Best Cheap Car Insurance in Orlando, FL

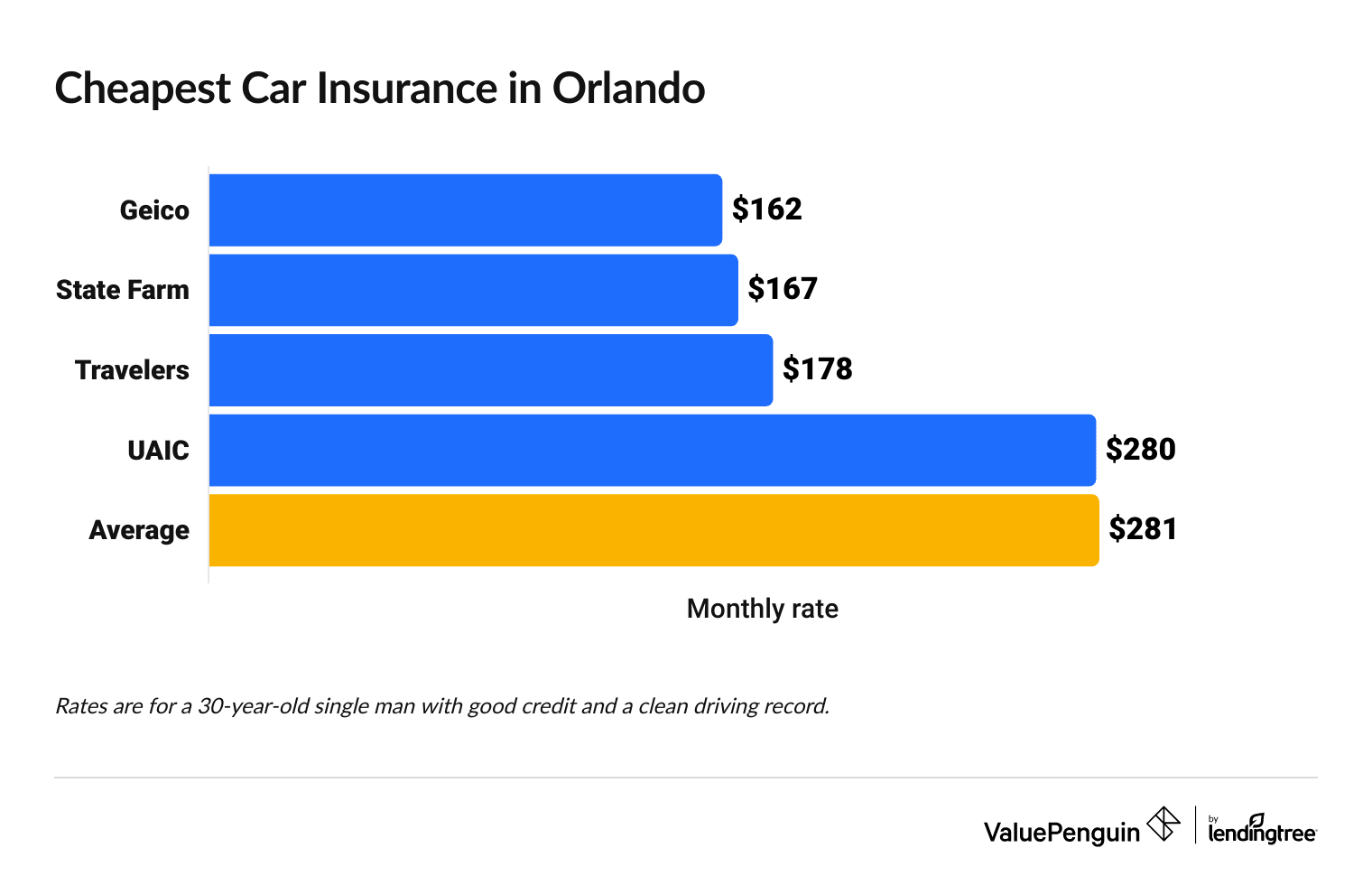

Geico has the cheapest car insurance quotes in Orlando, with an average rate of $162 per month for full coverage, or $39 per month for minimum liability coverage.

Find Cheap Auto Insurance Quotes in Illinois

Best cheap auto insurance companies in Orlando, FL

How we chose the top companies

Cheapest full coverage auto insurance in Orlando: Geico

Geico has the cheapest full coverage car insurance quotes in Orlando, with an average rate of $162 per month.

Geico is 42% cheaper than the average cost of full coverage car insurance in Orlando. At $281 per month, that's $9 more than the Florida average.

State Farm is also worth considering for car insurance, as it's only $5 per month more than Geico and has top-rated customer service.

Compare Car Insurance Rates in Orlando

Cheapest full coverage car insurance in Orlando

Company | Monthly rate | |

|---|---|---|

| Geico | $162 | |

| State Farm | $167 | |

| Travelers | $178 | |

| UAIC | $280 | |

| Progressive | $287 |

Cheapest minimum liability insurance in Orlando,: Geico

Geico has the cheapest minimum-coverage car insurance quotes in Orlando.

A policy from Geico costs around $39 per month, or 60% cheaper than the citywide average.

The average cost of car insurance in Orlando is $113 per month for minimum coverage.

Cheap minimum coverage car insurance quotes in Orlando

Company | Monthly rate |

|---|---|

| Geico | $39 |

| State Farm | $58 |

| Travelers | $61 |

| Farmers | $115 |

| Progressive | $130 |

The average minimum liability car insurance cost in Orlando is slightly above the Florida state average, which is $101 per month. Florida has the fifth-highest car insurance rates in the United States for a minimum coverage policy.

Cheapest insurance for teen drivers in Orlando: Geico

Geico has the most affordable car insurance in Orlando for teen drivers.

A minimum coverage policy from Geico costs $87 per month for an 18-year-old. That's 69% cheaper than the city average. Geico also has the cheapest full coverage quotes, with an average cost of $417 per month. That is exactly half the cost of the Orlando citywide average of $835 per month.

Monthly car insurance quotes for Orlando teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $87 | $417 |

| Travelers | $129 | $451 |

| State Farm | $153 | $490 |

| Allstate | $368 | $1,320 |

| Farmers | $383 | $1,390 |

On average, an 18-year-old driver in Orlando pays two to three times more for insurance than a 30-year-old driver.

Young drivers tend to pay more for insurance because they have less driving experience and take more risks behind the wheel. This makes them more likely to be involved in an accident and make an insurance claim.

Teens should consider sharing a policy with their parents if they can — it's usually much cheaper to join a family policy than to have two separate policies.

Cheapest car insurance in Orlando after a speeding ticket: State Farm

State Farm has the cheapest rates in Orlando for drivers with a speeding ticket. Full coverage from State Farm costs an average of $181 per month after a single speeding ticket, which is 45% cheaper than the city average.

Cheapest car insurance after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $181 |

| Travelers | $217 |

| Geico | $272 |

| UAIC | $280 |

| Progressive | $385 |

In Orlando, drivers with a speeding ticket on their record pay an average of 18% more for a full coverage insurance policy compared to drivers with a clean record. The effect of a speeding ticket on your insurance rate decreases over time, and generally goes away completely after about three years with a clean record.

Cheapest car insurance after an accident: State Farm

State Farm has the cheapest full coverage quotes in Orlando for drivers with an at-fault accident on their record. They offer policies at an average of $195 per month, which is 52% less expensive than the city average of $330 per month.

Drivers can also find affordable rates at Geico, where the average rate is $222 per month. But its customer service tends not to be as good as State Farm's.

Cheapest after an accident in Orlando

Company | Monthly rate |

|---|---|

| State Farm | $195 |

| Geico | $222 |

| Travelers | $240 |

| UAIC | $370 |

| Progressive | $431 |

Having an at-fault accident on your record in Orlando will increase your rates by around 46%.

Cheapest car insurance for teens with a speeding ticket or accident: Geico

Geico has the cheapest quotes for young drivers in Orlando with a bad driving record.

After a speeding ticket, a minimum-coverage policy for an 18-year-old costs an average of $102 per month. That's two-third less than the city average

Geico's average rate after an at-fault accident is just $90 per month, the cheapest across Orlando . That's also about half the price of the next-cheapest company, Travelers.

Monthly minimum coverage quotes for young drivers with incidents

Company | Ticket | Accident |

|---|---|---|

| Geico | $102 | $90 |

| Travelers | $157 | $178 |

| State Farm | $168 | $185 |

| Allstate | $368 | $708 |

| UAIC | $401 | $499 |

Teen drivers in Orlando can expect to pay more for car insurance after a ticket or accident than those with a clean record. Car insurance rates for an 18-year-old driver increase by an average of 9% after a single speeding ticket and 35% after an at-fault accident.

Cheapest car insurance in Orlando after a DUI: Travelers

Travelers has the most affordable car insurance in Orlando for drivers with a recent DUI. A full coverage policy from Travelers costs an average of $284 per month — 40% cheaper than the Orlando average of $393 per month.

Cheapest car insurance after a DUI

Company | Monthly rate |

|---|---|

| Travelers | $284 |

| Geico | $346 |

| Progressive | $353 |

| Farmers | $459 |

| State Farm | $495 |

Drivers with a DUI on their record are statistically much more likely to make a claim than a driver without one. On average, in Orlando pay $449 per month for full coverage, which is 60% more than drivers with a clean record.

In addition, Florida drivers with a DUI may have to get an FR-44 filing. These drivers need to have higher liability limits on their insurance policy, which will usually increase their rates even more.

Cheapest car insurance for drivers with poor credit: UAIC

UAIC has the cheapest full coverage car insurance quotes for Orlando drivers with bad credit, with an average rate of $280 per month. That's nearly half the price of the city average, which comes in at $536 per month.

Cheapest for drivers with poor credit

Company | Monthly rate |

|---|---|

| UAIC | $280 |

| Geico | $302 |

| Travelers | $366 |

| Progressive | $446 |

| Farmers | $558 |

Orlando drivers with a poor credit score typically pay about twice as much compared to someone with a good score.

Your credit score isn't based on your ability to drive safely. However, car insurance companies believe that drivers with bad credit are more likely to make a claim in the future, which makes them more expensive to insure.

Average cost of car insurance in Orlando by neighborhood

The cheapest car insurance in the Orlando area can be found in Bithlo .

Bithlo residents pay an average of $252 per month for full coverage.

The Pine Hills Neighborhood has the highest rates, at an average of $334 per month.

Full coverage car insurance quotes in Orlando vary by $83 per month between the cheapest and most expensive ZIP codes. You might pay more if the roads in your neighborhood are poorly maintained or if there's a lot of car theft in your area.

Full coverage car insurance quotes by Orlando ZIP code

ZIP | Monthly Rate | % from average |

|---|---|---|

| 32789 | $259 | -6% |

| 32801 | $304 | 11% |

| 32803 | $268 | -3% |

| 32804 | $307 | 12% |

| 32805 | $328 | 19% |

What's the best type of car insurance coverage in Orlando, FL?

Full coverage is the best car insurance for most people in Orlando.

Full coverage car insurance pays to repair or replace your car if it's damaged, even if it's from an accident you caused or a non-driving incident like a windstorm.

In Florida, full coverage insurance includes the following:

- Collision coverage: Pays for damage to your car in a collision, even if you were responsible for the crash.

- Comprehensive coverage: Pays to repair or replace your car if it's stolen or damaged from something besides an accident, like a fire or hurricane.

- Personal injury protection: Pays for your own medical bills after a crash.

- Liability protection: Pays for medical, car repair, and other expenses for others if you were responsible for a car crash. Divided into coverage for property damage and bodily injury.

In Orlando, full coverage car insurance costs $145 more per month, on average, than a liability-only policy.

Technically, most drivers in Florida are only required to carry property damage liability and personal injury protection coverage.

But by skipping the other coverages, you may be responsible for covering the shortfall out of your own pocket after a crash.

Frequently asked questions

How much is car insurance in Orlando, Florida?

The average cost of car insurance in Orlando is $281 per month for full coverage. That's 3% more than the average cost of car insurance in Florida.

Who has the cheapest auto insurance in Orlando, FL?

Geico has the cheapest car insurance in Orlando. It offers minimum coverage at an average rate of $39 per month, and full coverage at $162 per month.

What is the best car insurance in Orlando, FL?

Geico has the best-rated car insurance in Orlando, based on its cheap quotes, coverage availability and the overall value it provides drivers in the area.

Methodology

To find the best cheap car insurance companies in Orlando, ValuePenguin gathered insurance rates from seven of the top car insurance companies in Florida. Quotes are for a 30-year-old driver with a clean driving record and good credit score, who drives a 2015 Honda Civic EX.

Full coverage car insurance quotes include comprehensive and collision coverage, along with liability limits that are higher than the Florida state minimum requirements.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Personal injury protection: $10,000

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury liability: $50,000 per person/$100,000 per accident

- Comprehensive and collision deductible: $500

ValuePenguin used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should only be used for comparative purposes. The actual rates from these insurers may vary.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.