The Best Cheap Renters Insurance in Colorado (2025)

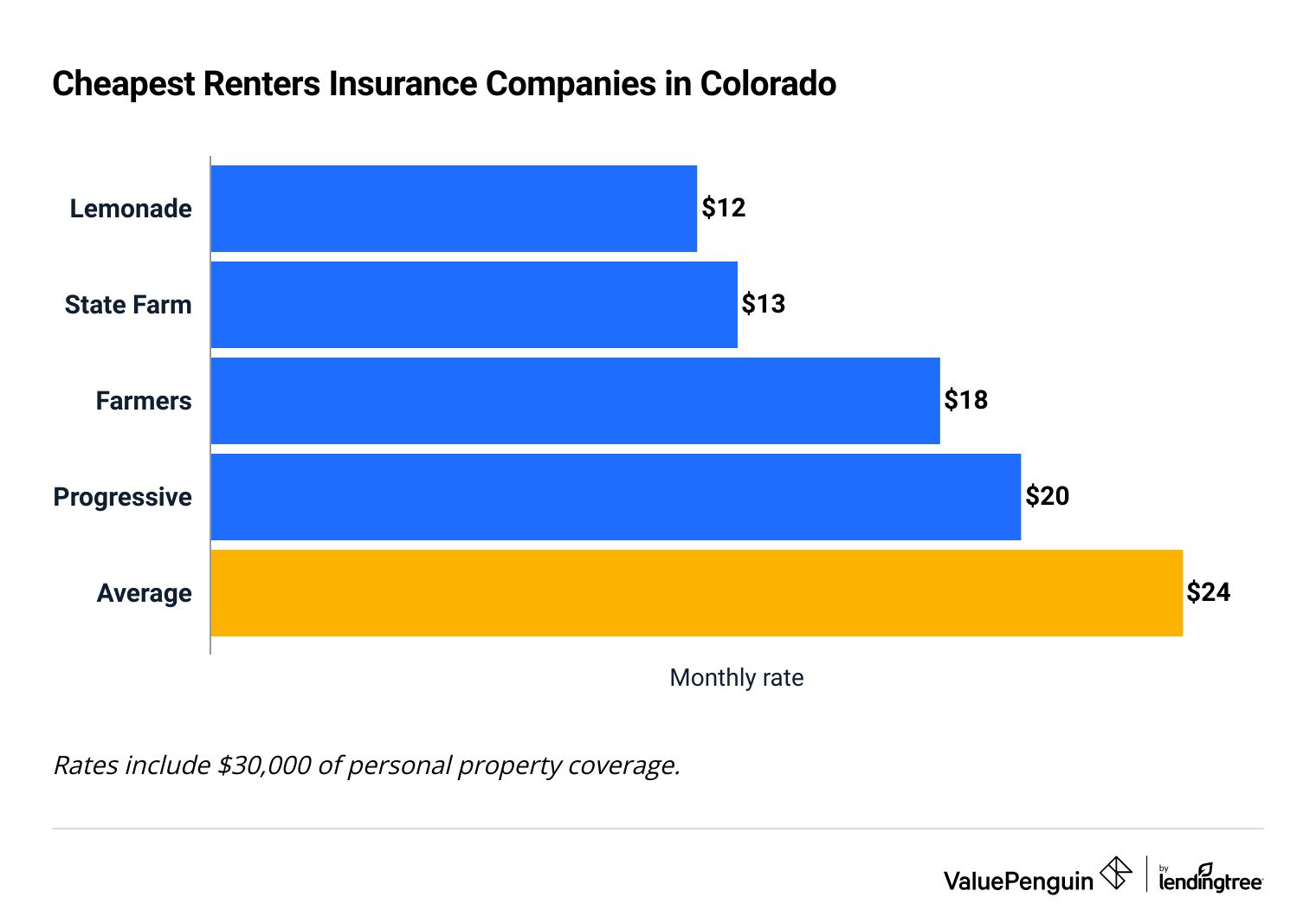

Lemonade has the cheapest renters insurance quotes in Colorado, at $12 per month.

Compare cheap renters insurance options in Colorado

Best Cheap Renters Insurance in Colorado

To help you find the best renters insurance in Colorado, ValuePenguin editors rated companies based on price, coverage availability and customer service. To find the cheapest rates in CO, our editors collected 200 quotes from eight of the largest renters insurance companies in Colorado.

Cheapest renters insurance in Colorado

Lemonade offers the cheapest renters insurance quotes in Colorado.

A policy from Lemonade costs around $12 per month, which is half the state average.

State Farm also has affordable renters insurance in Colorado, at an average of $13 per month. In addition, State Farm has far fewer customer complaints than Lemonade, making it a better choice for most people.

Compare cheap renters insurance options in Colorado

The average cost of renters insurance in Colorado is $24 per month , or $288 per year.

Renters in Colorado pay $1 per month more for insurance than the national average of $23 per month.

Cheap renters insurance quotes in Colorado

Company | Monthly cost | ||

|---|---|---|---|

| Lemonade | $12 | ||

| State Farm | $13 | ||

| Farmers | $18 | ||

| Progressive | $20 | ||

| Assurant | $22 | ||

Best CO renters insurance overall: State Farm

-

Editor's rating

- Cost: $13/mo

State Farm's affordable rates and dependable customer service make it the best choice for most Colorado renters.

-

Cheap rates

-

Good customer service

-

Lots of coverage options

-

Few discounts

-

Some people must buy a policy over the phone

State Farm offers some of the cheapest renters insurance rates in Colorado, at around $13 per month. That's $11 per month less than the state average.

Renters in Colorado are generally satisfied with the service they get from State Farm.

State Farm earned a good score on J.D. Power's customer satisfaction survey. Additionally, it gets an average number of complaints compared to other companies its size. That means State Farm will generally help fix or replace your damaged belongings quickly after a disaster.

State Farm also offers lots of ways for renters to customize their protection. For example, you can add water backup coverage, which pays for water damage caused by backed-up pipes or a broken sump pump.

Best renters insurance in Colorado for cheap rates: Lemonade

-

Editor's rating

- Cost: $12/mo

Lemonade has the cheapest rates in the state, along with great online tools.

-

Cheapest quotes in CO

-

Excellent website and app

-

Helpful coverage add-ons

-

Mixed customer service reviews

-

Difficult to speak with a person

Colorado renters can find the most affordable rates with Lemonade. A policy costs an average of $12 per month, which is half the Colorado average.

Lemonade offers several ways for renters to customize their policies with extra protection. For example, you can add coverage for pet damage. So if your dog scratches the hardwood floor in your rental home, Lemonade will pay to fix it.

Lemonade renters insurance is a great option for renters who prefer to manage their policy online.

Using Lemonade's online quote form, you can get a quote and buy your policy in minutes. Its claims process is also fast, with some simple processes in under a minute.

However, Lemonade customers may have a more difficult time with complicated claims. The company earned the top score on J.D. Power's customer satisfaction survey. But, it still gets three and a half times more complaints than an average company its size. So you may have a harder time working with Lemonade if a fire damages everything in your home, or someone gets injured in your pool.

Best customer service for Colorado renters: Amica

-

Editor's rating

- Cost: $35/mo

Amica offers top rated customer service, but it comes at a price.

-

Excellent customer service

-

Lots of discounts

-

Expensive rates

Amica has the best-rated customer service in Colorado. It only gets In addition, Amica earned the highest score on J.D. Power's claims satisfaction survey. That means you can count on Amica to help you get your life back to normal quickly after an emergency.

However, Amica's excellent service comes at a cost. It has the second-highest rates in Colorado, at an average of $35 per month. That's $11 per month more than the state average.

Amica offers a number of discounts that can make its insurance more affordable, including::

- Bundling discount

- Automatic payment discount

- Paperless discount

- Claim-free discount

- Loyalty discount

However, it's unlikely these discounts will lower your rates enough to beat Lemonade or State Farm.

Colorado renters insurance rates by city

Denver, Colorado's largest city, has the most expensive renters insurance rates compared to other large Colorado cities.

Renters insurance in Denver costs around $27 per month, which is $3 per month more than the state average.

Castle Rock and Lakewood have the cheapest rates in the state, at $22 per month, on average. Lakewood is a Denver suburb, while Castle Rock is a town between Denver and Colorado Springs.

Average cost of Colorado renters insurance by city

City | Monthly rate | % from average |

|---|---|---|

| Arvada | $23 | -2% |

| Aurora | $23 | -1% |

| Boulder | $23 | -3% |

| Brighton | $24 | 1% |

| Broomfield | $23 | -4% |

How to find the cheapest renters insurance in Colorado

To find the cheapest renters insurance in Colorado, start by figuring out how much coverage you need. Then, compare quotes from multiple companies to find the best rates for you.

Figure out how much coverage you need. The amount of coverage you choose has a major impact on the amount you'll pay for renters insurance. It's important that you have enough coverage to protect you in an emergency. But you also don't want to overpay for coverage you don't need.

Shop around for quotes from multiple companies. In Colorado, there's a $23 per month difference between the cheapest and most expensive renters insurance companies. Choosing the cheapest option could save you $276 per year.

Aside from your coverage levels, insurance companies consider your age, marital status, location and other factors. They may also factor in your insurance history and whether you've made claims in the past. So, the most affordable company for your friends, family or neighbors may not be the cheapest choice for you.

What renters insurance coverage do I need in Colorado?

Colorado renters need protection against numerous natural disasters, including floods, tornadoes, extreme snowstorms and wildfires.

Fortunately, renters insurance typically protects against damage caused by wildfires, wind, tornadoes and heavy snowfall.

However, if you live in an area with a high risk of damage, some companies may not offer coverage for one or all of these types of damage.

It's important to check your policy to make sure you're covered for the most common types of damage in your area. If you're missing an important coverage, like fire protection, you can typically buy a separate policy from an independent agent.

Renters insurance doesn't protect against weather-related flooding, like rising lakewater or snowmelt.

You need to buy a separate flood insurance policy to protect your stuff against flood damage.

Colorado renters insurance trends

Renters insurance prices have gone up 23.0% in Colorado over the last six years.

Renters insurance prices, on average, have steadily increased from 2020 to 2022, but jumped up 14.3% between 2023 and 2024.

Among the major CO insurers, the biggest increases have been at Travelers (56.8%), Chubb (45.5%) and American Family Insurance (39.7%).

Renters insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What is the average cost of renters insurance in Colorado?

Renters in Colorado pay $24 per month, on average. That's $1 per month more than the average cost nationally.

Who has the cheapest renters insurance in Colorado?

Lemonade has the cheapest renters insurance in Colorado. A policy costs $12 per month, or $144 per year, on average.

How much is renters insurance in Colorado Springs?

Renters in Colorado Springs pay an average of $24 per month for insurance. That's the same as the Colorado state average. In comparison, Denver renters insurance costs an average of $25 per month.

Is renters insurance required in Colorado?

There's no state law in Colorado requiring you to buy renters insurance. However, your landlord or property management company can require you to have coverage as a part of your lease agreement.

Methodology

To find the cheapest renters insurance in Colorado, ValuePenguin gathered 200 quotes from addresses in 25 of the state's largest cities. Rates are for a 30-year-old woman living alone with no prior renters insurance claims.

Quotes include the following limits:

- Personal property: $30,000

- Personal liability: $100,000

- Medical payments: $1,000

- Loss of use coverage: $9,000

- Deductible: $500

Customer service ratings are based on data from the National Association of Insurance Commissioners (NAIC) complaint index, J.D. Power annual customer satisfaction survey scores and our own ValuePenguin editor's ratings.

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.