Federated National Home Insurance Review

FedNat is no longer selling homeowners insurance, and its parent company has filed for bankruptcy. We recommend that homeowners insured with FedNat shop around for a new policy.

Find Cheap Homeowners Insurance Quotes in Your Area

Federated National is a regional insurance company that offers straightforward, no-frills home insurance at affordable rates to Florida homeowners. The company, also called FedNat, has poorly-rated customer service.

But it's one of the more popular home insurance companies in Florida, and in some areas, it outperforms its competition. For those reasons, it is a solid homeowners insurance option but not among the best in the state.

Consider the following alternatives to FedNat

FedNat is no longer selling insurance policies as of September, 2022.

The company has become insolvent, which means that it doesn't have enough money to pay existing claims and other expenses.

We recommend the following alternatives, all of which earned 4 stars or better from our editors.

Pros and cons

Pros

Gives FL homeowners an option for coverage

Cheap rates in some areas of FL

Cons

Not a lot of coverage options

No option to bundle with car insurance

Online tools aren't very helpful

Federated National Home Insurance: Our Thoughts

When compared to most nationally known insurers, Federated National doesn't look great: The company has notable customer service issues, and it lacks a lot of coverage options available in most states. However, homeowners in Florida often have a limited set of options for home insurance, so FedNat is nevertheless a decent option for Floridians looking for home insurance coverage.

Home insurance rates from Federated National are more affordable than average, based on our analysis. That said, the company is more expensive than several larger competitors, but it's still a solid option with good rates.

Additional benefits are fairly limited for Federated National customers; it doesn't offer many perks, discounts or additional coverage options that homeowners can use to protect their homes. It does offer flood insurance, personal liability umbrella coverage and identity theft protection, however.

The most troubling aspect of FedNat is its poor customer service reviews. Even after improving in the last full year, it has a high number of complaints registered with the National Association of Insurance Commissioners, suggesting that customers are often unhappy with the service they receive.

Bottom line

Federated National has competitive rates for home insurance, though its coverage options and customer service leave a lot to be desired. But Florida homeowners can struggle to get coverage from nationally known providers, and FedNat outperforms its regional competition in some of the state's largest counties. As such, it is still a solid option for Florida homeowners.

Federated National Home Insurance Quote Comparison

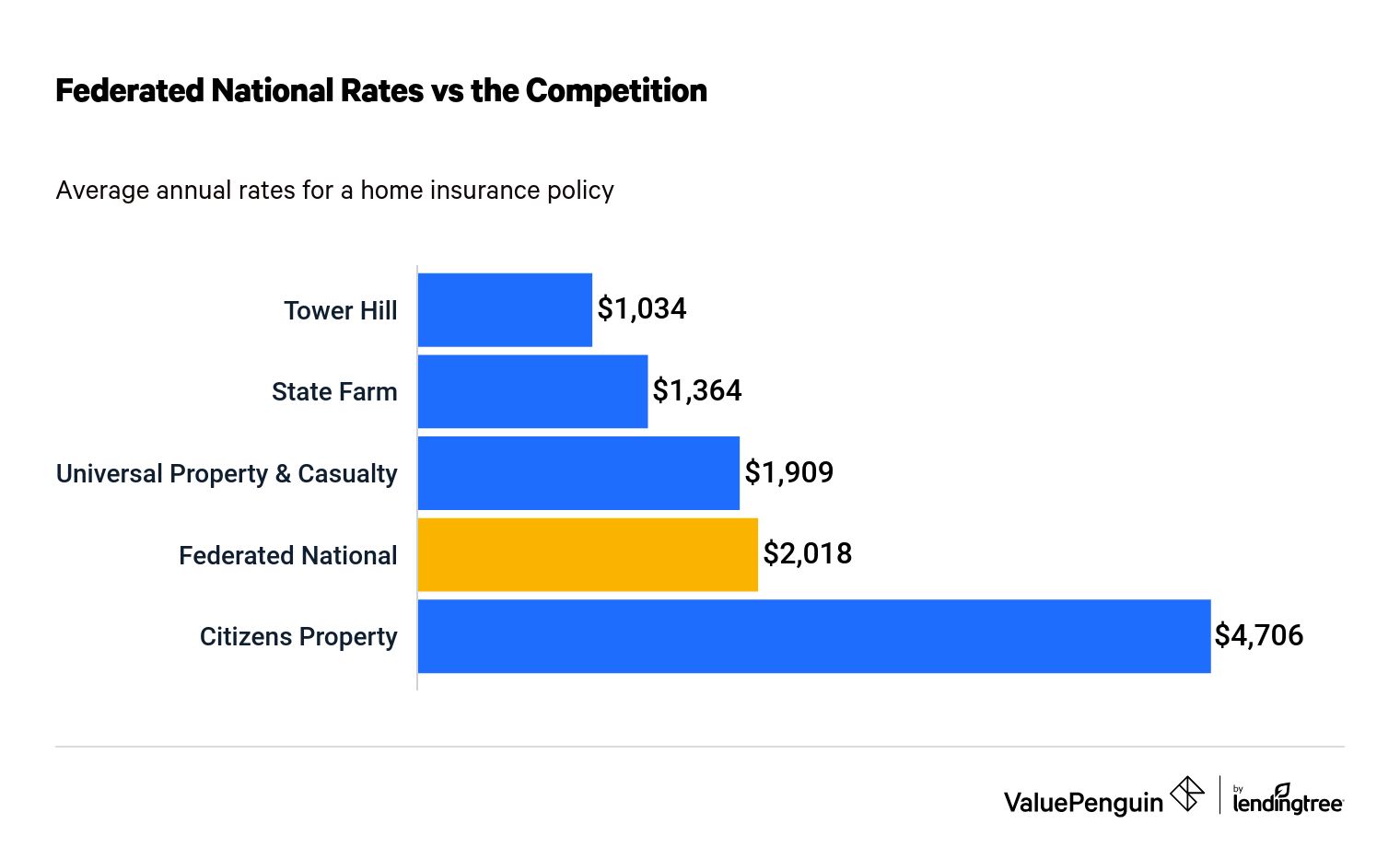

We found Federated National to be an affordable option for Florida homeowners, costing $188 less per year than average, but far from the cheapest. Its quotes for standard home insurance came in more expensive than several competitors when compared to four of the largest Florida insurers.

Find Cheap Homeowners Insurance Quotes in Your Area

Federated National homeowners insurance rates vs. competitors

Company | Average annual rate |

|---|---|

| Tower Hill | $1,034 |

| State Farm | $1,364 |

| Universal Property & Casualty | $1,909 |

| Federated National | $2,018 |

| Citizens Property | $4,706 |

One aspect in FedNat's favor is it is one of the more affordable options in the three largest counties in Florida — Miami-Dade, Broward and Palm Beach — which are home to 28% of the state's residents. All three are on the eastern coast of the state and regularly face considerable hurricane threats.

Federated National Homeowners Insurance Coverage

Federated National offers straightforward HO-3 homeowners insurance coverage to its customers. These standard policies cover the structure of your home for "open perils," which means you'll be reimbursed for damage from any cause, except for some named exclusions. For example, HO-3 policies protect you against fire, lightning, hail and wind damage, but they don't cover you in the case of war, earthquakes or flooding.

A standard homeowners policy also protects your personal property, such as your furniture, clothing, appliances and electronics. However, these items are only covered if damaged by a peril named in your policy.

Federated National doesn't include much in the way of extra benefits or discounts for homeowners buying standard policies. For example, other insurance companies might give you a discount for buying both home and auto insurance together, or allow you to customize your coverage online; FedNat Insurance doesn't offer these perks.

Add-on coverage from Federated National

While FedNat's additional coverages are fairly limited, it does offer a few coverage options beyond standard homeowners insurance that allow you to boost how your insurance protects you. Available coverages include:

- Federally backed flood insurance: This coverage, backed by the federal government, pays for damage to your home from flooding. Note that the rates and requirements for this flood insurance are set by the government and don't differ among insurers.

- Umbrella liability coverage: Umbrella liability protects you in case someone sues you for medical or other damages, such as if they are injured while on your property.

- Flo by Moen: Customers can receive a discount if they get a smart home monitoring and leak detection system, which can shut off water remotely in the case of a leak of a damaged pipe.

- Service Line Coverage: This extends homeowners protection to underground pipes, wiring and service lines.

- Social Media Coverage and ID Theft Protection: Listed as separate options, ID Theft Protection includes reimbursement after identity theft and recovery services, while Social Media Coverage allows for tracking accounts and notification if one is compromised.

- Equipment Breakdown: This coverage protects homeowners from unexpected repair or replacement costs because of electrical, mechanical or pressure system breakdowns.

Online service options

Federated National's website offers about as much functionality as you'd expect from a smaller regional insurance company, but the website is not as fully featured as those run by nationally known insurance companies.

While insurance shoppers can get insurance quotes online, they'll have to wait for an agent to reach out to find out the details and actually buy a policy. For the quote process, FedNat requires considerably less information than many larger insurers.

Existing customers can also use an online login to pay their bills and file claims. Additionally, the only way to cancel an insurance policy with Federated National is in writing; it can't be done online or even over the phone, making it unduly difficult to stop service if you're unsatisfied.

Federated National Customer Service Reviews and Ratings

Federated National consistently receives below-average customer service reviews. The company had a complaint ratio from the National Association of Insurance Commissioners of 1.99 in 2020, indicating that it garnered almost double the number of complaints expected for a company of its size. The company did see a significant drop in its complaint ratio, from 6.46 in 2019.

The most common reasons for filed complaints were regarding denied claims, followed by unsatisfactory settlements and delays during the claim process. In recent years, FedNat along with some of its biggest competitors for home insurance in Florida — Universal Property, Citizens Property and Security First — had particularly high complaint numbers.

Demotech is no longer rating FedNat for financial stability after the announcement that it will be consolidating under its affiliate, Monarch. Monarch currently holds an "A" or Exceptional rating from Demotech. But it's worth noting that an "A" is the third-best ranking Demotech provides, behind "A Prime" and "A Double-Prime".

Other Federated National Insurance Types

In addition to homeowners coverage, Federated National also offers a few different insurance products.

- High-value home insurance

- Condo insurance

- Renters insurance

- Landlord insurance

FedNat owns two other home insurance companies, Monarch National and Maison Insurance Company. Federated National only directly sells policies in Florida, but it also underwrites homeowner and fire policies in five other states through SageSure Insurance Managers.

- Alabama

- Louisiana

- South Carolina

- Mississippi

- Texas

Frequently Asked Questions

Is FedNat a good insurance company?

Federated National is a solid insurance company, offering below-average rates and especially good rates in Florida's three largest counties. The company does, however, have a reputation for poor customer service.

What is FedNat Insurance's AM Best rating?

Federated National does not have a rating from AM Best. It was rated by Demotech, another industry reviewer, but the company removed its financial stability rating after FedNat made an announcement that it will be consolidating under it's affiliate, Monarch. Monarch has an "A" or Exceptional rating from Demotech.

What states is Federated National Insurance in?

Federated National only directly sells policies in Florida. However, the company does underwrite policies in Alabama, Louisiana, South Carolina, Mississippi and Texas.

Methodology

Sample rates were gathered from hundreds of ZIP codes in Florida for a home worth $172,500 and built in 1987. Policies also included $100,000 in liability coverage.

Rates were gathered using Quadrant Information Services, which sources data from public insurance filings. Use these rates for comparative purposes only, as yours may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.