Best Cheap Car Insurance in Miami, Florida

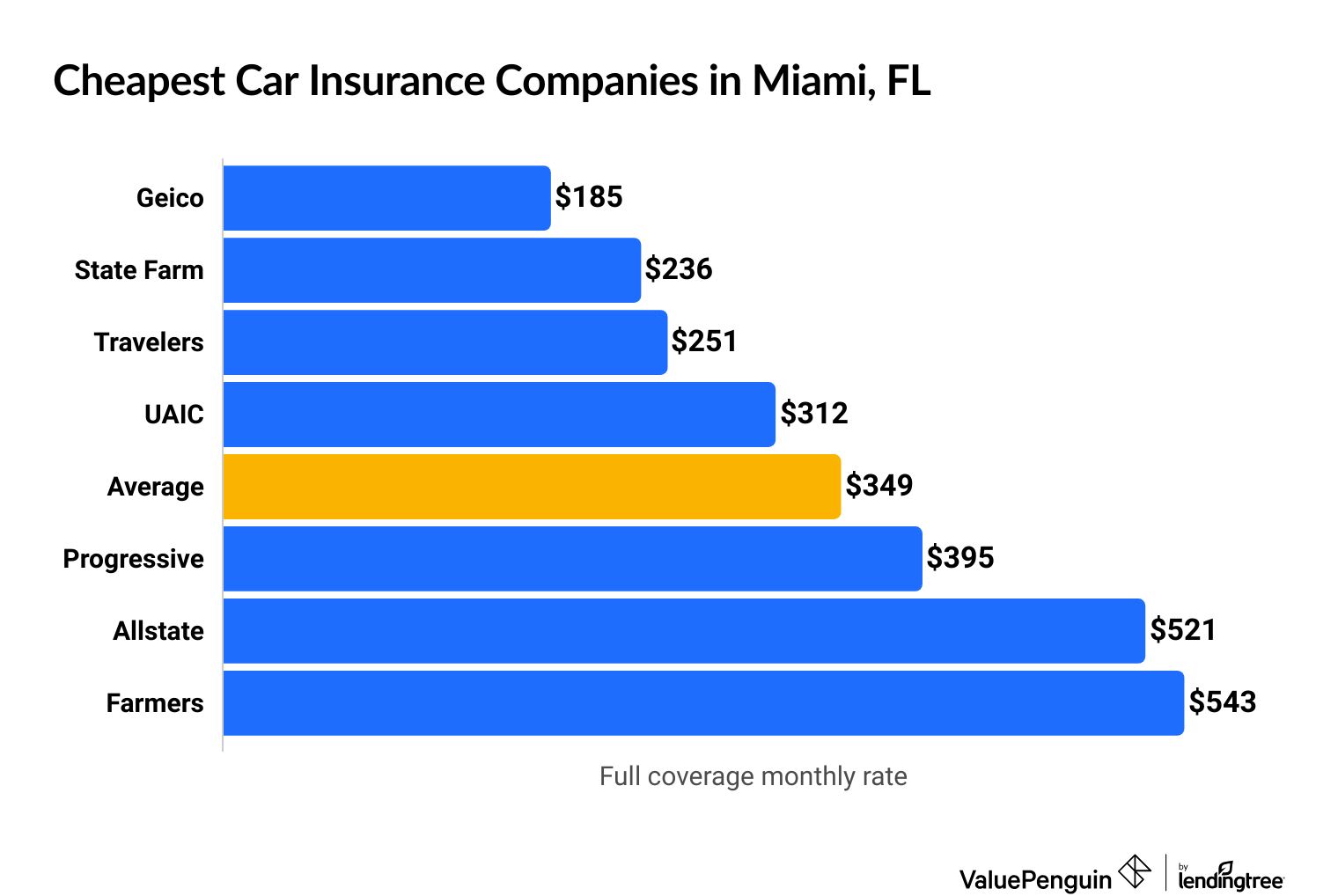

Geico has the cheapest auto insurance in Miami. A full coverage policy costs an average of $185 per month.

Compare Car Insurance Rates in Miami, FL

Best cheap car insurance in Miami, FL

How we chose the top companies

Best and cheapest car insurance in Florida

- Cheapest full coverage: Geico, $185/mo

- Cheapest minimum liability: Geico, $48/mo

- Cheapest for young drivers: Geico, $112/mo

- Cheapest after a ticket: State Farm, $256/mo

- Cheapest after an accident: Geico, $259/mo

- Cheapest for teens after a ticket: Geico, $131/mo

- Cheapest after a DUI: Travelers, $398/mo

- Cheapest for poor credit: UAIC, $312/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Geico has the cheapest rates for full and minimum coverage policies in Miami. But, the company has a middle of the road reputation for customer service.

State Farm offers the best combination of affordable rates and quality customer service for most people. However, the company is a poor choice if you have a DUI on your record or poor credit.

Cheapest car insurance in Miami: Geico

Geico has the cheapest full-coverage auto coverage in Miami, FL.

Geico's average rate is $185 per month, on average. That's roughly half the average cost of full coverage car insurance in Miami ($349).

State Farm also has affordable coverage, at $236 per month, on average.

Find Cheap Auto Insurance Quotes in Miami

State Farm and Geico both have an excellent reputation for customer service in Miami.

Cheapest full coverage car insurance in Miami

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $185 | ||

| State Farm | $236 | ||

| Travelers | $251 | ||

| UAIC | $312 | ||

| Progressive | $395 | ||

Auto insurance in Miami costs more than the Florida state average ($272). That's on top of Florida already having higher average rates than the rest of the country. Still, you can save money by shopping around and comparing quotes.

Cheapest minimum liability auto insurance in Miami, FL

Geico has the cheapest minimum liability car insurance in Miami, at $48 per month, on average.

That's roughly a third of Miami’s citywide average, $140 per month.

Best cheap liability auto insurance

Company | Monthly rate |

|---|---|

| Geico | $48 |

| Travelers | $90 |

| State Farm | $96 |

| UAIC | $169 |

| Progressive | $170 |

Find Cheap Auto Insurance Quotes in Miami

Cheapest car insurance for Miami teens: Geico

Geico has the most affordable car insurance for teen drivers in Miami.

The company charges an average of $112 per month for liability-only coverage and $501 per month for full coverage. That's roughly one-third and one-half the citywide average ($371 and $1,052), respectively.

The next cheapest option, Travelers, has significantly higher rates, at $190 per month for liability-only coverage and $638 for full coverage, on average.

Monthly car insurance rates for teen drivers

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $112 | $501 |

| Travelers | $190 | $638 |

| State Farm | $227 | $656 |

| UAIC | $398 | $683 |

| Allstate | $414 | $1,466 |

Teen drivers can get cheap car insurance by finding discounts. For example, many companies let you save money on your monthly rate if you maintain a good GPA or complete a safety course.

Cheapest car insurance in Miami after a speeding ticket: State Farm

State Farm has the cheapest coverage in Miami for drivers with a speeding ticket on their record, at an average of $256 per month. That's roughly 38% cheaper than the $416 citywide average.

Cheapest coverage after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $256 |

| Travelers | $309 |

| UAIC | $312 |

| Geico | $320 |

| Allstate | $521 |

Cheapest car insurance in Miami after an accident: Geico

Geico has the cheapest auto insurance in Miami for drivers who've been in an at-fault accident, at an average of $259 per month. That's about half the city average, $507 per month.

Cheapest car insurance after an accident

Company | Monthly rate |

|---|---|

| Geico | $259 |

| State Farm | $278 |

| Travelers | $342 |

| UAIC | $402 |

| Progressive | $593 |

Auto insurance rates typically go up after an accident because companies think these drivers are more likely to file a claim in the future. Keep in mind, though, that your rates typically won't rise until your insurance policy renews.

This means it's a good idea to shop around for car insurance when your coverage is set to expire.

Cheapest quotes for teens after a ticket or accident: Geico

Geico has the cheapest car insurance for Miami teens who've had a ticket or accident. An 18-year old in Miami with coverage from Geico pays $131 per month for minimum coverage after a ticket, on average, and an average of $115 per month after an accident. That's around a third and a quarter of the average cost of coverage in Miami — $411 and $499, respectively.

Monthly minimum coverage rates for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Geico | $131 | $115 |

| Travelers | $232 | $264 |

| State Farm | $249 | $274 |

| UAIC | $398 | $496 |

| Allstate | $414 | $824 |

In Miami, a teen with an accident pays an average of $128 per month more than a teen who does not have a traffic violation. However, shopping around can help keep your costs down. Geico charges teen drivers in Miami with an accident on their record about a quarter of the citywide average.

Cheapest car insurance for Miami drivers with a DUI: Travelers

Travelers has the cheapest auto insurance in Miami for drivers who have a DUI, at $398 per month, on average. That's nearly 30% cheaper than the Miami average ($557).

Cheapest Miami car insurance after a DUI

Company | Monthly rate |

|---|---|

| Travelers | $398 |

| Geico | $409 |

| Progressive | $473 |

| UAIC | $539 |

| Farmers | $603 |

In Miami, a DUI will raise your monthly rate by an average of $208 per month.

Cheapest quotes for drivers with poor credit: UAIC

UAIC has the cheapest quotes for Miami drivers with poor credit. A full coverage car insurance policy costs an average of $312 per month for these drivers. That's less than half the citywide average for Miami.

Cheapest car insurance for poor credit in Miami

Company | Monthly rate |

|---|---|

| UAIC | $312 |

| Geico | $351 |

| Travelers | $525 |

| Progressive | $636 |

| Farmers | $780 |

Average car insurance cost in Miami by neighborhood

The cost of car insurance in Miami varies by hundreds of dollars per year depending on where you live.

Residents of the cheapest Miami neighborhood, Kendall, pay an average of $82 per month less than residents of the most expensive Westview. Insurance companies use your ZIP code when setting rates because of factors like theft, vandalism and traffic.

Full coverage quotes by Miami ZIP code

ZIP | Monthly Rate | % from average |

|---|---|---|

| 33122 | $353 | 2% |

| 33125 | $369 | 7% |

| 33126 | $362 | 5% |

| 33127 | $381 | 10% |

| 33128 | $367 | 6% |

Frequently asked questions

Who has the cheapest car insurance in Miami?

Geico has the cheapest car insurance in Miami, at $185 per month for full coverage, on average. That's roughly half the citywide average, $349 per month.

What's the best car insurance in Miami?

State Farm has the best car insurance in Miami. The company has a high customer satisfaction score from JD Power, and the company gets significantly fewer complaints than an average company its size, according to the National Association of Insurance Commissioners (NAIC), an industry group.

What's the average cost of car insurance in Miami?

On average, a full coverage car insurance policy in Miami costs an average of $349 per month. A minimum liability policy costs $140 per month, on average.

Methodology

To find the best cheap car insurance in Miami, FL, ValuePenguin collected quotes from seven of the most popular insurance companies in Florida. Rates are for a 30-year-old single man with good credit and no accident history who drives a 2015 Honda Civic EX.

Full coverage policies include comprehensive and collision coverage, plus liability limits that meet the Florida state requirements.

- Bodily injury liability: $50,000 per person/$100,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: $10,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person/$100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates came from public insurance company filings and should be used for comparative purposes only. Your own quotes may differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.