Who Has the Cheapest Car Insurance in Stockton, California?

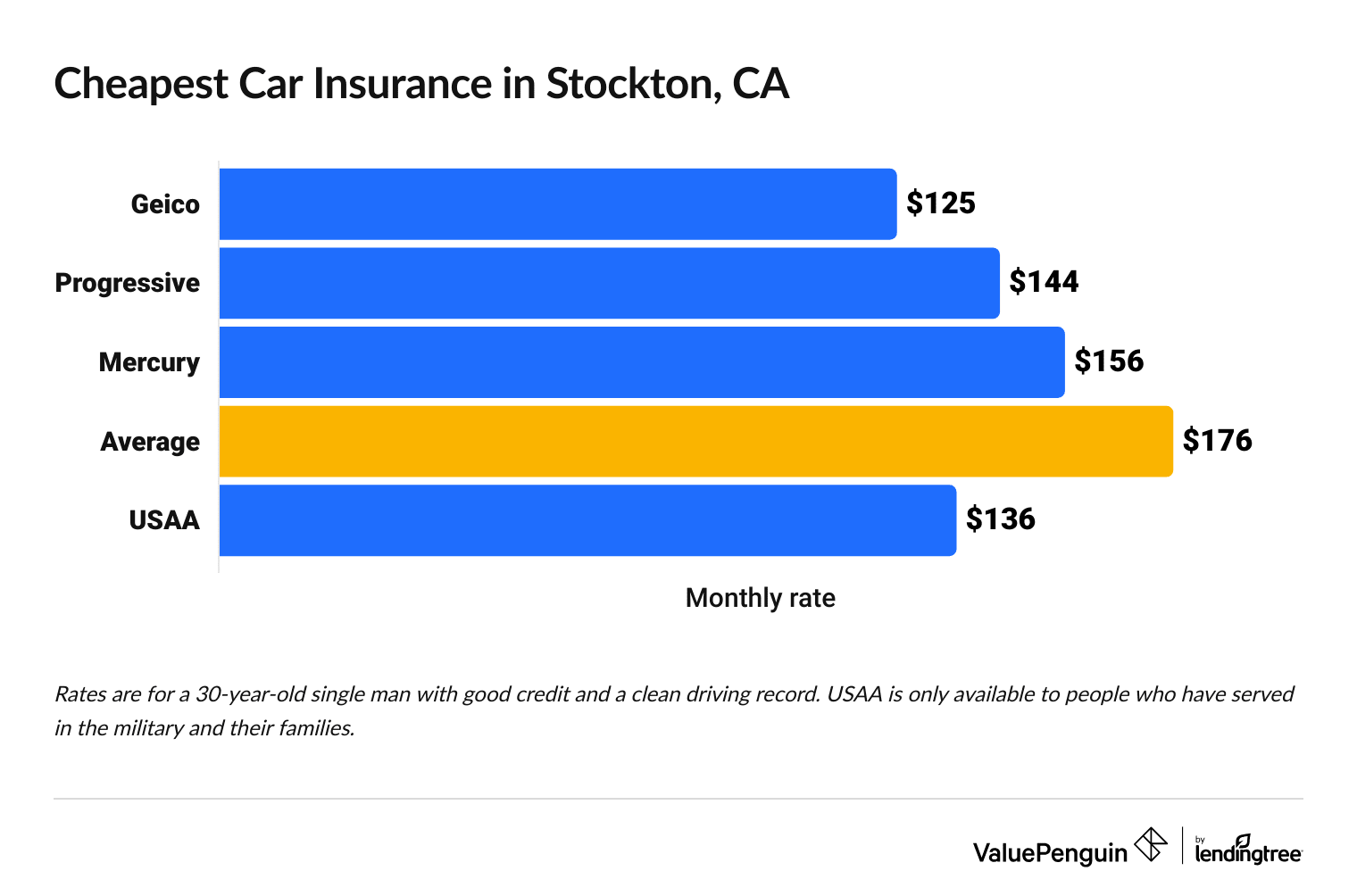

The cheapest car insurance in Stockton, CA is from Geico, at $125 per month for full coverage. It also has the cheapest liability-only coverage, at $42 per month.

Compare Car Insurance Rates in Stockton, CA

Best cheap car insurance companies in Stockton

How we chose the top companies

Cheapest car insurance in Stockton: Geico

Geico has the best prices for full-coverage car insurance in Stockton, at $125 per month.

That's 29% less than the typical price in Stockton .

Compare Car Insurance Rates in Stockton, CA

People who have served in the military should also consider USAA, which has an average price of $136 per month. USAA also has some of the best customer service of any insurance company in the country.

Cheapest full-coverage car insurance in Stockton

Company | Monthly rate | |

|---|---|---|

| Geico | $125 | |

| Progressive | $144 | |

| Mercury | $156 | |

| Allstate | $187 | |

| AAA | $193 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance in Stockton: Geico

Geico has the cheapest rates for a basic, state-minimum car insurance policy in Stockton. The company average for price liability-only coverage is just $42 per month, which is 30% cheaper than the average citywide.

AAA is also an affordable option, at $50 per month. AAA also scored very well in J.D. Power insurance customer service rankings, though you do need to buy an AAA membership separately to qualify.

Compare Car Insurance Rates in Stockton, CA

Cheapest car insurance in Stockton, CA

Company | Monthly rate |

|---|---|

| Geico | $42 |

| AAA | $50 |

| Progressive | $52 |

| Mercury | $59 |

| State Farm | $68 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers in Stockton: Geico and State Farm

Geico and State Farm have the best prices for car insurance for 18-year-olds in Stockton.

They each charge an average of $130 per month, which is 17% less than the city average .

State Farm has better customer service than Geico, which could mean you get paid faster after a claim, for example.

For full coverage, Geico's rates are a little cheaper: $324 per month, or $15 less than State Farm's prices.

Cheapest car insurance for young drivers

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $130 | $324 |

| State Farm | $130 | $339 |

| Mercury | $153 | $371 |

| Progressive | $157 | $433 |

| AAA | $161 | $591 |

*USAA is only available to current and former military members and their families.

On average, car insurance for an 18-year-old in Stockton costs $156 per month for liability-only insurance and $418 per month for full coverage.

Younger drivers have less experience behind the wheel and are more likely to take risks while driving, so they tend to make claims more often than older drivers. That results in higher insurance rates.

Save on teen car insurance rates

One of the best ways to save on insurance as a teenager is to share a policy with an older family member, such as a parent. Doing so will almost always result in a lower total price than separate policies.

You can also qualify for teen-specific discounts. These include savings for getting good grades, taking an extra safety course, or applying for an "away at school discount."

Cheapest car insurance for drivers with a speeding ticket: Geico

Geico has the best prices for car insurance after a speeding ticket, with an average price of $196 per month.

Geico's prices are 21% cheaper than the typical price in Stockton, where the average rate is $249 per month.

Progressive and Mercury also have affordable rates at around $220 per month, but both companies have worse customer service than Geico.

Cheapest car insurance for people with a speeding ticket

Company | Monthly rate |

|---|---|

| Geico | $196 |

| Progressive | $221 |

| Mercury | $222 |

| AAA | $244 |

| Allstate | $269 |

*USAA is only available to current and former military members and their families.

Insurance companies have found that drivers who have been caught speeding are more likely to be involved in a crash or make a claim. As a result, you're likely to see a rate increase after just one ticket. The average cost of full coverage increases after a speeding ticket by 42%, or $249 per month.

Cheapest car insurance in Stockton after an accident: Progressive

Progressive has the cheapest insurance after a crash in Stockton, at $237 per month. Progressive is one-third cheaper than the average rate citywide.

Car insurance companies often raise rates for drivers who've been at fault for an accident because they're more likely to make another claim in the future. The average annual price for full coverage is $352 for drivers with an at-fault accident. That's twice as expensive as a driver with a clean record.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| Progressive | $237 |

| Mercury | $247 |

| Geico | $317 |

| State Farm | $384 |

| AAA | $393 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for young drivers after a ticket or accident: Geico

Geico has the cheapest rates for 18-year-olds after they've gotten a ticket or been in an accident.

After one speeding ticket, 18-year-olds will pay an average of just $146 per month for a liability-only policy with Geico. That's 29% less than the average rate in Stockton .

And after an at-fault accident, Geico charges teen drivers an average of $178 per month for minimum coverage — 23% less than the typical price citywide .

Company | Ticket | Accident |

|---|---|---|

| Geico | $146 | $178 |

| Mercury | $203 | $193 |

| Progressive | $204 | $228 |

| State Farm | $206 | $216 |

| Allstate | $236 | $314 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for Stockton drivers with a DUI: Mercury Insurance

The most affordable option for insurance after a DUI comes from Mercury Insurance, priced at $277 per month. Mercury's prices are 44% lower than a typical rate in Stockton.

Driving under the influence is one of the most severe driving violations. Insurance companies typically increase rates a lot after you get a DUI. The average cost of car insurance after a DUI was $493 per month for full coverage. That's nearly three times as expensive than what you'd pay with a clean record.

Cheapest car insurance for drivers with a DUI

Company | Monthly rate |

|---|---|

| Mercury | $277 |

| Geico | $316 |

| Progressive | $346 |

| USAA | $422 |

| Farmers | $469 |

*USAA is only available to current and former military members and their families.

Unfortunately, many companies won't cover drivers who've been convicted of a DUI. If you can't get a quote from a mainstream insurance company, you may need to consider a nonstandard insurance company that specializes in providing coverage to high-risk drivers — at higher prices.

Average car insurance cost in Stockton by neighborhood

The Civic Center neighborhood has the highest car insurance rates in Stockton.

Rates in Civic center average $202 per month, or $35 more than the cheapest neighborhood, Brookside

Car insurance can differ by where you live, even within a specific city. For example, you might pay more for car insurance if you live in an area with a high rate of car theft or a neighborhood where most people park on the street.

ZIP | Monthly Rate | % from average |

|---|---|---|

| 95202 | $202 | 13% |

| 95203 | $179 | 1% |

| 95204 | $171 | -4% |

| 95205 | $184 | 3% |

| 95206 | $190 | 7% |

Methodology

To find the best cheap car insurance in Stockton, ValuePenguin gathered quotes from the state's largest insurance companies for every ZIP code in the city. Rates are for a 30-year-old man who owns a 2015 Honda Civic EX and has a good credit score.

Full coverage quotes include higher liability limits than the state minimum requirement, along with comprehensive and collision coverage.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person, $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Medical payments | $10,000 |

| Uninsured and underinsured motorist bodily injury | $50,000 per person, $100,000 per accident |

| Comprehensive and collision | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.