FL Farm Bureau Insurance Review: Basic Coverage & Support

Florida Farm Bureau offers basic coverage at higher rates, but it may be worth it to get help managing all your insurance and banking in one place.

Find Cheap Homeowners Insurance Quotes in Your Area

Florida Farm Bureau is an insurance company with somewhat barebones coverage offerings, higher than average home insurance prices and a lot of hoops to jump through before you can get coverage. However, they offer a wide array of financial services, so Floridians looking to have one company manage their insurance, banking and loans may find the convenience is worth the trade-off.

Pros and cons

Pros

Good for bundling home and auto insurance, plus banking and other financial services

Helpful local agents

Cons

Can't buy or manage your policy online

Few coverage upgrades

Florida Farm Bureau: Our thoughts

Florida Farm Bureau (FLFB) is an adequate insurance company — it has good customer service, is financially stable and offers must-have insurance coverages for auto and home. However, it offers few optional coverages or benefits, such as glass coverage for your car or guaranteed replacement cost coverage for your home. If you need more than basic coverage options from your insurance company, you'll need to look elsewhere.

At FLFB, there are more hurdles to signing up for a policy than you'll encounter at most other insurers. You can't get an online quote for home or auto insurance, so the only way to find out what you'll pay is to contact an agent. You also need to become a member of the Florida Farm Bureau before you can buy insurance from the organization (though you can get a quote before signing up). You don't have to be involved in farming to join, but the annual $45 fee adds an extra expense, and the other membership benefits are marginal if you aren't in the farming community.

However, Florida Farm Bureau offers an array of financial products such as checking and savings accounts, loans and retirement planning. If you're already using FLFB's other products, you may find a benefit to having one organization manage all aspects of your financial life; however, the company doesn't provide a discount or bonus for doing so.

Florida Farm Bureau insurance is only available to residents of Florida, though Farm Bureau branches in other states also provide insurance to their residents. FLFB is based in Gainesville and has agencies in many locations throughout the state.

Bottom Line: Florida Farm Bureau Insurance may be worth considering if you're already a member of the Florida Farm Bureau organization or plan to use another of the group's financial products. But limited perks and a convoluted path to getting coverage mean people not already connected to the company should start their insurance search elsewhere.

Florida Farm Bureau home insurance: Costs and coverages

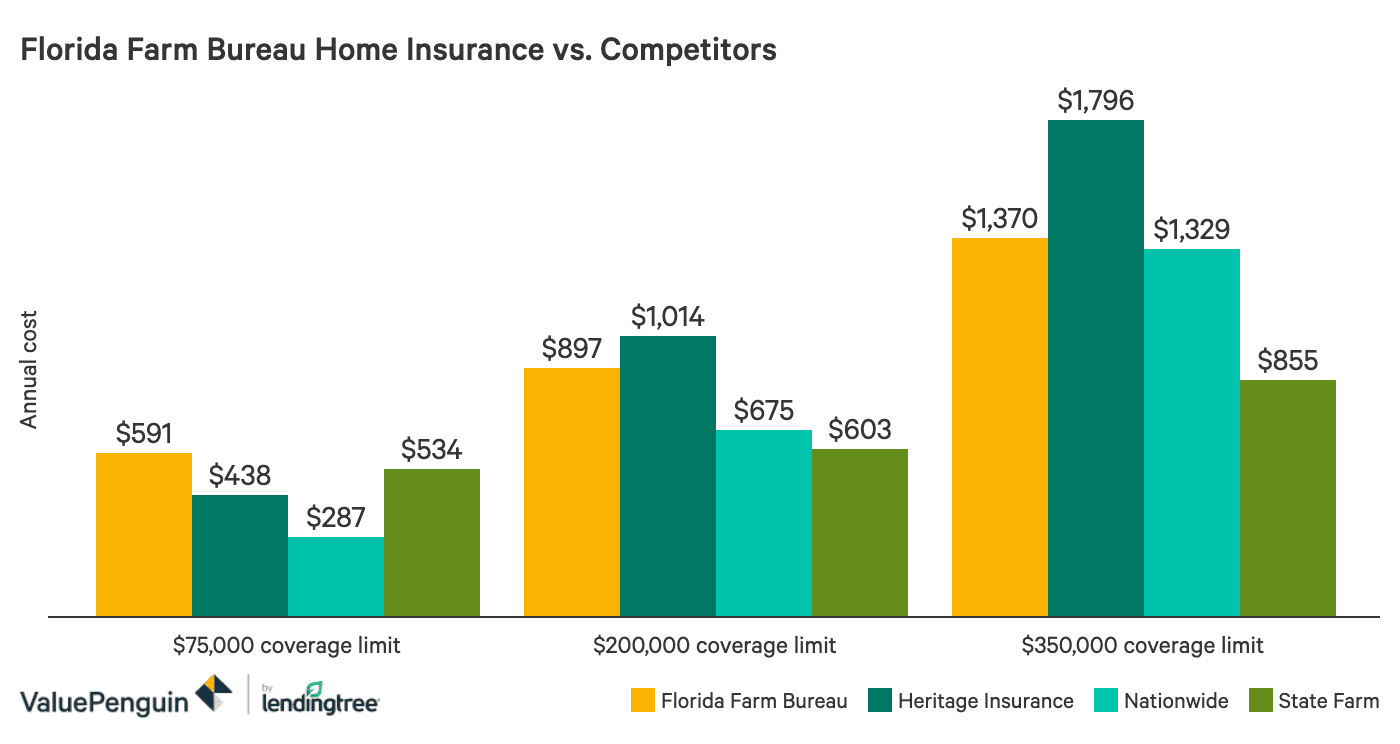

Florida Farm Bureau's rates for homeowners insurance are slightly higher than its competitors'. Across three sample homes, the average cost for home insurance from Florida Farm Bureau is $953 per year. The overall average among the four companies we looked at was $866, about 9% cheaper.

Find Cheap Homeowners Insurance Quotes in Your Area

Company | $75,000 coverage limit | $200,000 coverage limit | $350,000 coverage limit |

|---|---|---|---|

| Florida Farm Bureau | $591 | $897 | $1,370 |

| Heritage Insurance | $438 | $1,014 | $1,796 |

| Nationwide | $287 | $675 | $1,329 |

| State Farm | $534 | $603 | $855 |

However, Florida Farm Bureau's rates are more competitive for higher property coverage limits. For a home with a replacement cost of $350,000, Florida Farm Bureau's rates were only 2% over the sample average.

Home insurance coverages available from Florida Farm Bureau

Florida Farm Bureau doesn't provide much detail about the home insurance coverages it provides. You'll be able to get the standard coverages for structural and personal property damage and additional living expenses, but FLFB doesn't seem to offer any more elaborate benefits that could differentiate it from other insurers.

Notable homeowners insurance coverages

- Structural damage coverage: Pays to repair the structure of your home after it's damaged

- Personal property coverage: Pays to repair or replace your personal property when it is damaged or stolen

- Liability coverage: Protects you from legal liability if you are sued for injury or other incident

- Additional living expenses: Pays for additional expenses if your home is uninhabitable after an incident

- Medical Payments: Pays for medical bills of others if they are injured while on your property

Car insurance coverages and discounts from FLFB

Florida Farm Bureau provides all common and mandatory coverages like PIP, liability, collision and comprehensive coverage, but it only has a few extra benefits and coverages beyond that. Drivers looking for more extensive coverages, such as glass repair coverage or an OEM parts guarantee, will need to look elsewhere.

Notable optional car insurance coverages

- Pet injury coverage: Pays for up to $500 of veterinary or other expenses if your cat or dog is injured in a car accident. No other pets are covered.

- Transportation expense coverage: Pays for extra transportation and lodging costs if you get in a crash more than 100 miles from home.

Car insurance discounts are limited at Florida Farm Bureau. Rates for Florida drivers will be reduced for common things like a claim-free discount or a good student discount, but not much sets it apart from its competitors.

Notable car insurance discounts

- Multi-car discount for having more than one car insured on your policy

- Claim-free discount for not filing claims

- Good student discount for young drivers above a certain GPA

- Young driver training discount for taking a driver safety class

No online car insurance quotes available from Florida Farm Bureau

One major drawback of Florida Farm Bureau is that the company doesn't provide online quotes or rate comparisons. The only way to see how FLFB's rates compare with other companies is to contact an agent to provide a quote for you.

Florida Farm Bureau insurance reviews and ratings

Florida Farm Bureau has mixed customer reviews and ratings. In 2019, the company had a complaint ratio from the National Association of Insurance Commissioners (NAIC) of 2.32 for car insurance, and 2.98 for home insurance. This means that the NAIC received more than twice as many complaints about FLFB than can be expected for a company of its size. It did not receive any complaints in 2020, though it's likely due to a reporting error from the Florida Office of Insurance Regulation.

Florida Farm Bureau has excellent financial stability. FLFB's parent company, the Southern Farm Bureau Casualty Insurance Company, has an A+ financial stability rating from A.M. Best. This means that the company and its subsidiaries have a "superior" financial footing and are highly likely to be able to pay out claims regardless of economic climate or the scale of a widespread disaster.

Claims process

Making a claim with Florida Farm Bureau is straightforward, and there are several options to do so. You can call your agent directly, or call FLFB's claims hotline 24 hours a day at 1-866-275-7322. You can also begin the claim on the company's website or on the Farm Bureau app.

Farm Bureau membership in Florida: Costs and benefits of joining

You must join the Florida Farm Bureau to get an insurance policy from the company. Membership costs $45 per year, in addition to your insurance premium. The organization is primarily a farming lobbyist group and represents the interests of farmers in American government. However, joining the Farm Bureau entitles you to a few other benefits that aren't strictly insurance-related. These include travel discounts, savings on cars and farm equipment and a free accidental death benefit, among others. However, these benefits are ancillary to FLFB's strength as an insurer.

Financial services provided by Florida Farm Bureau

- Home and auto insurance

- Life insurance

- Retirement planning

- Banking, credit cards and loans

- Flood insurance

Note that the Farm Bureau Bank doesn't require you to be a member in order to open an account or get a loan, but you may need to be a member to qualify for some bank services.

Methodology

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.