Encompass Auto & Home Insurance Review

Encompass is a good company if you want a wide array of home policy options, but you will pay more for even basic coverage.

Find Cheap Auto Insurance Quotes in Your Area

Encompass Insurance Company has a variety of ways you can expand your policy, including three coverage packages as part of a home-auto bundle called EncompassOne. Given its breadth of policy options and relatively strong customer service experience, we recommend looking into Encompass, especially if price is not a top concern.

Pros and cons

Pros

Many ways to add to your policy

Great for bundling polices

Good customer service for home insurance

Cons

High car insurance rates

No online claims or quotes

Encompass Insurance: Our thoughts

Auto insurance takeaway: Rates for Encompass are high, and you'll need to purchase a special coverage level to get more than fairly standard options. At those higher levels, you can add unlimited accident forgiveness or windshield repairs with no deductible.

Homeowners insurance takeaway: Encompass homeowners insurance rates tend to be more expensive than other major insurers. But the policies are customizable, allowing you to increase or decrease coverage to find a balance you're comfortable with.

If you're looking for homeowners and auto insurance policies with a variety of features and optional coverage add-ons, Encompass can provide you with a large selection of policy options at higher rates. Encompass emphasizes bundling auto and homeowners insurance together and provides special bonuses to encourage this approach, such as a single deductible for all claims.

Encompass offers three different coverage packages — Special, Deluxe and Elite — each with varying add-on features. Encompass also has a good customer service reputation, although you will have to call an insurance agent for a quote and handle claims over the phone. Some bills can be paid online through the company's "MyEncompass" portal.

Encompass auto insurance

Encompass offers a wide range of extra coverage options, but you'll have to pay more on top of already-high auto insurance rates. You can add features such as accident forgiveness or roadside assistance, or upgrade to Special, Deluxe or Elite coverage tiers.

Encompass auto insurance quotes

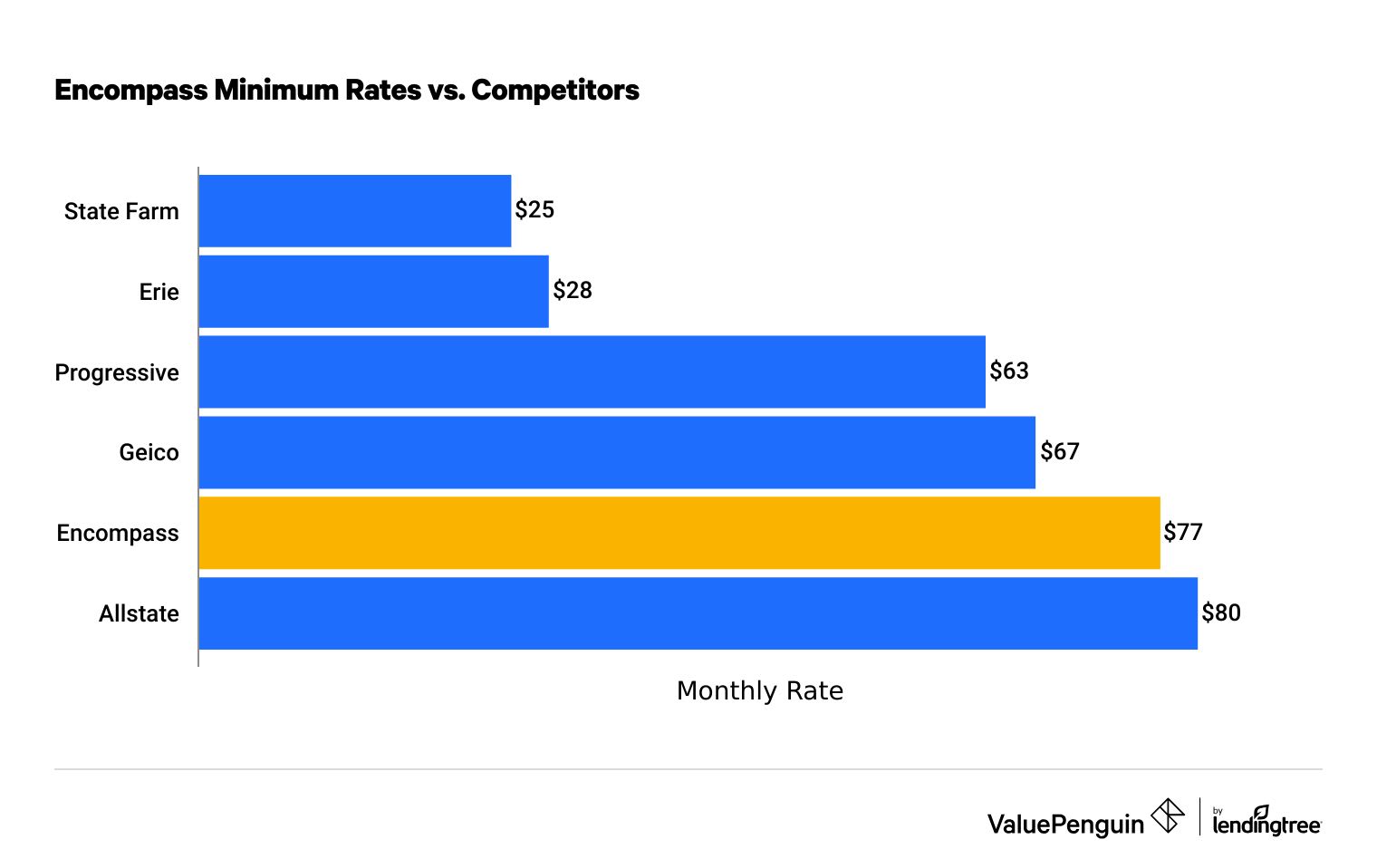

Encompass auto insurance rates are higher than average, with full coverage rates of $208 per month.

That comes in at 26% more than average. You can get cheaper rates with other companies such as State Farm, Erie or Progressive.

Find Cheap Auto Insurance Quotes in Your Area

Encompass rates vs. competitors

Company | Min. coverage | Full coverage | |

|---|---|---|---|

| State Farm | $25 | $83 | |

| Erie | $28 | $93 | |

| Progressive | $63 | $195 | |

| Geico | $67 | $202 | |

| Encompass | $77 | $208 | |

| Allstate | $80 | $212 | |

Encompass auto insurance discounts

Encompass has an impressive range of discounts, which can help lower the company's high rates. Discount will vary depending on your location.

Discount | How to get it |

|---|---|

| Safe driving | No covered driver on your policy has had an at-fault accident in the past year. Up to 5% off. |

| Defensive driver | You successfully complete a defensive driving course approved by Encompass. |

| Future effective date | Get your policy issued a week or more before it comes into effect. |

| Encompass Easy Pay | You'll get a discount for making automatic bill payments through the Encompass Easy Pay plan. |

| Good payer | Included when you start your policy, and continued if all your payments are on time for a year. |

Encompass auto insurance coverages

Beyond standard coverages, Encompass insurance policies can be purchased as one of their three packages, with varying amounts of features added to your coverage. Elite packages provide the most comprehensive and expensive coverage compared to the Special and Deluxe levels. Outside the features included in these packages, you can also customize your policy with optional add-ons, though some features, such as unlimited accident forgiveness, are only available with the Elite policy.

Feature | How it works |

|---|---|

| New car replacement | If your car is under four model years old and is totaled in a covered loss, Encompass will replace it with a current model year car or a car of equivalent size and class. This is an optional add-on for all three packages. |

| Accident forgiveness | This prevents increased premiums after your first at-fault accident and is only available in Deluxe and Elite packages. If you purchase an Elite policy, you can get enhanced accident forgiveness, meaning the add-on will apply to multiple at-fault accidents. |

| Loan/lease gap coverage | This coverage pays the difference between the current value of your car loan and what your car is worth if it is totaled. If your car is worth less than your outstanding loan, Encompass will make up the difference, and you won't owe anything to your creditor. This add-on is optional for all three packages and requires you to have both comprehensive and collision insurance coverage. |

| Roadside assistance | 24/7 roadside assistance is available if your car breaks down. The add-on includes the Encompass Roadside Assistance app, which you can use to show Encompass your location and request assistance. This service is included in the Elite package and is an optional add-on for other packages. |

Each level of coverage Encompass offers comes with a more expansive set of protections.

Coverages | Special | Deluxe | Elite | |

|---|---|---|---|---|

| New Car replacement | ||||

| Roadside assistance | ||||

| Electronic equipment coverage | ||||

| Gap coverage | ||||

| First-time accident forgiveness |

Encompass also offers standard car insurance coverages including:

- Bodily injury and property liability coverage

- Collision and comprehensive coverage

- Medical payments and personal injury protection

EncompassOne Policy: Bundled home and auto insurance

Encompass offers an attractive set of bundling options as part of the EncompassOne package. However, EncompassOne packages are not available in Florida, Massachusetts, North Carolina or Texas.

Bundle & Save

Auto

Home

The most notable feature of the bundled policy is its single deductible. This means if a covered peril damages both your home and your car, you will only pay the higher individual deductible in the event you make a claim.

For example, say your current policy contains a $500 deductible for damage to your home and a $250 comprehensive deductible for damage to your car. If a thunderstorm damages your house and your automobile, you will only pay the $500 deductible under a single deductible policy.

Encompass specialty coverage

Encompass also provides additional insurance options if you have a specialty vehicle, such as a motorcycle, recreational vehicle or boat. If you own a boat or other watercraft, you may be able to bundle your boat insurance into an EncompassOne policy with your home or auto insurance. Check with an Encompass agent for possible discounts.

You can also purchase personal umbrella coverage, home business coverage and identity fraud coverage.

Encompass homeowners insurance review

While Encompass homeowners insurance rates can be expensive, they include a lot of policy coverage options. If you're willing to pay a bit more, you can get a high level of protection for your home.

Encompass homeowners insurance quotes

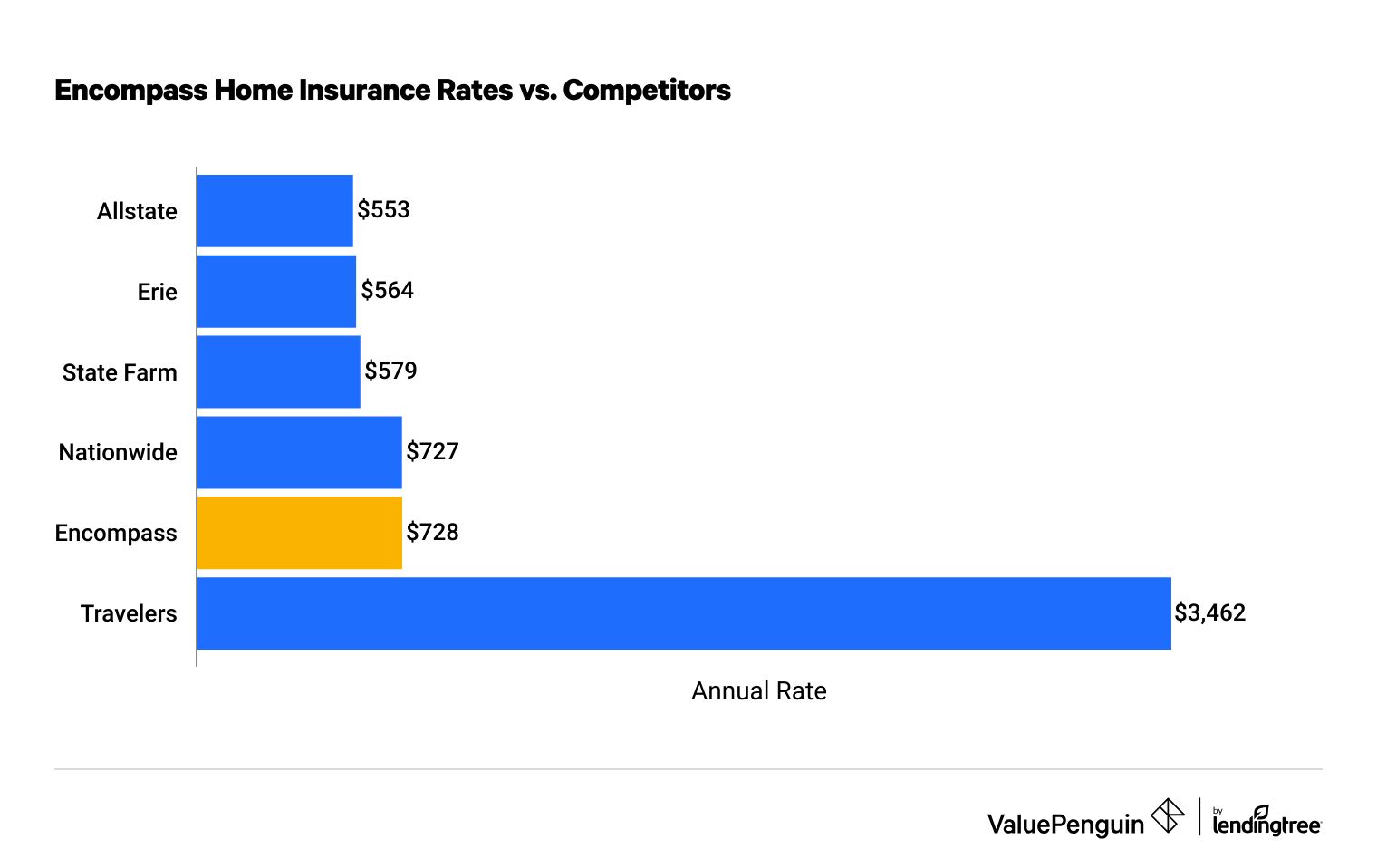

Encompass homeowners insurance rates are more expensive than several large competitors. Its rates were considerably less than those at Travelers, higher than rates for Allstate, Erie and State Farm, and about as expensive as Nationwide.

Find Cheap Homeowners Insurance Quotes in Your Area

Encompass home insurance rates

Company | Monthly rate | |

|---|---|---|

| Allstate | $553 | |

| Erie | $564 | |

| State Farm | $579 | |

| Nationwide | $727 | |

| Encompass | $728 | |

| Travelers | $3,462 |

Your specific homeowners insurance rate may differ greatly depending on your location, and you should measure your Encompass rates against other rates in your area.

Encompass homeowners insurance coverage options

Encompass has a wide array of extra features you can add to your coverage, along with standard features you'd expect from an HO-3 policy. Similar to auto coverage, the company offers three packages — Special, Deluxe and Elite — that provide different combinations of coverage and a few special features.

Coverage | Special | Deluxe | Elite |

|---|---|---|---|

| Additional living expenses | |||

| Homeowners association extension (HOA) | |||

| Jewelry and fur | |||

| Medical expense coverage | |||

| Burglary or theft recovery |

One of the unique features available in both Deluxe and Elite homeowners policies is the property location limit. This feature allows you to pool coverage of all your property under a single limit, set at twice the replacement value of your home. This gives you rare flexibility to fully cover damage, whether it affects your home itself, your personal belongings or another structure that's part of your home. Most home insurance policies have different limits for different types of property.

For example, a standard policy might limit coverage of the structure of your home to its replacement value, say $500,000, and provide a separate limit of $350,000 covering what you have in your home. This means if the contents of your home sustained $400,000 of damage, you would be on the hook for the remaining $50,000. Under the Encompass property location limit, all of your property is covered under a combined limit up to twice the replacement value of your home. In this case, that's $1 million, which would easily cover $400,000 in damage to your personal belongings.

Regardless of whether you opt for a Special, Deluxe or Elite policy, all packages include the standard policy features in a regular home policy.

Coverage details | |

|---|---|

| Dwelling coverage | Covers rebuilding or repairing your home’s structure in the event of a covered peril, including separate structures on your residence premises, attached or unattached to your dwelling |

| Personal belongings | Covers damage or theft of the contents of your home |

| Additional living expenses | Covers your cost of living up to at least a year if a covered loss makes your home uninhabitable |

| Personal liability | Covers the costs of legal liability (due to yourself or other covered persons on your policy) from personal injury, bodily injury or property damage |

| Medical expenses | Covers medical expenses due to an injury on your property or an injury caused by a covered person in your policy |

Encompass homeowners insurance discounts

Although availability may vary depending on your location, Encompass also provides some limited discount options.

- Claim-free: If your home has been claim free for five years, it may be eligible for a 15% discount

- Dwelling age: If your home is less than 20 years old

- Renovation: If your home has updated home systems such as heating, cooling, plumbing or a new roof in the last 10 years

- Protection devices: If your home has fire alarms, burglar alarms or other safety devices

- Homebuyer: If your home is less than 49 years old and was purchased within the last five years, you may be eligible for a discount of up to 10%

Encompass customer service and reviews

Encompass has average to below-average customer service for auto insurance and good service for home insurance.

The company received 84% fewer home insurance complaints than an average company its size, according to the National Association of Insurance commissioners. Encompass received 6% fewer auto insurance complaints, but its second-largest subsidiary received more complaints than average. Fewer complaints tends to mean customers are happier with their coverage and experience.

Encompass does lag in terms of certain parts of the online experience. You cannot get a quote or file an insurance claim online, meaning these will have to be handled on the phone. The company does, however, have a roadside assistance app.

How to file a claim with Encompass

You will have to file your claims with Encompass over the phone. You take similar steps for auto claims, home claims and catastrophe claims.

- Call the Encompass Insurance phone number: 1-800-588-7400 to report a loss.

- Speak to a claims center team member. This should be within 24 hours, but it might take longer.

- Have an inspector evaluate the damage.

- Speak to an adjuster to review your estimate.

- Complete your claim by filling out the final documentation

Methodology

ValuePenguin collected home car insurance quotes from Encompass and large competitors in Pennsylvania, where the company does a considerable amount of business. Auto quotes are for a 30-year-old man with a 2015 Honda Civic, a clean driving record and good credit. Home insurance quotes are for a house with dwelling coverage that matches the median home value in the state.

The company's star rating was calculated using a proprietary formula that factors in rates, customer service and coverage options.

All quotes used rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should only be used for comparison — your own quotes will be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.