Auto Insurance

High Costs and Safety Concerns: Why Millions of Americans Aren't Buying Electric Vehicles

From a rise in affordable options to Tesla's recent recall, electric vehicles (EVs) have been making headlines lately. But despite the stir, many Americans aren't ready to make the switch — and price is a particular concern.

ValuePenguin asked more than 2,000 U.S. consumers about their attitudes toward EVs. In addition to going over consumers' top reservations, stick around for tips on deciding whether to make the switch — including how going electric may affect your auto insurance rates.

On this page

Key findings

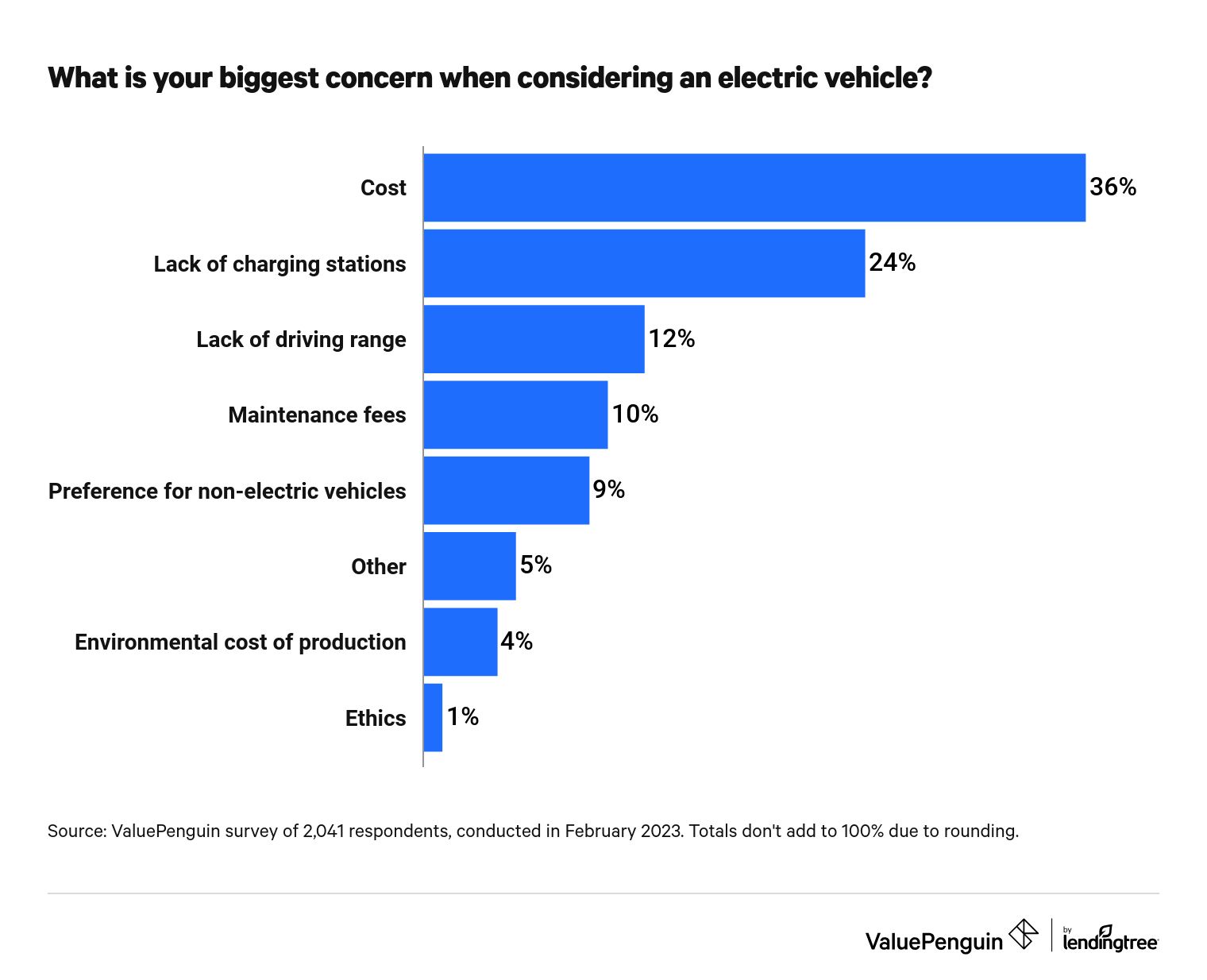

- Despite a federal initiative to have electric vehicles (EVs) account for at least 50% of new car sales by 2030, many Americans aren't ready to convert. Although tax breaks could help with the overall cost, 36% of Americans say their major concern is price — this is followed by a lack of charging stations (24%) and driving range (12%). With the average price of an EV at $58,725, income level could be a major barrier to ownership. Americans making less than $35,000 are 43% more likely to cite price as a deterrent than those in households making at least $100,000.

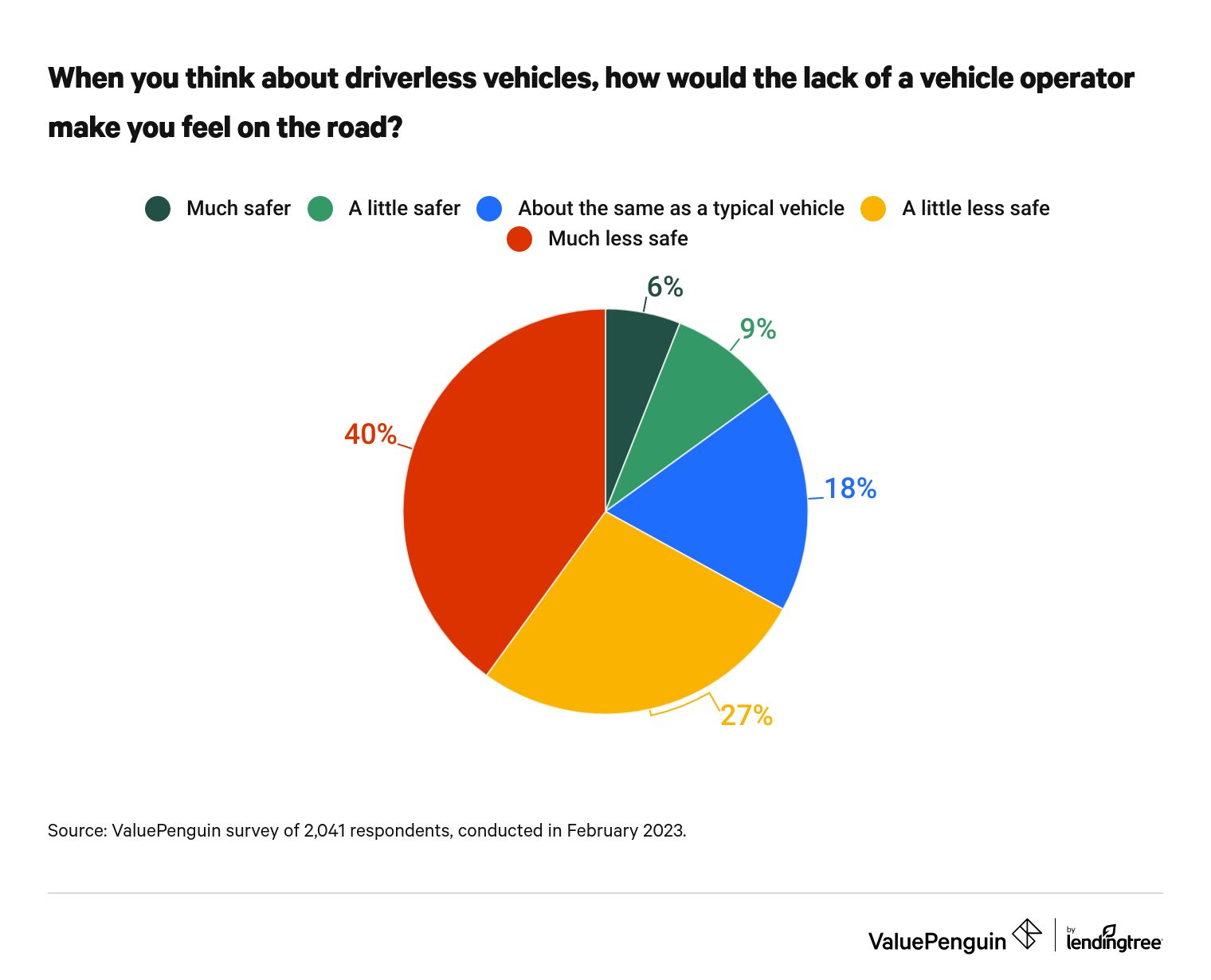

- Cost aside, safety fears could be driving the hesitation. As more EV manufacturers offer automated driving features, 40% of Americans say a driverless automobile would make them feel much less safe on the road and 45% say these vehicles pose a tremendous risk to pedestrians. Even with the distrust in autonomous technology, though, Americans still hold human operators responsible: 53% say the driver is at fault if they get in an accident even if the car is being controlled by self-driving tech.

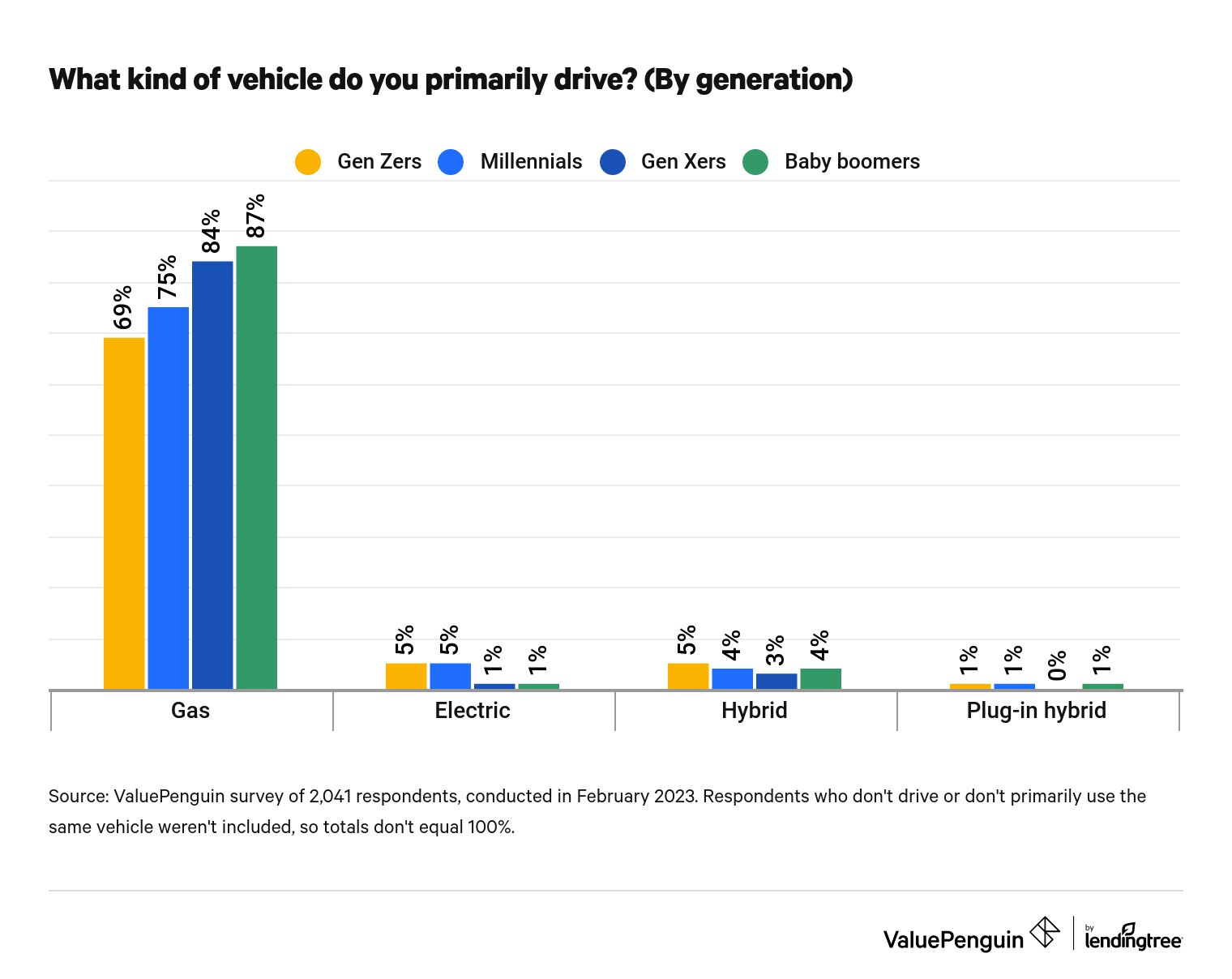

- Despite a 65% jump in EV sales in 2022, cost, accessibility and trust could be why 79% of Americans are primarily driving gas cars. You'll find more baby boomers at the pump than any other generation — 87% are driving traditional vehicles, followed by 84% of Gen Xers. Gen Zers are the most likely generation to drive an electric vehicle (whether purely electric, hybrid or plug-in hybrid), but they're also the most likely to report they don't drive or don't primarily use the same vehicle.

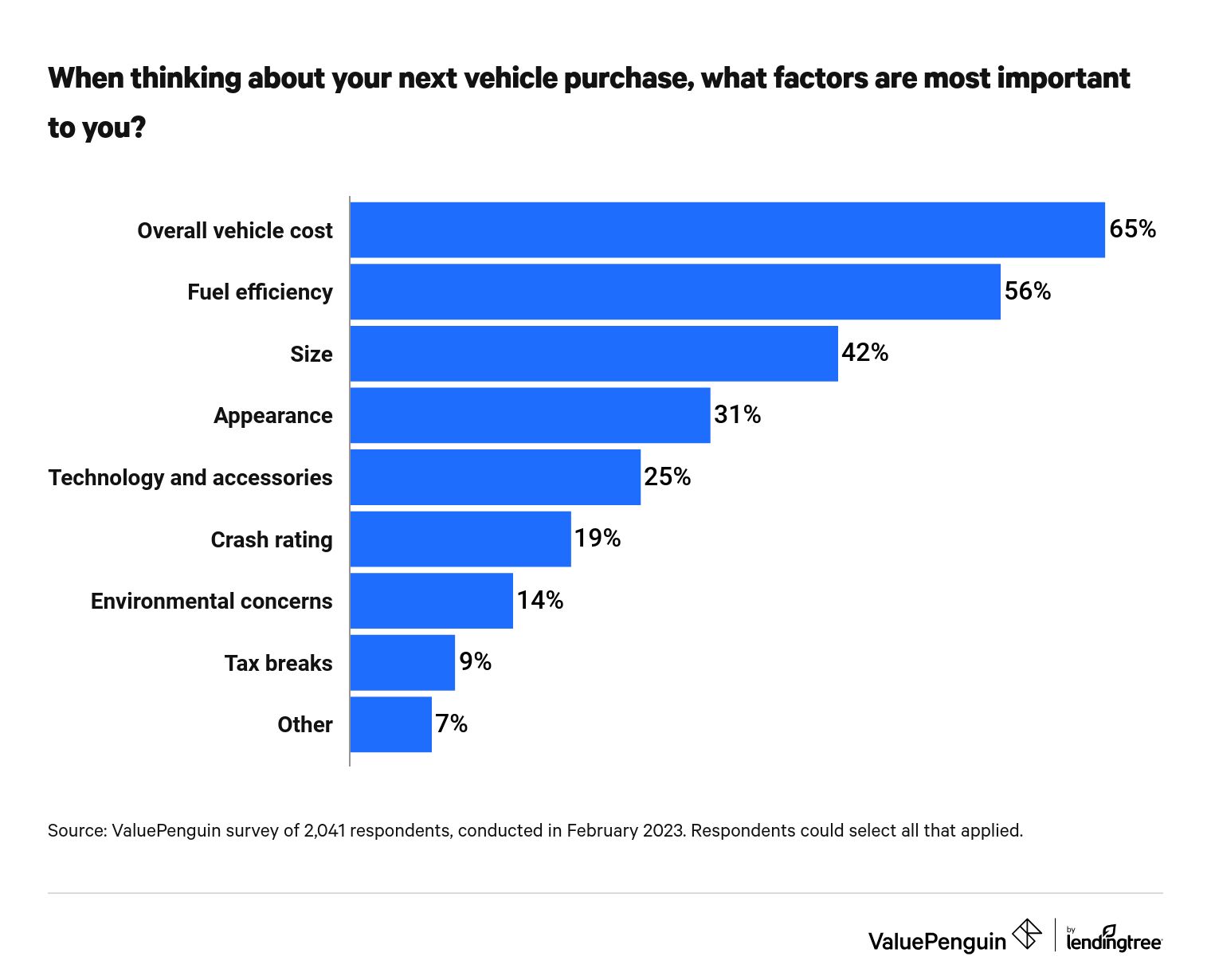

- Perhaps considering the impact vehicles have on climate change, Americans' affinity to purchase an EV in the future could be closely aligned with their political views. 22% of Democrats will consider the environment for a future vehicle purchase, compared with 6% of Republicans. In general, the biggest decision makers for vehicle purchases come down to cost (65%), fuel efficiency (56%) and size (42%).

Not all consumers are ready to go electric — here's what they're worried about

Although the U.S. government is ready to switch to EVs, many consumers aren't quite there. To help meet the federal goal of converting 50% of new car sales to electric vehicles by 2030, several initiatives have been introduced, including tax credits of up to $7,500.

Despite this, 36% of Americans say price is their major concern when considering EVs — the most common roadblock. Given the price of EVs, that's understandable. New EVs cost an average of $58,725 in January 2023, according to Kelley Blue Book estimates. While that's down 7.1% from a year ago (a notable achievement given that the average cost of all new cars has risen 5.9% in the same time), that cost may not be low enough for some consumers.

That's particularly true of low-earning Americans. While 40% of consumers making less than $35,000 cite cost as a top worry for EVs, just 28% of six-figure earners express similar concerns. That means low earners are 43% more likely to worry about the price tag the most.

ValuePenguin insurance expert Divya Sangameshwar says these concerns are warranted.

"Americans aren't ready for widespread EV adoption," she says. "It comes down to the complicated math behind EV ownership. EV proponents argue that EVs are cheaper because they're cheaper to fuel and maintain — especially when gas prices are high. But the premium pricing of EVs leads to a very understandable hesitancy to buy one."

Following cost, a lack of charging stations (24%) and driving range (12%) are the top deterrents for consumers. Consumers with a master's degree (31%) and six-figure earners (28%) are particularly likely to cite charging station concerns. Meanwhile, men are much more likely to worry about a lack of driving range than women — 16% versus 8%, respectively.

While Sangameshwar understands these concerns, she believes the EV industry is rapidly changing — and many Americans aren't keeping up with the latest technology.

While there are about 47,200 publicly accessible EV charging stations in the U.S., according to an IEA analysis, President Joe Biden said during his 2023 State of the Union address that the country would build 500,000 EV charging stations.

"EVs have also shifted from first-generation models that barely ran for 100 miles on a charge to new and updated offerings that are now approaching 500 miles per charge," Sangameshwar says.

Self-driving tech may spark safety fears

It's not just the cost that's turning consumers off of EVs: Self-driving technology is also a major safety concern. Despite a growing number of EV manufacturers that plan to offer self-driving technology (with Mercedes, Volvo and Hyundai among the most recent adapters), 40% of Americans say a driverless car would make them feel much less safe on the road.

Older consumers are generally more wary of self-driving technology than younger ones. More than 8 in 10 (83%) baby boomers ages 59 to 77 say a driverless car would make them feel at least a little less safe on the road — that compares with:

- 70% of Gen Xers ages 43 to 58

- 59% of millennials ages 27 to 42

- 49% of Gen Zers ages 18 to 26

Consumers wouldn't feel comfortable outside their cars, either — 45% of consumers say they'd feel much less safe as pedestrians around self-driving cars. By age group, all generations are more likely to feel at least a little less safe as a pedestrian than as a driver.

Older consumers are again less likely to feel comfortable around self-driving tech than younger consumers — 85% of baby boomers feel at least a little less safe as a pedestrian around a driverless car. That compares with:

- 71% of Gen Xers

- 62% of millennials

- 53% of Gen Zers

Regardless of their comfort level, consumers agree: The human is responsible for any accidents that occur. Even if a car is being controlled by self-driving tech, 53% say the driver is at fault if they get in an accident.

Still, that means 47% believe the manufacturers are at fault. By demographic, those most likely to blame the manufacturer are:

- Consumers earning between $35,000 and $49,999 (52%)

- Consumers whose highest education is a high school degree (51%)

- Gen Zers (51%)

Why don't consumers trust self-driving technology? "Americans' distrust of full self-driving technology could partially come from the fact that it's still, for the large part, unregulated," Sangameshwar says. "Although that might be changing soon as federal regulators are taking a closer look at the safety of vehicles with full self-driving features."

This comes amid Tesla's most recent recall, involving this type of technology. The leading EV manufacturer announced in February that it was recalling nearly 363,000 self-driving cars, citing safety risks as the primary reason. In its investigation, the National Highway Traffic Safety Administration (NHTSA) said Tesla's "Full Self Driving" feature didn't sufficiently adhere to traffic safety laws — and it may violate traffic laws before drivers could intervene.

Despite a lack of awareness, most consumers believe cars with self-driving features should be more expensive to insure

Though those safety concerns are well-warranted, Americans' distrust of self-driving technology may also be driven by a lack of awareness. In fact, 29% say they know nothing about self-driving features such as lane assist, adaptive cruise control or hands-free steering — many of which may already be in their cars.

Women (35%) are more likely to not know anything about self-driving features than men (22%). Meanwhile, consumers whose highest education is a high school degree (42%) and those making less than $35,000 (39%) are also among the most likely groups to not know anything about self-driving technology.

Despite this, 69% of Americans believe cars with self-driving features should be more expensive to insure. Consumers earning between $75,000 and $99,999 (74%) are the most likely to say self-driving technology should come with insurance price hikes. To put that into perspective, 65% of those making less than $35,000 say similarly — the least of any income group.

It's also worth noting that 35% of Americans aren't willing to pay more for a car with self-driving capabilities. That's particularly true among:

- Baby boomers (52%)

- Americans with older children (46%)

- Divorced Americans (42%)

- Americans with some college education (41%)

79% are primarily driving gas cars

Although EV sales jumped by 65% in 2022, according to Kelley Blue Book estimates, 79% of Americans are primarily driving gas cars. By generation, baby boomers (87%) are the most likely to say they're primarily driving traditional vehicles, followed by 84% of Gen Xers.

Why are older consumers less likely to drive EVs? According to Sangameswhar, there are a few factors at play.

"Older Americans may not be fully sold on EVs because they just don't know enough about them to commit to buying one," she says. "They may also be distrustful of the EV auto manufacturers, but they could be open to getting an EV from a legacy auto brand they know or trust, like Ford or Honda."

In a distant second, 4% of Americans say they own a hybrid. Those with a master's degree (12%), six-figure earners (7%), married Americans (6%) and Gen Zers (5%) are among the most likely to drive hybrids.

Gen Zers (11%) are the most likely generation to own an EV — whether purely electric, hybrid or plug-in hybrid. However, they're also most likely to report they don't drive or don't primarily use the same car — which means they may still drive traditional cars just as often.

Democrats are more likely to go green for the environment

Consumers' carbon footprint is top of mind for a lot of consumers when it comes to their next car purchase, though that often varies by political party. While only 14% of consumers say they'd consider environmental concerns when making their next car purchase, that percentage is significantly higher among Democrats (22%). Comparatively, 6% of Republicans say similarly.

Car tech in general is a much bigger factor among Democrats. While 27% of Democrats say they'd consider technology and accessories when choosing their next car, 22% of Republicans say similarly. In addition, Democrats are more willing to pay more for self-driving technology in vehicles — 29% versus 19%, respectively.

Regardless of whether they're sticking to gas cars or going electric, cost is vital for consumers when it comes time to buy a new car. Overall, 65% of Americans say they're concerned about the price tag. That's particularly true for:

- Baby boomers (77%)

- Americans with kids older than 18 (74%)

Cost isn't the only factor on consumers' minds, though. After price, Americans consider fuel efficiency (56%), car size (42%) and appearance (31%) most in their decisions.

Men and women also have different considerations when buying a new car. Men are more likely to consider cost than women — 71% versus 59%. They're also more likely to consider both fuel efficiency — 59% versus 53% — and tax breaks — 12% versus 7%.

Thinking of making the switch? Here's what to consider

Getting a new car is a major financial decision, and navigating the EV industry can be particularly tough. Whether you're fed up with gas prices or want to go green for the environment, Sangameswhar says to consider the following factors before making the switch to EVs:

-

Do your research on the cost of an EV to maximize savings. "The upfront cost is a significant part of the math when you compare EVs and gas cars," she says. "While Kelley Blue Book found that new EVs are about $9,300 more than the overall industry average purchase price, the high sticker price of an EV could be offset by tax credits if the car is compliant with new manufacturing requirements."

-

Factor in the cost of insurance. "While your dealership probably won't be upfront about the cost to insure an EV, they're about 28% more expensive to insure compared to a gas car, according to a recent ValuePenguin analysis on car insurance rates," she says. "It would be good to talk to your insurer about how much your premiums may increase if you switch to an EV."

-

Don't forget repair costs. "While EVs may have lower maintenance costs than a gas car, they're a lot more expensive to repair if they get damaged in a car crash or bad weather," she says. A 2022 report from CCC Intelligent Solutions found that the average EV model cost $4,041 to fix — about 27% more than the average for roughly comparable non-EV models.

Methodology

LendingTree commissioned Qualtrics to conduct an online survey of 2,041 U.S. consumers ages 18 to 77 from Feb. 7-10, 2023. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. All responses were reviewed by researchers for quality control.

We defined generations as the following ages in 2023:

- Generation Z: 18 to 26

- Millennial: 27 to 42

- Generation X: 43 to 58

- Baby boomer: 59 to 77