Who Has the Cheapest Renters Insurance in Louisiana? (2025)

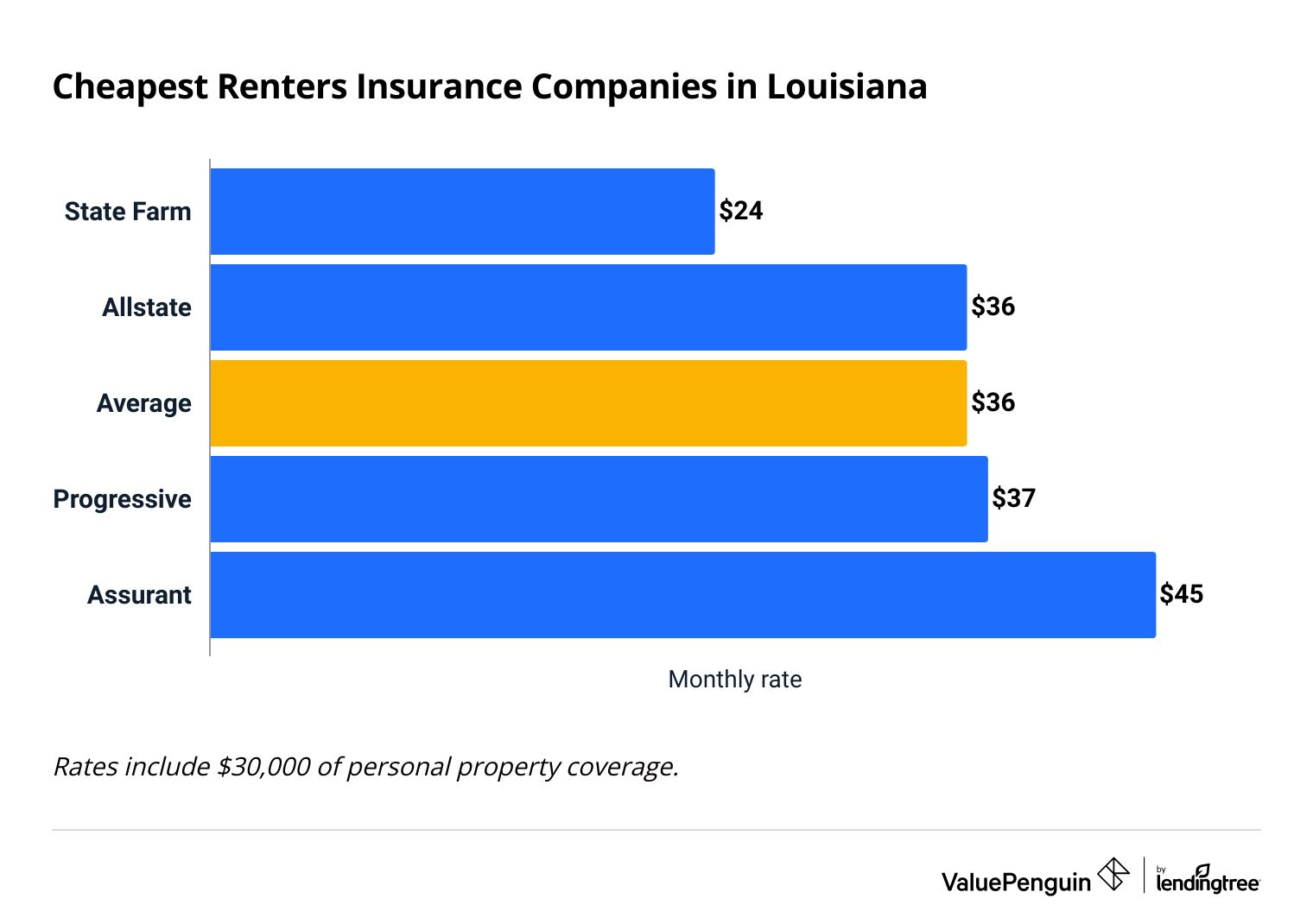

State Farm has Louisiana's cheapest renters insurance, at $24 per month.

Compare Renters Insurance Quotes in Louisiana

Best Cheap Renters Insurance in Louisiana

ValuePenguin's editors use price, coverage availability and customer service to rate companies and find the best renters insurance in Louisiana. To calculate the lowest rates in LA, our team collected rates from four of the largest companies offering quotes in Louisiana.

Cheapest renters insurance in Louisiana

State Farm has the cheapest renters insurance in Louisiana.

A State Farm policy costs an average of $24 per month. That's $12 per month less than the state average.

Compare cheap renters insurance options in Louisiana

On average, renters insurance in Louisiana costs $36 per month, or $428 per year.

Louisiana renters pay the highest rates in the country, $13 more per month than national average of $23 per month. That's likely because the state often gets hurricanes and flooding. Nearby states like Arkansas, Mississippi and Alabama are also among the most expensive for renters coverage.

Cheap renters insurance quotes in Louisiana

Company | Monthly cost | ||

|---|---|---|---|

| State Farm | $24 | ||

| Allstate | $36 | ||

| Progressive | $37 | ||

| Assurant | $45 | ||

Best LA renters insurance for most people: State Farm

-

Editor's rating

- Cost: $24/mo

State Farm has cheap rates and local agents who can give your customer service a personal touch.

-

Affordable rates

-

Many extra coverage options

-

In-person agents who can help you

-

Not many discounts

-

Sometimes can't buy a policy completely online

State Farm has cheap renters in Louisiana, with extra ways to add to your policy and local agents nearby

The company's average rate is $24 per month, which is 31% cheaper than the state average.

State Farm also has a range of options renters can add to their policies. For example, you can get coverage if a water backup damages your furniture or get replacement cost coverage, which pays more if your old stuff gets damaged.

State Farm customers appear satisfied with their customer service. The company has an above-average score in J.D. Power's claims satisfaction survey. And it gets an average number of complaints for a company its size. You'll also have a local agent if you need to reach out with questions.

The biggest drawback with State Farm is a lack of discount options. You can only lower your rates by bundling with an auto policy or adding home security systems.

Best renters insurance in Louisiana for extra coverage: Progressive

-

Editor's rating

- Cost: $37/mo

Progressive offers a range of options for extra coverage and includes more protection even with a basic policy than other insurance companies.

-

Wide range of extra coverage options

-

Wide set of discounts

-

More expensive than average

-

Poor customer service

Louisiana renters who want extra coverage will have a good set of options with Progressive.

- Water back-up coverage

- Personal injury coverage

- Valuable items coverage

Progressive also offers the chance to lower your rates with a wide set of discounts, including savings for bundling with car insurance, getting a quote three days before your policy starts, getting your documents by email or paying for your whole policy at once.

Those discounts could help because Progressive rates are more expensive than average in Louisiana at $37 per month.

The company has a poor reputation for customer service, which can be an issue when you have to file a claim. Progressive also gets considerably more customer complaints than average and scored poorly on J.D. Powers ranking for renters insurance satisfaction.

Best for military families in Louisiana: USAA

-

Editor's rating

USAA offers great customer service and benefits specifically for military members.

-

Good customer service

-

Basic policies come with extra coverages

-

Have to be a military member to get coverage or quotes

USAA is an excellent option for members of the military, veterans and their families who are renting a home in Louisiana.

A standard policy from USAA perks includes free replacement cost coverage and protection for your military uniforms and gear while you're on duty. You'll also have flood coverage without paying extra.

USAA also has an excellent customer service reputation, so you can feel confident that you'll be taken care of in an emergency. The company earned the highest score on J.D. Power's customer satisfaction survey and receives an average number of complaints .

Unfortunately, the company only offers insurance to military members, veterans and some military family members. That means most people can't buy a policy.

Louisiana renters insurance rates by city

Renters living in Alexandria pay the cheapest insurance rates among the largest cities in Louisiana.

Residents of the city, which lies right in the middle of the state along the Red River, will pay an average of $20 per month for renters coverage. Harvey, a suburb across the Mississippi River from New Orleans, has the highest rates at $48 per month.

Louisiana renters living in coastal cities can expect to pay much more for insurance than those living further inland. People living in Harvey, Marrero, Kenner and Metairie pay an average of $44 per month for renters insurance. Renters in Louisiana's largest city, New Orleans, also pay a lot for coverage — rates are 16% higher than the state average. In comparison, the average rate in Shreveport, which is in the northwestern corner of the state, is just $30 per month.

Average cost of Louisiana renters insurance by city

City | Monthly rate | % from average |

|---|---|---|

| Alexandria | $20 | -43% |

| Baton Rouge | $33 | -7% |

| Bossier City | $30 | -16% |

| Gonzales | $32 | -10% |

| Gretna | $42 | 17% |

How to find the cheapest renters insurance in Louisiana

The simplest way to find the cheapest renters insurance where you live in Louisiana is to first calculate how much you'll need in coverage. Then, compare quotes from different companies, making sure to also ask about their discounts. That way you can find the lowest rates for what you want.

Decide how much coverage you want Your rates will change with how much coverage you choose to get. It's a good idea to have enough coverage to pay to replace all your stuff. But if you have too much coverage — you won't get a payout for more than what your belongings are worth.

Shop around with multiple companies. There's a difference of $245 per year between the cheapest and most expensive companies in Louisiana. That means getting multiple quotes could save you a considerable amount of money.

Insurance companies use a range of factors to set their prices, including where you live, how much coverage you have, your age and your insurance history. So the best company for people you know might not be the best for you.

What renters insurance coverage do I need in Louisiana?

Louisiana deals with both hurricanes and flooding just about every year, so renters insurance is extremely important for protecting your belongings.

You policy will protect your things should they get damaged by wind and other elements of hurricanes, but it won't cover flood damage that follows hurricanes.

Does renters insurance in Louisiana cover hurricanes?

Renters insurance will cover hurricane damage from things like wind or heavy rain.

But your policy on its own won't pay to replace furniture or other property damaged by flooding.

Some insurance companies won't cover homes in areas vulnerable to hurricanes. That includes most of coastal Louisiana and other parts of the state. You may need to look at a range of companies to find one that will cover you.

Does renters insurance in Louisiana cover flooding?

Regular renters insurance policies don't cover flood damage.

Much of Louisiana is vulnerable to flooding because of the state's low elevation, the several large rivers that run through it and the swampy terrain near the coast and inland.

You'll usually have two options if you want flood coverage in Louisiana. But you'll have to buy a separate policy.

Louisiana renters insurance trends

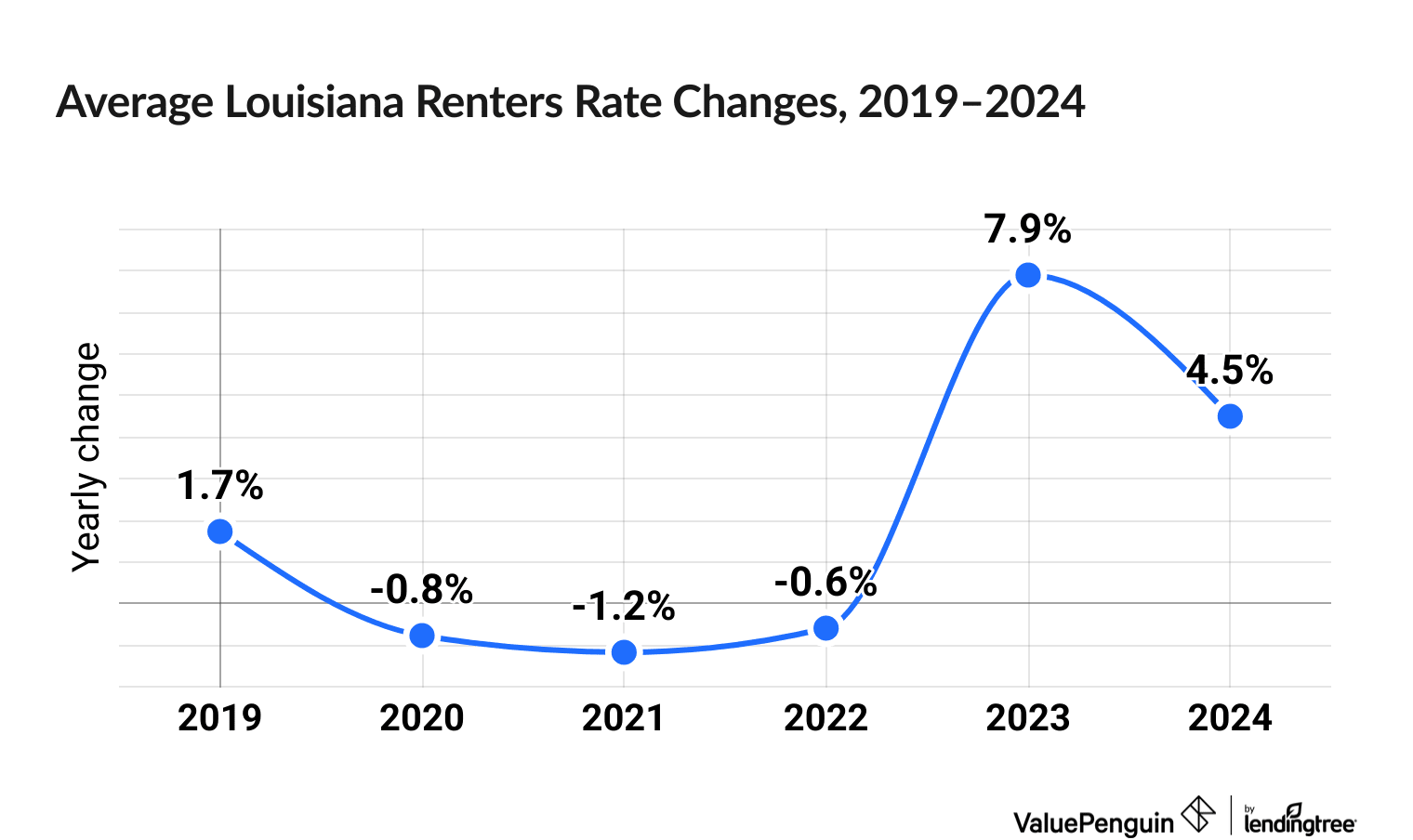

Renters insurance prices have gone up 16.2% in Louisiana over the last six years.

Depending on the company, Louisiana renters insurance rates went up between 5.6% and 99.9% over the last six years.

Renters insurance, on average, decreased every year between 2020 to 2022, but then saw a sharp jump of 17.3% across 2023 and 2024.

Among the major LA insurers, the biggest increases have been at Chubb (99.9%), Liberty Mutual (43.9%) and USAA (41.0%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is renters insurance in Louisiana?

The average cost of renters insurance in Louisiana is $36 per month, or $428 per month.

What does renters insurance cover in Louisiana?

A standard renters insurance policy should always include personal property coverage, liability protection, medical payments for guests and loss of use expenses. Lots of companies also offer extra coverage options to customize your policy, like replacement cost coverage. Louisiana renters living on the coast should look for an insurer that offers flood insurance, too.

Does Louisiana require renters insurance?

Renters insurance is not legally required in Louisiana. However, your landlord or property management company may make you get a policy as a part of your rental contract.

How much does renters insurance cost in New Orleans?

Renters insurance in New Orleans costs $41 per month, on average. That's 16% more expensive than the Louisiana state average. State Farm offers the cheapest rate for New Orleans renters at $29 per month.

Methodology

ValuePenguin gathered quotes from 20 of Loisiana's largest cities to find the cheapest renters insurance quotes in the state. Prices are for a 30-year-old woman with no previous renters claims.

Quotes include $30,000 of personal property coverage.

- Personal property: $30,000

- Personal liability: $100,000

- Medical payments: $1,000

- Loss of use coverage: $9,000

- Deductible: $500

Customer service ratings are compiled using complaint information from the National Association of Insurance Commissioners (NAIC), J.D. Power's annual customer satisfaction survey and ValuePenguin's own editor's ratings.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.