Selective Auto Insurance Review

Selective's new car replacement program may make it a good choice if you care about driving a brand new vehicle. But most drivers can find cheaper coverage and better customer service elsewhere.

Find Cheap Auto Insurance Quotes in Your Area

Selective auto insurance quotes are a little more expensive than average for most drivers. But it offers a few unique coverage options. For example, Selective has a new car replacement program that can be extended for up to six years. Most companies only offer new car replacement for one to two years.

However, Selective customers tend to complain about the company's long claims process. And you can only buy Selective auto insurance in 15 states.

Pros and cons

Pros

Affordable rates after an accident

Extra protection for new cars

Cons

Slow claims process

Can't compare quotes online

Limited availability

Selective Insurance quotes

Selective car insurance is 6% more expensive than average for most drivers.

A full coverage policy from Selective costs $157 per month. That's $8 more per month than average and $43 per month more expensive than the cheapest company, Geico.

Find Cheap Auto Insurance Quotes in Your Area

Selective could be a good fit for drivers with an at-fault accident on their record.

The company only raises full coverage rates by 15% after an at-fault accident. That's an increase of about $23 per month. However, both Geico and NJM offer cheaper rates after an accident.

Monthly car insurance quotes: Selective vs. competitors

Minimum coverage

Full coverage

Full coverage after an accident

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $49 | ||

| NJM | $87 | ||

| Selective | $91 | ||

| State Farm | $94 | ||

| Progressive | $110 | ||

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $49 | ||

| NJM | $87 | ||

| Selective | $91 | ||

| State Farm | $94 | ||

| Progressive | $110 | ||

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $114 | ||

| State Farm | $148 | ||

| NJM | $153 | ||

| Selective | $157 | ||

| Progressive | $173 | ||

Full coverage after an accident

Company | Monthly rate | ||

|---|---|---|---|

| Geico | $114 | ||

| NJM | $167 | ||

| Selective | $180 | ||

| State Farm | $242 | ||

| Progressive | $282 | ||

Unfortunately, you can't get a Selective auto insurance quote online. You'll need to contact a local independent agent to get a quote.

Shoppers who prefer to compare quotes online should consider a company like State Farm or Geico, where you can get quotes in a matter of minutes.

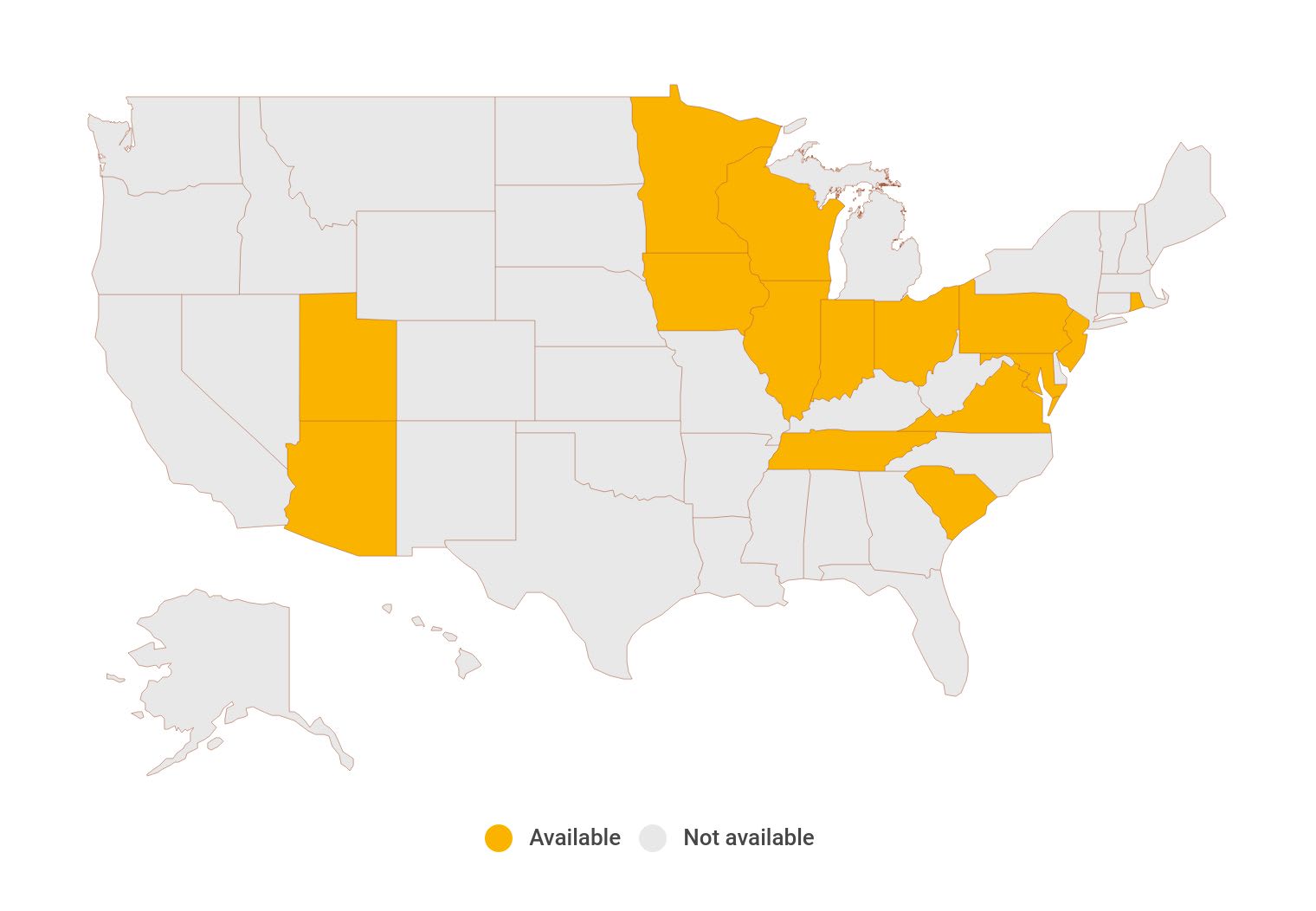

Where is Selective Insurance available?

Selective sells personal insurance — like auto, home and renters policies — in 15 states.

Selective Insurance discounts

Selective only has a few car insurance discounts to help drivers save money. It offers a discount for bundling your auto and home insurance, along with a handful of other ways to save.

- A multipolicy discount if you buy a home, condo or renters insurance policy from Selective

- An advanced quote discount if you buy your policy eight days before your current coverage expires

- A discount for those who also have a commercial vehicle insured with Selective

- A loss free discount for drivers who haven't made a car insurance claim for a certain period of time

- A good grades discount for drivers up to age 25

- A driving training discount for drivers up to 25 years old who complete an approved course

- A vehicle safety discount for cars with certain safety and anti-theft features

- A good payer discount for people who pay their car insurance bills on time

Selective auto insurance coverage

Selective offers a few helpful add-ons to increase your protection.

A basic policy from Selective comes with the coverage you need to drive legally. You can also add comprehensive and collision coverage, which help pay for damage to your own car.

Extra coverage: The Selective Edge

The Selective Edge is available when you get both home and auto insurance coverage from Selective.

It includes extra protection that wouldn't automatically be included in a standard auto or home policy. Additional car insurance coverages include:

- Roadside assistance if your car breaks down on the side of the road

- Pet injury coverage if you're in an accident while your pet is in the car

- Personal contents coverage for items that are stolen out of your car or damaged in an accident

- Accidental air bag deployment if your air bag opens and you need a replacement

- Key replacement

You'll also get upgrades to your home insurance policy, like guaranteed replacement cost if your home has to be rebuilt and extra protection for valuable jewelry.

Selective Insurance reviews and ratings

Selective Insurance customers aren't generally happy with the company's service, especially during the claims process.

Selective receives nearly seven times as many complaints as companies of a similar size, according to the National Association of Insurance Commissioners (NAIC). Most of the complaints are about a slow claims process. It could take a long time for you to get back on the road after an accident if you choose Selective.

However, Selective auto insurance customers don't have to worry about the company's ability to pay claims. Selective earned an A+ financial strength rating from AM Best. That means it has a superior ability to meet its financial obligations, even after a large catastrophe.

Contact Selective Insurance

Customers who get in an accident can file an auto insurance claim with Selective via:

- The Selective Insurance claims phone number, 866-455-9969

- Their Selective Insurance account online

- The Selective Insurance app

- The "report a claim" page on the Selective Insurance website, which does not require login

For billing questions, customers can call 800-735-3284 from 8 a.m. to 10 p.m. Eastern time during the work week and 8 a.m. to 6 p.m. on Saturdays.

Selective Insurance does not have a dedicated customer service number. You'll need to contact your insurance agent for help with your policy.

However, customers can use the MySelective app to access a number of helpful features. For example, the app allows you to:

- View policy information and insurance cards

- Use a live chat service for policy questions

- Contact an agent or a claims adjuster

- Call for roadside assistance 24/7

- Report a claim, add photos and check its status

- Locate repair shops

- Pay your bill

Frequently asked questions

What states is Selective Insurance licensed in?

Selective Insurance sells car, home and renters insurance in 15 states: Arizona, Illinois, Indiana, Iowa, Maryland, Minnesota, New Jersey, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Utah, Virginia and Wisconsin.

What is Selective Insurance's AM Best rating?

Selective Insurance has an A+ financial strength rating from AM Best. That means the company has a superior ability to pay claims and other debts, even if it has to pay out a lot of claims at the same time.

Is Selective a good insurance company?

Most people will find that Selective isn't the best company to buy car insurance from. Its rates are typically more expensive than average, and customers tend to complain about its slow claims process.

However, Selective does have some good coverage options for people with brand new cars. And drivers with an at-fault accident on their record can typically find affordable rates with Selective.

Methodology

To compare Selective Insurance quotes, ValuePenguin gathered auto insurance rates from every ZIP code across New Jersey. Rates are for a 30-year-old single man with good credit and a clean driving record who owns a 2015 Honda Civic EX.

Full coverage rates include higher liability limits than required in the state of New Jersey, along with comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Personal injury protection: $15,000

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

Quadrant Information Services provided the rate data used in this analysis. Rates were publicly sourced from insurer filings. They are intended for comparative purposes only. Your own rates will likely differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.