How Much Is Ford Car Insurance?

Find Cheap Ford Insurance Quotes

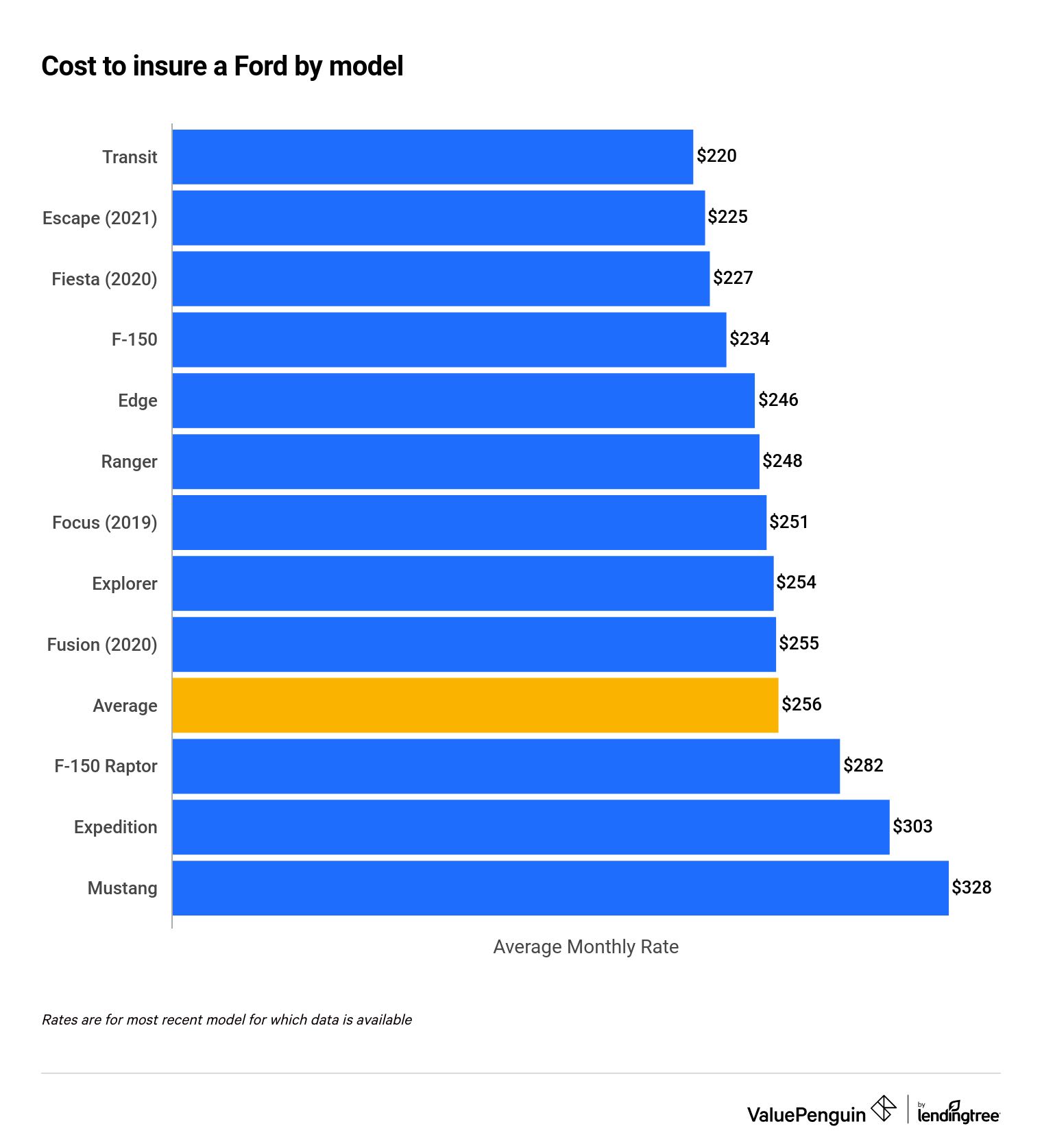

We compared quotes from the top insurers and found the average cost of auto insurance for a 2022 Ford is $3,171 per year. Eight of the most popular currently available models were analyzed, along with four older models.

The annual cost of insurance for 2022 Ford models ranged from $2,636 to $3,631 for the eight models we analyzed.

Ford drivers can take advantage of the Ford Insure program to get up to a 40% discount using on-board technology with newer models. The insurance, through Nationwide, provides lower rates for safe driving habits.

Compare Ford insurance costs by model and insurance company:

Ford insurance cost by model

The cheapest 2022 Ford model to insure based on our analysis is the Transit cargo van, which costs $2,636 per year on average for a 30-year-old male. The most expensive new Ford model to insure from our sample is the Ford Mustang, which costs $3,930 per year on average to insure.

Find Cheap Ford Insurance Quotes

The cost to insure a vehicle may vary based on a wide range of factors, including location, age and driver history. For this reason, we recommend always comparing quotes from multiple insurers in order to find the best rate.

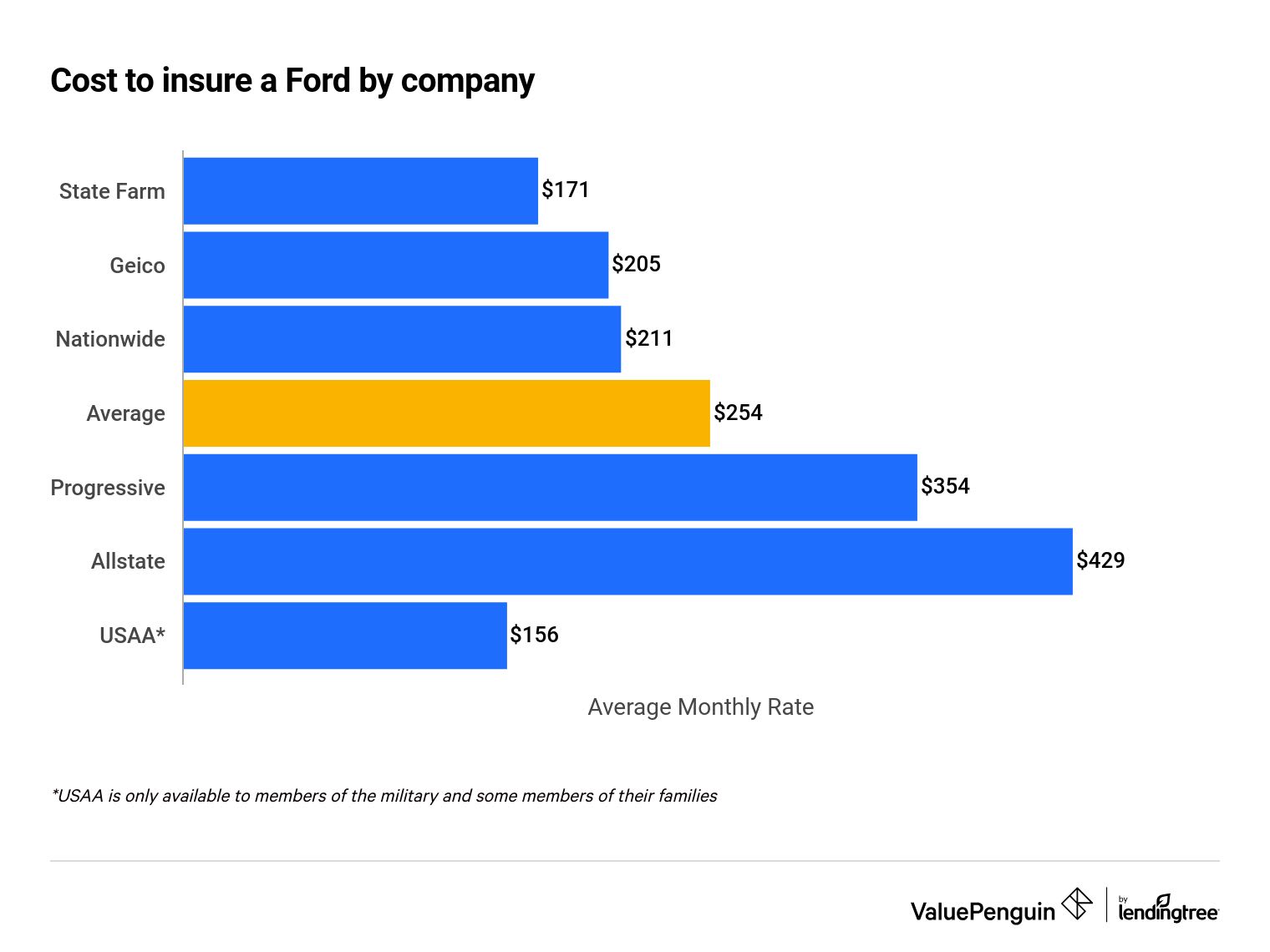

Ford insurance cost by company

State Farm has the cheapest car insurance for Ford owners — $2,047 per year for full coverage on a 2022 model. That's 47% cheaper than the average rate of $3,051 per year and 60% less than Allstate, the most expensive insurer.

Cheapest companies for Ford car insurance

Company | Annual cost | Monthly cost | |

|---|---|---|---|

| State Farm | $2,047 | $171 | |

| Geico | $2,465 | $205 | |

| Nationwide | $2,531 | $211 | |

| Progressive | $4,248 | $354 | |

| Allstate | $5,152 | $429 |

USAA is only available to members of the military and some military family.

Ford Edge insurance cost

The 2022 Ford Edge is middle of the pack in terms of rates among Fords. We found the average cost to insure a 30-year-old male is $2,949 per year. Teenage drivers can expect to pay more: The average cost to insure a Ford Edge for an 18-year-old is $8,496 per year.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Edge | $2,949 | $8,496 |

| 2021 Edge | $2,850 | $8,205 |

| 2020 Edge | $2,747 | $7,912 |

| 2019 Edge | $2,604 | $7,557 |

| 2018 Edge | $2,627 | $7,619 |

*Annual cost

Ford Escape insurance cost

With an average cost of $2,703 per year, the Ford Escape has the second-cheapest insurance rates out of the models we surveyed. This comes out to $225 per month. The average cost to insure an 18-year-old is $7,889 per year, which is more than double the cost for a 30-year-old.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2021 Escape | $2,703 | $7,889 |

| 2020 Escape | $2,651 | $7,746 |

| 2019 Escape | $2,533 | $7,439 |

| 2018 Escape | $2,504 | $7,371 |

| 2017 Escape | $2,409 | $7,092 |

*Annual cost

Ford Expedition insurance cost

The Ford Expedition is one of the largest vehicles the company offers and one of the most expensive, too. The average cost to insure a new one for a 30-year-old is $3,631 per year. For an 18-year-old, that average insurance cost for a new Ford Expedition is $10,440 per year.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Expedition | $3,631 | $10,440 |

| 2021 Expedition | $3,474 | $10,021 |

| 2020 Expedition | $3,365 | $9,665 |

| 2019 Expedition | $3,119 | $8,732 |

| 2018 Expedition | $3,227 | $9,386 |

*Annual cost

Ford Explorer insurance cost

The cost to insure a Ford Explorer had a range of $639 across the eight model years analyzed. The average cost to insure a new Ford Explorer for a 30-year-old is $3,052 per year. For an 18-year-old, the Ford Explorer has an average insurance cost of $8,954 per year.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Explorer | $3,052 | $8,954 |

| 2021 Explorer | $2,942 | $8,639 |

| 2020 Explorer | $3,039 | $8,909 |

| 2019 Explorer | $2,741 | $7,950 |

| 2018 Explorer | $2,750 | $8,114 |

*Annual cost

Ford F-150 insurance cost

Our analysis of rates found the average cost to insure a 2022 Ford F-150 is $2,812 per year for our 30-year-old driver. While insurance rates are usually the cheapest for older model years, this was not the case with the F-150, as the 2021 model is more expensive than the most recent model. The average cost to insure an 18-year-old for an F-150 is $8,262.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 F-150 | $2,812 | $8,262 |

| 2021 F-150 | $2,886 | $8,471 |

| 2020 F-150 | $2,802 | $8,135 |

| 2019 F-150 | $2,823 | $8,269 |

| 2018 F-150 | $2,415 | $7,101 |

*Annual cost

Ford Fiesta insurance cost

The Ford Fiesta, a subcompact car that was retired in 2019, has an average rate of $2,724 per year for a 30-year-old driving the most recent model. The average cost to insure a Ford Fiesta for an 18-year-old is $8,228 per year.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2019 Fiesta | $2,724 | $8,228 |

| 2018 Fiesta | $2,713 | $8,271 |

| 2017 Fiesta | $2,669 | $8,206 |

| 2016 Fiesta | $2,610 | $8,014 |

| 2015 Fiesta | $2,478 | $7,545 |

*Annual cost

Ford Focus insurance cost

Our analysis of quotes revealed that car insurance for the most recent Ford Focus available costs an average $3,010 per year for our 30-year-old driver. This is $63 per year more than the average of all the Ford models we surveyed. An 18-year-old can expect to pay an average of $9,188 per year to insure a Ford Focus.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2018 Focus | $3,010 | $9,188 |

| 2017 Focus | $2,822 | $8,618 |

| 2016 Focus | $2,828 | $8,656 |

| 2015 Focus | $2,710 | $8,237 |

*Annual cost

Ford Fusion insurance cost

The cost to insure a Ford Fusion is slightly higher than the rates for a Ford Focus. The average cost to insure a 2020 Ford Fusion is $3,065 per year for our 30-year-old sample driver. This comes out to $255 per month. Teenage drivers can expect to pay more than double that: We found the average annual cost to insure a Ford Fusion to be $9,117 per year for an 18-year-old.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2020 Fusion | $3,065 | $9,117 |

| 2019 Fusion | $3,006 | $8,981 |

| 2018 Fusion | $2,977 | $8,901 |

| 2017 Fusion | $2,890 | $8,688 |

| 2016 Fusion | $2,773 | $8,266 |

*Annual cost

Ford Mustang insurance cost

Our analysis found that the average cost to insure a new base model Ford Mustang is $3,930 per year for a 30-year-old and $14,010 per year for an 18-year-old. These rates make the Ford Mustang the most expensive to insure out of all Ford models we surveyed.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Mustang | $3,930 | $14,010 |

| 2021 Mustang | $3,582 | $13,004 |

| 2020 Mustang | $3,277 | $11,698 |

| 2019 Mustang | $3,142 | $11,049 |

| 2018 Mustang | $3,320 | $11,952 |

*Annual cost

Ford Ranger insurance cost

Ford introduced the Ranger in 2019 as a midsize pickup truck. The 2022 edition costs an average of $2,974 per year to insure for a 30-year-old. An 18-year-old pays an average of $8,599 per year.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Ranger XL | $2,974 | $8,599 |

| 2021 Ranger XL | $2,845 | $8,235 |

| 2020 Ranger XL | $2,693 | $7,811 |

| 2019 Ranger XL | $2,624 | $7,631 |

*Annual cost

Ford Raptor insurance cost

A new Ford Raptor costs an average of $3,384 per year for a 30-year-old to insure. That number jumps to $11,568 if an 18-year-old is behind the wheel. The Raptor is a type of F-150 and is among the largest vehicles the company makes, designed for high horsepower and off-road use.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Raptor | $3,384 | $11,568 |

| 2021 Raptor | $3,219 | $11,041 |

| 2020 Raptor | $3,116 | $10,628 |

| 2019 Raptor | $3,088 | $10,506 |

| 2018 Raptor | $2,694 | $9,226 |

*Annual cost

Ford Transit insurance cost

The cheapest Ford model to insure is its Transit van, which is less a traditional car or truck and instead a large van for carrying cargo or a large number of people. A 30-year-old can insure one for an average of $2,636 per year, while an 18-year-old will pay an average of $8,832 per year.

Year and model | 30-year-old driver* | 18-year-old driver* |

|---|---|---|

| 2022 Transit | $2,636 | $8,832 |

| 2021 Transit | $2,664 | $8,869 |

| 2020 Transit | $2,518 | $8,471 |

*Annual cost

Ford Insure

Ford drivers can cover their vehicles through the Ford company itself with a usage-based insurance program called Ford Insure. The automaker offers policies, underwritten by Nationwide, that take advantage of connected vehicle data to offer discounts for safe driving.

If you want to take advantage of Nationwide's already cheap rates, Ford Insure can help you save even more. Most eligible customers who don't mind having their driving tracked should at least look into this option.

Ford Insure is available to owners with eligible vehicles with model years 2020 or later. Drivers get a discount of 10% for enrolling, and after a trial period of four to six months, drivers receive a discount of up to 40%. The program is similar to Nationwide's SmartRide program.

Drivers must download the FordPass App and activate FordPass Connect to get started. The company tracks a range of behaviors to determine safe driving habits, such as:

- Miles driven

- Hard braking and acceleration

- Idle time

- Nighttime driving

Drivers have access to the same coverages available to Nationwide customers.

Ford Insure is available in every state except Louisiana, Oklahoma, Alaska and Massachusetts. The program is not available for the 2020 F-150 and Fusion Plug-in Hybrid.

Other discounts

Ford also partners with Mile Auto to offer pay-per-mile policies. Drivers can potentially save up to 40% for driving less than 10,000 miles per year.

State Farm customers with Fords from 2020 or later can take advantage of the company's usage-based insurance program, Drive Safe & Save Connected Car. Using technology built into the vehicle, drivers can save up to 30% on their policies in most states.

Methodology

To calculate the average cost of insurance for a Ford, we collected insurance rates from every ZIP code in Texas from six of the nation's largest insurers for two sample drivers: a 30-year-old male and an 18-year-old male. The Ford insurance rates we used were for a full-coverage policy with the following limits:

Coverage | Limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $10,000 |

| Property damage | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

This analysis used insurance quote data from Quadrant Information Services. The quotes used were publicly sourced from insurer filings and should only be used for comparison purposes. Actual rates for Ford models may differ from the estimates provided.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.