The Best Cheap Renters Insurance in New Hampshire (2025)

State Farm is the best renters insurance company for most people in New Hampshire. An average policy costs $10 per month.

Compare Cheap Renters Insurance in New Hampshire

Best Cheap Renters Insurance in NH

To help you find the best renters insurance in New Hampshire, ValuePenguin editors considered cost, customer service reviews and coverage availability. To find the average cost of renters insurance, our editors gathered rates from five top companies in New Hampshire across 25 of the largest cities and towns in the state.

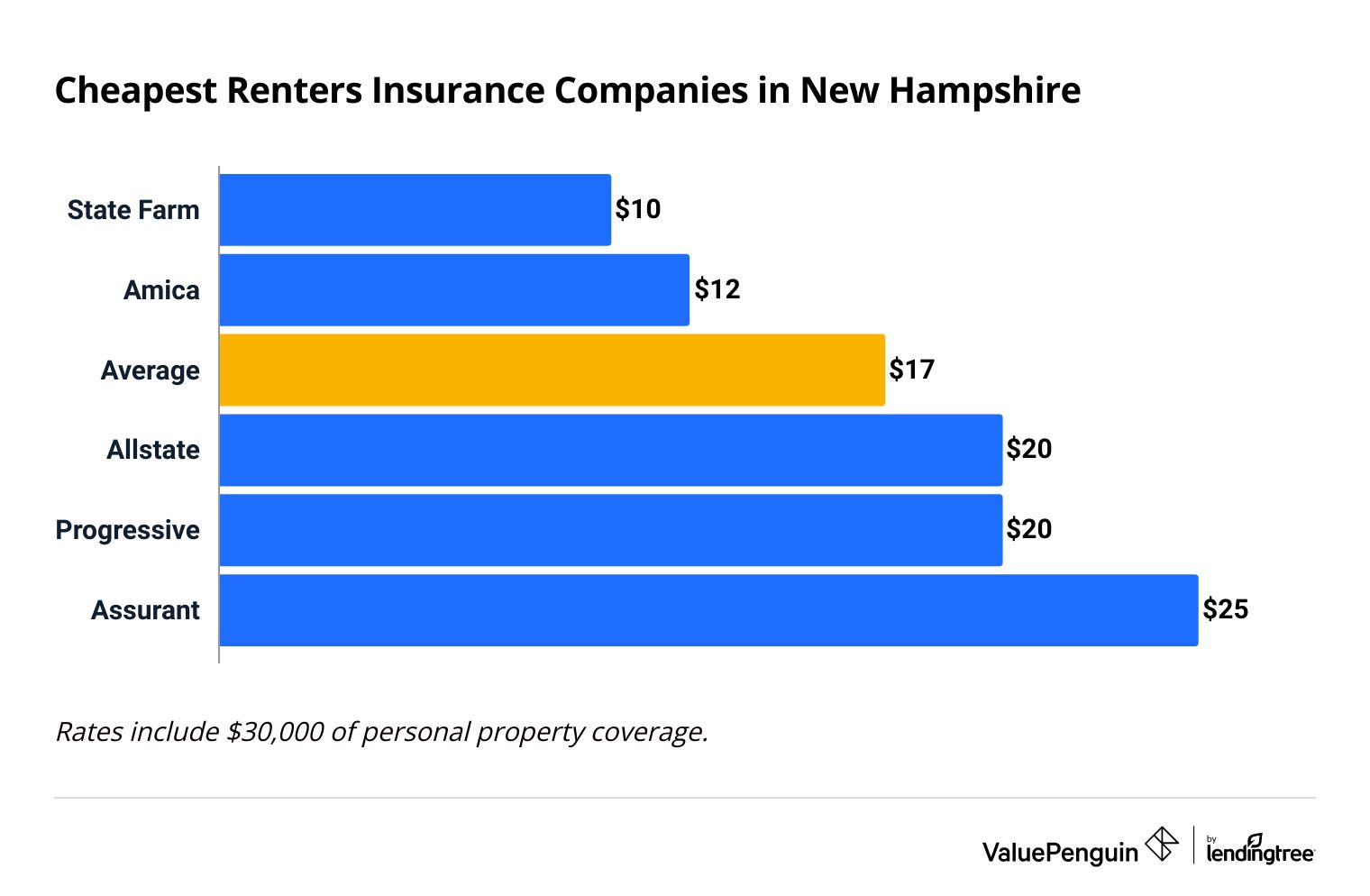

Cheapest renters insurance in New Hampshire

State Farm has the cheapest renters insurance quotes in New Hampshire.

A policy from State Farm costs $10 per month, or $120 per year, on average. That's $7 per month cheaper than the state average.

Compare Cheap Renters Insurance in New Hampshire

The average cost of renters insurance in New Hampshire is $17 per month, or $206 per year.

That's $5 per month less expensive than the average cost across the United States, making New Hampshire the seventh-cheapest state in the country for renters insurance.

Cheapest renters insurance companies in New Hampshire

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $10 | ||

| Amica | $12 | ||

| Allstate | $20 | ||

| Progressive | $20 | ||

| Assurant | $25 | ||

Best renters insurance in NH for most people: State Farm

-

Editor's rating

- Cost: $10/mo

State Farm has the most affordable renters insurance in New Hampshire.

-

Cheapest quotes in NH

-

Lots of coverage options

-

Great for bundling with auto insurance

-

Mixed customer service ratings

-

Some people have to speak with an agent to buy a policy

State Farm has the best renters insurance rates for most people in New Hampshire. The average cost of coverage is $10 per month, which is $7 per month less than New Hampshire's average.

State Farm is also a great choice if you're looking to bundle your renters and auto insurance.

In addition to a multi-policy discount, State Farm has very affordable car insurance in New Hampshire.

There are lots of ways to upgrade your renters insurance coverage with State Farm, including:

- Earthquake insurance

- Extra coverage for valuables, like jewelry

- Water backup coverage

However, State Farm's customer service is just middle-of-the-road. The company earned a good score on J.D. Power's customer satisfaction survey, and it gets an average number of complaints for a company its size. You can count on State Farm to take care of you in an emergency, but if excellent customer service is important to you, you should consider Amica.

Best customer service in New Hampshire: Amica

-

Editor's rating

- Cost: $12/mo

Amica has the top-rated claims process in New Hampshire.

-

Excellent customer service

-

Low cost coverage

-

Good discounts

-

Limited coverage options

Amica is the best choice for New Hampshire renters who value dependable customer service. Amica earned the top score on J.D. Power's property claims satisfaction survey. It also gets one-third as many complaints as an average company its size. That means you can trust Amica to take great care of you if you ever have to make a claim.

Amica is also the second-cheapest renters insurance company in New Hampshire.

A policy costs just $12 per month, or $144 per year, on average. That's $5 per month cheaper than the average cost in New Hampshire.

In addition, Amica offers a handful of discounts to help lower your rates. You can save by:

- Bundling auto and renters insurance

- Signing up for automatic payments

- Getting your policy documents and bills via email

You'll also get a discount if you haven't filed a claim in over three years or have been with your current insurance company for more than two years.

Amica's coverage is fairly standard but sufficient for most people. However, it doesn't offer as many coverage add-ons as other companies. For example, you can't get water backup coverage, which pays for water damage caused by backed-up pipes or a broken sump pump.

Best renters insurance discounts in New Hampshire: Progressive

-

Editor's rating

- Cost: $20/mo

Progressive offers lots of ways for renters to lower their insurance bill.

-

Lots of coverage add-ons

-

Numerous discounts

-

Expensive rates

-

Poor customer service

Progressive offers lots of discounts to help make its insurance more affordable.Renters can save money by:

- Bundling renters and auto insurance

- Getting a quote at least three days before your policy starts

- Paying your annual bill up front

- Getting bills and policy documents via email

You'll also get a discount if you live in a gated community. Even if you qualify for all of Progressive's discounts, it's unlikely you'll save enough to compete with State Farm's low rates.

Renters insurance from Progressive costs around $20 per month in New Hampshire. That's $3 per month more than the state average and $10 per month more than State Farm.

Progressive also offers lots of ways to customize your coverage. For example, you can add equipment protection to your policy. This coverage pays to fix or replace equipment like computers, tvs and small appliances if they're damaged by an electrical or mechanical failure, like a power surge.

However, Progressive has poor customer service reviews.

It earned the lowest score on J.D. Power's customer satisfaction survey. Progressive also gets 46% more complaints than an average company its size. Most customers complain about Progressive's long claims process, and some are unhappy about the amount Progressive offered to pay to replace their stuff.

New Hampshire renters insurance rates by city

Concord, the capital of New Hampshire, has the cheapest renters insurance compared to other large cities across the state.

The average cost of renters insurance in Concord is $16 per month, or $191 per year.

Hampton has the most expensive rates in the state, at $24 per month. Hampton's location close to the Atlantic means its homes are more likely to experience damage from coastal storms. That can lead to higher insurance rates.

Average cost of renters insurance in NH by city

City | Monthly rate | % from average |

|---|---|---|

| Bedford | $17 | -4% |

| Claremont | $16 | -5% |

| Concord | $16 | -7% |

| Derry | $18 | 5% |

| Dover | $18 | 8% |

How to find the best renters insurance in New Hampshire

The best renters insurance companies offer a combination of great customer service and helpful coverage options at an affordable price.

To find the best renters insurance for you, start by figuring out how much coverage you need. Then, shop around for quotes from multiple companies and compare customer service reviews.

Figure out how much renters insurance you need. Most renters insurance policies come with the same kinds of standard coverage, like protection for your belongings. However, some renters need more coverage than a basic policy provides.

For example, lots of companies allow you to upgrade your coverage so you can buy brand new items if your things are damaged. This is called replacement cost coverage.

It's important to make sure that any companies you're considering offer the coverage you need. That way you have the right protection and are making an apples-to-apples comparison.

Compare quotes from multiple companies. In New Hampshire, there's a difference of $15 per month between the most and least expensive renters insurance companies.

However, the cheapest company in the state isn't always the cheapest company for you. That's because insurance companies consider lots of factors when setting quotes, like your age, insurance history and location. For that reason, it's important to shop around to find the best price for you.

Consider customer service reviews. It's important to choose an insurance company you can count on to take good care of you in an emergency.

Companies with excellent customer reviews typically offer a fast and easy claims process. On the other hand, poor customer service could lead to more back and forth with the insurance company. So it may take longer to replace your stuff and you could have to spend more to do so.

What renters insurance coverage do I need in New Hampshire?

Nor'easters, summer thunderstorms, hurricanes and winter storms can all damage New Hampshire homes.

Fortunately renters insurance covers most of the damage these storms bring. This includes:

Wind damage: If heavy winds blow shingles off your roof, causing a roof leak, your insurance will pay for any belongings damaged by the leak.

Snow damage: If the weight of a heavy snowfall causes your roof to cave in, your insurance will replace your damaged things.

Frozen pipes: If your pipes freeze and burst, causing a flood in your home, your insurance will cover the cost to replace damaged stuff.

However, renters insurance doesn't cover weather-related flooding. So if your rental home floods due to heavy rains or rising rivers or lakes after a heavy snow runoff, insurance won't replace your things.

The only way to protect your belongings from flood waters is by getting a separate flood insurance policy.

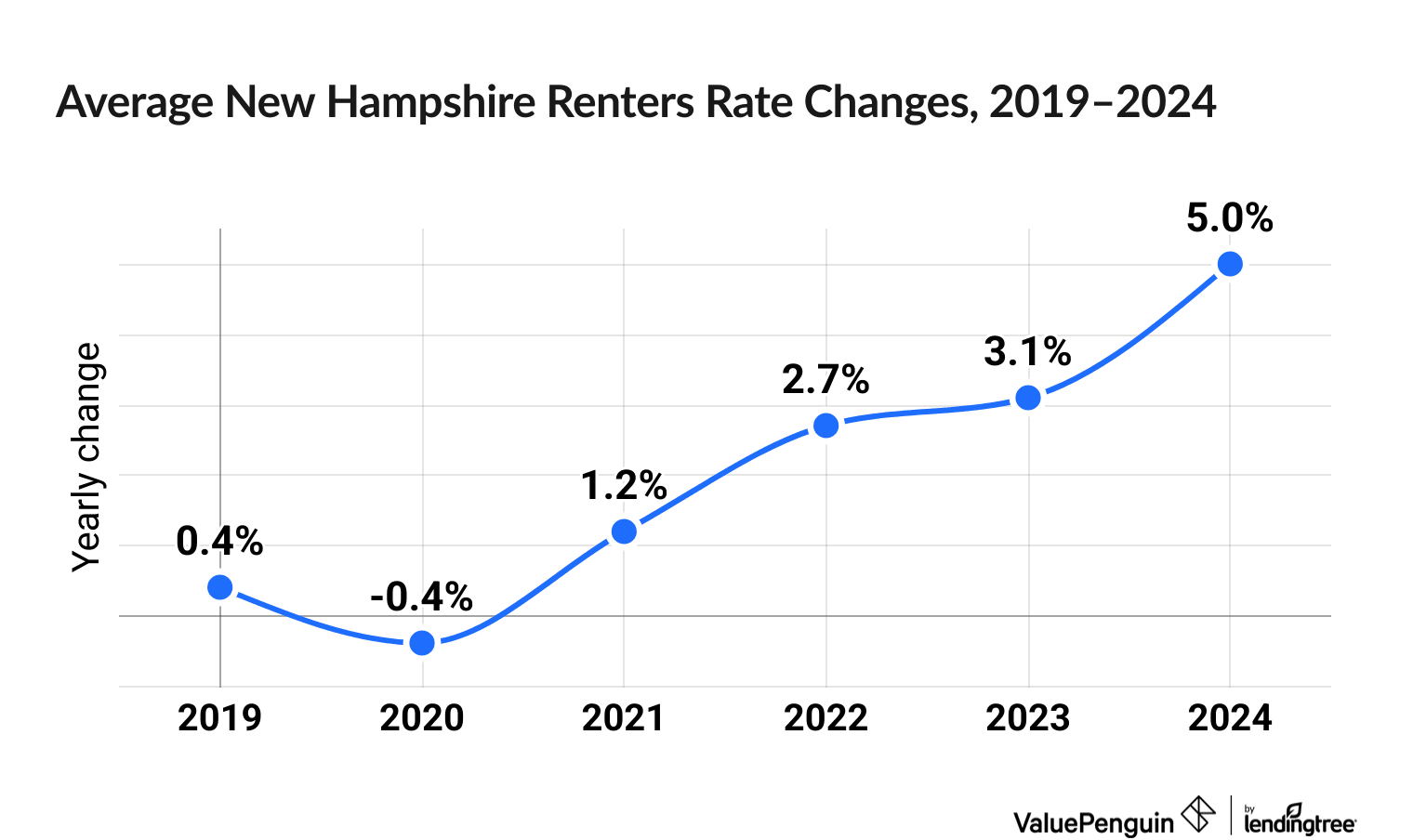

New Hampshire renters insurance trends

Renters insurance prices have gone up 13.0% in New Hampshire over the last six years.

New Hampshire renters insurance rates went up between 0.1% to 52.1%, depending on the company, over the last six years, with an overall increase of 13.0%.

Renters insurance prices, on average, decreased by 0.4% in 2020, but then saw a slight uptick of 8.8% across 2023 and 2024.

Among the major NH insurers, the biggest increases have been at Nationwide (52.1%), Farmers (43.1%) and Liberty Mutual (33.2%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is renters insurance in New Hampshire?

The average cost of renters insurance in New Hampshire is $17 per month, or $206 per year.

Can a landlord require renters insurance in NH?

Yes, your property management company or landlord may require you to buy renters insurance as a part of your lease agreement. It's important to check your lease to make sure your quotes have enough coverage to meet the requirement.

Who has the cheapest renters insurance in New Hampshire?

State Farm has the cheapest renters insurance quotes in New Hampshire, at around $10 per month. That's $7 per month less than the New Hampshire state average.

Methodology

To compare renters insurance rates in New Hampshire, ValuePenguin collected quotes from 25 of the most populous cities across the state. Rates are for a 30-year-old woman living alone with no claim history. Quotes include $30,000 of personal property protection, $100,000 of liability, $1,000 for medical payments to others and a $500 deductible.

ValuePenguin evaluated the customer service reputations of renters insurance companies in New Hampshire using three key measurements:

- NAIC complaint index: The NAIC complaint index communicates the number of complaints a company receives relative to its size. The figure 1.00 stands for the typical number of complaints, which means a complaint index below 1.00 signifies that a company gets fewer complaints than expected.

- J.D. Power Homeowners Insurance Study - Renters Insurance: J.D. Power evaluates national providers according to responses from customers.

- ValuePenguin editor's rating: Our editors rate insurance companies based on the availability of coverage options, customer service reviews and the overall value provided to customers.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.