Homeowners Insurance

Most and Least Affordable Cities in Illinois for Homeowners & Renters

Whether you are a homeowner or renter, location is a major deciding factor as to where you live.

ValuePenguin surveyed the largest cities in Illinois and found that in just one town, Decatur, homeowners paid less than renters, on average, in housing costs. Renters contributed an average of 31.4% of their income to housing costs annually, compared with homeowners who spent only 19.4% of their income on housing.

As a standard, when housing expenses exceed 30% of a person's income, they are considered burdened. Housing costs, including mortgage or rent payments, homeowners insurance and utilities, are all taken into consideration when determining home affordability. ValuePenguin utilized this home affordability metric to determine which cities in Illinois were most and least affordable to homeowners and renters alike.

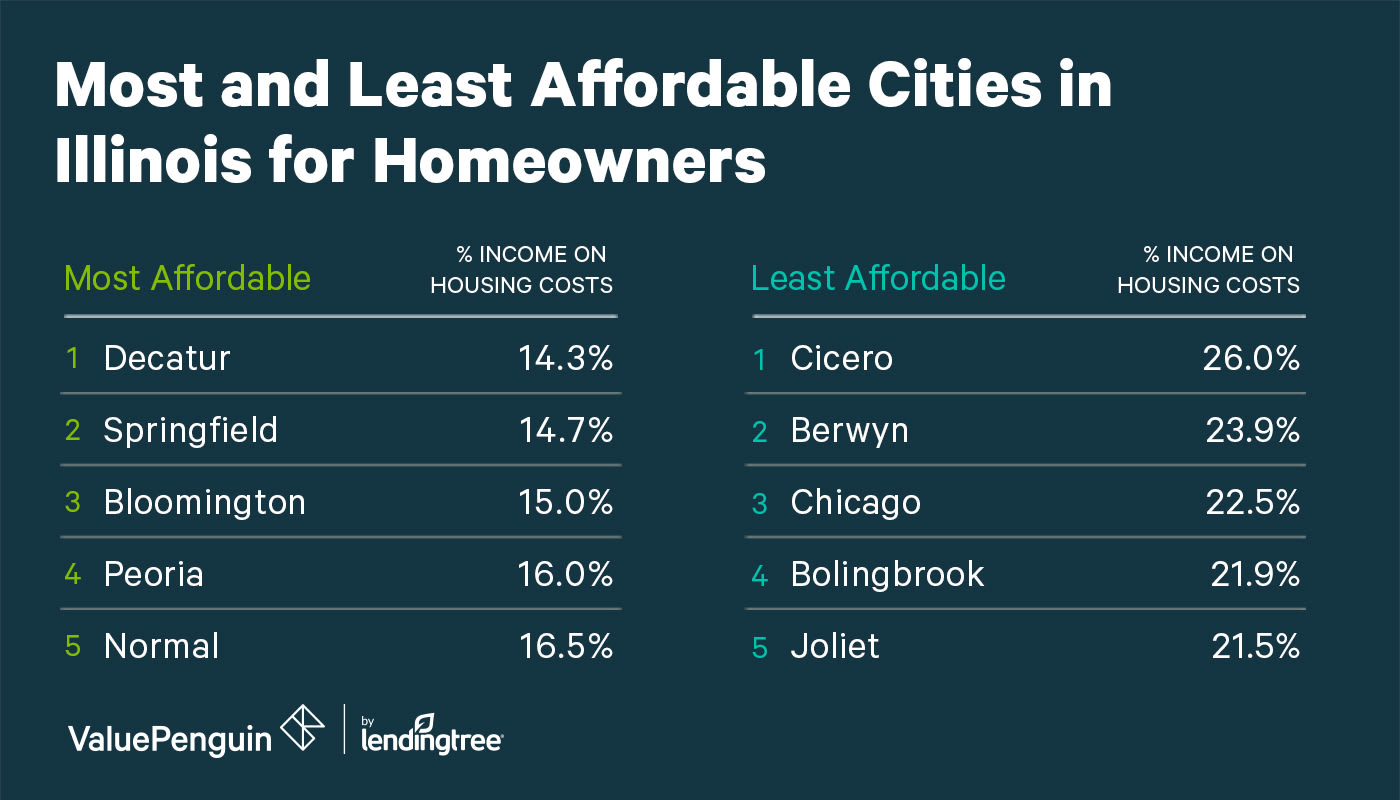

Most and least affordable cities for homeowners

All large cities in Illinois were found to be affordable to homeowners by definition, as no city's residents exceeded spending 30% of income on housing. Cicero was the least affordable, with homeowners contributing 26% of their income to housing. In Decatur, the most affordable city, residents spent nearly half of what those in Cicero did on housing — even though the difference in household income is less than $5,000.

Most affordable cities in Illinois for homeowners

The five most affordable cities in the state are all located within a 200-mile loop in central Illinois.

Not only was Decatur found to be the most affordable city in Illinois for homeowners, but it is also the only city in the state where it is cheaper to own than rent. Here renters pay an average of $7 more per month on housing. Homeowners in this city may have the lowest average household income at $55,367, but they also pay the lowest dollar amount annually here at only $7,896. This is less than any other homeowner and/or renter pays in the state of Illinois.

The capital city of Springfield, which is the largest city in central Illinois, is one of the most affordable towns, with residents only spending 14.7% of their income, or $10,668 annually, on housing.

Bloomington and Normal both have favorable affordability to homeowners, with 15% and 16.5% of annual income spent on housing, respectively. These two cities sit adjacent to one another, however Bloomington ranks as one of the top affordable cities for renters, while Normal was found to be one of the least affordable places to rent.

Peoria is the northernmost affordable town for homeowners and approximately 40 miles northwest of Bloomington and Normal. Here, homeowners spend an average of 16%, or $10,920, of their annual income on their homes.

Least affordable cities in Illinois for homeowners

Chicago and four of its southern and western suburbs rank as the most unaffordable cities in Illinois for homeowners.

Cicero and Berwyn, positioned just a few miles apart, are the most unaffordable towns in Illinois for homeowners. Positioned just west of Chicago, these cities' suburban residents contribute 26% and 23.9% of their income, respectively, to housing.

Following closely is Chicago, the most populated city in Illinois. Here residents contribute an average of 22.5% of household income, or $17,916 annually, to housing.

Bolingbrook is ranked as unaffordable for both homeowners and renters. While homeowners pay less on housing annually than renters, it still represents 22% of their annual income.

Joliet residents, who reside just 30 miles southwest of Chicago, spend on average 21.5% on housing annually. Homeowners spend an average of $16,836 annually on housing, $5,184 more than those who rent.

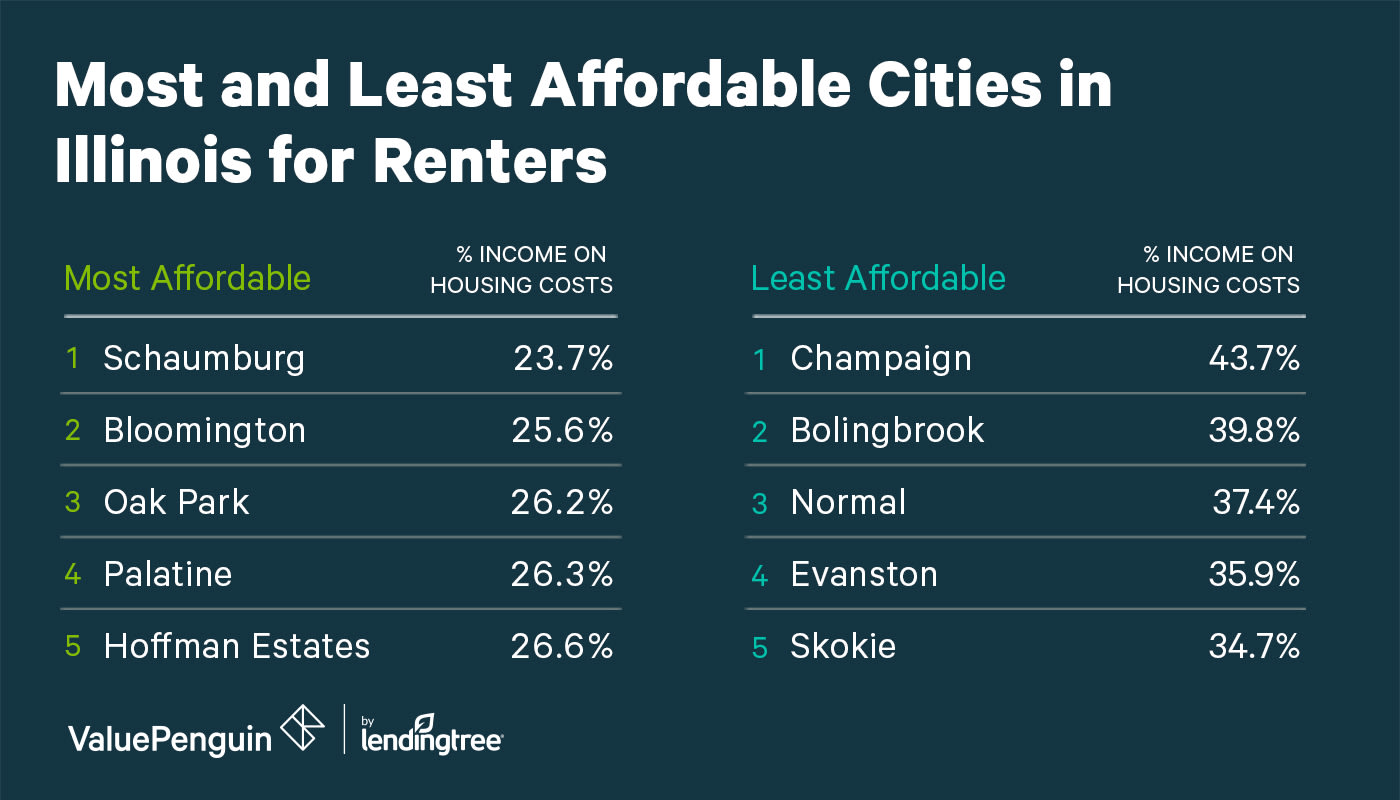

Most and least affordable cities for renters

Only renters in 10 large cities in Illinois pay less than 30% of their income on housing. The other 66% of large cities in Illinois exceed this home affordability threshold. Notably, Chicago’s renters only pay 33.8% of their income on housing, only slightly above the renters’ average of 31.4%. However, many Chicago suburbs rank for some of the most and least affordable cities in the state.

Most affordable cities in Illinois for renters

In terms of renter affordability, four of the five most affordable cities are located in close proximity to Chicago, with three situated approximately 30 miles northwest of the city.

Schaumburg, Palatine and Hoffman Estates are all situated outside of Chicago and represent the most affordable housing option for renters. Here, renters’ annual costs range from $14,040 to $16,032, which accounts for 23.7% to 26.6% of their annual income. Renters in Schaumburg have the highest renter income of all large Illinois cities surveyed.

Bloomington, also found on the homeowners affordability ranking, is the only affordable city for renters situated outside of the Chicago metro area. While affordable to all dwellers, Bloomington renters contributed 10.7% more of their income to housing than homeowners.

Less than 10 miles west of Chicago, Oak Park is the closest to the big city in the top five ranking. Here, renters only contribute 26.2% of their income annually, or $13,224. Homeowners in Oak Park contribute the highest dollar amount of any Illinois city — $25,896 — annually on housing.

Least affordable cities in Illinois for renters

Two major college towns, Champaign (University of Illinois) and Evanston (Northwestern) rank on the least-affordable list, with renters paying as much as 43.7% of their income on housing.

Renters in Bolingbrook, which also ranked unaffordable for homeowners, contribute 39.8% of their income to housing annually. This is nearly double what homeowners in Bolingbrook pay.

Normal renters pay a significantly higher percentage of their income to housing than homeowners, at 37.4% — in contrast, homeowners pay just 16.5%. Notably, homeowners earn over three times normal renters’ household income.

Less than five miles from ranked Evanston, Skokie neighbors Chicago’s northern border. Here, renters pay $239 more monthly than Skokie homeowners — contributing 34.7% of their income toward housing.

Protection for homeowners and renters

For homeowners and renters alike, the cost of insurance is a factor in determining home affordability. In both cases, it is important to shop around for an insurance policy that is most affordable to your area and best suits your coverage needs.

Homeowners

Illinois homeowners pay an average of $1,543 annually for home insurance. In most affordable Decatur, residents pay $1,415, which is 8% below the state average. Notably, those living in the least affordable town of Cicero, pay only $1,446, or 6% below the state average for home insurance.

Renters

The average cost of renters insurance in Illinois is $212. However, that changes drastically from city to city. If you are considering moving to Chicago, you should be prepared to budget upward of $286 annually for protection, but in affordable Oak Park, residents pay an average of $216.

Methodology

We analyzed population and housing cost data from the Census Bureau's American FactFinder database and the Standard Home Affordability Report. The 29 major Illinois cities included in our analysis reported a population of over 50,000 as of the 2010 Census.

City | Annual homeowner income | Annual homeowner housing costs | Homeowner affordability ratio | Annual renter income | Annual renter housing costs | Renter affordability ratio |

|---|---|---|---|---|---|---|

| Arlington Heights | $102,296 | $19,248 | 18.82% | $56,752 | $15,120 | 26.64% |

| Aurora | $84,608 | $17,280 | 20.42% | $44,474 | $13,740 | 30.89% |

| Berwyn | $75,250 | $17,964 | 23.87% | $41,695 | $11,256 | 27.00% |

| Bloomington | $87,197 | $13,056 | 14.97% | $37,864 | $9,708 | 25.64% |

| Bolingbrook | $93,160 | $20,412 | 21.91% | $39,339 | $15,660 | 39.81% |

| Champaign | $75,794 | $12,948 | 17.08% | $24,835 | $10,848 | 43.68% |

| Chicago | $79,680 | $17,916 | 22.48% | $36,576 | $12,348 | 33.76% |

| Cicero | $59,898 | $15,576 | 26.00% | $34,743 | $10,500 | 30.22% |

| Decatur | $55,367 | $7,896 | 14.26% | $23,128 | $7,980 | 34.50% |

| Des Plaines | $77,548 | $16,044 | 20.69% | $41,954 | $13,236 | 31.55% |

| Elgin | $77,684 | $16,632 | 21.41% | $40,185 | $12,324 | 30.67% |

| Evanston | $112,500 | $22,752 | 20.22% | $43,301 | $15,552 | 35.92% |

Housing costs represent the median amount spent per month. Affordability is determined by comparing annual housing costs and income.