The Best and Cheapest Home Insurance Companies in Iowa (2025)

State Farm has the best home insurance in Iowa for most people, with an average rate of $1,608 per year.

Compare Home Insurance Quotes in Iowa

Best Cheap Home Insurance in Iowa

To find the best and cheapest home insurance in Iowa, ValuePenguin gathered thousands of quotes for Iowa home insurance. Our experts used each company's average rates, coverage options, discounts, customer satisfaction and third-party ratings to determine which companies to highlight as the best and cheapest. See the full methodology.

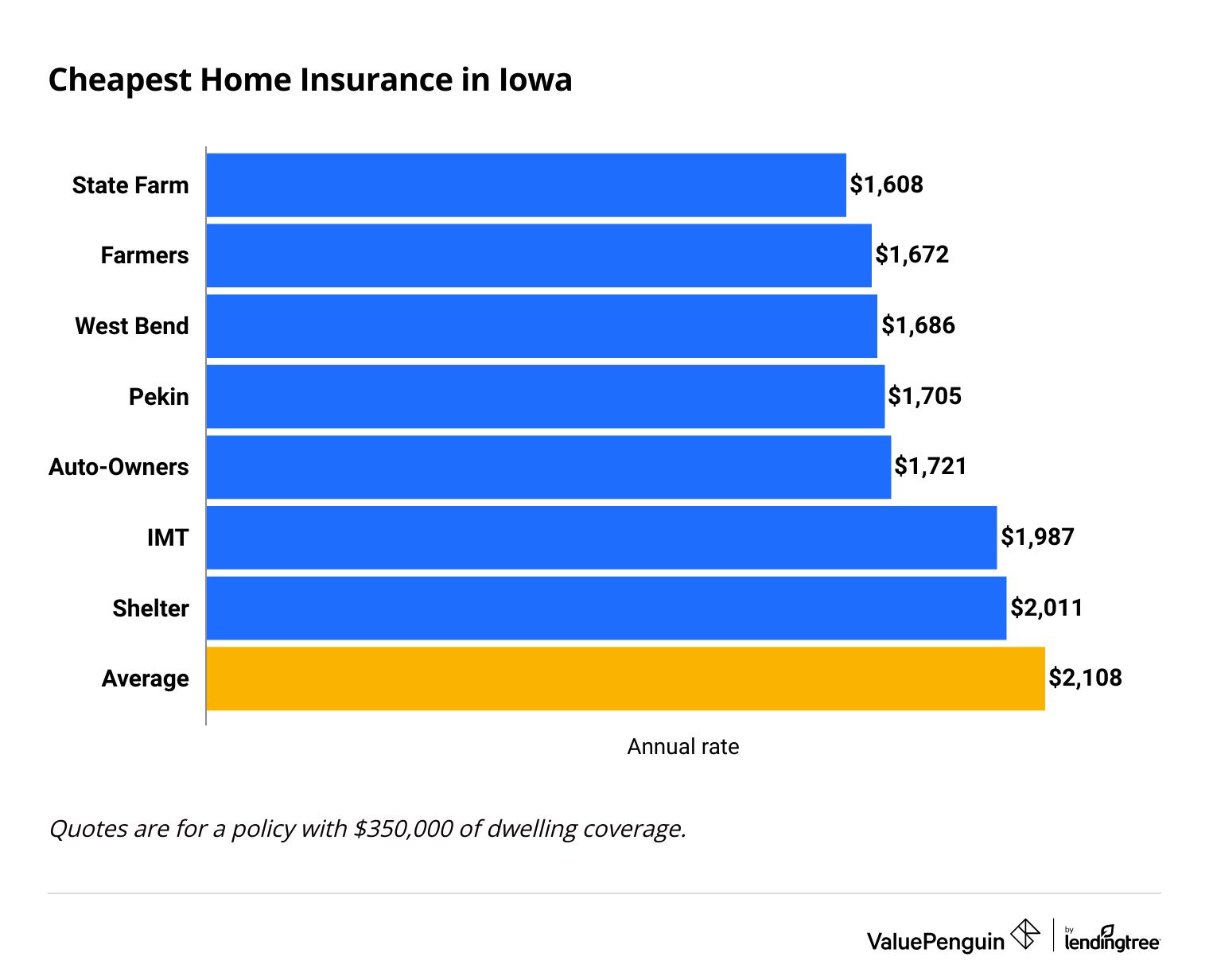

Cheapest homeowners insurance companies in Iowa

State Farm has the cheapest home insurance in Iowa, with rates averaging $1,608 for $350,000 in dwelling coverage.

The average cost for home insurance in Iowa as a whole is $2,108 per year. State Farm is $500 cheaper per year, on average.

Compare Home Insurance Quotes in Iowa

But cost isn't the only thing you should consider when you shop for home insurance. Customer satisfaction, coverage options and discounts are also important. Considering all these factors helps you get the right policy for your needs and budget.

Cheap home insurance in Iowa

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Farmers | $1,096 | ||

| State Farm | $1,131 | ||

| IMT | $1,161 | ||

| Pekin | $1,172 | |

| West Bend | $1,176 | |

$200,000

Company | Annual rate | ||

|---|---|---|---|

| Farmers | $1,096 | ||

| State Farm | $1,131 | ||

| IMT | $1,161 | ||

| Pekin | $1,172 | |

| West Bend | $1,176 | |

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,608 | ||

| Farmers | $1,672 | ||

| West Bend | $1,686 | |

| Pekin | $1,705 | |

| Auto-Owners | $1,721 | ||

$500,000

Company | Annual rate | ||

|---|---|---|---|

| Auto-Owners | $2,099 | ||

| State Farm | $2,148 | ||

| Pekin | $2,191 | |

| Farmers | $2,217 | ||

| West Bend | $2,355 | |

$1 million

Company | Annual rate | ||

|---|---|---|---|

| Pekin | $3,497 | |

| State Farm | $3,701 | ||

| Auto-Owners | $3,971 | ||

| Farmers | $4,056 | ||

| West Bend | $4,932 | |

Severe weather in Iowa

Severe weather is common in Iowa, particularly tornadoes, floods and harsh winter storms. Your home insurance usually covers damage from wind, rain, snow and ice, but you need a separate policy for flood damage.

Best home insurance in Iowa for most people: State Farm

-

Editor's rating

- Cost: $1,608/yr

State Farm's cheap rates and local agents make it the best for most people.

Pros:

-

Cheap rates

-

Local agents

-

Good for bundling with auto insurance

-

Not as many extra coverages as other companies

-

Not as many discounts as other companies

State Farm is the best home insurance company in Iowa for most people because of its cheap rates and local agents. The company has agents in more than 120 Iowa cities. A local agent can help you pick the right home insurance coverage and can make managing your policy and filing claims easier.

State Farm is also a great option if you want to bundle your auto and home insurance with one company. It has low rates for Iowa car insurance, making it a cheap option for home and auto coverage.

But State Farm doesn't have as many coverage options and discounts as some companies. If you want to customize your policy, Auto-Owners is a better choice. And while State Farm's customer satisfaction is average, Auto-Owners and Farm Bureau get fewer complaints.

Best home insurance coverage options in Iowa: Auto-Owners

-

Editor's rating

- Cost: $1,721/yr

Auto-Owners has many extra coverage options and discounts.

Pros:

-

Cheap rates

-

Plenty of coverage options and discounts

-

Good customer satisfaction

-

No online quotes

If you want personalized coverage, Auto-Owners is a great option. You can add dozens of add-on coverages to build a policy that fits your needs. Options include guaranteed home replacement, identity theft coverage and equipment breakdown coverage. Auto-Owners also lets you add inland flood insurance coverage to your home insurance policy, so you don't need to buy a separate flood insurance policy.

You can save on Auto-Owners home insurance by paying your policy in full each year, bundling your policies, having a water shut-off system and having an automatic generator. And Auto-Owners has excellent customer service, with 60% fewer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC).

To get an Auto-Owners quote, you have to work with a local insurance agent. You can't get a quote online. To find an agent in your area, use the Auto-Owners agent locator tool.

Best home insurance in Iowa for farms: Farm Bureau

-

Editor's rating

- Cost: $2,230/yr

Farm Bureau has good coverage and perks for farmers.

Pros:

-

Good coverage for farmers

-

Cheap auto rates make it good for bundling

-

High customer satisfaction

-

Expensive rates

-

Membership required

If you live on one of the nearly 85,000 farms in Iowa, Farm Bureau is a good option for coverage. The company sells coverage for farm vehicles, livestock, crops, horses and more. Even if you live on a small farm or ranch, you might want to consider a farm insurance policy rather than a regular home insurance policy for better coverage.

To get insurance from Farm Bureau, you need a membership. A membership won't cost more than $60, but it's still an added fee. However, you do get several extra perks for joining, including discounts on home and farm equipment, access to health and fitness programs, and savings on travel and entertainment.

But if you just need home insurance, Farm Bureau probably isn't the best option. Its rates are high, and you'll have the Farm Bureau membership fee on top of your annual rate.

Average home insurance cost in Iowa

Iowa home insurance costs an average of $2,108 per year for $350,000 in dwelling coverage.

Dwelling coverage pays for damage to the structure of your home, including the roof, walls and floors. The more expensive your home is, the more dwelling coverage you need and the more you'll pay for home insurance.

Average cost of home insurance in Iowa by dwelling amount

Dwelling coverage | Annual cost |

|---|---|

| $200,000 | $1,428 |

| $350,000 | $2,108 |

| $500,000 | $2,777 |

| $1,000,000 | $5,008 |

Iowa home insurance is more expensive than coverage in nearby Wisconsin, where the same policy costs $1,394 per year. But in the other surrounding states — Illinois, Minnesota, Missouri, Nebraska and South Dakota — home insurance is more expensive. In these states, home insurance costs between $2,132 and $4,370 per year for $350,000 in dwelling coverage.

Iowa home insurance rates by city

In Des Moines, home insurance costs $2,055 per year, on average, for $350,000 in dwelling coverage.

That's 3% less than the state average for the same amount of coverage. Bettendorf, along the eastern edge of the state, has the cheapest home insurance, with an average rate of $1,845 per year. Carter Lake, along the border with Nebraska, has the most expensive yearly rate, at $2,684.

City | Annual rate | % from avg. |

|---|---|---|

| Ackley | $2,071 | -2% |

| Ackworth | $2,142 | 2% |

| Adair | $2,242 | 6% |

| Adel | $2,108 | 0% |

| Afton | $2,266 | 8% |

Rates are for a policy with $350,000 of dwelling coverage.

The best-rated homeowners insurance companies in Iowa

USAA, Auto-Owners and Farm Bureau are the best-rated home insurance companies in Iowa.

All three companies have a low level of customer complaints, according to the National Association of Insurance Commissioners (NAIC). They also offer good coverage options and discounts. However, USAA is only available if you're a military member or family member of someone in the military.

Company |

Rating

|

Complaints

|

|---|---|---|

| USAA | Low | |

| Auto-Owners | Low | |

| Farm Bureau | Low | |

| State Farm | Average | |

| American Family | Low |

Common causes of home damage in Iowa

Iowa's weather can be unpredictable and damaging. High winds, tornadoes, hail, winter storms and flooding can all cause catastrophic damage to homes. Making sure your home insurance covers you for the most common types of severe weather in the state can give you peace of mind.

Does Iowa home insurance cover tornadoes and wind damage?

Iowa is often hit by tornadoes and strong summer storms that come with high winds. Most home insurance policies automatically cover wind damage, including damage caused by tornadoes. You might have a separate deductible for wind, though, and it's usually higher than the deductible for other types of damage.

In 2023, Iowa recorded 73 tornadoes. And 131 tornadoes hit the state in 2024. That includes a large and devastating tornado that struck Greenfield, IA, on May 21, 2024. Four people were killed and dozens were injured.

Does home insurance in Iowa cover hail damage?

Fortunately, most home insurance policies automatically cover hail damage. Just like with wind coverage though, you may have a separate, higher deductible to pay if you file a claim after a hailstorm. Hail is common in Iowa, with 270 hailstorms recorded in 2023.

You might also get a discount if your home is less likely to be damaged by hail. This can include having hail-resistant roofing, siding and windows.

Does home insurance in Iowa cover snow and ice?

Winter storms are common in the plains. Cold temperatures can cause pipes to freeze and burst. Snow and ice can build up on roofs, damaging the structure of your home and creating leaks.

Home insurance normally covers damage caused by cold temperatures, ice and snow. But you probably won't have coverage if a lack of home maintenance contributed to the damage. Before winter hits, make sure your home is ready. That way, if you do have damage, insurance is more likely to pay for it.

Does Iowa home insurance cover flooding?

Home insurance does not cover damage caused by floods. You need to buy a separate flood insurance policy to get coverage for flood damage.

Even if you don't live near a river or body of water, you could still be at risk for floods. Flooding is common in Iowa, with every county recording at least one flood since records began in 1953. And even an inch of floodwater can cause thousands of dollars of damage.

How to save on home insurance in Iowa

Home insurance in Iowa can be expensive, depending on where you live and how much coverage you need. But you can take a few steps to get a cheaper home insurance policy.

Update and maintain your roof. Newer roofs are less likely to be damaged by wind and hail, so most insurance companies give you a discount. Even if you don't need a new roof, keeping your roof in good condition can help you avoid filing claims, which increases your rate.

Bundle your policies. Getting your auto and home insurance from the same company can save you hundreds of dollars each year. Bundling discounts are usually some of the biggest savings that insurance companies offer.

Shop around. Each home insurance company sets its own rates, which means the same coverage costs different amounts depending on the company you choose. Shopping around lets you find the cheapest rate for the coverage you need.

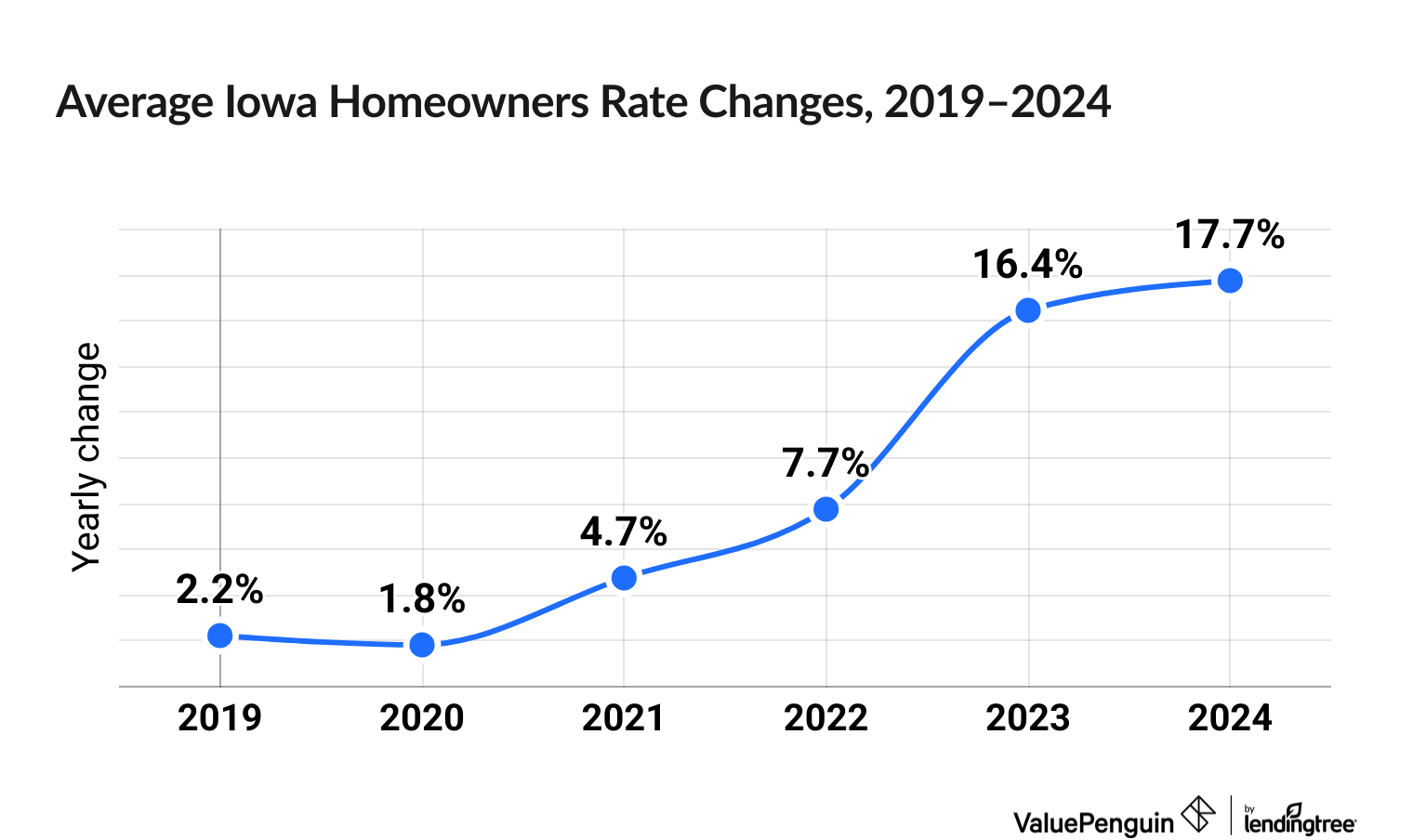

Iowa’s home insurance costs over time

Home insurance prices have surged 60.6% in Iowa over the last six years.

Iowa homeowners have seen steep increases in home insurance prices, up 17.7% in 2023 and 16.4% in 2024.

Over the last six years, three large companies saw their rates more than double: IMT (114.1%), West Bend (106.1%) and Farmers (102.5%).

USAA saw the smallest increase by wide margin, with an increase in home insurance rates of 17.9%.

Home insurance rate change data was compiled using RateWatch from S&P Global, which uses information from the National Association of Insurance Commissioners (NAIC).

Frequently asked questions

How much is home insurance in Iowa?

Home insurance in Iowa costs $2,108 per year, on average. Your rate will be different based on where you live, the details of your home, if you've filed any home insurance claims and more.

What is the cheapest homeowners insurance in Iowa?

State Farm has the cheapest rates for policies with $350,000 in dwelling coverage, costing $1,608 per year, on average. Depending on how much coverage you need, other cheap companies include Farmers, Auto-Owners and Pekin.

Who has the best home insurance in Iowa?

State Farm has the best home insurance in Iowa for most people because of its cheap rates, local agents and good customer service. Auto-Owners is a good option if you want to add extra coverage to your policy, and Farm Bureau is good if you need farm coverage.

Methodology

ValuePenguin gathered quotes from Iowa's largest home insurance companies across all the state's ZIP codes. Our quotes use a 45-year-old man with no home insurance claims and the following coverage limits:

- Dwelling coverage: $200,000, $350,000, $500,000 or $1 million

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Quotes are from Quadrant Information Services. Quadrant uses publicly available insurance company filings to source its rates. These rates are averages. Your rates will be different based on your situation.

Iowa home insurance company reviews use rates, coverages, discounts, customer complaint numbers from the National Association of Insurance Commissioners (NAIC), scores from J.D. Power's home insurance customer satisfaction survey and ValuePenguin's editorial ratings.

Other sources include the Federal Emergency Management Agency (FEMA), the Iowa Department of Public Safety, the Storm Prediction Center and the United States Department of Agriculture (USDA).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.