Cheapest Car Insurance in San Antonio, TX

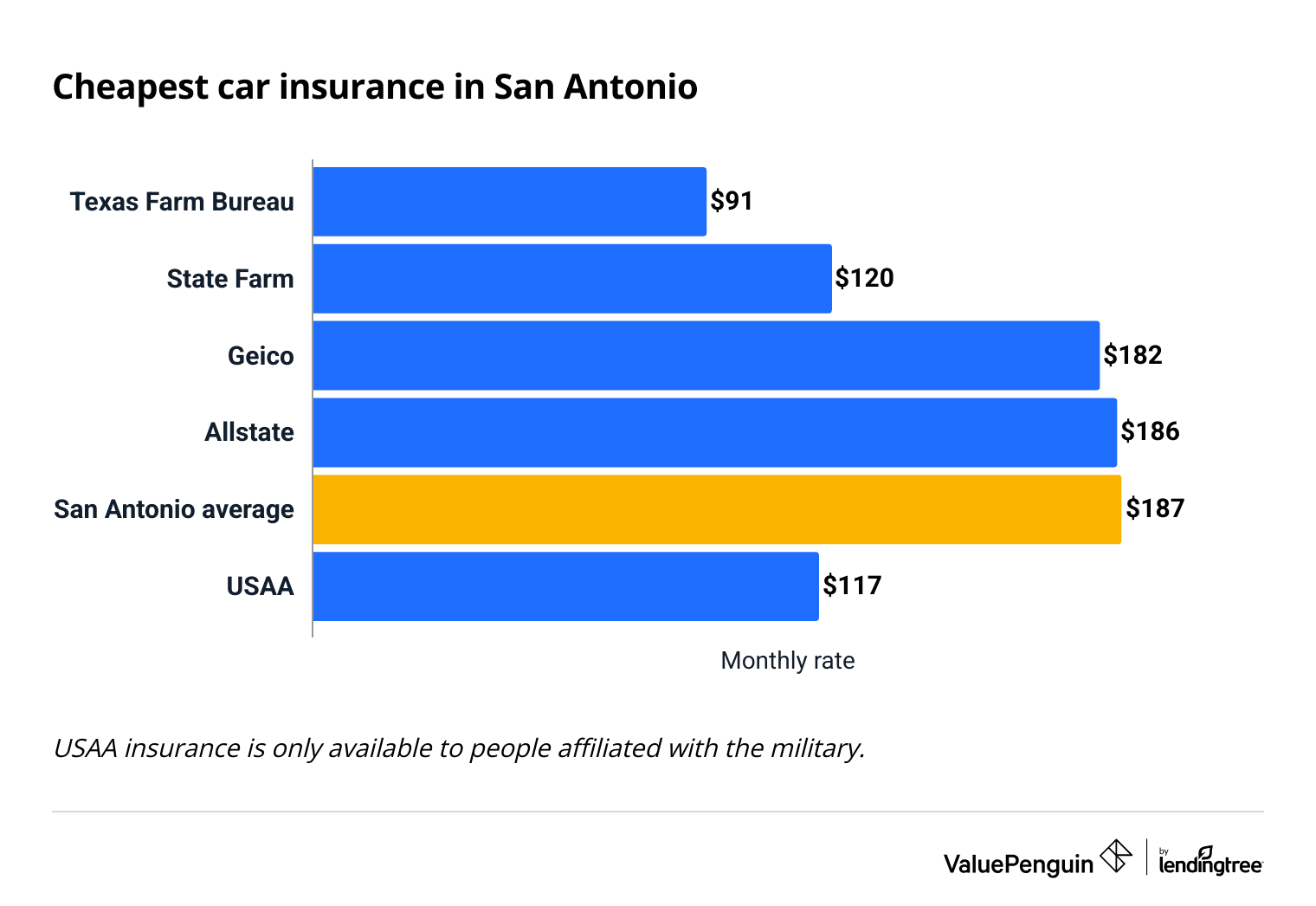

Texas Farm Bureau has the cheapest car insurance in San Antonio, at $91 per month for full coverage and $38 per month for minimum coverage.

Find Cheap Auto Insurance Quotes in San Antonio

Best cheap car insurance companies in San Antonio

How we chose the top companies

Best and cheapest car insurance in Texas

- Cheapest full coverage: Texas Farm Bureau, $91/mo

- Cheapest minimum liability: Texas Farm Bureau, $38/mo

- Cheapest for young drivers: Texas Farm Bureau, $72/mo

- Cheapest after a ticket: Texas Farm Bureau, $91/mo

- Cheapest after an accident: State Farm, $141/mo

- Cheapest for teens after a ticket: Texas Farm Bureau, $72/mo

- Cheapest after a DUI: State Farm, $128/mo

- Cheapest for poor credit: Allstate, $186/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Cheapest car insurance in San Antonio: Texas Farm Bureau

Texas Farm Bureau offers the cheapest full coverage quotes for San Antonio drivers.

A policy from TX Farm Bureau costs $91 per month, on average. That's about half the citywide average .

Find Cheap Auto Insurance Quotes in San Antonio

Cheapest full coverage car insurance in San Antonio

Company | Monthly rate | |

|---|---|---|

| Texas Farm Bureau | $91 | |

| State Farm | $120 | |

| Geico | $182 | |

| Allstate | $186 | |

| Progressive | $230 |

*USAA is only available to current and former military members and their families.

In San Antonio, a full coverage policy costs about two and a half times as much as a liability-only policy, but it could end up being a better value if you're involved in a major accident.

That's because full coverage car insurance helps pay for repairs to your own car, even if you caused the crash. It'll also cover causes of damage like vandalism, fire and theft.

Cheap liability insurance quotes in San Antonio: Texas Farm Bureau

Texas Farm Bureau has the cheapest quotes for minimum-coverage car insurance in San Antonio.

At $38 per month, a policy from Texas Farm Bureau is about half the price of the average San Antonio company.

Cheap auto insurance in San Antonio

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $38 |

| State Farm | $51 |

| Progressive | $64 |

| Geico | $78 |

| Allstate | $81 |

*USAA is only available to current and former military members and their families.

To avoid overpaying, it's important for San Antonio drivers to shop around. The most expensive company, Farmers, charges four times as much as Farm Bureau for the same coverage.

Find Cheap Auto Insurance Quotes in San Antonio

Cheap quotes for young San Antonio drivers: Texas Farm Bureau

Texas Farm Bureau has the most affordable auto insurance quotes for young drivers in San Antonio.

A minimum-coverage policy for an 18-year-old driver costs $72 per month at Texas Farm Bureau in the city. That's 70% cheaper than the San Antonio average. Farm Bureau also offers the cheapest quote for full coverage insurance, at $152 per month.

Cheapest for teens

Company | Liability only | Full coverage |

|---|---|---|

| Texas Farm Bureau | $72 | $152 |

| State Farm | $175 | $351 |

| Geico | $197 | $405 |

| Allstate | $269 | $572 |

| Progressive | $333 | $1,127 |

*USAA is only available to current and former military members and their families.

Insurance rates can be expensive for young drivers in San Antonio, but there are ways to make your payments more affordable:

- Ask about discounts. Many companies offer discounts for installing security devices in your car, getting good grades as a student and being a safe driver. These discounts can add up to hundreds or even thousands of dollars in savings.

- Share a policy with your parents. Ask your parents about getting a combined or multicar policy. Their rates will usually go up, but it’ll be cheaper than two separate policies.

- Compare quotes. The difference between the cheapest and the most expensive insurance company can be over $1,000 per month. To make sure you get a good deal on auto insurance, we recommend shopping for quotes from multiple companies.

Cheapest San Antonio auto insurance after a ticket: Texas Farm Bureau

Texas Farm Bureau has the most affordable auto insurance quotes for San Antonio drivers with a recent speeding ticket.

A full coverage policy from Texas Farm Bureau costs $91 per month after a single speeding ticket. In some cases, Texas Farm Bureau may not raise rates at all after your first ticket. It's also less than half the city average, and $29 per month less than the next-cheapest option

Cheapest after a ticket

Company | Monthly rate |

|---|---|

| Texas Farm Bureau | $91 |

| State Farm | $120 |

| Allstate | $186 |

| Geico | $219 |

| Progressive | $306 |

*USAA is only available to current and former military members and their families.

Rates go up by an average of 21% after a single speeding ticket in San Antonio.

If you have a ticket or accident on your record, you can expect to pay more for auto insurance. That's because your insurance company will generally view a past incident as a sign that you're more likely to be in an accident, which makes you more expensive to insure.

It's difficult to avoid an increase in your rates after an incident, though not every company will raise your rates after your first ticket. You should ask your insurance company if you can save money with discounts. If you take steps like enrolling in a defensive driving class or adding certain safety features to your car, you may be able to secure lower rates.

Cheapest San Antonio car insurance after an accident: State Farm

State Farm has the cheapest auto insurance for San Antonio drivers who have caused an accident. A full coverage policy costs $141 per month after an accident, which is 58% less than average in San Antonio .

Cheapest after an accident

Company | Monthly rate |

|---|---|

| State Farm | $141 |

| Texas Farm Bureau | $146 |

| Allstate | $199 |

| Geico | $296 |

| Progressive | $365 |

*USAA is only available to current and former military members and their families.

It's always a good idea to compare quotes every time your driving record changes. Insurance companies take different approaches to driving incidents, and some companies penalize drivers more than others. For instance, Farmers Insurance nearly triples rates after a crash, while State Farm only raises them by 17%. The best time to do this is about a month before your policy renews, as your old rates won't change until your policy expires.

Cheapest insurance in San Antonio for teens with a ticket or accident: Texas Farm Bureau

Texas Farm Bureau has the cheapest quotes for young drivers with tickets or accidents on their records.

A minimum-coverage policy from Texas Farm Bureau costs an average $72 per month for an 18-year-old driver with a single speeding ticket, which is about the same as the rate for a teen driver with a clean record.

Young drivers who have caused an accident pay around $104 per month for minimum coverage from Farm Bureau, which is 71% cheaper than average.

Best cheap minimum coverage for teens with a bad record

Company | Ticket | Accident |

|---|---|---|

| Texas Farm Bureau | $72 | $104 |

| State Farm | $175 | $198 |

| Geico | $219 | $292 |

| Allstate | $269 | $273 |

| Progressive | $338 | $346 |

*USAA is only available to current and former military members and their families.

Cheapest car insurance for drivers with a DUI: State Farm

State Farm has the cheapest quotes for San Antonio drivers after a DUI. At $128 per month, a full coverage policy from State Farm is half the price of the citywide average.

Cheapest after a DUI in San Antonio

Company | Monthly rate |

|---|---|

| State Farm | $128 |

| Texas Farm Bureau | $179 |

| Allstate | $240 |

| Progressive | $269 |

| Geico | $331 |

*USAA is only available to current and former military members and their families.

San Antonio drivers with a DUI pay 42% more each month for full coverage insurance than those with a clean record. DUI citations generally stay on your record longer than accidents or speeding tickets, so they can have a bigger impact on your rates over time.

Cheapest car insurance for drivers with poor credit: Allstate

Allstate has the cheapest rates for San Antonio drivers with poor credit. A full coverage policy costs $186 per month, less than half the city average.

Texas Farm Bureau also has competitive rates for bad-credit drivers, at $205 per month.

Cheapest for poor credit in San Antonio

Company | Monthly rate |

|---|---|

| Allstate | $186 |

| Texas Farm Bureau | $205 |

| Progressive | $398 |

| Geico | $479 |

| Farmers | $634 |

*USAA is only available to current and former military members and their families.

If you have a low credit score, you can pay twice as much for full coverage car insurance in San Antonio than a driver with a good credit score.

This is because insurance companies see a low credit score as a sign that you are more likely to file a claim, so they may raise your rates to account for that risk.

Car insurance quotes in San Antonio by ZIP code

Residents of the Garden Ridge neighborhood pay the cheapest rates in San Antonio for full coverage, at $169 per month.

Drivers living in ZIP code 78206, located near downtown San Antonio, have the highest rates.

Car insurance rates vary across San Antonio by as much as $42 per month for a full coverage policy. That's because each neighborhood has a different crime rate, population density and accident rate. As a result, prices vary depending on which ZIP code you live in.

ZIP | Monthly Rate | % from average |

|---|---|---|

| 78023 | $180 | 0% |

| 78109 | $172 | -5% |

| 78112 | $177 | -2% |

| 78201 | $187 | 3% |

| 78202 | $181 | 1% |

What's the best car insurance for San Antonio drivers?

Full coverage is the best option for most drivers, especially those who drive a new or expensive car.

If you want protection for your own car, you'll need to get a full coverage policy.

Drivers in Texas are required to buy liability coverage, which protects other drivers and their vehicles if you cause an accident. Many drivers select minimum liability coverage because it's affordable. However, it may not provide enough coverage if you're in a bad accident.

Frequently asked questions

How much does car insurance cost in San Antonio?

The average cost of full coverage car insurance in San Antonio is $187 per month. Liability-only insurance costs $73 per month, on average.

Where can I find cheap auto insurance in San Antonio?

Texas Farm Bureau has the cheapest car insurance rates in San Antonio for most drivers. A minimum-coverage policy from Texas Farm Bureau costs around $38 per month, while full coverage costs $91 per month.

What is the best auto insurance in San Antonio?

USAA provides excellent customer service for Texas drivers, but it's only available to people with ties to the military. We recommend State Farm if you can't get USAA. The company gets fewer complaints than its competitors and earned an outstanding ValuePenguin editor's score.

Where can I find cheap liability insurance in San Antonio?

Texas Farm Bureau has the cheapest liability-only quotes in San Antonio. A policy costs $38 per month, on average. Drivers should also compare quotes from State Farm, where a policy is only $51 per month, on average.

How much is auto insurance in the 78221 ZIP code?

Drivers who live in the 78221 ZIP code of San Antonio, near the Mission del Lago golf course, pay $179 per month for full coverage insurance. That's about average for San Antonio.

Methodology

To find the best cheap car insurance in San Antonio, TX, ValuePenguin gathered quotes from seven of the top insurance companies in Texas for all ZIP codes across the city. Quotes are for a 30-year-old male driver who owns a 2015 Honda Civic EX and has a good credit score, unless otherwise stated. Young driver quotes are based on an 18-year-old driver with a liability-only insurance policy.

Rates include the following coverage limits:

Minimum coverage

Full coverage

- Bodily injury liability: $30,000 per person/$60,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: waived

- Comprehensive and collision: waived

Minimum coverage

- Bodily injury liability: $30,000 per person/$60,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: waived

- Comprehensive and collision: waived

Full coverage

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.