Why is Car Insurance So Expensive in Michigan?

Why are car insurance rates so high in Michigan? The state's costly no-fault law is the key factor. The increase in car insurance rates has slowed dramatically in recent years, but Michigan drivers still pay the most for coverage, 270% more.

Insurers generally raise rates when the gap between what customers pay and what is paid out starts to shrink, which is usually attributed to heavy losses caused by frequent and severe claims.

Not only are insurance claim payouts in Michigan among the highest in the country, but they also primarily stem from no-fault/personal injury protection (PIP) claims. If not for Michigan's huge PIP payouts (even when compared to other no-fault states), it can be argued that the state's auto insurance rates would not be as high as they are.

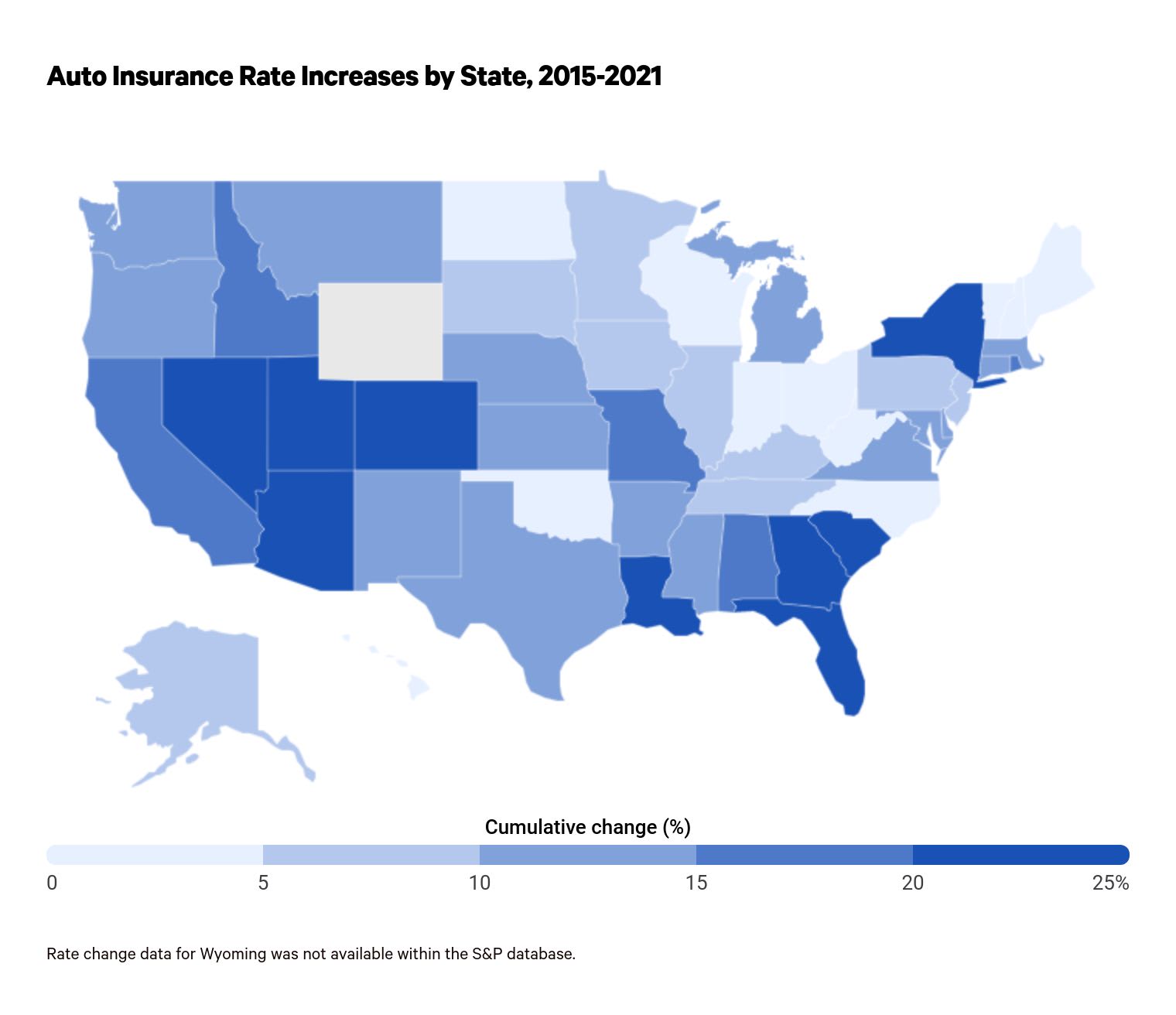

The rise in Michigan's auto insurance rates slowed significantly since 2017

The largest insurance companies in Michigan have raised car insurance rates by an average of 13% since 2015. That's a significant slowdown after a 47% jump from 2011 to 2017.

Why do some states experience higher rates than others? There are numerous reasons, but an insurer's profits on policies, often called loss ratios , play a big part. If companies see narrow or negative profit margins in a given market, they tend to raise rates there.

In Michigan, those ratios have dipped dramatically in recent years, from 136% in 2011 to 82% in 2020. This likely explains the slowing in the rise of prices.

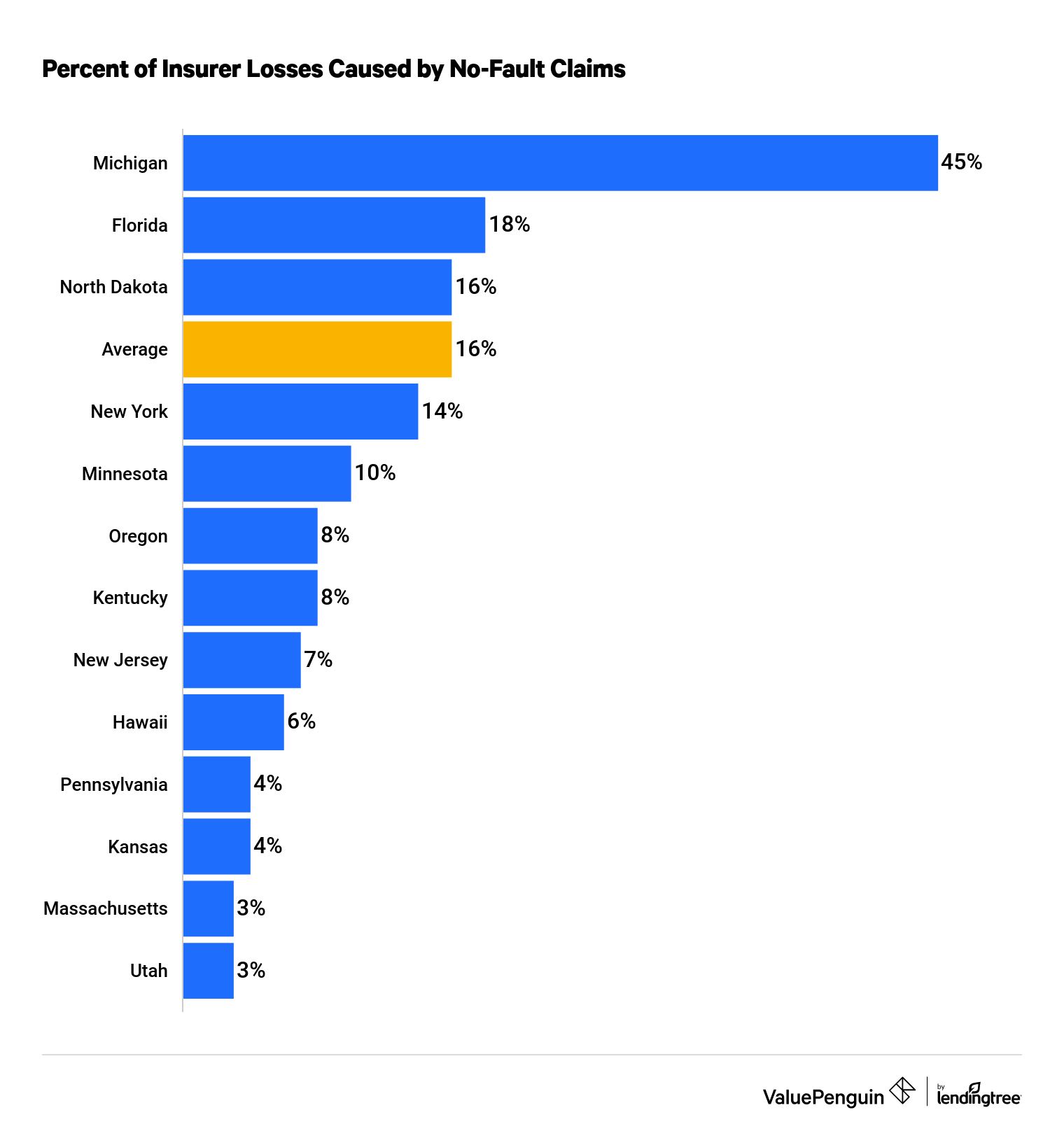

Most auto insurance losses in Michigan come from no-fault losses

A major portion of Michigan’s high insurance payouts stemmed from no-fault or PIP claims. Over the past decade, 45% of all auto insurance losses in Michigan were no-fault losses. That's significantly more than the 16% of average total losses that no-fault losses account for across the U.S.

Why are Michigan's losses so much greater than everywhere else? It is likely driven by the fact that Michigan PIP has a minimum limit of $250,000. Higher PIP limits means higher payouts and higher losses.

No-fault losses likely driving force behind decline of Michigan rate increases

The slowing of Michigan's car insurance rate increases runs alongside some stability in terms of no-fault losses disappearing. From 2011 through the middle of 2016, that type of insurance cost Michigan companies 66% more than it was taking in.

In recent years, however, whether by increasing prices or fewer claims, those numbers have flipped. The combined loss ratios of those policies in Michigan are no longer more than 100%, meaning they're no longer losing money.

Year | No-fault CLR in previous year | Rate increase |

|---|---|---|

| 2016 | 119% | 4% |

| 2017* | 136% | 6% |

| 2018 | 122% | 3% |

| 2019 | 126% | 3% |

| 2020 | 76% | -4% |

| 2021 | 82% | 1% |

The other components of auto insurance — liability, collision and comprehensive coverage — remained much more manageable for Michigan insurers. The combined loss ratio due to liability claims (those filed through bodily injury liability or property damage liability) in 2020 was 76.8%, while the loss ratio from physical damage claims (collision and comprehensive) was 68.9%.

Why is car insurance so expensive in Michigan?

Car insurance is expensive in Michigan because the state has some of the highest minimum insurance requirements of any state. That means higher prices for more required coverage.

Michigan drivers pay an average of $7,161 per year for full-coverage insurance. That's 270% more than the national average and close to double the next most expensive state.

Michigan has some of the highest minimum-liability coverage requirements in the country and requires most drivers to carry at least $250,000 in PIP coverage.

Coverage | Limit |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Personal injury protection | $250,000 |

| Property damage liability | $10,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

Additionally, the state has a high percentage of uninsured drivers, more than 25%, which also raises insurance rates.

Methodology

We obtained financial information on no-fault loss ratios and rate increases for Michigan auto insurers in all states through the S&P Market Intelligence Tool. Data on uninsured drivers was from the Insurance Research Council.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.