Health Insurance

Who Pays More for Health Care in New York? A Comparison of Business and Individual Health Insurance

Health insurance costs can be a large burden for both small-business owners and individuals who need to purchase their own coverage. However, depending on the size of an organization, offering health insurance may be required by the Affordable Care Act (ACA). Therefore, a common question is, what is the cheapest health insurance option? For many individuals and business owners, it can depend on a variety of factors. Most importantly, it can be beneficial to compare health insurance options to ensure appropriate coverage is in place.

ValuePenguin and Wellthie, an expert in the small group health insurance industry, took a deep dive into health insurance in New York to analyze the cost differences between small group and individual health insurance premiums.

Key findings

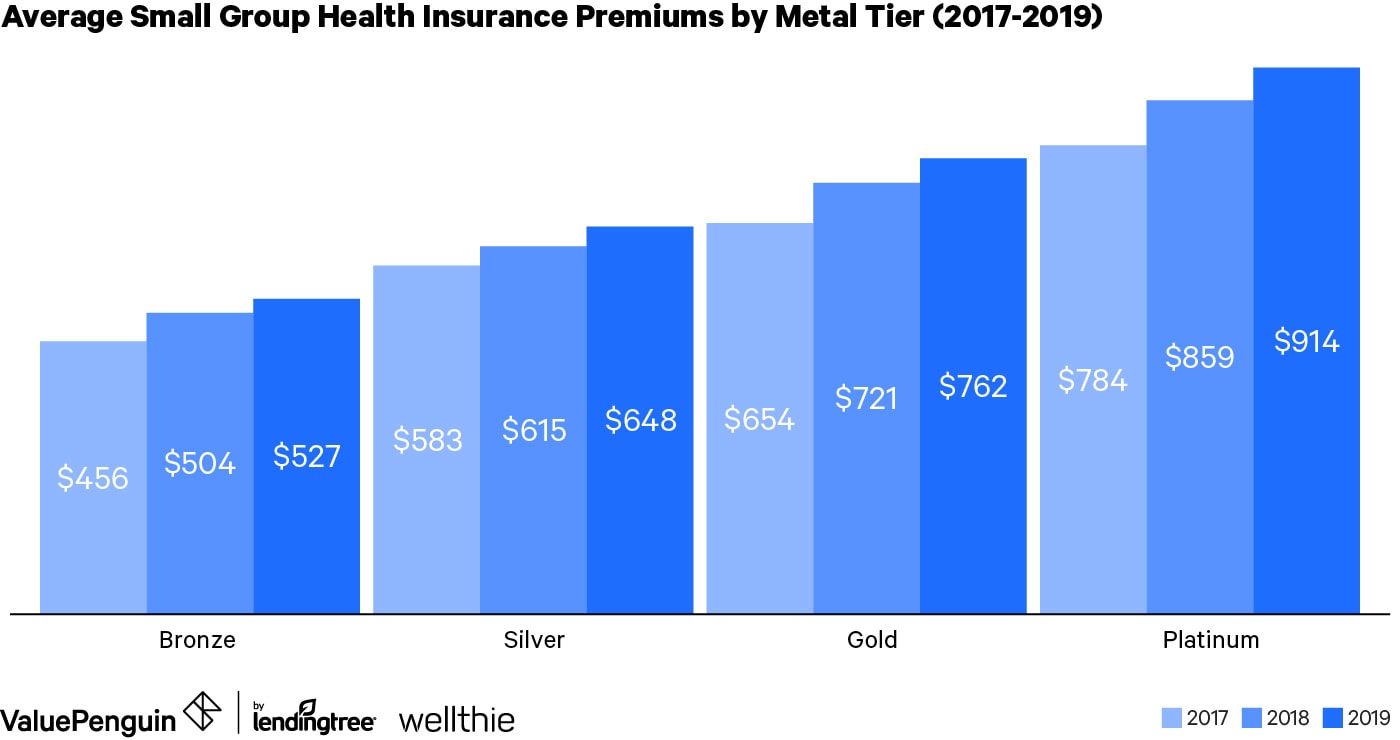

- The price of small group health insurance rose by 15% from 2017 to 2019.

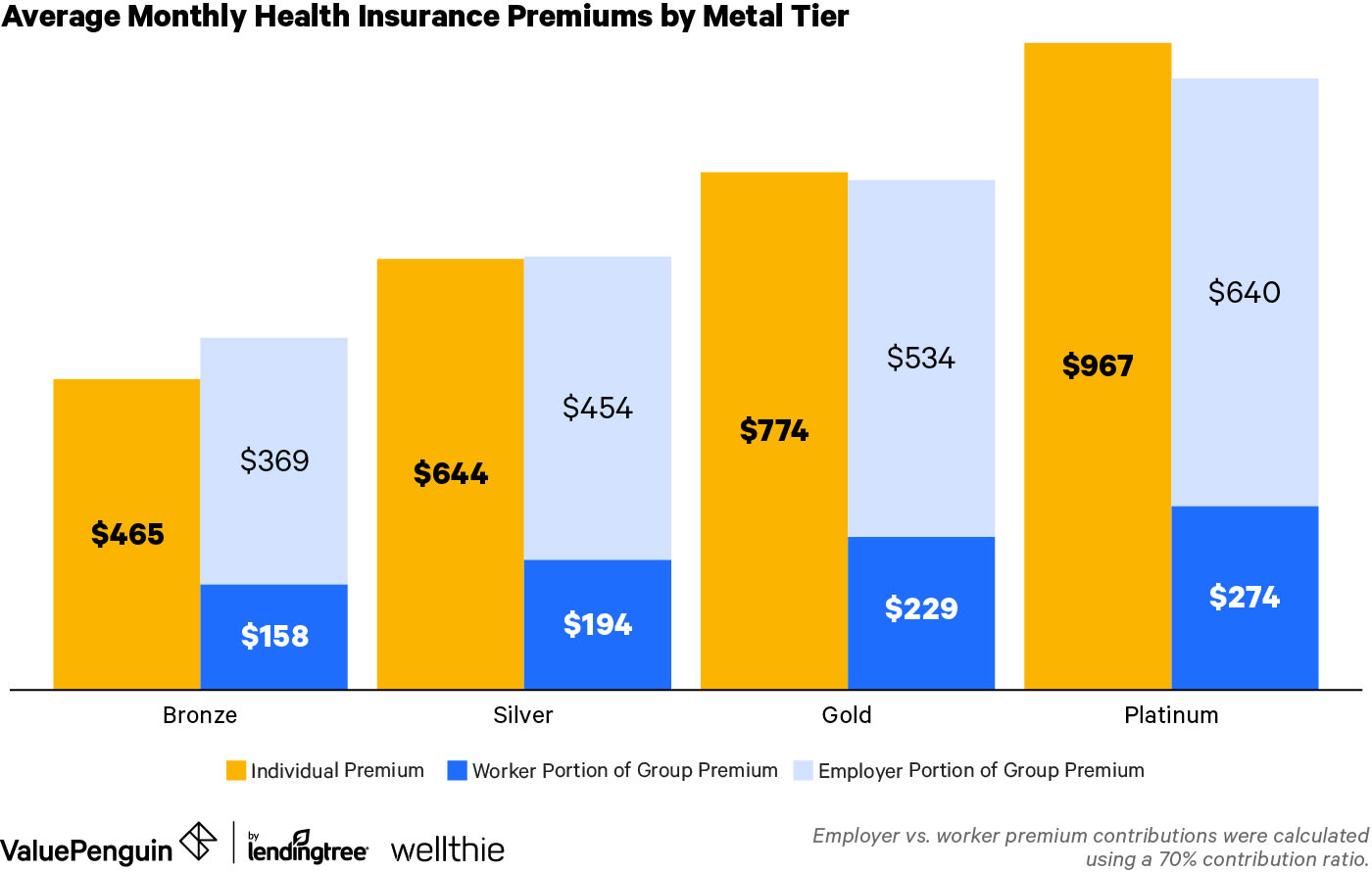

- The average monthly cost of small group and individual health insurance is roughly the same, at $712 for 2019. However, employees insured under a small group plan would only pay $213 of the total premium for health insurance.

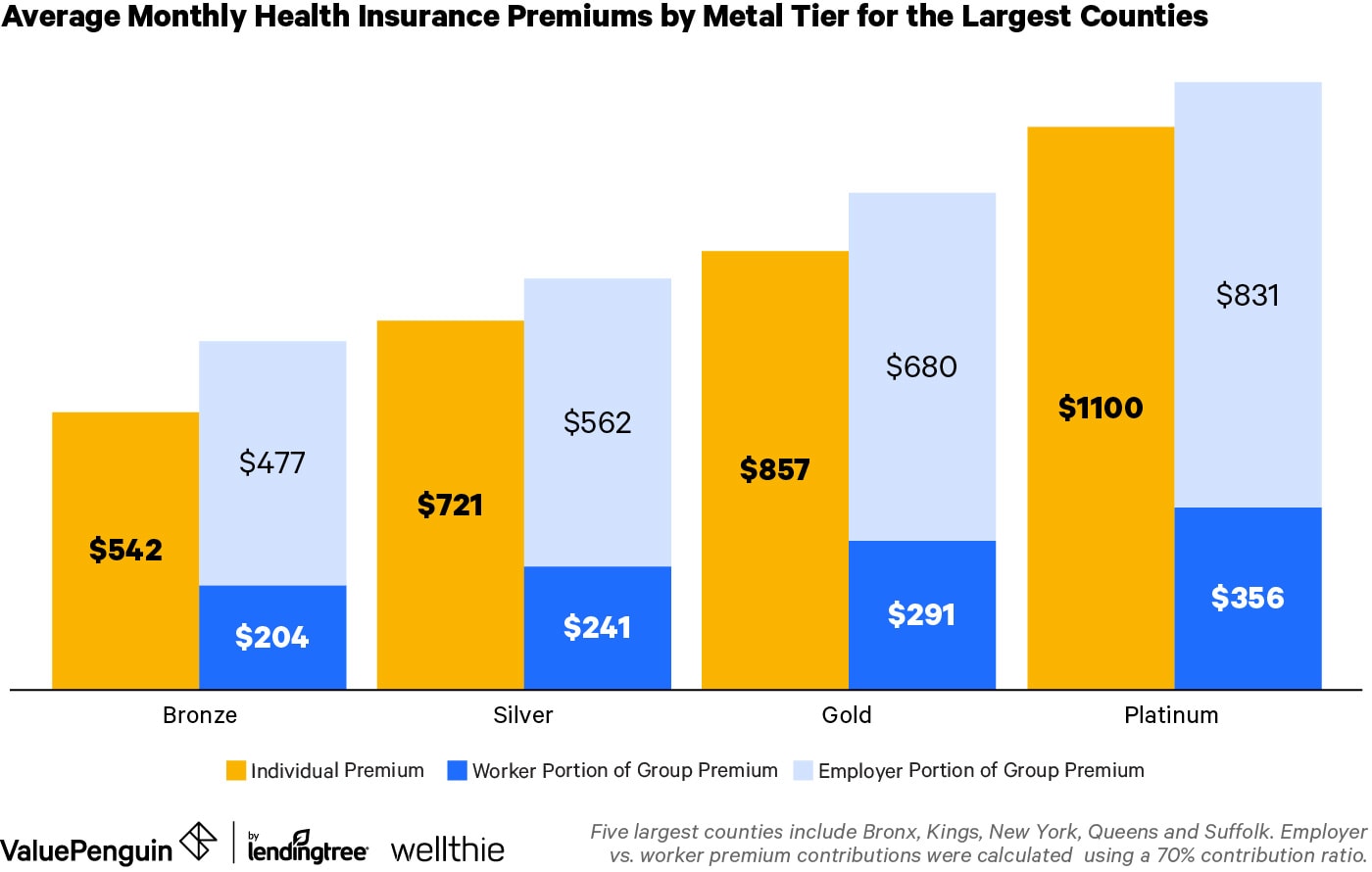

- In the metropolitan areas of New York (five largest counties), small group premiums were 13.12% more expensive than individual premiums.

Small group insurance premiums have increased by 15% over the past two years

Group health insurance premiums have steadily risen since the start of 2017 for small-business owners. The largest increase in costs for qualified health insurance occurred between 2017 and 2018, where the average monthly premium rose by 8.92%. However, between 2018 and 2019, premiums jumped by 5.6% on average for a small group health plan across all coverage metal tiers. Even though this is a smaller increase, small-business owners should be aware of these increases in costs, as they will inevitably affect the bottom line of a business.

By metal tier, Gold metal plans saw one of the largest average increases in premium costs, with an increase of 16.49% over the two-year time period. This should be noted by small-business owners, as these are the most common policies sold on the small group marketplace, with a total of 172 health plans being offered in 2019.

Rate increase from 2017 to 2019

Plan type | Change |

|---|---|

| Bronze | 15% |

| Silver | 11% |

| Gold | 16% |

| Platinum | 17% |

Individuals who do not receive health insurance through an employer spend $499 more on average for coverage

Besides small group health insurance, individual health insurance is available to people who currently do not receive coverage through an employer or federal programs like Medicaid or Medicare. This type of insurance differs from a group plan in that the premiums are entirely paid by the individual. Therefore, the plans can be much more expensive for an individual compared to being insured under an employer policy.

Individual vs small group health insurance rates

Plan type | Individual | Small group |

|---|---|---|

| Bronze | $465 | $527 |

| Silver | $648 | $644 |

| Gold | $774 | $762 |

| Platinum | $914 | $967 |

In this study, we have decided to use an employer-to-employee contribution ratio of 70%. This is an industry average and means that an employer would be responsible for paying 70% of the monthly premiums, while employees would pay the remaining 30%. This is represented in the graph as the light blue (employer) and blue (employee) columns.

Employees pay 195% more for an individual policy in New York's five largest counties

Differences between small group and individual health insurance premiums have even larger gaps in some of the most populated areas of New York State. On average, monthly health insurance premiums were 13.12% more expensive in small group plans when compared to a marketplace policy. For this analysis, we used the five largest counties based on population size, which were Bronx, Kings, New York, Queens and Suffolk Counties.

Although the small group policies in aggregate are more expensive in these highly populated areas of the state, the difference in premiums for the employee is narrower. On average, a person would pay 195% or $532 more for an individual policy compared to their monthly premium portion for small group health insurance.

Great employee benefit programs can attract the best talent

Depending on the size of the organization, small-business owners may be required to offer employees a health insurance option. In 2019, the ACA currently does not have the individual mandate, but the employer mandate is still in place. This ruling requires employers with 50 or more full-time-equivalent (FTE) employees to offer minimum essential coverage or face a fine. However, if there are less than this number of employees, an employer is not required to offer health insurance coverage. But it can be smart to still include coverage for a variety of reasons.

Offering health insurance to employees can greatly improve your business. According to the Harvard Business Review, in their survey of the "Most Desirable Employee Benefits", over 88% of respondents said better health, dental and vision insurance is a consideration they make before accepting a job. Thus, employers may find that a potential candidate for a position would decide not to join a company if a health benefit plan is not included. This could negatively affect profits and bottom line, as companies won't be hiring the best workers.

Average group and individual plan monthly rates by county

County | Individual | Small group |

|---|---|---|

| Albany | $704 | $640 |

| Allegany | $602 | $651 |

| Bronx | $802 | $930 |

| Broome | $751 | $716 |

Methodology

ValuePenguin, in conjunction with Wellthie, compiled health insurance plans and quotes from both the small group and individual health insurance marketplace in New York. Wellthie is an online small group benefits marketplace that allows business owners to connect with carriers and brokers to find a benefit program that works best for their business. This allows Wellthie to have an in-depth knowledge of the industry and provide some of the most detailed quotes available.

Quotes and plans were pulled for the 2019 plan year for a single individual and then averaged depending on the metal tier of coverage. For all employer-employee contribution calculations, an industry standard of a 70% contribution from the employer was used. In calculating the largest counties in New York, we used Census Intercensal County Population Data to determine which were the most populated.