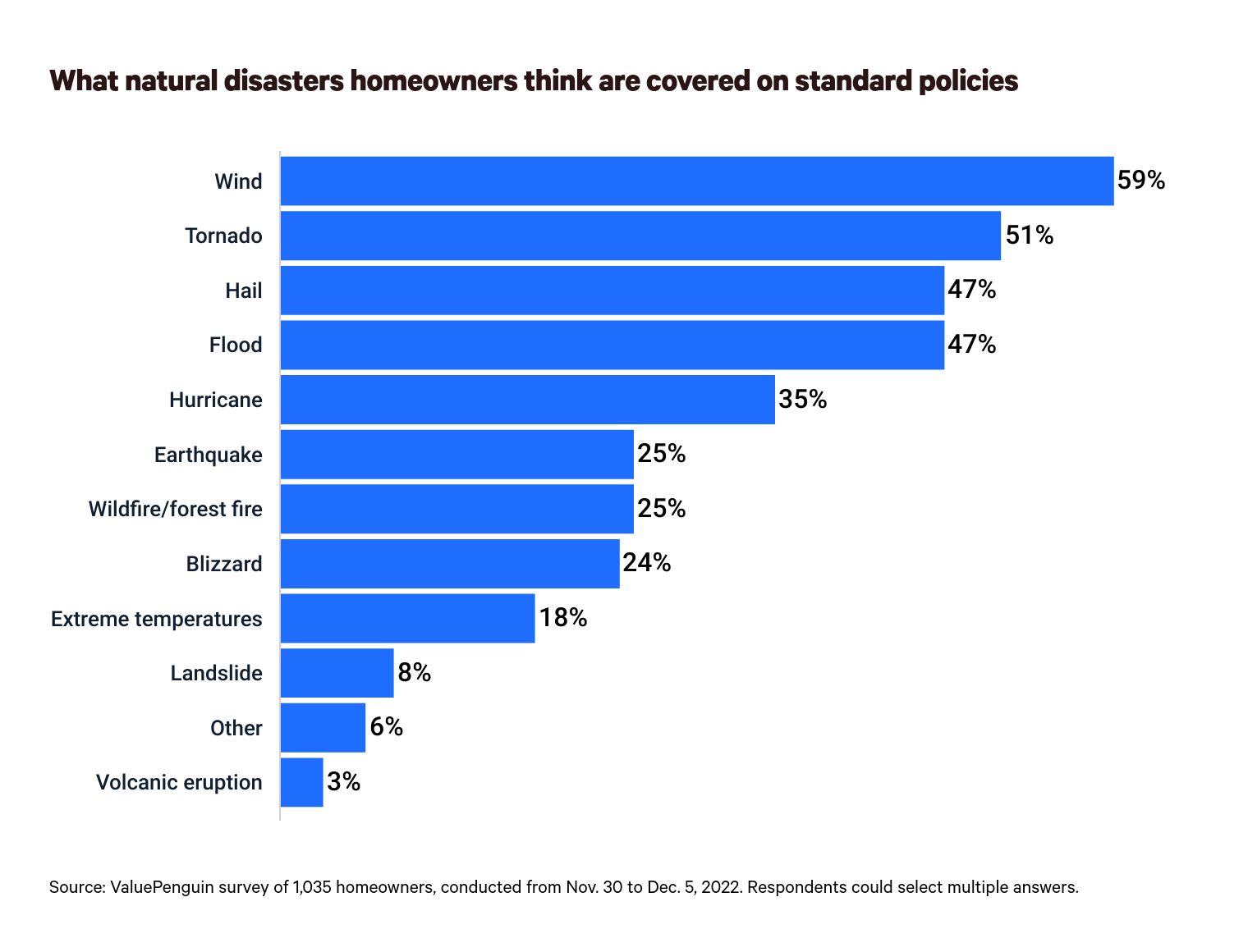

- A claim denial could come as a shock to some. When asked what weather-related disasters are covered by insurance, 47% of people wrongly assume that a flood claim would be covered under homeowners insurance. Depending on the state in which you live, 51% of those who answered that tornadoes are covered could be denied. The same goes for the 25% of homeowners who believe wildfires are covered.

55% of homeowners have never filed a home insurance claim

When it comes to homeowners insurance, it seems the majority are lucky. More than half (55%) of homeowners say they’ve never filed a home insurance claim, while 43% have. Another 2% don’t know if they’ve filed a claim.

But who’s the luckiest? By age group, Gen Xers ages 42 to 56 are, with 59% of them saying they've never filed a claim. On the other hand, baby boomers ages 57 to 76 are the most likely to have filed a claim (47%). That’s followed by Gen Zers ages 18 to 25 and millennials ages 26 to 41, both at 42%.

Time may be on some homeowners’ side, as first-time homeowners are more likely to say they haven’t filed a claim (59%) than those who previously owned another home (53%).

However, according to ValuePenguin home insurance expert Divya Sangameshwar, that doesn’t necessarily mean homeowners aren’t experiencing home damage.

Just 6% of insured homes had a claim in 2020 — the latest data from the Insurance Services Office (ISO). "That’s because most people only file claims for major damages," Sangameshwar says. "Many Americans opt to pay out of pocket for minor repairs to avoid a jump in their homeowners insurance premiums or losing coverage altogether."

There’s good news for the homeowners who’ve filed a claim, though. Of the 43% of homeowners who’ve filed a claim, 44% say they were reimbursed for the amount they expected, while 31% received more than expected and 26% say they received less than they thought.

Homeowners most likely to file claims for weather-related damages

The majority of homeowners who’ve filed an insurance claim say Mother Nature is to blame. Seven in 10 (70%) who’ve filed a claim say it was for weather-related damages.

Among those who’ve made these weather-related insurance claims, 34% were reimbursed for more than expected, 25% received less than expected and 41% received about what they expected.

By region, those in the South (77%) are the most likely to have filed a weather-related claim. That’s followed by 73% of homeowners in the Midwest.

As the weather becomes increasingly volatile, will more homeowners file claims?

"The answer to this question is an unequivocal yes," Sangameshwar says. "The impact of extreme weather on how much we’ll pay for homeowners insurance premiums can be seen in states like Florida, where the cost of homeowners insurance is nearly three times higher than the national average. Insurers have started to pull out of the Florida insurance market, canceling customers’ policies and leaving property owners with fewer and more expensive insurance options as they look to rebuild after Hurricane Ian."

As extreme weather events become more expensive and frequent, Sangameshwar says what’s happening in Florida could happen elsewhere — ultimately requiring federal government intervention. In fact, in 2022, the U.S. Department of the Treasury’s Federal Insurance Office announced plans to start collecting granular ZIP code-level data from U.S. home insurance companies on policies and pricing. This data aims to offer more transparency around home insurance pricing, identifying areas vulnerable to insurance disruptions from climate change and dictating future policies on home insurance pricing.

Homeowners are concerned about weather-related damages

In general, 57% of homeowners say they’re somewhat or extremely concerned about extreme weather conditions causing damage to their home, while only 19% say they’re at least somewhat unconcerned. By age group, Gen Xers (61%) are most likely to be at least somewhat concerned, while baby boomers (51%) are least likely.

Despite the overarching concern, most homeowners think their homeowners insurance would cover disaster-related damages. In a worst-case scenario (such as a total loss from severe weather), 44% of homeowners say they’re at least somewhat confident their home would be fully covered — the most common response. Following that:

- 34% are extremely confident

- 12% are neutral

- 6% are somewhat unconfident

- 4% are extremely unconfident

Notably, men are more likely to feel confident in their insurance than women: 82% of men say they’re at least somewhat confident their home would be fully covered in a worst-case scenario, compared with 76% of women.

37% of homeowners haven’t updated their home insurance policy since purchasing their home

For many homeowners, their insurance policy is a one-and-done situation. In fact, 37% of homeowners haven’t updated their home insurance policies since they purchased their homes.

New buyers in the past year and those who make less than $35,000 a year (both 48%) are the most likely not to have touched their policies since their home purchase. However, those who’ve filed a claim may have learned their lesson the hard way. Of this group, 71% have made at least one update to their insurance policy since purchasing their home.

Of the 57% of homeowners who’ve updated their home insurance policies at some point since their purchase, most (51%) are adding extra coverage to keep up with home appreciation. Homeowners who purchased between one and two years ago are the most likely (28%) to have increased their deductibles, perhaps to save on yearly insurance costs. Meanwhile, 28% of those who’ve updated their home insurance policies say they’ve added coverage for personal possessions or valuables like jewelry, antiques and art.

Insurance companies keep homeowners on their toes

Insurance companies don’t always make it easy to keep your coverage. Overall, 19% of homeowners say they’ve had to adjust something about their home or make repairs to get or keep insurance coverage.

Insurance companies generally perform home inspections when new policies are written. But they may also do inspections after large claims are filed — or even randomly.

"If they find that your roof is in poor condition, your home has major structural issues or plumbing issues, or you have an ineligible dog breed or feature like an unsecured trampoline or pool, you can receive a notice requiring you to correct the issues or risk your policy being canceled," Sangameshwar says.

In hurricane-prone states like Florida, homeowners insurance companies may issue a non-renewal notice if your roof is older than 10 years old.

For homeowners who’ve previously filed a claim, 30% say they’ve had to adjust something or make repairs — possibly suggesting that insurance companies may scrutinize those who’ve filed claims more closely.

By demographic, Gen Zers (33%) and homeowners who bought their property between one and two years ago (31%) are the most likely to have made a repair or adjustment. Meanwhile, baby boomers (9%) and those whose children are all 18 and older (10%) are the least likely.

What homeowners need to know about their insurance policies

Homeowners may need additional education about their insurance policies — particularly as many consumers seem misinformed about severe weather damages.

When asked what weather-related disasters are covered by insurance, 47% of consumers wrongly assume that a flood claim would be covered under homeowners insurance. Homeowners insurance policies don’t cover flood damages, Sangameshwar says. You’ll need a separate flood insurance policy to cover flood damages.

"Homeowners who live in high-risk areas are required to have flood insurance, but these flood zones are based on historical flood data," she says. "Thanks to climate change, floods are happening in zones that may not be classified as high risk, so it’s important to get flood insurance. You also can’t get flood insurance at the last minute (e.g., 48 hours before a hurricane hits) and expect to be covered, since it takes 30 days for a policy to take effect."

Additionally, depending on the state in which you live, 51% of those who answered that tornadoes are covered could be denied. While regular wind and hail damage are covered in standard homeowners insurance policies, you may need additional coverage if you live in "tornado alley" or certain states where high winds are common.

The same goes for the 25% of homeowners who believe wildfires are covered. For wildfires, standard homeowners insurance policies will cover fire damage, but it may depend on your location. And Americans living in areas that experience wildfires may see homeowner insurance rates increase by an average of 24%, with some states seeing rates increase by as much as 40% or more after a wildfire — even if homes aren’t affected by wildfires.

"Your homeowners insurance will help you rebuild your home, other structures and personal property in case it burns down," Sangameshwar says. "However, if you live in an area where wildfire risk is increasing, you need to regularly review your insurance coverage to make sure your dwelling, other structure and personal property coverage is keeping pace with rising costs."

When it comes to their insurance policy, Sangameshwar says consumers should also know the following:

- You may be missing out on discounts. "If you installed an alarm or home surveillance system, or if you installed new windows, a roof or other safety features, you could qualify for discounts on your policy," she says. "Contact your insurance company to take advantage of any updates you made."

- Make sure you have enough coverage and that the disasters you’re most prone to are covered. As noted earlier, insurers may require homeowners to buy additional windstorm coverage to protect against wind damages in some states where tornadoes or hurricanes are common. And you may need flood insurance since homeowners insurance won’t cover flood damage.

- If your budget allows for it, make regular repairs and updates to your home to reduce extreme weather risk. "This includes repairing previous storm damages in a timely manner, regularly inspecting and repairing damages to your roof and siding, installing hail-resistant roofs and hurricane shutters, trimming trees and securing outdoor furniture," she says. Doing so can better ensure any future claims won’t be denied.

Methodology

ValuePenguin commissioned Qualtrics to conduct an online survey of 1,035 U.S. homeowners ages 18 to 76 from Nov. 30 to Dec. 5, 2022. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2022:

- Generation Z: 18 to 25

- Millennial: 26 to 41

- Generation X: 42 to 56

- Baby boomer: 57 to 76