The Best Cheap Renters Insurance in Maryland (2025)

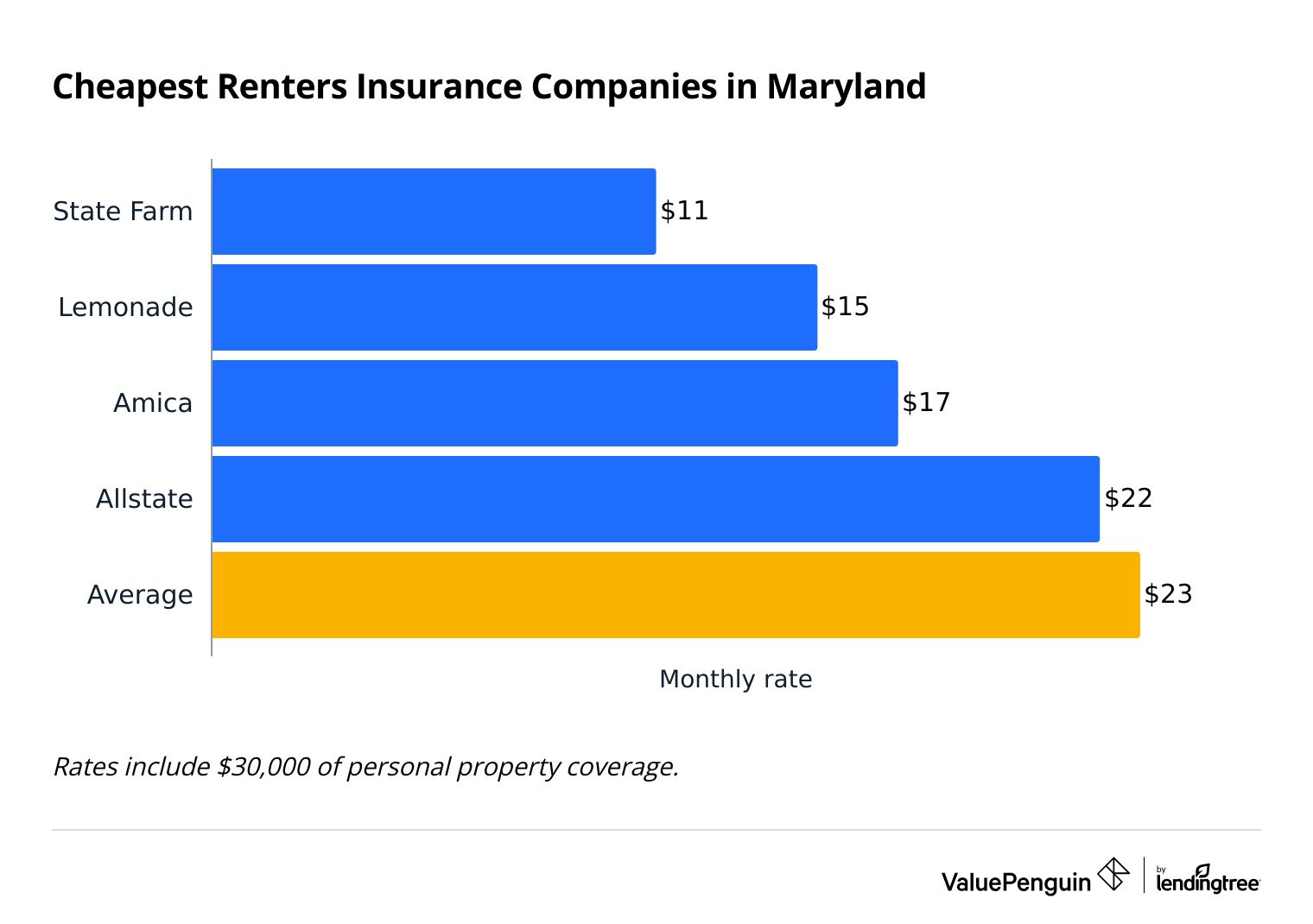

State Farm has the cheapest renters insurance quotes in Maryland, at $11 per month.

Compare cheap renters insurance options in Maryland

Best Cheap Renters Insurance in Maryland

To help you find the best renters insurance in Maryland, ValuePenguin editors rated companies based on price, coverage availability and customer service. To find the cheapest rates in MD, our editors collected 135 quotes from seven of the largest renters insurance companies in the state.

See the full methodology.

Cheapest renters insurance in Maryland

State Farm offers the cheapest renters insurance quotes in Maryland.

A policy from State Farm costs around $11 per month, which is half the state average.

Lemonade also has affordable renters insurance in MD, at an average of $15 per month.

Compare cheap renters insurance options in Maryland

The average cost of renters insurance in Maryland is $23 per month, or $280 per year.

The price of renters insurance in Maryland is the same as the national average, about $23 per month.

Cheap renters insurance quotes in Maryland

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $11 | ||

| Lemonade | $15 | ||

| Amica | $17 | ||

| Allstate | $22 | ||

| Assurant | $25 | ||

Best MD renters insurance for most people: State Farm

-

Editor's rating

- Cost: $11/mo

State Farm's affordable rates and dependable customer service make it the best choice for most Maryland renters.

-

Cheapest rates in MD

-

Good customer service

-

Lots of coverage options

-

Few discounts

State Farm offers the cheapest renters insurance rates in Maryland, at $11 per month. That's less than half the state average and 25% cheaper than the second-cheapest option, Lemonade.

State Farm earned a good score on J.D. Power's customer satisfaction survey. Additionally, it gets an average number of complaints compared to other companies its size. That means State Farm will generally fix or replace your damaged belongings quickly after a disaster.

State Farm also offers lots of ways for renters to customize their protection. For example, you can add identity theft coverage, which pays for costs if someone steals your identity.

Best customer service: Amica

-

Editor's rating

- Cost: $17/mo

Amica has top-notch customer service for Maryland renters.

-

Dependable customer service

-

Affordable rates

-

Equipment breakdown coverage

-

Few coverage options

-

Only one office in MD

Amica is a great choice for renters willing to spend a bit more for top-tier service.

At $17 per month, Amica's rate is 27% lower than the Maryland average. It's $6 more per month than the cheapest option and is consistently well-rated by its customers.

Amica receives far fewer complaints than an average insurance company its size, according to the National Association of Insurance Commissioners (NAIC) — suggesting customers tend to be satisfied with their experience.

Amica discounts include:

- Bundling discount

- Automatic payment discount

- Paperless discount

- Claim-free discount

- Loyalty discount

One downside is that Amica doesn't offer a lot of extra coverage options. But one uncommon offering Amica does offer is equipment breakdown, which may be useful if you own your own appliances like an oven or dishwasher. If any device breaks down due to an electrical surge, this coverage will pay to repair or replace it. Just keep in mind there's usually a deductible of a few hundred dollars, so it's only useful for big-ticket items.

The other drawback to Amica is its few offices. It mostly sells and manages renters insurance online, and there's only one Amica office in the state. If you prefer to meet in person with a renters insurance agent in order to buy your policy or ask questions, you'll likely need to look elsewhere, such as State Farm.

Best MD renters insurance for military members: USAA

-

Editor's rating

USAA has excellent service, and its insurance comes with military-specific benefits.

-

Great customer service

-

Standard policy includes uniform and war zone coverage

-

Discounts for service members

-

Only available if you're affiliated with the military

USAA renters insurance is only available to people affiliated with the military.

However, if you qualify for USAA, it's a great option for renters insurance. Its service is very highly rated by its customers, with very few complaints.

It also offers a few important military-specific benefits:

- Uniform and gear coverage: If your military uniform or gear is damaged while you're on active duty, USAA will pay to fix it for free, without a deductible.

- Active war zone coverage: USAA will pay to repair or replace your belongings if they're damaged while you're in a foreign active war zone. Almost all renters insurance companies typically exclude these types of dangerous areas.

Maryland renters insurance rates by city

Bowie, between Baltimore and Washington, D.C., is the most expensive major city in Maryland for renters insurance, at $28 per month.

Renters insurance in Bowie is 21% more expensive than the state average.

Bethesda residents have the cheapest rates in the state, at $21 per month, on average. Gaithersburg and Rockville also have similar rates.

Average cost of Maryland renters insurance by city

City | Monthly rate | % from average |

|---|---|---|

| Annapolis | $25 | 9% |

| Baltimore | $26 | 10% |

| Bel Air | $23 | 0% |

| Bethesda | $21 | -12% |

| Bowie | $28 | 21% |

How to find the cheapest renters insurance in Maryland

To find the cheapest renters insurance in Maryland, start by figuring out how much coverage you need. Then, compare quotes from multiple insurance companies to find the best rates for you.

Figure out how much coverage you need. Having more coverage on your renters insurance policy will increase your rates. It's important that you have enough coverage to protect you in an emergency. But you also don't want to overpay for coverage you don't need.

Shop around for quotes from multiple companies. In Maryland, the priciest insurance company is four times more expensive than the cheapest option. Choosing the cheapest option could save you almost $400 per year.

Aside from your coverage levels, insurance companies consider things like your age, where you live and your credit, among other factors. They may also factor in your insurance history and whether you've made claims in the past. So, the most affordable company for your friends, family or neighbors may not be the cheapest choice for you.

What renters insurance coverage do I need in Maryland?

Maryland's location on the Eastern Seaboard means renters need to protect themselves against damage from tropical storms and hurricanes.

Does Maryland renters insurance protect against hurricanes?

Renters insurance covers some, but not all, types of hurricane damage.

Renters insurance typically covers wind, hail and lightning damage.

Renters living close to the water, especially in Maryland's Eastern Shore, may have a separate hurricane deductible. A hurricane deductible is usually higher than your regular deductible. It may cost more to fix or replace your things if a hurricane destroys them.

However, flood damage isn't covered by renters insurance. You'll have to buy a separate flood insurance policy to protect your belongings from damage caused by floodwaters or heavy rains.

Maryland renters insurance trends

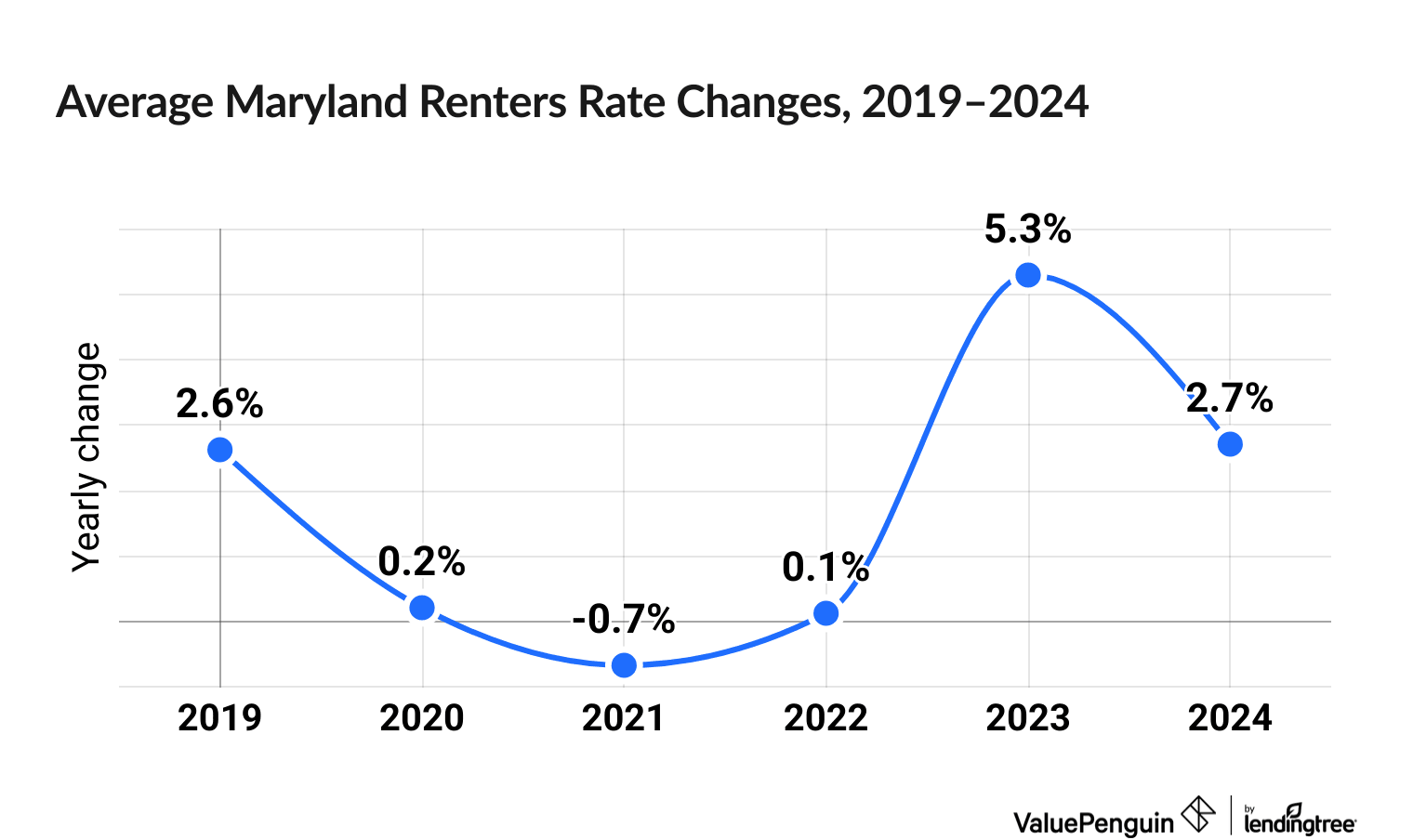

Renters insurance prices have gone up 11.9% in Maryland over the last six years.

Maryland renters insurance rates went up between 2.8% and 48.6% over the last six years, depending on the company.

Renters insurance prices, on average, decreased 0.7% in 2021, but then increased steadily, with a steeper uptick of 9.5% across 2023 and 2024.

Among the major MD insurers, the biggest increases have been at Farmers(48.6%), Liberty Mutual (43.2%) and USAA (30.7%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is renters insurance in Maryland?

The average cost of renters insurance in Maryland is $23 per month. That's about the same as the national average for renters insurance.

Is renters insurance mandatory in Maryland?

Renters insurance is not legally required in Maryland. Your property management company or landlord may require you to buy a policy, though, so it's important to check your lease agreement.

Who has the best renters insurance in Maryland?

State Farm is the best renters insurance company for most people in Maryland. At $11 per month, it has the cheapest coverage in the state. Lemonade is another affordable option that has an easy-to-use mobile app.

Methodology

To find the cheapest renters insurance in Maryland, ValuePenguin gathered 135 quotes from addresses in 21 of the state's largest cities. Rates are for a 30-year-old woman living alone with no prior renters insurance claims.

Quotes include the following limits:

- Personal property: $30,000

- Personal liability: $100,000

- Medical payments: $1,000

- Loss of use coverage: $9,000

- Deductible: $500

Customer service ratings are based on data from the National Association of Insurance Commissioners (NAIC) complaint index, J.D. Power annual customer satisfaction survey scores and our own ValuePenguin editor's ratings.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.