Best and Cheapest Home Insurance Companies in Louisiana (2025)

Allstate offers the best homeowners insurance in Louisiana. It has very affordable rates at around $1,369 per year, along with helpful coverage add-ons.

Compare Home Insurance Quotes in Louisiana

Best Cheap Home Insurance in Louisiana

ValuePenguin studied thousands of home insurance quotes from across every ZIP code in Louisiana to find the cheapest rates. Our experts compared coverage options, discounts, availability and customer service ratings to find the best company for you as a homeowner.

Cheapest homeowners insurance in Louisiana

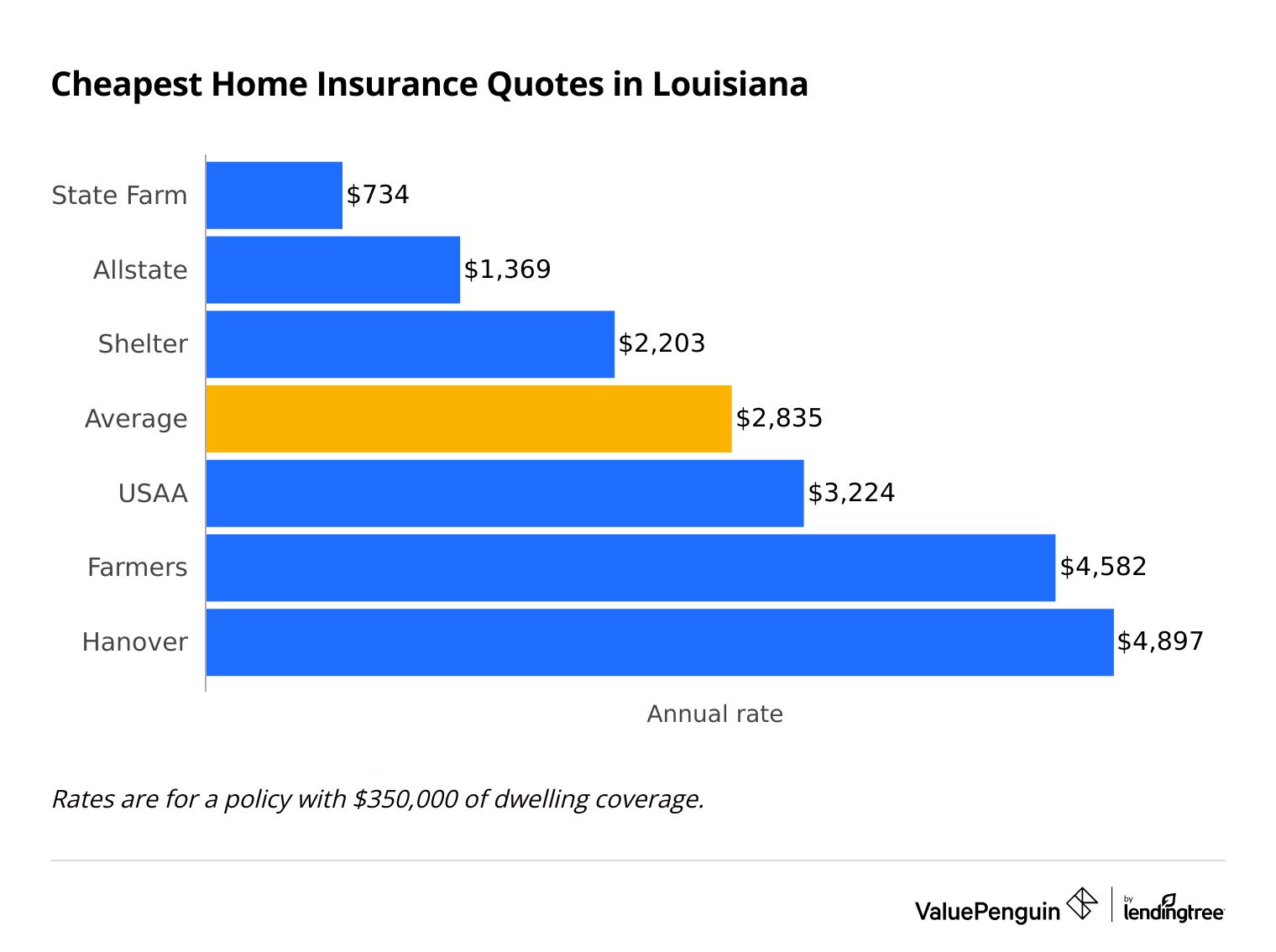

State Farm offers the cheapest home insurance quotes in Louisiana, with an average rate of $734 per year.

That’s 74% cheaper than the Louisiana state average. However, State Farm may not offer home insurance to people living near the Louisiana coast.

Allstate is the second-cheapest option in Louisiana, at $1,369 per year. While that's much more expensive than State Farm, it's still less than half the state average. And Allstate typically offers coverage to coastal homes.

Compare Home Insurance Quotes in Louisiana

The average cost of home insurance in Louisiana is $2,835 per year. But it varies greatly depending on where you live.

Louisiana homeowners insurance is typically more expensive near the Gulf of Mexico or in low-lying areas prone to flooding. And some companies, such as State Farm, may not offer coverage in these areas.

Cheapest home insurance quotes in Louisiana by dwelling coverage

$200,000

$350,000

$500,000

What home insurance do I need in Louisiana?

Many Louisiana homes are at high risk of flooding caused by hurricanes or heavy rainfall. According to the Louisiana Watershed Initiative, 51% of the state is in a special flood hazard area (SFHA).

Homeowners insurance doesn't usually protect against flood damage. Mortgage lenders typically require you to have a separate flood insurance policy if your home is in an SFHA.

High winds from hurricanes and tropical storms can also cause major damage to Louisiana homes. Most homeowners insurance policies cover wind damage. But if you live near the coast, you may need to buy a separate wind insurance policy.

Best overall Louisiana home insurance: Allstate

-

Editor's rating

- Cost: $1,369/yr

Allstate is the best choice for most people due to its cheap rates, helpful coverage and wide availability.

-

Affordable quotes

-

Lots of coverage options and discounts

-

Offers flood insurance

-

Mixed customer service reviews

Allstate's rates are the second cheapest in Louisiana, at $1,369 per year for $350,000 of dwelling coverage. That's less than half the state average of $2,835 per year.

Allstate offers lots of discounts to help lower your insurance bill. Some are very easy to get, including a welcome discount when you switch to Allstate, or an early signing discount for buying a policy one week before your current coverage ends.

One benefit of choosing Allstate is its wide range of coverage options.

For example, Allstate offers flood insurance through either the National Flood Insurance Program (NFIP) or its subsidiary, Beyond Floods. This is helpful if a major storm causes both wind and flooding damage because you won't need to file two separate claims. In addition, people with expensive homes or belongings can get more coverage than an NFIP policy offers.

However, Allstate's customer service reviews are mixed. It earned a below-average score on J.D. Power's customer satisfaction survey. But Allstate's largest subsidiary in Louisiana gets fewer customer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC). That makes it hard to predict what type of experience you'll have with Allstate if you have to file a claim.

Cheapest home insurance in Louisiana: State Farm

-

Editor's rating

- Cost: $734/yr

State Farm has the cheapest rates in Louisiana, along with dependable customer service.

-

Cheapest quotes in LA

-

Reliable customer service

-

Some people can't buy a policy online

-

Few coverage options and discounts

-

May not offer coverage to coastal homes

A policy from State Farm costs $734 per year for $350,000 of dwelling coverage. That's around one-quarter of the Louisiana state average, which is $2,835 per year.

State Farm also has a reputation for great customer service.

It earned a high score on J.D. Power's customer satisfaction survey. State Farm also gets fewer complaints than average, according to the NAIC. That means you can expect State Farm to help fix your home quickly after damage.

However, State Farm may not be available to everyone in Louisiana. It doesn't typically offer policies to coastal homes. So people in parts of New Orleans, Lake Charles or Slidell may not be able to get coverage from State Farm.

Best customer service in Louisiana: Shelter

-

Editor's rating

- Cost: $2,203/yr

Shelter has the best customer service in Louisiana, along with useful coverage options.

-

Excellent customer service

-

Basic policy includes extra coverage

-

Helpful add-ons for waterfront homes

-

Not the cheapest option

-

Few discounts

Louisiana homeowners can count on Shelter to provide an easy, fast claims process after damage to their homes. The company gets 48% fewer complaints than an average insurance company of its size, according to the NAIC. That's the best complaint score in the state, compared to other major insurance companies.

Shelter's basic home insurance policy includes credit card fraud and check forgery coverage at no additional cost. Most insurance companies offer this coverage for an extra fee.

Shelter is an especially great choice for homes on the water.

That's because you can add docks and pier coverage to your home insurance policy. It also offers watercraft activity protection, which covers medical bills and liability costs for some watercraft activities.

Home insurance from Shelter is 22% cheaper than average, at $2,203 per year for $350,000 of dwelling coverage. However, it's $1,469 per year more expensive than the most affordable company, State Farm.

How much is homeowners insurance in Louisiana?

The average cost of homeowners insurance in Louisiana is $2,835 per year.

Louisiana home insurance is 32% more expensive than the national average of $2,151 per year. That makes it the seventh-most expensive state in the country for home insurance.

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,765 |

| $350,000 | $2,835 |

| $500,000 | $4,074 |

| $1,000,000 | $8,566 |

While property insurance in Louisiana is expensive, it's not much different from other Gulf Coast states. Texas, Florida and Mississippi are all in the top 10 most expensive states for home insurance.

Louisiana home insurance rates by city

Chase, a small community in northeastern Louisiana, has the cheapest home insurance quotes in the state.

A policy in Chase costs around $1,981 per year for $350,000 of dwelling coverage.

Creole, a community near Hackberry Beach, has the most expensive quotes in the state. Homeowners in Creole pay an average of $5,391 per year for insurance. That's likely due to its proximity to the Gulf Coast, which makes homes in Creole a high risk for coastal storm damage.

Average home insurance cost in Louisiana by city

City | Annual rate | % from avg. |

|---|---|---|

| Abbeville | $3,557 | 25% |

| Abita Springs | $2,722 | -4% |

| Acme | $2,051 | -28% |

| Addis | $2,717 | -4% |

| Aimwell | $2,086 | -26% |

Rates are for a policy with $350,000 of dwelling coverage.

Louisiana home insurance rates are typically higher along the Gulf Coast. That's because coastal homes are at risk of wind damage caused by tropical storms and hurricanes. Rates also tend to be higher in large cities and places with high crime rates.

For example, homeowners insurance in New Orleans, the largest city in Louisiana, costs around $4,300 per year. That's 52% higher than the statewide average.

Best Louisiana homeowners insurance companies

State Farm is the best-rated home insurance company in Louisiana.

State Farm has a reputation for reliable customer service, and it offers the cheapest home insurance in the state. USAA also earned a high score due to its excellent customer service reviews. However, both State Farm and USAA may not be available to all Louisiana homeowners.

Shelter is an excellent choice for homeowners who can't get State Farm or USAA. It has very few customer complaints and affordable home insurance rates.

Best Louisiana insurance companies

Company |

Rating

|

Complaints

|

|---|---|---|

| State Farm | Average | |

| USAA* | Average | |

| Shelter | Low | |

| Allstate | Average | |

| Hanover | Average |

*USAA is available only to military members, veterans and their families.

What home insurance do I need in Louisiana?

Louisiana's history of floods and strong hurricanes — more than two dozen since 2000 — makes flood insurance a necessity for every homeowner in the state.

Your home insurance policy won't protect you from flood damage. But it does protect you from other types of damage caused by hurricanes, including wind.

Does homeowners insurance in Louisiana cover hurricanes?

Home insurance typically covers some types of hurricane damage, such as wind and hail.

However, it doesn't usually protect against flood damage.

Coastal homes may have to pay a separate deductible for hurricane damage. Your hurricane deductible is usually between 2% and 5% of your dwelling coverage limit.

Does Louisiana home insurance cover wind damage from a hurricane?

Most home insurance policies cover wind damage, but some add a separate deductible for hurricane damage.

Insurance companies may not offer wind insurance to homes with a very high risk of wind damage, like those directly on the coast. If you can't find a company that offers home insurance with wind protection, you may need to buy a separate windstorm policy.

Does home insurance in Louisiana cover flooding?

Standard home insurance doesn't cover flood damage.

Homes in Louisiana have a higher chance of flood and hurricane damage due to the state's proximity to the Gulf Coast and Mississippi River, along with its low elevation.

If you want flood protection in Louisiana, you have to buy a separate policy.

How to find the best homeowners insurance in Louisiana

The best home insurance in Louisiana combines affordable rates with reliable customer service and useful protection. To find the best company for you, start by figuring out how much coverage you need. Then, shop for quotes from multiple companies and look at customer service reviews for your top choices.

Decide how much home insurance you need. Most home insurance policies include the same basic coverage. However, some companies offer add-ons that could be helpful, depending on your situation.

For example, Allstate offers a program called HostAdvantage if you use your home as a short-term rental or Airbnb. It also sells flood insurance, which can be important for many Louisiana homeowners.

Compare quotes from multiple companies. There's a difference of more than $4,000 per year between the most and least expensive companies in Louisiana.

In addition, each company calculates home insurance rates differently. Companies consider your home's location and building materials, along with your insurance history. For that reason, the cheapest company for your family, friends and neighbors may be different from the best choice for you.

Consider customer service scores. It's important to choose a company you can count on to take care of you in an emergency. Companies with great service typically have a stress-free claims process and help get your home fixed quickly.

On the other hand, poor customer service can mean more back-and-forth with the insurance company. And you could end up paying more for repairs.

Start by reviewing our ValuePenguin editor's ratings, which consider customer service ratings, complaints, coverage availability and overall value.

If you want to do more research, you can look up the J.D. Power home insurance study. Another option is to view customer complaints via the National Association of Insurance Commissioners (NAIC) complaint index.

Rising Louisiana home insurance costs

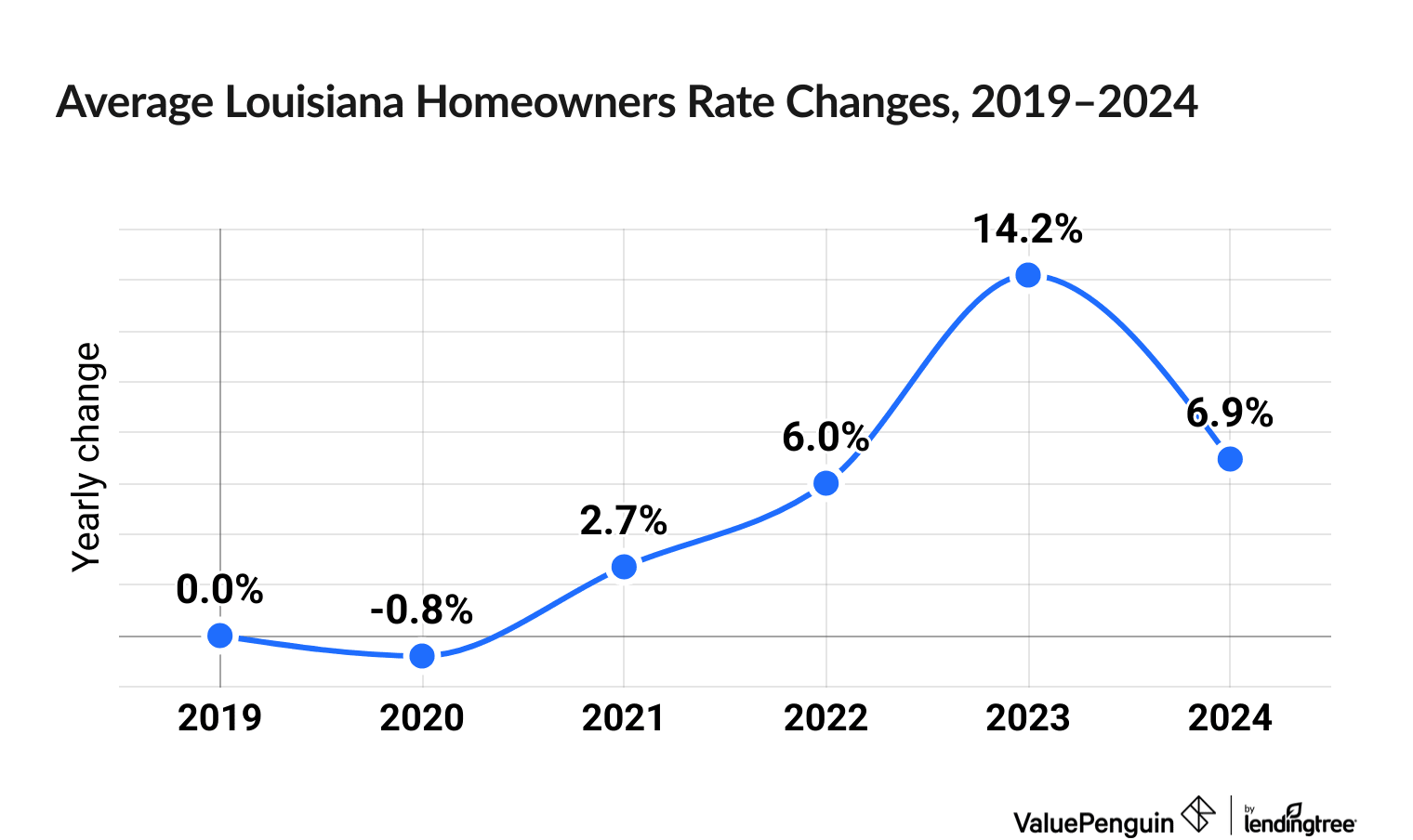

Home insurance prices are up 31.8% in Louisiana over the last six years.

Louisiana homeowners saw a jump in their home insurance prices in 2023, experiencing an increase of 14.2%. This was followed by a 6.9% increase in 2024.

Two companies saw steep increases over the last six years, with Louisiana Farm Bureau (at 127.2%) and Progressive (100.8%) more than doubling their home insurance rates.

State Farm, the most prominent insurance company in the state, actually experienced a decrease over the last five years, down 1.1%.

Home insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

What is the average cost of homeowners insurance in Louisiana?

The average cost of homeowners insurance in Louisiana is $2,835 per year, or $236 per month. That's 32% higher than the national average of $2,151 per year.

Who has the cheapest home insurance in Louisiana?

State Farm offers the cheapest home insurance in Louisiana. The average rate is $734 per year, which is 74% cheaper than the state average.

Which company has the best home insurance in Louisiana?

Allstate has the best home insurance in Louisiana because of its cheap rates, good discounts that are easy to qualify for and helpful coverage add-ons. In addition, Allstate offers flood insurance. This is very helpful for people living in the 51% of Louisiana located in a special flood hazard area (SFHA).

Why is home insurance so high in Louisiana?

Louisiana home insurance can be expensive due to the high risk of weather-related damage across the state. Coastal cities are particularly at risk of wind damage from tropical storms and hurricanes. The state also has higher crime rates than average, which means there's a greater chance of theft and vandalism claims.

How much is homeowners insurance in New Orleans, Louisiana?

Home insurance in New Orleans costs an average of $4,300 per year. That's 52% higher than the Louisiana average. In comparison, homeowners insurance in Baton Rouge, the second-largest city in the state, costs around $2,643 per year.

How much is homeowners insurance in Slidell, LA?

Home insurance in Slidell costs $3,085 per year, on average. That's 9% higher than the average homeowners insurance quote in Louisiana, which is $2,835 per year.

Methodology

To find the best cheap home insurance in LA, ValuePenguin collected home insurance quotes for every ZIP code across the state of Louisiana from the state's largest home insurance companies. Rates are for a 45-year-old married man with no history of insurance claims and a good credit score. Quotes include the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

ValuePenguin ranked each company's customer service by comparing the National Association of Insurance Commissioners (NAIC) complaint index, J.D. Power's home insurance customer satisfaction rankings and our ValuePenguin editor's ratings.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.