Cheap Auto Insurance in Ocala, Florida

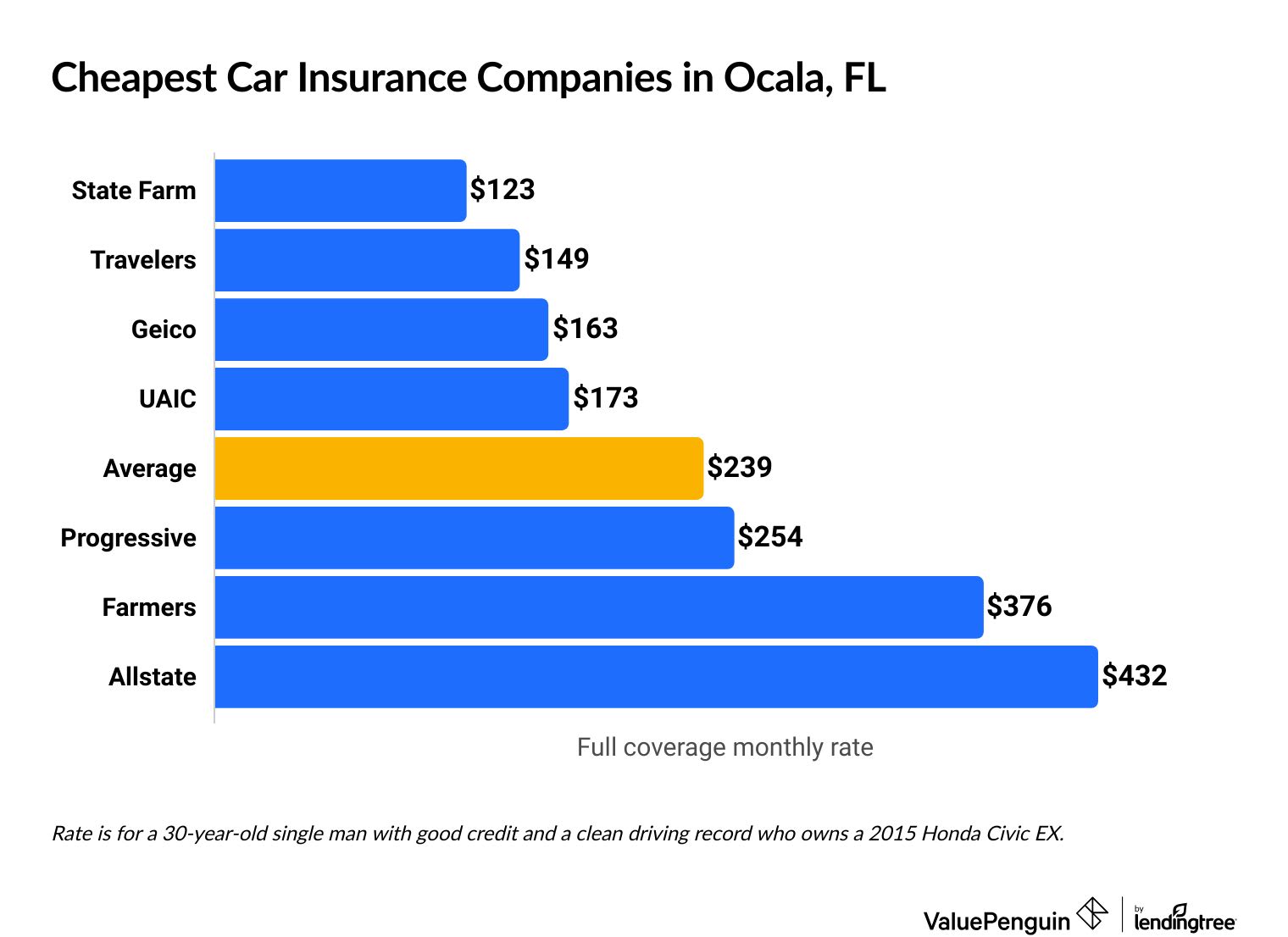

State Farm has the cheapest car insurance in Ocala, at $123 per month for full coverage.

Find Cheap Auto Insurance Quotes in Ocala

Best cheap auto insurance in Ocala, FL

How we chose the top companies

Best and cheapest car insurance in Ocala, FL

State Farm is the best choice for most people in Ocala. It typically has very affordable rates, and it has the best-rated customer service in Florida.

- Cheapest full coverage: State Farm, $123/mo

- Cheapest minimum liability: Geico, $37/mo

- Cheapest for young drivers: Geico, $81/mo

- Cheapest after a ticket: State Farm, $132/mo

- Cheapest after an accident: State Farm, $143/mo

- Cheapest for teens after a ticket: Geico, $93/mo

- Cheapest after a DUI: Travelers, $234/mo

- Cheapest for poor credit: UAIC, $173/mo

Monthly rates are for full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Cheapest car insurance in Ocala: State Farm

State Farm has the cheapest full coverage car insurance in Ocala.

Full coverage from State Farm costs $123 per month, on average. That's nearly half the city average.

Compare Car Insurance Rates in Ocala, Florida

The average cost of auto insurance in Ocala is $239 per month for a full coverage policy. That's $33 per month less than the Florida state average.

Cheap full coverage car insurance quotes in Ocala

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $123 | ||

| Travelers | $149 | ||

| Geico | $163 | ||

| UAIC | $173 | ||

| Progressive | $254 | ||

Cheapest minimum coverage in Ocala: Geico & State Farm

Geico and State Farm have the cheapest minimum coverage quotes in Ocala, at around $37 per month.That's less than half the Ocala average for minimum coverage, which is $83 per month.

Minimum coverage from Geico costs about $6 per year less than State Farm, on average. However, State Farm tends to have better customer service reviews. It's worth comparing rates from both companies so you can decide which is the best choice for you.

Cheapest Ocala, FL auto insurance

Company | Monthly rate |

|---|---|

| Geico | $37 |

| State Farm | $37 |

| Travelers | $44 |

| UAIC | $81 |

| Farmers | $103 |

Compare Car Insurance Rates in Ocala, Florida

Cheapest Ocala auto insurance for teens: Geico or State Farm

Geico has the cheapest minimum coverage car insurance for Ocala teens. A policy from Geico costs around $81 per month for an 18-year-old driver. That's less than half the Ocala average of $208 per month.

State Farm has the cheapest full coverage quotes for young drivers in Ocala. At an average of $258 per month, full coverage from State Farm is nearly half the citywide average of $712 per month.

Cheapest Ocala car insurance for teens

Company | Minimum coverage | Full coverage |

|---|---|---|

| Geico | $81 | $413 |

| State Farm | $100 | $358 |

| Travelers | $101 | $385 |

| UAIC | $196 | $395 |

| Allstate | $296 | $1,159 |

Ocala teens pay two to three times more for car insurance than older drivers. That's because they have less experience behind the wheel, so they're more likely to make a mistake and cause a crash.

The easiest way for young drivers in Ocala to find cheaper car insurance rates is by sharing a policy with their parents. A family policy is typically much cheaper than two separate policies.

Many companies also have discounts geared towards young drivers. For example, State Farm offers the Steer Clear program. This program rewards young drivers with a discount when they take online safety courses and practice driving with a mentor.

Cheapest car insurance in Ocala after a speeding ticket: State Farm

State Farm has the most affordable car insurance quotes in Ocala for drivers with a speeding ticket. Full coverage from State Farm costs around $132 per month after one speeding ticket. That's less than half the Ocala average, which is $285 per month.

Cheap car insurance in Ocala, FL after a speeding ticket

Company | Monthly rate |

|---|---|

| State Farm | $132 |

| UAIC | $173 |

| Travelers | $182 |

| Geico | $271 |

| Progressive | $337 |

Insurance rates in Ocala go up by around 19% after one speeding ticket. That's an average increase of $46 per month for full coverage insurance.

Cheapest car insurance in Ocala after an accident: State Farm

State Farm has the lowest car insurance quotes in Ocala for drivers with an at-fault accident on their record. Full coverage from State Farm costs an average of $143 per month after one crash, which is less than half the Ocala city average.

Cheapest Ocala car insurance after an accident

Company | Monthly rate |

|---|---|

| State Farm | $143 |

| Travelers | $201 |

| UAIC | $222 |

| Geico | $222 |

| Progressive | $374 |

Don't worry about switching car insurance companies right after your accident. Your rate won't go up until your current policy renews. However, any quotes you get will consider your accident, so they'll probably be higher than what you're paying now.

Instead, wait until you get your renewal offer from your current company. Then, shop for quotes from multiple companies to find the cheapest accident insurance for you.

Cheap quotes for Ocala teens after a ticket or accident: Geico

Geico has the most affordable car insurance in Ocala for young drivers with a bad driving record.

After a speeding ticket, minimum coverage from Geico costs around $93 per month for an 18-year-old. That's less than half the Ocala average of $227 per month.

After an accident, Geico charges young drivers around $83 per month for minimum coverage. That's one-third of the average price across Ocala.

Best rates for Ocala teens with a ticket or accident on their record

Company | Ticket | Accident |

|---|---|---|

| Geico | $93 | $83 |

| State Farm | $110 | $121 |

| Travelers | $122 | $140 |

| UAIC | $196 | $242 |

| Allstate | $296 | $565 |

Ocala teens can expect their rates to go up by around 9% after one speeding ticket and 35% after an accident. That's a smaller increase than older drivers typically see because teens already pay more for insurance, even if they have clean records.

Cheapest Ocala car insurance after a DUI: State Farm

Travelers offers the most affordable car insurance in Ocala after a DUI. At $234 per month, full coverage from Travelers costs $90 per month less than the Ocala average.

Cheap Ocala, Florida auto insurance after a DUI

Company | Monthly rate |

|---|---|

| Travelers | $234 |

| UAIC | $297 |

| Progressive | $308 |

| Geico | $345 |

| State Farm | $353 |

A DUI is one of the most serious driving violations. link url="/how-does-dui-affect-your-auto-insurance-rates" title="how does dui affect your auto insurance rates"]After a DUI[/link], insurance rates typically go up 36% in Ocala. That's an average increase of $85 per month for a full coverage policy.

In addition, Florida drivers typically have to get FR-44 insurance after a DUI. This means you'll have higher minimum coverage requirements, and you'll have to pay your insurance company to file an FR-44 form.

Cheapest car insurance for Ocala drivers with poor credit: UAIC

UAIC has the lowest full coverage quotes in Ocala for drivers with poor credit, at $173 per month. That's less than half the Ocala average for these drivers, which is $438 per month.

Best car insurance quotes in Ocala for poor credit

Company | Monthly rate |

|---|---|

| UAIC | $173 |

| Travelers | $293 |

| Geico | $303 |

| Progressive | $391 |

| Farmers | $504 |

Ocala drivers with bad credit pay twice as much for full coverage insurance as those with good credit.

Your credit score doesn't reflect your driving ability, but insurance companies believe drivers with bad credit are more likely to make a claim or miss an insurance payment. As a result, you'll likely see higher rates if you don't have great credit.

Average car insurance cost in Ocala by neighborhood

The 34481 ZIP code — which includes the Fellowship, Liberty and Rolling Hills neighborhoods — has the cheapest car insurance rates in Ocala.

People living in the 34479 ZIP code, including Anthony and part of Silver Springs, pay the highest rates in the city.

Insurance prices vary by up to $10 per month within the city of Ocala. You might pay more for car insurance if car thefts or hit-and-runs are a problem in your neighborhood.

ZIP | Monthly Rate | % from average |

|---|---|---|

| 34470 | $235 | 2% |

| 34471 | $234 | 2% |

| 34472 | $232 | 1% |

| 34473 | $226 | -2% |

| 34474 | $230 | 0% |

What's the best car insurance coverage in Ocala, FL?

Full coverage car insurance is a good idea for most Florida drivers with cars worth more than $5,000 or newer than eight years old. If you have a car loan or lease, the lender typically requires you to have full coverage.

In addition to the property damage liability and personal injury protection required by Florida state, full coverage also includes:

- Bodily injury liability coverage: Pays for damage to others in a car crash you cause. It covers expenses like medical bills and lost wages.

- Comprehensive coverage: Pays for damage to your car due to things other than a collision, such as theft, vandalism or animals.

- Collision coverage: Pays for damage your car sustains in a crash, regardless of who is at fault.

Frequently asked questions

How much is car insurance in Ocala, Florida?

The average cost of full coverage car insurance in Ocala is $239 per month. That's 12% cheaper than the Florida state average of $272 per month.

Who has the best cheap car insurance in Ocala, FL?

State Farm is the best choice for most Ocala drivers. It has the cheapest full coverage and is tied with Geico for the minimum coverage rates in the city. State Farm also has some of the best customer service, so you can expect to be back on the road quickly after a crash.

How much is Geico in Ocala, FL?

Full coverage car insurance from Geico costs an average of $163 per month in Ocala. That's $40 per month more expensive than the cheapest company in the city, State Farm. Both Geico and State Farm offer minimum coverage insurance for around $37 per month in Ocala.

Methodology

To find the best and cheapest Ocala, FL auto insurance, ValuePenguin editors collected quotes from seven of the largest insurance companies in Florida. Quotes are for a 30-year-old man with a clean driving record and good credit score who owns a 2015 Honda Civic EX.

Full coverage rates include higher liability limits than the state requirement along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

Insurance rate data is from Quadrant Information Services. These rates were publicly sourced from company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.