Best and Cheapest Home Insurance Companies in Tennessee

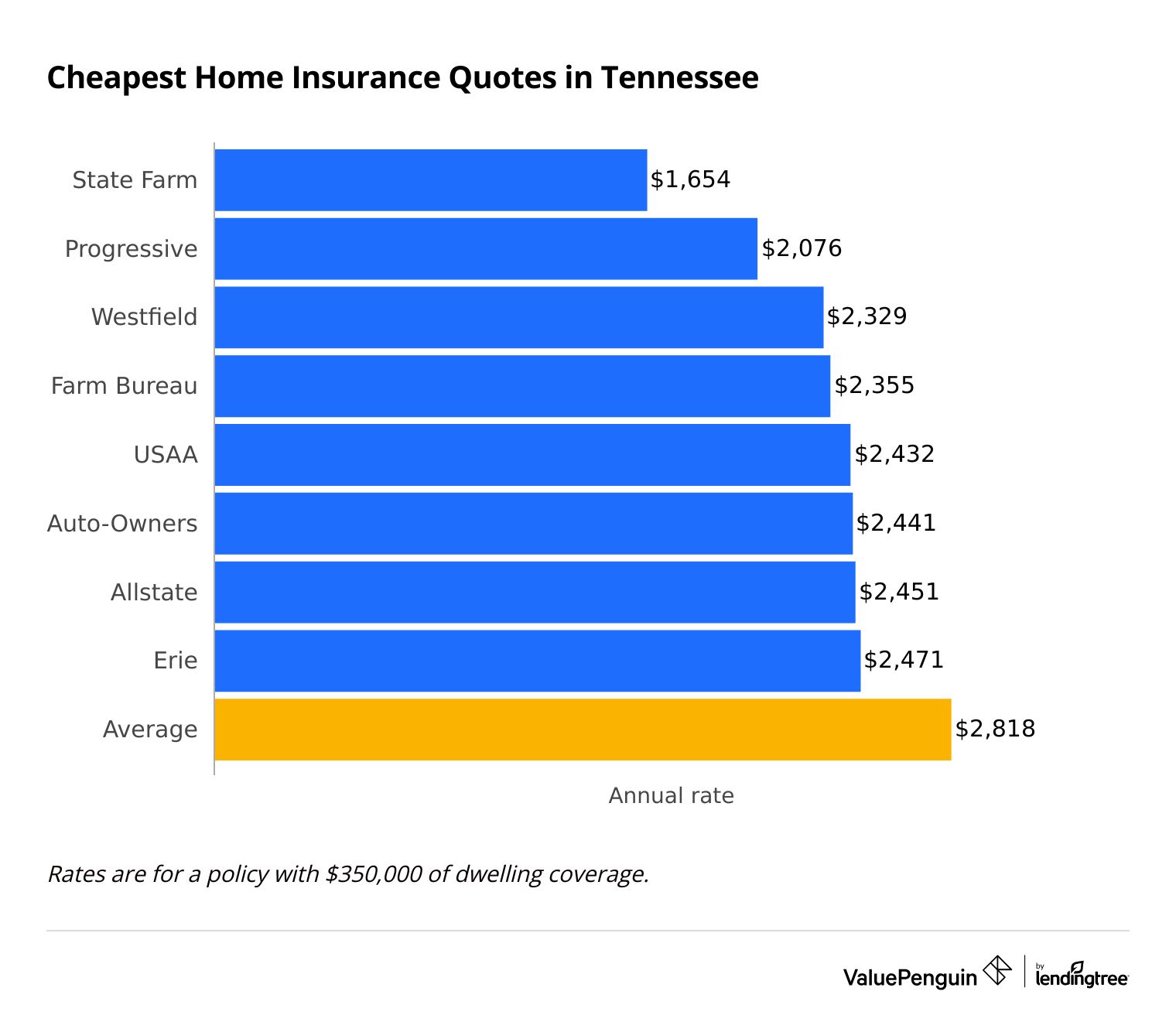

State Farm has the best home insurance in Tennessee at $1,654 per year, on average.

Compare Home Insurance Quotes in Tennessee

Best Cheap Tennessee Homeowners Insurance

Picking the best home insurance company in TN means finding a company with the right coverage options and great customer service at an affordable rate. ValuePenguin collected thousands of home insurance quotes and compared 11 top companies to find the best insurance for Tennessee homeowners.

Best cheap insurance companies in Tennessee

State Farm has the best home insurance rates for most Tennessee homeowners.

A policy from State Farm costs $1,654 per year for $350,000 of dwelling coverage. That's $1,165 less than the Tennessee state average.

Find Cheap Homeowners Insurance Quotes in Your Area

State Farm also offers very affordable rates for more expensive homes in Tennessee.

A State Farm policy with $500,000 of dwelling coverage costs $2,207, which is $1,538 less than average. A policy with $1 million costs $3,758 per year, which is close to half the statewide average.

Tennessee home insurance rates by dwelling coverage amount

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,177 | ||

| Progressive | $1,444 | ||

| Erie | $1,546 | ||

| USAA | $1,551 | ||

| Farm Bureau | $1,581 | ||

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,177 | ||

| Progressive | $1,444 | ||

| Erie | $1,546 | ||

| USAA | $1,551 | ||

| Farm Bureau | $1,581 | ||

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,654 | ||

| Progressive | $2,076 | ||

| Westfield | $2,329 | ||

| Farm Bureau | $2,355 | ||

| USAA | $2,432 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $2,207 | ||

| Progressive | $2,861 | ||

| Westfield | $2,923 | ||

| Farm Bureau | $3,100 | ||

| Auto-Owners | $3,121 | ||

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $3,758 | ||

| Progressive | $5,025 | ||

| Westfield | $5,143 | ||

| Allstate | $5,719 | ||

| USAA | $5,875 | ||

What home insurance do I need in TN?

Homes in Tennessee experience damage caused by severe weather, including wind, hail, flooding and snow. Sinkholes can also be a problem for Tennessee homeowners.

Most home insurance policies protect your home against damage caused by wind, hail or snow.

Home insurance doesn't typically cover flood damage or sinkholes. You may want to buy a separate or sinkhole policy if you live in an area where these types of damage are common.

Best homeowners insurance in TN for most people: State Farm

-

Editor's rating

- Cost: $1,654/yr

State Farm is a great choice because it has cheap rates and reliable customer service.

-

Cheapest quotes in TN

-

Dependable customer service

-

Great for bundling policies

-

Few coverage options and discounts

-

Can't typically buy a policy fully online

Homeowners insurance from State Farm costs 40% to 46% less than the Tennessee state average, depending on how much coverage you need.

State Farm doesn't offer many home insurance discounts. However, you can save around 24% for bundling your home and auto insurance with State Farm. That's one of the largest discounts in the industry.

In addition, State Farm offers very affordable auto insurance in Tennessee. That makes State Farm an excellent option for homeowners looking to work with one company for all their insurance needs.

A basic State Farm policy comes with enough coverage for most people. But the company doesn't offer that many ways to upgrade your protection. It may not be a great option for people who need extra coverage, like flood insurance.

Best customer service in Tennessee: Erie

-

Editor's rating

- Cost: $2,471/yr

Erie is an excellent choice because of its top-rated customer service and upgraded protection.

-

Excellent customer service

-

Basic policy includes extra coverage

-

Helpful local agents

-

Can't get a quote online

-

Not the cheapest company

-

Few discounts

Erie's top-rated customer service means you can expect a quick and easy claims process after an emergency.

Erie earned the highest score on J.D. Power's home insurance survey. And it only gets around one-third as many complaints as an average company of a similar size, according to the NAIC.

In addition, Erie's standard home insurance policy includes extra protection at no additional cost. Homeowners automatically get:

- Guaranteed replacement cost

- Theft coverage

- Extra valuables coverage for jewelry, watches and firearms

- Extra coverage for cash and precious metals

However, extra coverage and excellent service comes at a price. An Erie policy costs $2,471 per year for $350,000 of coverage. That's $817 more than a policy from State Farm. But, it's still $347 per year less than the Tennessee average.

Best TN home insurance company for flood coverage: Auto-Owners

-

Editor's rating

- Cost: $2,441/yr

Auto-Owners is a great choice for Tennessee homeowners who need flood insurance.

-

Lots of coverage options and discounts

-

Offers flood insurance

-

Few customer complaints

-

No online quotes

-

Not the cheapest option

Auto-Owners offers many ways for Tennessee homeowners to upgrade their insurance coverage.

This includes inland flood coverage, which can be very helpful if your home is in an area with a low to moderate flood risk. With this coverage, Auto-Owners pays to repair or rebuild your home after flood damage.

Inland flood coverage also pays to move your things to a safe place before a flood hits and living expenses if your home isn't safe afterward. In comparison, a policy from the National Flood Insurance Program (NFIP) only pays for damage to your home and belongings.

Auto-Owners customers can also add:

- Guaranteed replacement cost for the structure of your home

- Identity theft and cyber protection

- Equipment breakdown coverage

- Ordinance or law coverage

- Special personal property coverage

- Water backup coverage

Auto-Owners isn't the cheapest option for homeowners insurance in Tennessee, but it's typically more affordable than average. And Auto-Owners has lots of discounts to help lower your insurance bill.

Best TN homeowners insurance for military families: USAA

-

Editor's rating

- Cost: $2,432/yr

USAA offers low-cost home insurance and unique benefits to homeowners connected to the military.

-

Excellent customer service

-

Basic policy includes unique benefits

-

Affordable coverage

-

Not available to all homeowners

Tennessee homeowners with ties to the military should consider getting a quote from USAA. However, USAA is not available to everyone. Only two groups of people may apply, which includes current or former military members and anyone whose immediate family member has been a customer of USAA in the past.

USAA provides a few unique benefits and perks to service members and their families.

For example, it covers your personal property in war zones, which most companies don't do. This means any belongings you bring with you while you're deployed are protected.

USAA also has a reputation for providing excellent service to its customers, especially when it comes to claims. So you can count on USAA to get your life back to normal quickly after an accident.

Average cost of homeowners insurance in Tennessee

Homeowners insurance in Tennessee costs an average of $2,818 per year

Tennessee is the 11th-most expensive state in the country for home insurance. A policy in Tennessee costs $668 per year more than the national average of $2,151.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,961 |

| $350,000 | $2,818 |

| $500,000 | $3,745 |

| $1,000,000 | $6,981 |

However, home insurance rates in Tennessee are fairly comparable to its neighboring states. A policy in Kentucky costs an average of $2,744 per year, while home insurance in North Carolina costs $2,666 per year.

Tennessee home insurance rates by city

Walnut Hill, a suburb of Bristol near the Virginia border, has the cheapest home insurance rates in the state.

A home in Walnut Hill costs around $2,118 per year to insure.

Bogota, a small town near the Mississippi River, has the most expensive rates in the state at $3,693 per year.

Average cost of homeowners insurance in TN by city

City | Annual rate | % from avg |

|---|---|---|

| Adams | $2,704 | -4% |

| Adamsville | $3,255 | 15% |

| Afton | $2,362 | -16% |

| Alamo | $3,371 | 20% |

| Alcoa | $2,369 | -16% |

Rates are for a policy with $350,000 of dwelling coverage.

Homeowners insurance prices can vary greatly based on home cost and design, specific location and other factors. So the average rate in your city may be different than what you pay.

Best home insurance companies in Tennessee

Erie and USAA have the best customer service for Tennessee homeowners.

Both companies earned high scores on J.D. Power's customer satisfaction survey. And both companies get far fewer complaints than expected, according to the NAIC.

Auto-Owners, Farm Bureau and State Farm are also great choices for Tennessee homeowners.

Best homeowners insurance in TN

Company |

Rating

|

Complaints

|

|---|---|---|

| Erie | Low | |

| USAA* | Low | |

| Auto-Owners | Low | |

| Farm Bureau | Low | |

| State Farm | Average |

*USAA is only available to military members, veterans and their families.

When shopping for the right homeowners insurance company, it's important to consider the level of service you'll get. Great customer service can make a big difference in an emergency.

A company with good reviews can help you fix your home quickly and get back on your feet. On the other hand, poor service could lead to a frustrating claims process and you may have to pay more for repairs.

What home insurance coverage is important in Tennessee

Wind, hail and flooding can all cause major damage to homes in Tennessee.

The state is far enough inland that full-force hurricanes don't impact it often. However, it's common for the outer bands of major storms to affect the eastern part of the state.

Tennessee can also experience severe winter storms, where conditions like snow and freezing rain can lead to insurance claims.

Is wind damage covered by insurance in Tennessee?

Most home insurance policies cover wind damage. This is true whether the wind breaks a window, blows shingles off your roof or causes a tree to fall on your home.

Wind damage is one of the most common causes of home insurance claims nationwide, and Tennessee is no different. In 2023, wind caused $91 million of property damage across the state, according the National Centers for Environmental Information.

Is flood damage covered by homeowners insurance?

Homeowners insurance doesn't generally cover damage from weather-related flooding.

You'll need a separate flood insurance policy to protect your home against flooding due to rainwater or an overflowing river or lake.

You have two main options for flood insurance: a government-sponsored policy through the National Flood Insurance Program (NFIP), or a policy from a private insurance company.

How much is flood insurance in Tennessee?

The average cost of a National Flood Insurance Program (NFIP) policy in Tennessee is $1,269 per year. Policies backed by the NFIP have the same coverages and rates no matter which company you buy from.

The cost of a private policy varies by company. Tennessee homeowners concerned about flood damage should consider Auto-Owners, which offers inland flood coverage as an add-on to your basic home insurance policy.

Are sinkholes covered by Tennessee house insurance?

Basic home insurance doesn't usually cover damage caused by sinkholes.

In Tennessee, home insurance companies must offer separate sinkhole coverage for an extra cost. This coverage protects your dwelling and personal property from damage caused by a sinkhole.

Sinkhole coverage can be costly in high-risk areas. Companies may ask to inspect your property before providing a quote.

How to find the best homeowners insurance in TN

The best home insurance companies in Tennessee offer great customer service and helpful coverage at an affordable price. To find the best home insurance for you, decide what coverage you need, shop around for quotes and check out customer service reviews.

Find the right coverage. Not all home insurance companies offer the same types or amounts of coverage.

It's important to decide what coverage options you need before shopping around. That way, you can make sure you're comparing quotes with the right amount of protection for your home.

For example, Auto-Owners gives some Tennessee homeowners the option to add inland flood coverage to their home insurance policies.

Companies may offer identity theft coverage, equipment breakdown protection or other coverage add-ons.

Compare quotes to find the cheapest rate.

The difference between the most and least expensive home insurance companies is $4,219 per year in Tennessee. As a result, you could save a significant amount of money just by shopping around for the best rate.

Consider customer service reviews. It's important that you can count on your insurance company to take care of you if you ever experience an emergency. That's why it's crucial to choose a company with a reputation for great customer service.

You can start by reviewing ValuePenguin editor's ratings, which score companies based on service scores, coverage availability and cost.

If you want to do further research, you can look up J.D. Power’s customer satisfaction scores. You can also use the National Association of Insurance Commissioners (NAIC) complaint index to view customer complaints.

Tennessee home insurance trends

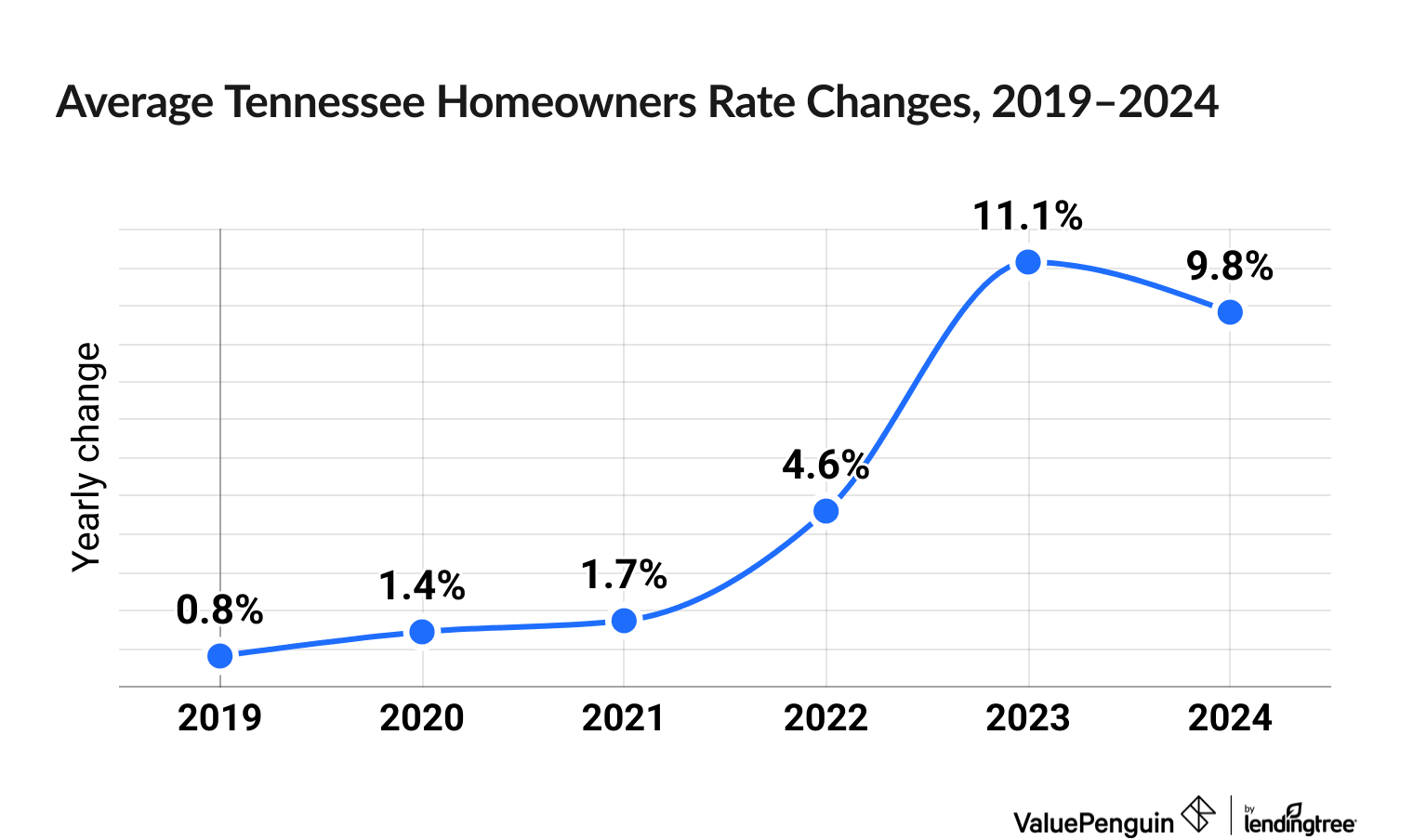

Home insurance prices are up 32.7% in Tennessee over the last six years.

Tennessee homeowners have seen their home insurance prices rise in recent years, with increases of 11.1% in 2023 and 9.8% in 2024.

Among companies, Farmers experienced the biggest increase in home insurance costs by a wide margin. Between 2019 and 2024, their rates rose by 94.0%, while the next highest, Erie Insurance and Liberty Mutual, had increases of 56.0% and 50.8%, respectively.

Home insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is flood insurance in TN?

Flood insurance in Tennessee costs an average of $1,269 per year for a policy from the National Flood Insurance Program (NFIP). The typical policy includes $273,000 worth of coverage.

How much is home insurance in TN?

The average cost of homeowners insurance in Tennessee is $2,818 per year, or $235 per month.

Why is homeowners insurance so expensive in Tennessee?

Home insurance in Tennessee can be expensive because the state is prone to severe weather events like hail, rain and sinkholes. Homeowners insurance is $668 more expensive per year in Tennessee than the national average, which is $2,151 per year.

How much is homeowners insurance in Knoxville, TN?

Home insurance in Knoxville costs an average of $2,380 per year. That's 16% cheaper than the Tennessee state average. In comparison, homeowners insurance in Memphis costs $3,617 per year, while home insurance in Nashville costs $2,675 per year.

Methodology

To find the best cheap home insurance in Tennessee, ValuePenguin collected insurance quotes from 11 of the top insurance companies in Tennessee for every ZIP code in the state. Rates are for a 45-year-old married man with good credit and no prior home insurance claims. Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Insurance company service ratings are based on National Association of Insurance Commissioners (NAIC) complaint index scores, J.D. Power's home insurance customer satisfaction survey rankings and our own ValuePenguin editor's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.